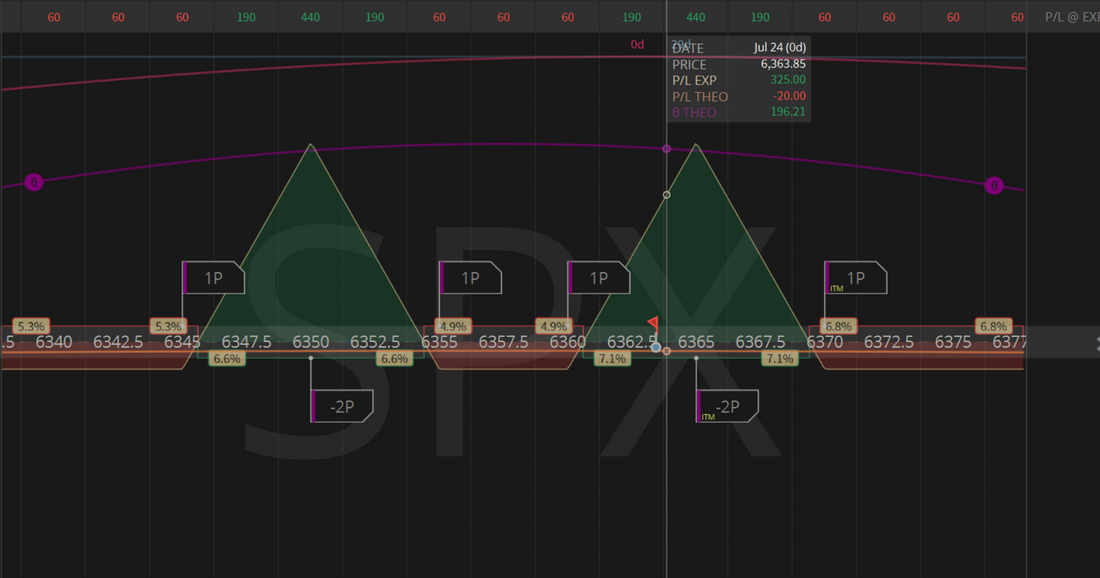

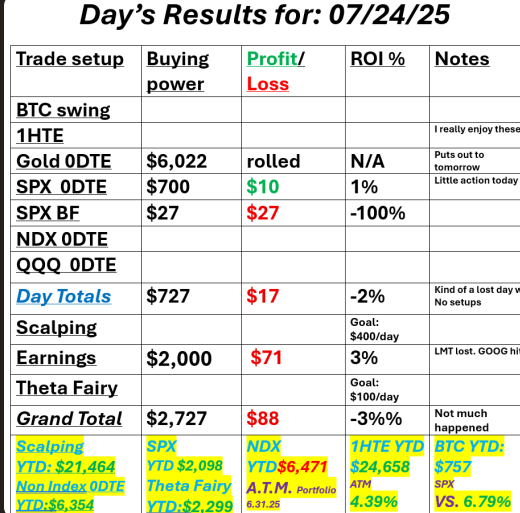

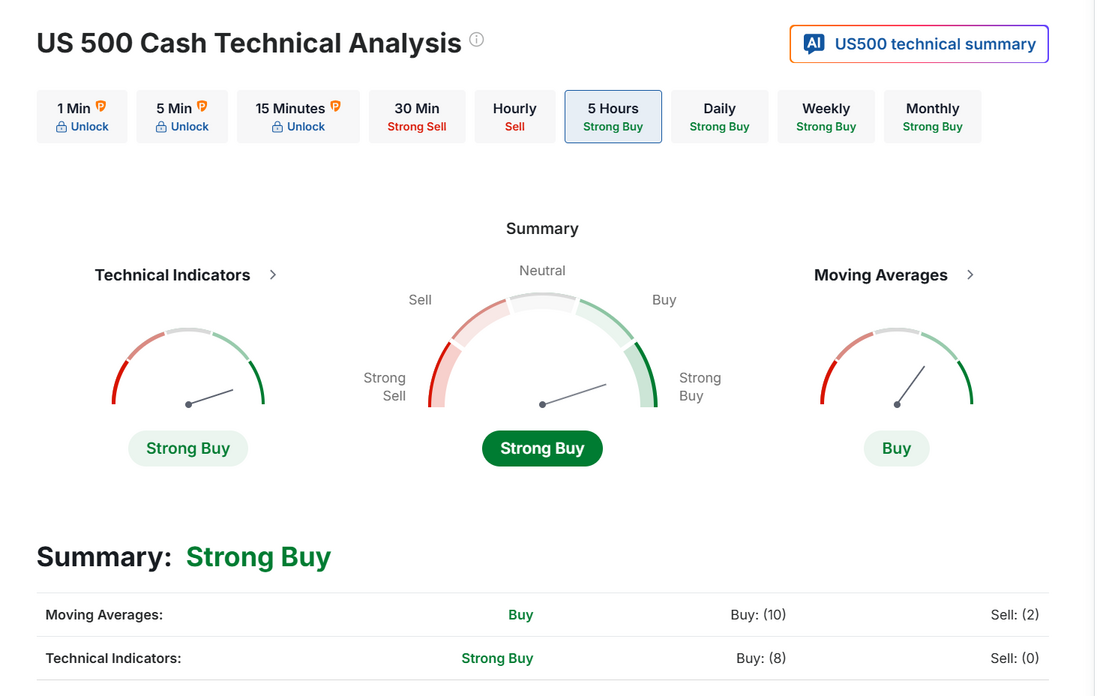

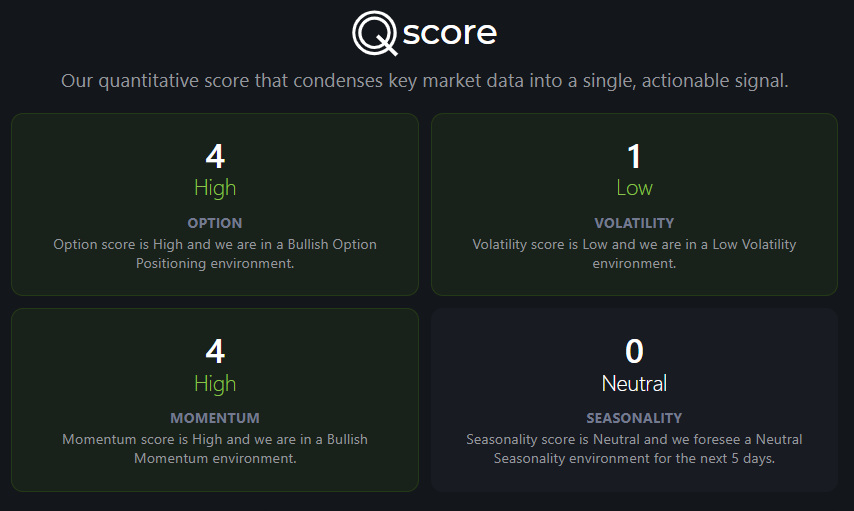

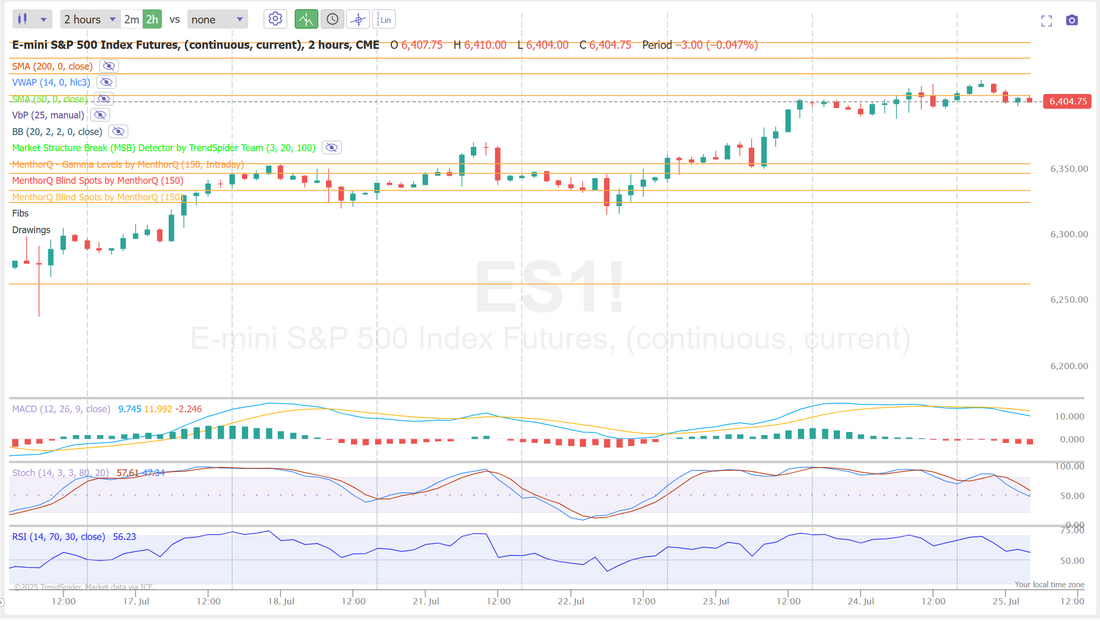

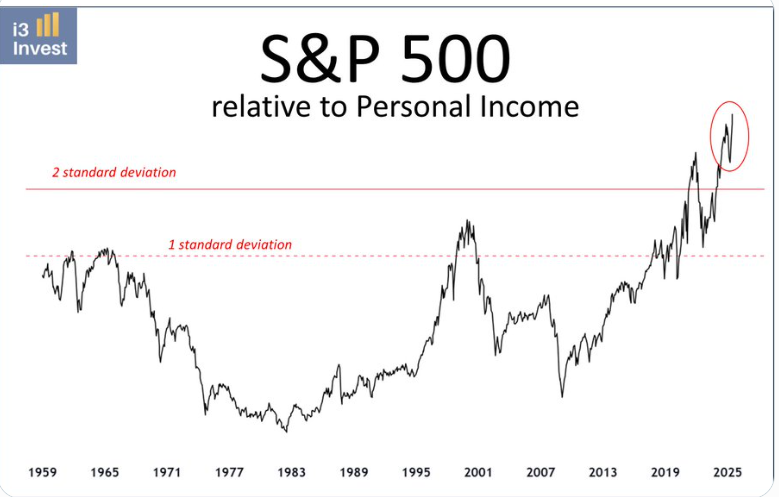

What's the best part of trading for you?I love trading and I'm super grateful to be able to make a living from it. Some days are up and some are down but one thing I love about it is that every day is a new day with new opportunities. If you didn't like today, tomorrow will most likely serve something else up that you very well may like! Yesterday was one of those rare days where I felt like we were just wasting our time. We never really got any substantive setups working. That's not totally true. We repositioned out Gold puts to todays expiration and they look to provide some good cash flow today but as far as booking results from yesterday it was a bust. I did add another butterfly late yesterday that cost me $47 dollars and hit for a $325 profit but...I didn't add it as an official trade to the group and so it doesn't get counted in our P/L matrix. It was a nice hit though and we very well may be back using butterflies today. As I said, not much to report from yesterday. Let's take a look at the markets. Surprise, surprise. The bullish bias continues to hold. The SPX chart as of July 24, 2025, shows a strong upward trend in spot prices, with a steady sequence of higher highs and higher lows. The momentum score remains elevated at level 4, just below its recent peak of 5, indicating continued strength but slightly less acceleration in recent sessions. This persistent high momentum may reflect broad market confidence, although some moderation suggests short-term consolidation could be underway. In the near term, watching for any drop in momentum score or a reversal in price pattern could be useful for gauging shifts in market behavior. Positive gamma continues. Quant score continues to be bullish. Looking at intra-day levels: /ES futures are flat, as I type. One thing I would take note of is the placement of the different gamma walls. As you can see (orange lines) there are more resistance areas, cloistered close together creating multiple resistance zones, close to current levels. On the downside they are farther away. This implies that we are stretched to the upside. We will get a downturn today? No one knows but with each passive day of bullish price action, the potential for a retrace grows. Resistance levels today are 6411, 6425, 6438. Support is all the way down at 6357. My bias or lean today is neutral. Yes, everything still points bullish but I'm looking for a bit of a pause today. Extremes almost always result in a reversion to the mean. If you aren't seriously preparing for something like this or say it can't happen, I'd take a hard look at your risk managment. Here's something else to consider. Wall Street’s AI bubble now eclipses the dotcom bubble. Tech now makes up 34% of the S&P 500 — surpassing the 33% peak in 2000. Top 10 stocks control 40% of the index vs. 25% in ’99. Concentration risk is real. Trade docket for today is very simple. We don't need much to bump our net liq's $1,000+ dollars today. Our Gold puts are expiring today. That should be $500 profit. Our Copper trade for today has already executed and that whole trade expires Monday. It's up $400+ as I type. We'll also focus on SPX today and I believe more butterflies may be on the agenda. I look forward to finishing the week strong with you all! Our net liq should have a good shot today at doing the same thing it did last week...finishing at the high of the week. That's what it's all about at the end of the day.

See you all in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |