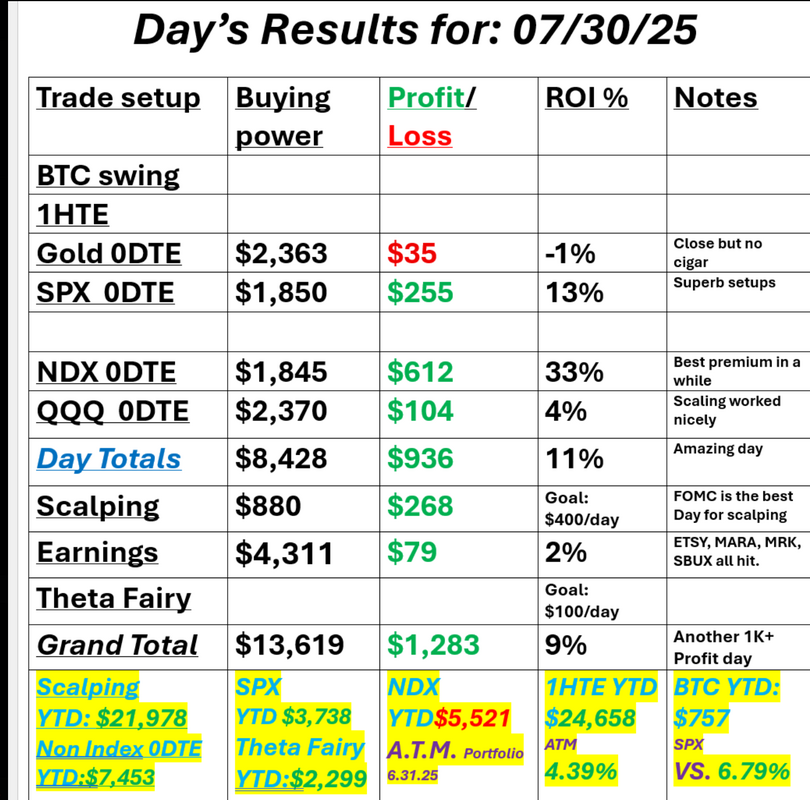

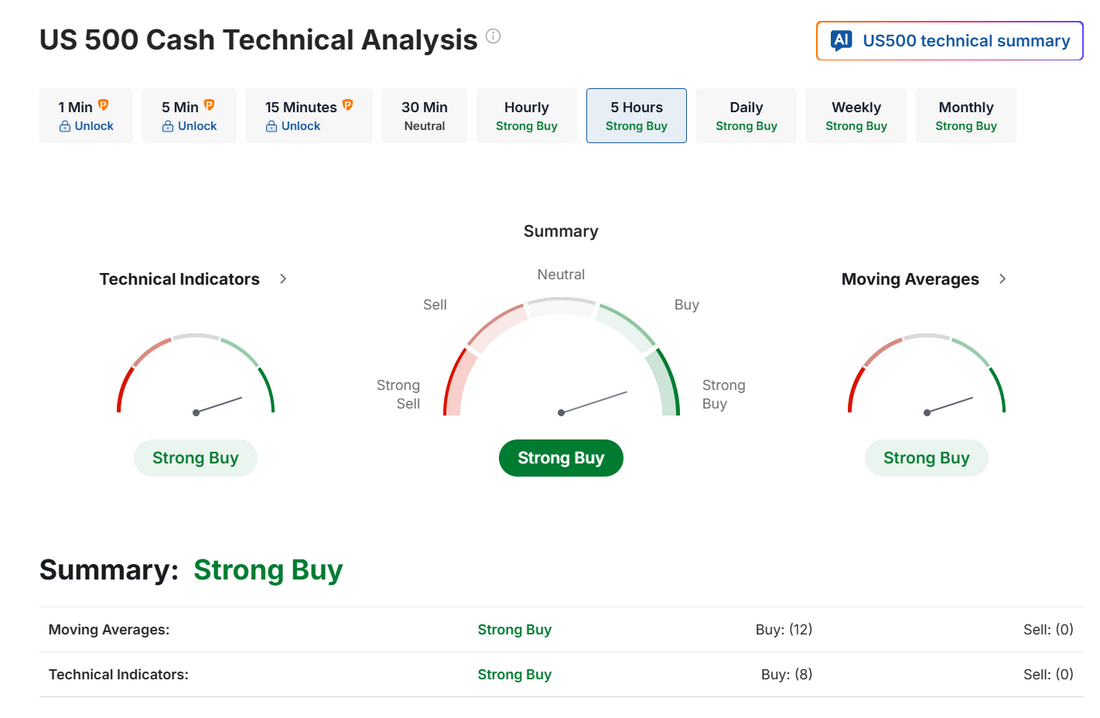

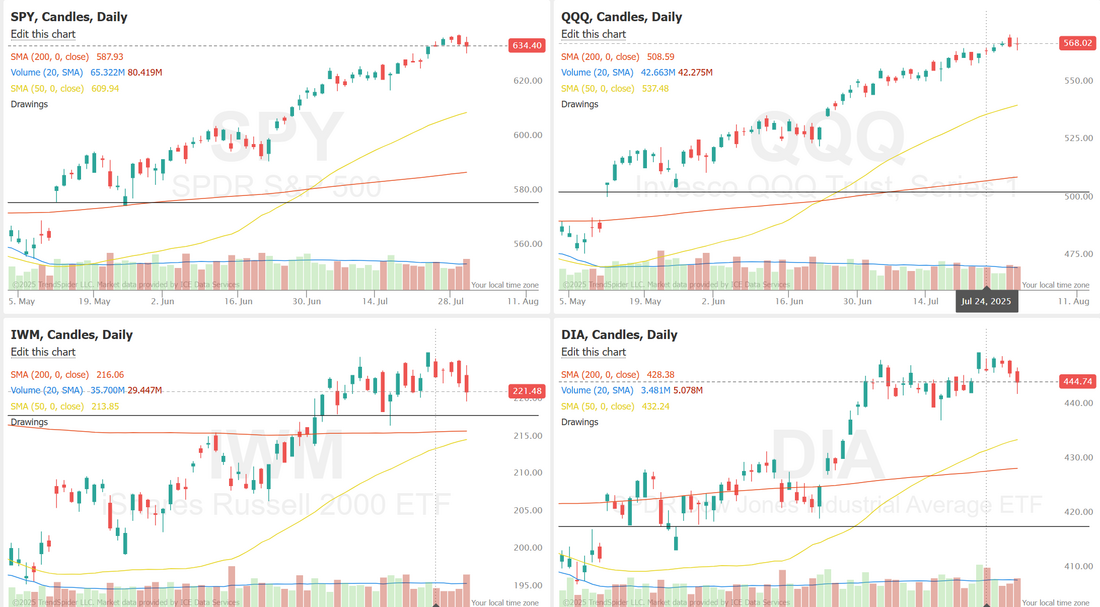

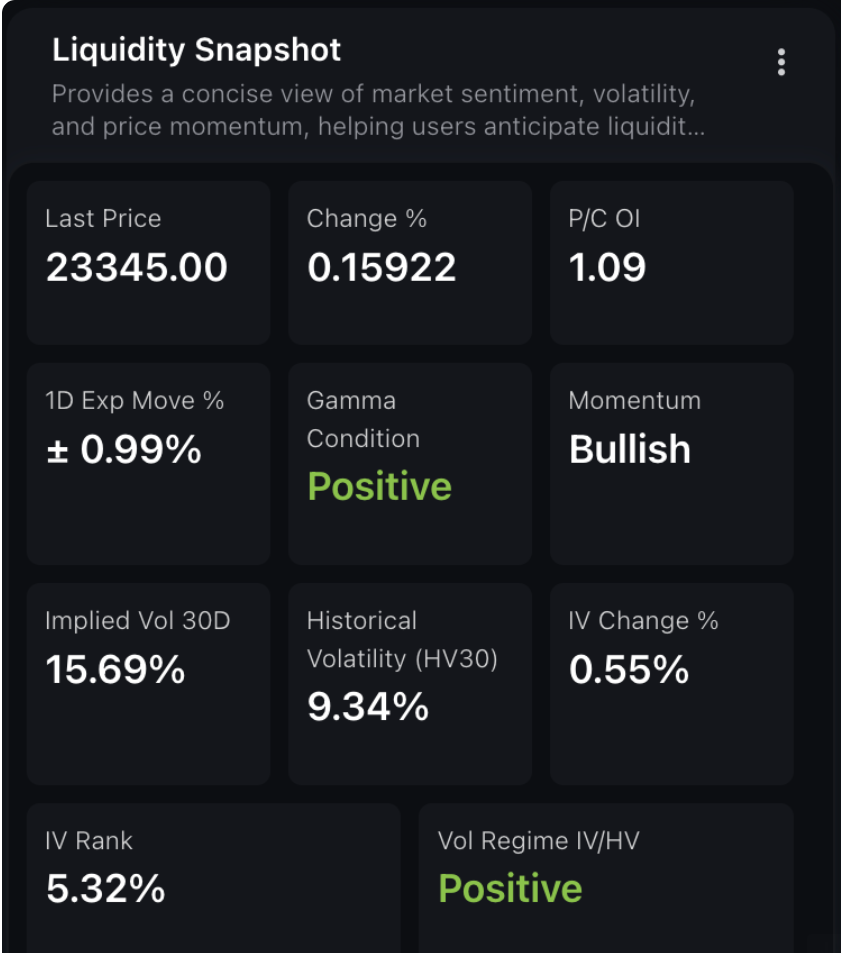

Do we get a 1%+ day today?It's been a very, very long time since we've had a 1% or greater move in the SPX in a single day. Is today the day? Futures are up almost 1% as I type. Blowout earnings from a couple tech stocks and more talk of trade deals getting done are pushing the futures this morning after an interesting session yesterday with Powell not wanting to commit to rate cuts...again. We had an exceptional day yesterday. FOMC days usually present some great movement and that's all we are looking for, as traders. We certainly got it yesterday and we did a nice job of being patient and timing the moves. Take a look at our results below: FOMC is usually a day that delivers for us. With MSFT and META reporting blowout numbers on AI benefits the futures are pushing us to new heights this morning. We've got PCE, Jobless claims and consumer spending coming out shortly which could also affect the days trajectory. The question at hand is, can the market hold these futures gains and build or do we give it back? Let's take a look at the markets: Markets continue to be bullish but waning is starting to show. The bull appears to be getting tired. Federal Reserve Chair Jerome Powell held firm on interest rates, signaling no immediate cuts despite mounting pressure from the White House and dissent from two Fed governors. The FOMC’s decision to keep rates steady for the fifth consecutive meeting marks a cautious approach, as Powell emphasized the need for more data on inflation and employment before taking action. While market participants had hoped for clearer signals on potential easing in September, Powell’s neutral tone cooled those expectations, with rate-cut odds dropping to around 40%. With uncertainty lingering around Trump’s tariff policy and its inflationary impact, the Fed appears focused on managing inflation risk efficiently rather than responding preemptively. Markets responded with a dip in equities and a stronger dollar, reflecting investor recalibration. Now let's look at positioning. The SPX Option Score chart as of July 30, 2025, suggests that while the spot price continues its steady climb near recent highs, the Option Score has begun to drift lower from its previously elevated range. After maintaining consistent readings near the 4–5 level throughout the rally, the recent dip toward 3 could indicate a cooling in options market conviction. In the short term, this shift may reflect some hesitation or reduced bullish sentiment among option traders despite the index's resilience. Market participants may want to monitor whether this divergence widens further, especially as the SPX approaches potential resistance around 6400. The NDX liquidity snapshot paints a constructive short-term picture, with bullish momentum and a positive gamma condition suggesting a supportive backdrop for price stability or further upside. Implied volatility at 15.69% remains elevated relative to 30-day historical volatility at 9.34%, indicating a rich premium environment, although the low IV rank of 5.32% signals implied vol is still low compared to its past range. The put/call open interest ratio at 1.09 shows a slight defensive bias, but with the volatility regime also flagged as positive, overall market structure appears conducive to continued resilience, barring a sharp volatility shock. September S&P 500 E-Mini futures (ESU25) are up +0.97%, and September Nasdaq 100 E-Mini futures (NQU25) are up +1.30% this morning as forecast-beating quarterly results from Meta and Microsoft boosted sentiment. Meta Platforms (META) surged over +11% in pre-market trading after the maker of Facebook and Instagram posted upbeat Q2 results and issued strong Q3 revenue guidance. Also, Microsoft (MSFT) climbed more than +8% in pre-market trading after the technology behemoth reported stronger-than-expected FQ4 results and provided an upbeat FQ1 revenue growth forecast for the Azure cloud unit. In addition, both companies vowed to spend heavily on artificial intelligence. On the trade front, U.S. President Donald Trump said on Wednesday he reached an agreement with South Korea that would set a 15% tariff on its exports to the U.S. and include a commitment from Seoul to invest $350 billion in the U.S. Also, President Trump said he would impose a 25% tariff on India’s exports to the U.S. beginning Friday and threatened a further penalty related to the country’s energy imports from Russia. In addition, U.S. Commerce Secretary Howard Lutnick said on Wednesday that the U.S. reached trade agreements with Cambodia and Thailand. Investors now await the release of the Federal Reserve’s first-line inflation gauge and earnings reports from “Magnificent Seven” companies Apple and Amazon. As widely expected, the Federal Reserve left interest rates unchanged yesterday. The Federal Open Market Committee voted 9-2 to keep the federal funds rate in a range of 4.25%-4.50%. Governors Christopher Waller and Michelle Bowman voted against the decision, favoring a quarter-point rate cut instead. In a post-meeting statement, officials lowered their assessment of the U.S. economy, saying that “although swings in net exports continue to affect the data, recent indicators suggest that growth of economic activity moderated in the first half of the year.” The Fed had earlier described growth as expanding “at a solid pace.” At a press conference, Fed Chair Jerome Powell said that the slowdown in growth highlighted in the Fed’s statement “largely reflects a slowdown in consumer spending.” However, Mr. Powell refrained from signaling that a rate cut is likely in September. “It seems to me, and to almost the whole committee, that the economy is not performing as though a restrictive policy is holding it back inappropriately,” he said, adding, “We have made no decisions about September.” “The next two months of data will be pivotal, and we see a path to a resumption of the Fed’s easing cycle in the autumn should tariff inflation prove more modest than expected or the labor market show signs of weakness,” said Ashish Shah at Goldman Sachs Asset Management. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed. IDEX Corp. (IEX) plunged over -11% and was the top percentage loser on the S&P 500 after the company cut its full-year adjusted EPS guidance. Also, Old Dominion Freight Line (ODFL) slumped more than -9% and was the top percentage loser on the Nasdaq 100 after the company posted downbeat Q2 results. In addition, Seagate Technology (STX) slid over -3% after the data storage company issued soft FQ1 guidance. On the bullish side, Teradyne (TER) surged more than +18% after the maker of testing equipment for semiconductors and robotics posted better-than-expected Q2 adjusted EPS. The U.S. Bureau of Economic Analysis, in its initial estimate of Q2 GDP growth, said on Wednesday that the economy grew at a +3.0% annualized rate, stronger than expectations of +2.5%. Also, the U.S. ADP employment change rose by 104K in July, stronger than expectations of 77K. At the same time, U.S. June pending home sales unexpectedly fell -0.8% m/m, weaker than expectations of +0.2% m/m. “The significant beat in Q2 GDP is just a rebound from the drop in Q1. Don’t get me wrong, these GDP data are great, just not that great. The economy remains resilient and growing, and that’s the most important takeaway from this report,” said Jamie Cox at Harris Financial Group. Meanwhile, U.S. rate futures have priced in a 59.0% chance of no rate change and a 41.0% chance of a 25 basis point rate cut at the next central bank meeting in September. Second-quarter corporate earnings season rolls on, and market participants await reports today from high-profile companies such as Apple (AAPL), Amazon.com (AMZN), Mastercard (MA), AbbVie (ABBV), and KLA Corp. (KLAC). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, exceeding the pre-season estimate of +2.8%. On the economic data front, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.7% y/y in June, compared to the previous figures of +0.2% m/m and +2.7% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate June Personal Spending to rise +0.4% m/m and Personal Income to grow +0.2% m/m, compared to the May figures of -0.1% m/m and -0.4% m/m, respectively. The U.S. Employment Cost Index will be reported today. Economists expect this figure to come in at +0.8% q/q in the second quarter, compared to +0.9% q/q in the first quarter. The U.S. Chicago PMI will come in today. Economists forecast the July figure at 41.9, compared to the previous value of 40.4. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 222K, compared to last week’s number of 217K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.358%, down -0.43%. Trade docket for today: Busy. /GC 0DTE, /MNQ scalping again. ABBV, ARM, CVS, HOOD, META, MSFT, QCOM, AAPL, AMZN, XOM earnings trades. QQQ 0DTE, SPX and NDX 0DTE's. My lean or bias today is bearish. By bearish I mean we retrace from this highs we are seeing in the futures, as I type. /NQ is up +320 and /ES is up 60+ Let's take a look at our intra-day levels: 6460, 6470, 6475, 6480 are resistance levels. 6448, 6443, 6433 are support. Today should be a good opportunity day with futures already soaring. I'll see you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |