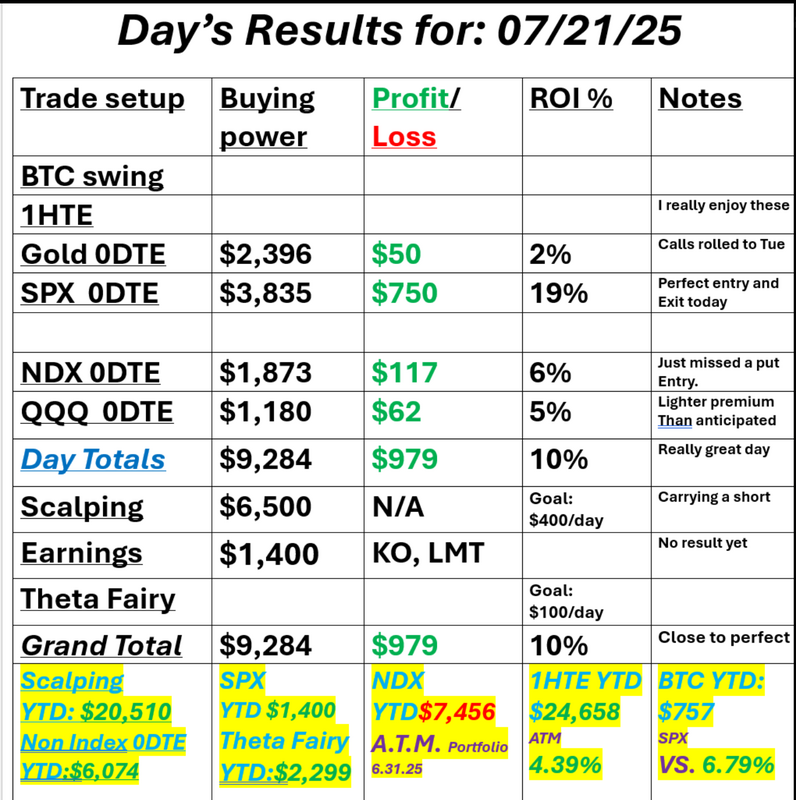

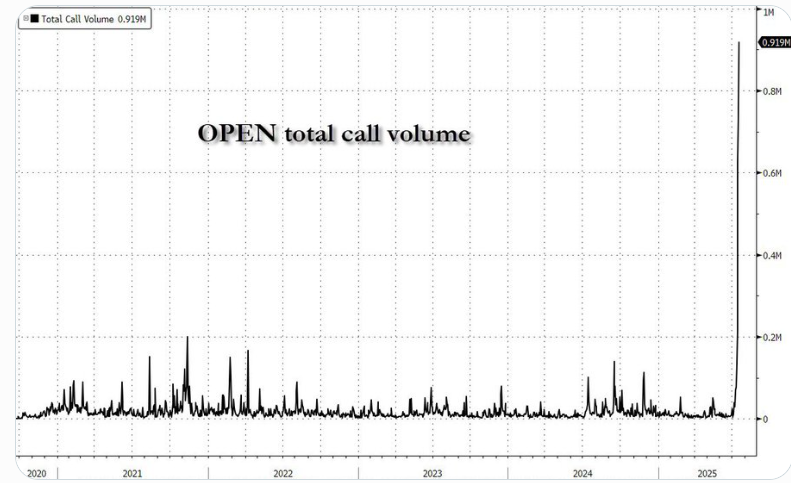

Heavy resistance remainsWe had another great day yesterday. Our levels were spot on all day and that helped us control our entries and exits. Gold gave us something to work on but other than that we came really close to a $1,000+ dollar profit day. Some of our members got a fill on our NDX put order (I didn't) and that pushed them over the top. Here's a look at my day: I'm traveling today so I'll be giving our levels inside our trading room. September S&P 500 E-Mini futures (ESU25) are trending down -0.04% this morning as investors brace for a raft of corporate earnings reports and continue to keep a close eye on any trade developments between the U.S. and key trading partners as the August 1st deadline approaches. White House Press Secretary Karoline Leavitt said that U.S. President Donald Trump could issue additional unilateral tariff letters before August 1st. She added that more trade deals could also be reached before the deadline. Meanwhile, Philippine President Ferdinand Marcos Jr. will become the latest foreign leader eager to strike a deal before the deadline as he meets with Trump in the Oval Office later today. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed, with the S&P 500 and Nasdaq 100 notching new all-time highs. Verizon Communications (VZ) climbed over +4% and was the top percentage gainer on the S&P 500 and Dow after the carrier posted upbeat Q2 results and raised the lower end of its full-year adjusted EPS growth forecast. Also, chip stocks gained ground, with Arm Holdings (ARM) rising more than +3% to lead gainers in the Nasdaq 100 and Qualcomm (QCOM) advancing over +2%. In addition, Block (XYZ) surged more than +7% after S&P Dow Jones Indices announced that the stock would be added to the S&P 500 index on Wednesday, July 23rd. On the bearish side, Bruker (BRKR) plunged over -12% after the maker of scientific instruments posted weaker-than-expected preliminary Q2 results. Economic data released on Monday showed that the Conference Board’s leading economic index for the U.S. fell -0.3% m/m in June, weaker than expectations of -0.2% m/m. “While stocks may be due for a breather, we believe the bull market remains intact. We maintain our June 2026 S&P 500 price target of 6,500, and recommend using volatility as an opportunity to phase into markets,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. Second-quarter corporate earnings season is ramping up. Investors will be closely monitoring earnings reports today from notable companies like Coca-Cola (KO), Philip Morris International (PM), RTX Corp. (RTX), Texas Instruments (TXN), Intuitive Surgical (ISRG), Danaher (DHR), Lockheed Martin (LMT), and General Motors (GM). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. On the economic data front, investors will focus on the U.S. Richmond Fed Manufacturing Index, which is set to be released in a couple of hours. Economists foresee this figure coming in at -2 in July, compared to the previous value of -7. Meanwhile, Fed Chair Jerome Powell is scheduled to deliver opening remarks later today at a conference focused on capital frameworks for large banks. With Fed officials in a blackout period before the July 29-30 policy meeting, Mr. Powell is likely to avoid commenting on interest rates. U.S. rate futures have priced in a 97.4% probability of no rate change and a 2.6% chance of a 25 basis point rate cut at the upcoming monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.389%, up +0.23%. Trade docket today: Gold 0DTE, Copper next tranche, /MNQ short scalp, KO, LMT, ENPH earnings, QQQ 0DTE, SPX and NDX 0DTE. Ladies and Gentlemens, the Warren Buffett indicator has now officially entered the exosphere. 208% Guess what happens next? Looks like the biggest gamma squeeze in history Be prepared folks. If you aren't hedging for a downside move you may be taking on too much risk. My lean or bias today is Neutral. We need a catalyst to move us. Looking at Gamma levels (orange lines) it seems to indicate more downside than upside. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |