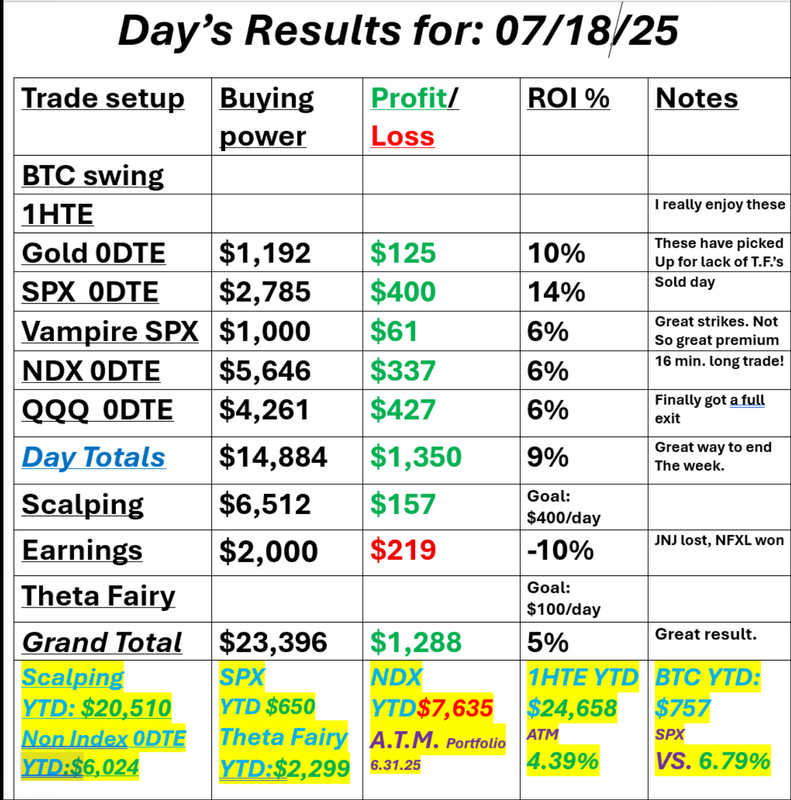

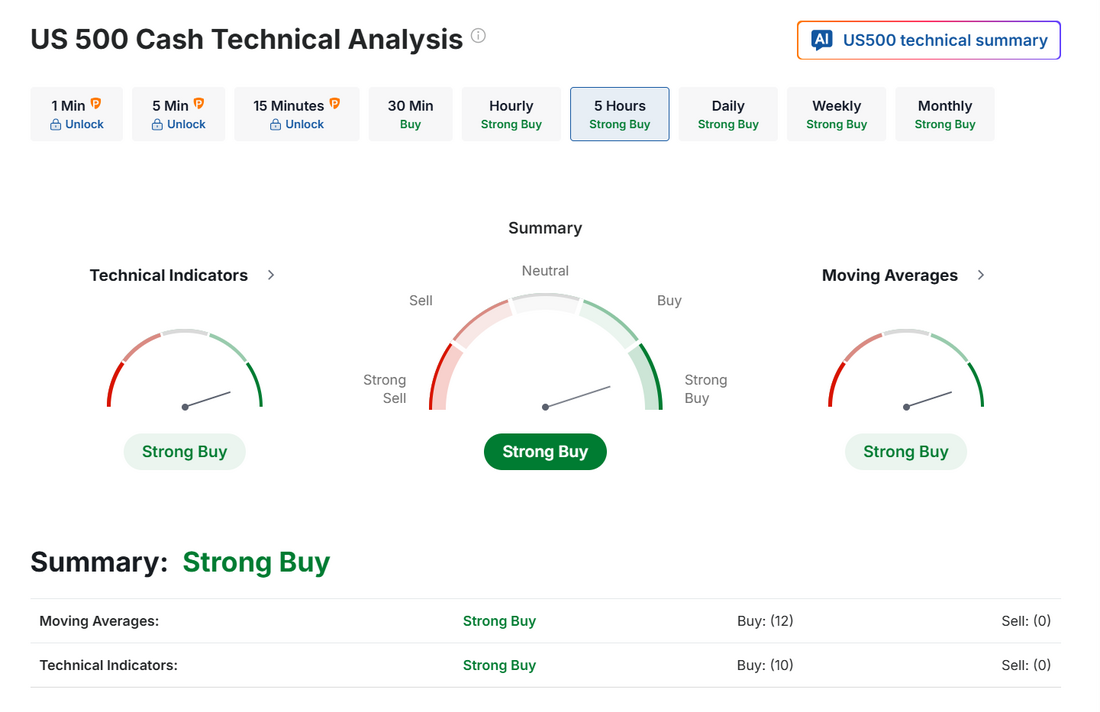

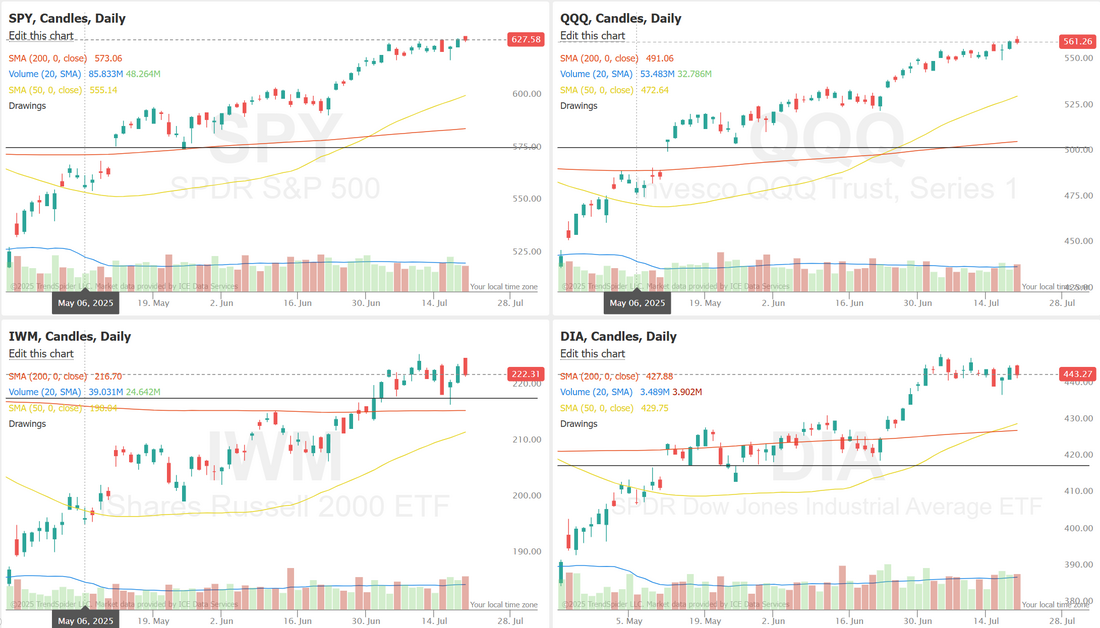

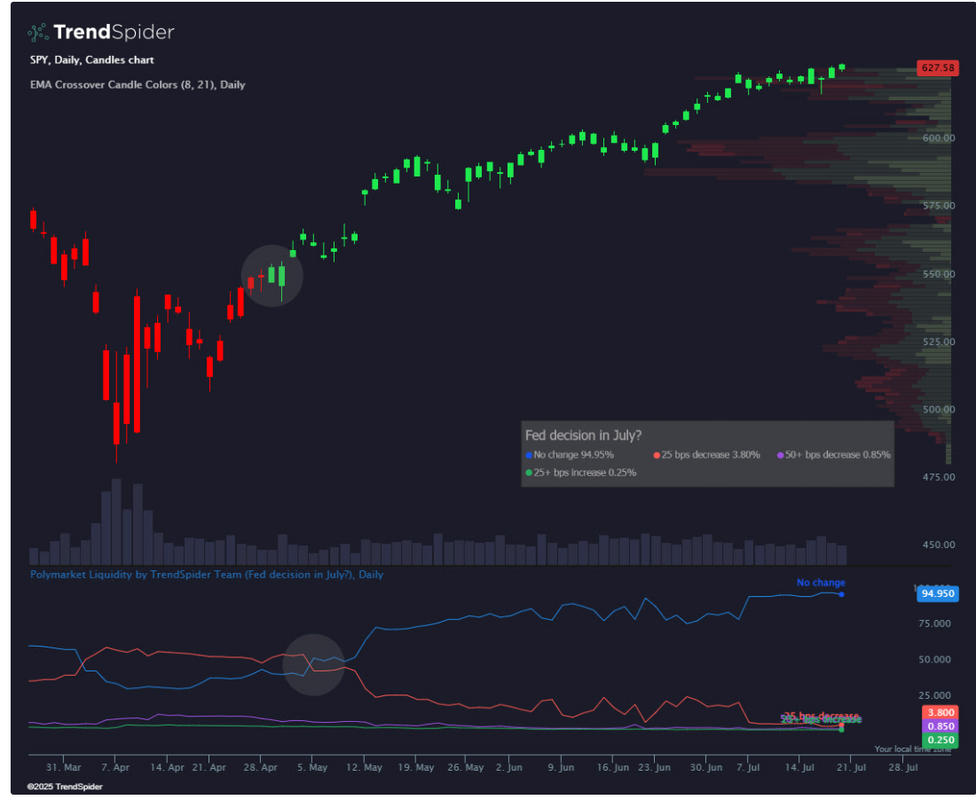

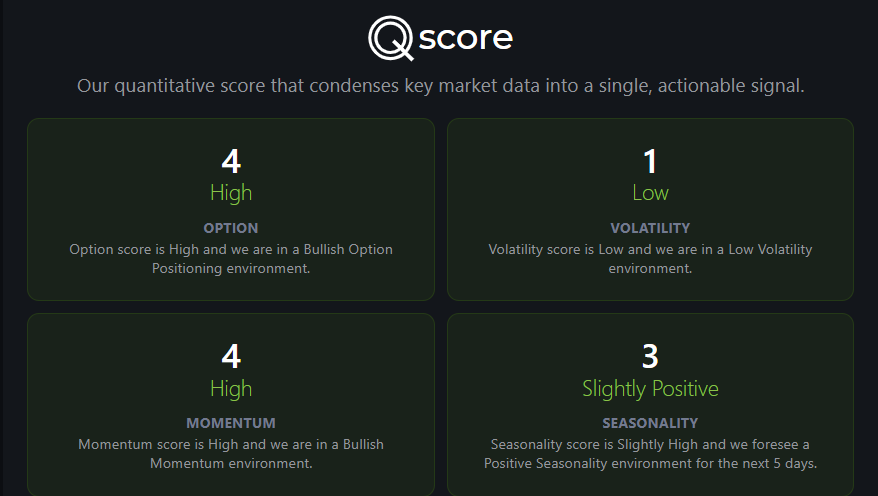

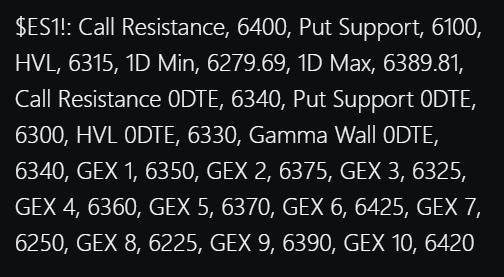

Can the bulls breakout?After two weeks of going no where the bulls were able to break out to the upside on Thurs. Fri. came and gave it all back! Never the less, the bulls are trying. We had a solid day Friday and really, a very solid week. It seemed like we had a loser every day but our net liq went up every single day! Take a look at our last Friday. Let's take a look at the markets. Technicals are bullish. Friday gave back a good portion of Thursdays gains. We continue to sit near the ATH's. The SPY edged higher last week, closing at $627.58 (+0.64%), maintaining its bullish posture. The bullish 8/21 EMA crossover indicator initiated in April remains strong, with price consistently finding support during pullbacks. Alongside the bullish EMA crossover, the decrease in rate cut expectations on the Polymarket Indicator helped fuel the ongoing rally, showing markets shrugged off the need for lower rates. The QQQ finished in the green last week, closing at $561.26 (+1.27%), as tech earnings season kicked off with Netflix’s report. Interestingly, the index started its bullish run in May even as the prediction market flashed declining odds of a Fed rate cut, defying the typical relationship between lower rates and tech strength. This divergence suggests that expectations are already priced in, raising the risk of a “sell-the-news” reaction when rate cuts eventually happen. Small caps underperformed last week with the IWM closing at $222.33 (+0.29%). With at least one rate cut expected later this year, small caps could have more upside potential than their large-cap peers, provided the ETF continues to hold support above the 8/21 EMA crossover. The key question for traders is whether the market has already priced in the coming policy shift or if there’s still meaningful upside once cuts are delivered. Gamma continues to be positive coming into today. Quant score is about as bullish as can be. Key intra-day levels: Intra-day chart: For bulls, they need to break above 6373. Support levels are 6339, 6319, 6300. September S&P 500 E-Mini futures (ESU25) are up +0.27%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.28% this morning, pointing to a higher open on Wall Street, while investors await more news on trade talks, a fresh batch of U.S. economic data, and a slew of corporate earnings reports, with a particular focus on results from “Magnificent Seven” stalwarts Tesla and Alphabet. U.S. equity futures drew support from falling Treasury yields, which extended their drop to a fourth day. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Health insurance stocks retreated, with Molina Healthcare (MOH) plunging over -10% to lead losers in the S&P 500 and Elevance Health (ELV) sliding more than -8%. Also, Netflix (NFLX) slumped over -5% even after the streaming giant reported stronger-than-expected Q2 results and raised its full-year revenue guidance. In addition, Sarepta Therapeutics (SRPT) plummeted more than -35% after the company said another patient had died from acute liver failure following treatment with one of its experimental gene therapies for a muscle disease. On the bullish side, Invesco Ltd. (IVZ) surged over +15% and was the top percentage gainer on the S&P 500 after the investment management firm proposed changing the structure of its QQQ exchange-traded fund. Economic data released on Friday showed that the University of Michigan’s preliminary U.S. consumer sentiment index rose to a 5-month high of 61.8 in July, stronger than expectations of 61.4. Also, the University of Michigan’s U.S. July year-ahead inflation expectations fell to a 5-month low of 4.4%, better than expectations of no change at 5.0%, while 5-year implied inflation expectations fell to a 5-month low of 3.6%, better than expectations of 3.9%. In addition, U.S. June housing starts rose +4.6% m/m to 1.321M, stronger than expectations of 1.290M, while building permits, a proxy for future construction, unexpectedly rose +0.2% m/m to 1.397M, stronger than expectations of 1.390M. Fed Governor Christopher Waller said in a Bloomberg TV interview on Friday that he sees no evidence of rising inflation expectations, which gives the Fed room to proceed with rate cuts. He also reiterated that the central bank should lower rates when policymakers meet later this month, citing data indicating the U.S. labor market is “on the edge.” Meanwhile, U.S. rate futures have priced in a 95.3% chance of no rate change and a 4.7% chance of a 25 basis point rate cut at next week’s monetary policy meeting. Second-quarter corporate earnings season kicks into high gear this week, with investors awaiting fresh reports from major companies such as Tesla (TSLA), Alphabet (GOOGL), Intel (INTC), ServiceNow (NOW), International Business Machines (IBM), NXP Semiconductors N.V. (NXPI), Coca-Cola (KO), AT&T (T), Verizon (VZ), General Motors (GM), Blackstone (BX), American Airlines (AAL), Southwest Airlines (LUV), Philip Morris International (PM), Chipotle (CMG), Union Pacific (UNP), Honeywell (HON), and Phillips 66 (PSX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. Market watchers will also closely monitor preliminary purchasing managers’ surveys on U.S. manufacturing and services sector activity for July for any signs of how President Trump’s tariff policies are affecting the economy. Other noteworthy data releases include U.S. Existing Home Sales, Initial Jobless Claims, the Richmond Fed Manufacturing Index, New Home Sales, Durable Goods Orders, and Core Durable Goods Orders. “As the final shape of the U.S. tariff regime is still up in the air, the recent moderate inflation trend has apparently not helped to reduce uncertainty about the ultimate impact of Trump’s trade policy on inflation,” said ABN Amro analysts. In addition, investors will continue to await any updates on U.S. tariff agreements with other countries ahead of the August 1st deadline, when reciprocal tariffs are set to take effect. U.S. President Donald Trump said he’s close to announcing a couple of “big” trade deals. U.S. central bankers are in a media blackout period before the July 29-30 policy meeting, though Fed Chair Jerome Powell is scheduled to deliver opening remarks on Tuesday at a conference focused on capital frameworks for large banks. Today, investors will focus on the Conference Board’s Leading Economic Index for the U.S., which is set to be released in a couple of hours. Economists expect the June figure to be -0.2% m/m, compared to the previous number of -0.1% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.381%, down -1.13%. My bias or lean today is slightly bullish. You really have to be right now but I'm not expecting too much upside. Similar to the last few weeks. Trade docket today: We got a compromised fill on our Gold 0DTE after exchange issues last night. We'll continue to work that today. Our copper trade is finally in a place that we can add the next scale in. I'll continue to work the /MNQ futures for scalping today and we'll go over the cover we used on Friday. LULU cash flow. QQQ 0DTE, SPX 0DTE. Possible NDX 0DTE. KO, LMT earnings. A quick note. We'll be headed up to the cabin in East canyon tomorrow for our annual boating, rock crawling, mountain biking week with limited space and bandwidth to zoom. We'll be trading every day, of course, but today will be the only zoom session this week.

I'll see you all in the zoom session shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |