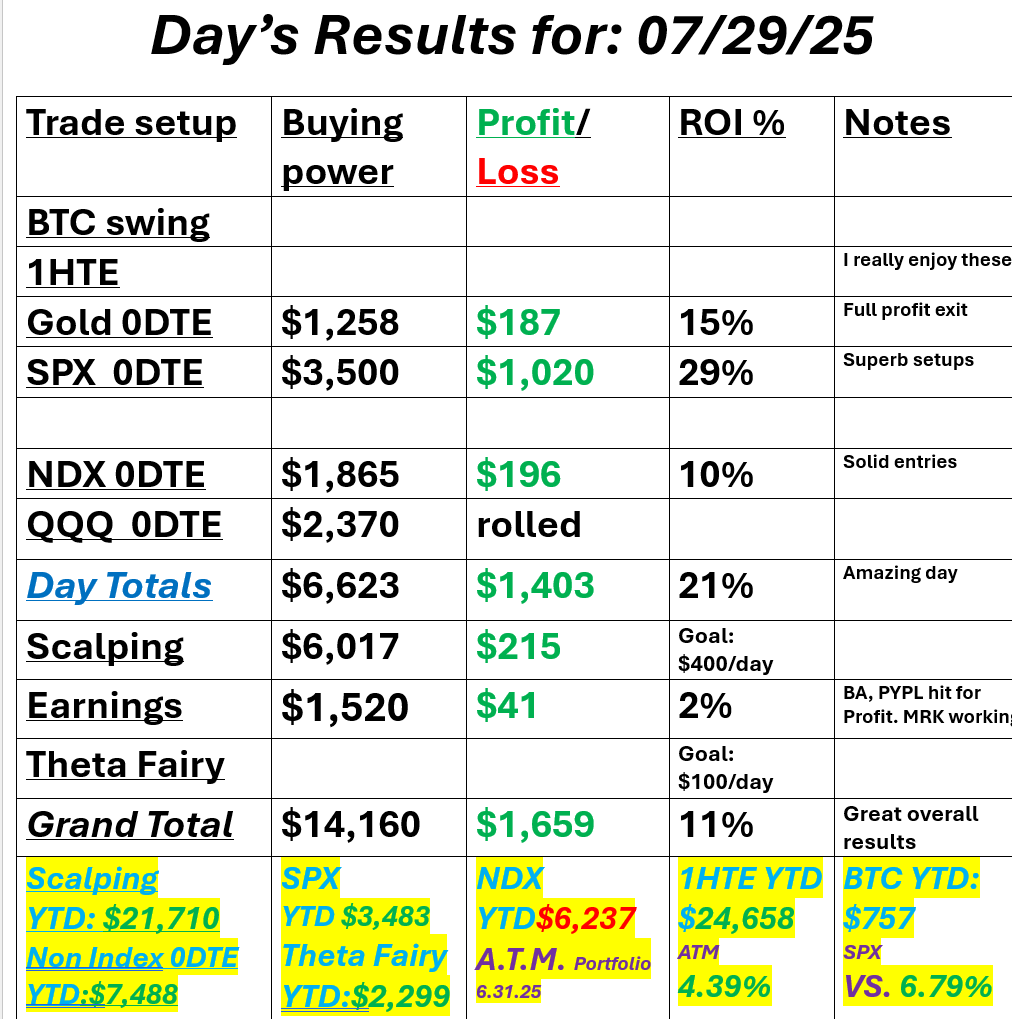

FOMC dayIt's FOMC day and you know what that means for us. We have a very specific way we trade today, which we'll go over again in our live zoom. We had a barn burner of a day yesterday September S&P 500 E-Mini futures (ESU25) are up +0.12%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.21% this morning, pointing to a slightly higher open on Wall Street, while investors await the Federal Reserve’s policy decision, a fresh batch of U.S. economic data, including the ADP employment report and the first estimate of second-quarter GDP, as well as earnings reports from “Magnificent Seven” companies Microsoft and Meta. In yesterday’s trading session, Wall Street’s major indexes ended in the red. United Parcel Service (UPS) slumped over -10% and was among the top percentage losers on the S&P 500 after the delivery company reported weaker-than-expected Q2 adjusted EPS and said it would not provide full-year revenue or operating profit guidance due to macroeconomic uncertainty. Also, Brown & Brown (BRO) plunged more than -10% after the company posted weaker-than-expected Q2 organic revenue growth. In addition, UnitedHealth Group (UNH) fell over -7% and was the top percentage loser on the Dow after the company reported weaker-than-expected Q2 adjusted EPS and provided below-consensus FY25 guidance. On the bullish side, Corning (GLW) surged more than +11% and was the top percentage gainer on the S&P 500 after the maker of specialty glass and ceramics reported better-than-expected Q2 results and issued above-consensus Q3 core EPS guidance. A Labor Department report released on Tuesday showed that U.S. JOLTs job openings fell to 7.437 million in June, weaker than expectations of 7.510 million. At the same time, the U.S. Conference Board’s consumer confidence index rose to 97.2 in July, stronger than expectations of 95.9. In addition, the U.S. May S&P/CS HPI Composite - 20 n.s.a. eased to +2.8% y/y from +3.4% y/y in April, weaker than expectations of +2.9% y/y. “Overall, it was a mixed round of data that has done little to materially challenge the price action or macro narrative,” said Ian Lyngen at BMO Capital Markets. Today, all eyes are focused on the Federal Reserve’s monetary policy decision. The Federal Open Market Committee is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%. The decision comes amid intense political pressure, evolving trade policy, and economic cross-currents. Market watchers will follow Chair Jerome Powell’s post-policy meeting press conference for any indication of a greater openness from the central bank to ease policy when it next meets in September. Second-quarter corporate earnings season continues in full force. Investors will be closely monitoring earnings reports today from “Magnificent Seven” companies Microsoft (MSFT) and Meta Platforms (META). Prominent companies like Qualcomm (QCOM), Arm (ARM), Lam Research (LRCX), and Altria (MO) are also scheduled to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, exceeding the pre-season estimate of +2.8%. On the economic data front, investors will focus on the Commerce Department’s first estimate of gross domestic product, set to be released in a couple of hours. Economists, on average, forecast that U.S. GDP growth will stand at +2.5% q/q in the second quarter, compared to the first-quarter figure of -0.5% q/q. The U.S. ADP Nonfarm Employment Change data will also be closely monitored today. Economists expect the July figure to come in at 77K, compared to the June figure of -33K. U.S. Pending Home Sales data will be reported today. Economists forecast the June figure at +0.2% m/m, compared to the previous figure of +1.8% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -2.300M, compared to last week’s value of -3.169M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.326%, down -0.21%. No levels or bias on FOMC day. We usually start the day with a high theta, low risk setup. Take that off before FOMC then re-apply once Powell starts speaking. Trade docket: Busy with earnings today. MARA, MRK, SBUX, ETSY, MSFT, META, QCOM, ARM, ABBV, CVS. We missed an entry on Gold 0DTE so we'll try a 1DTE today. QQQ 0DTE, SPX and NDX 0DTE. I'll see you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |