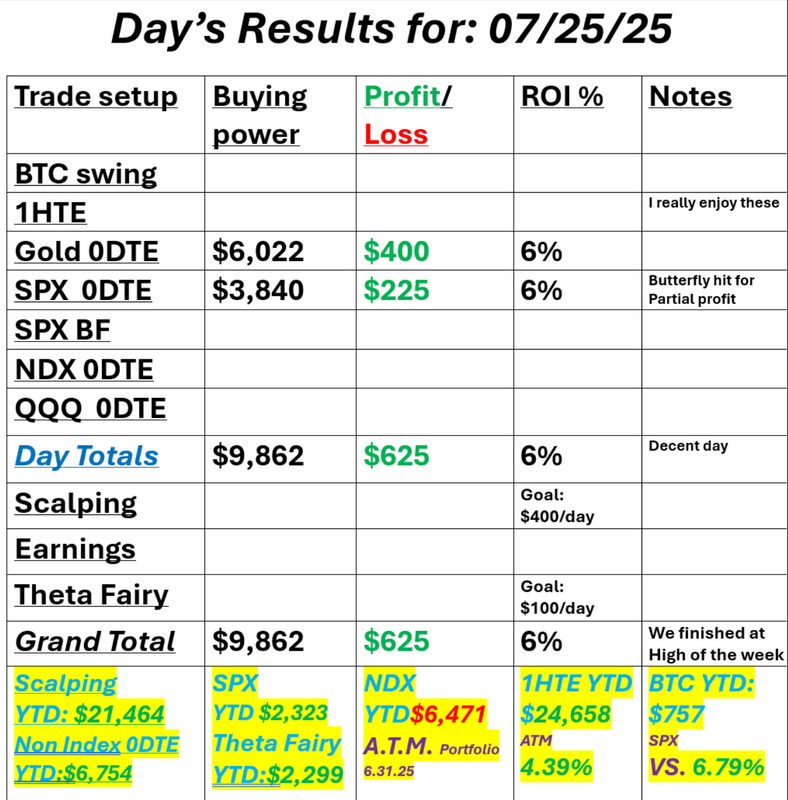

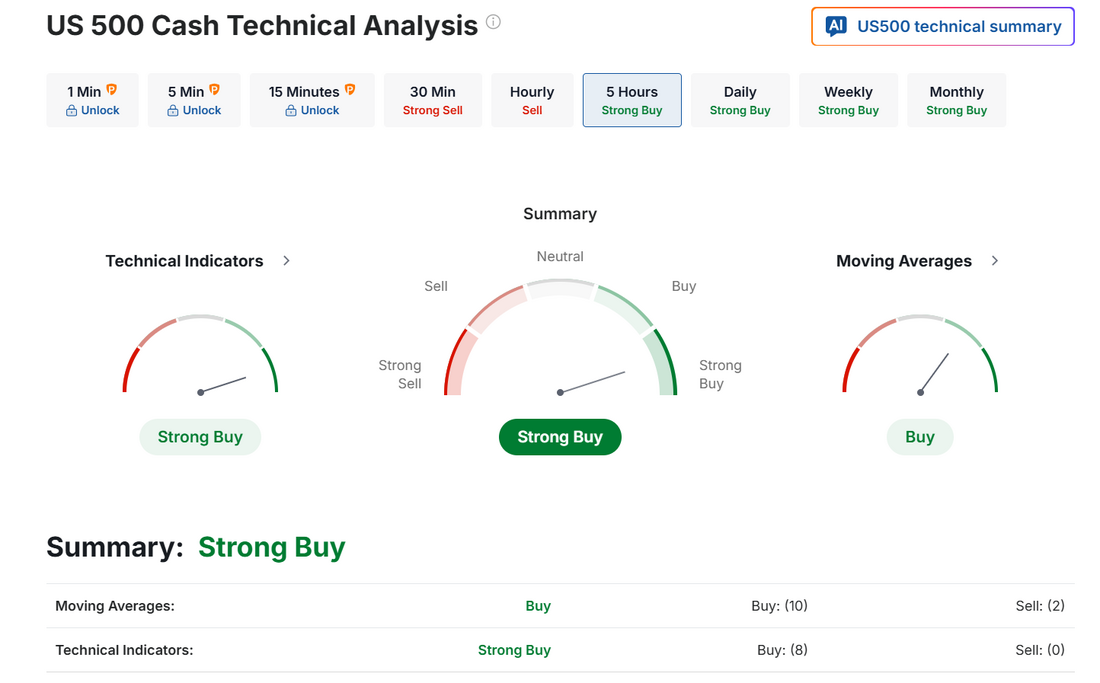

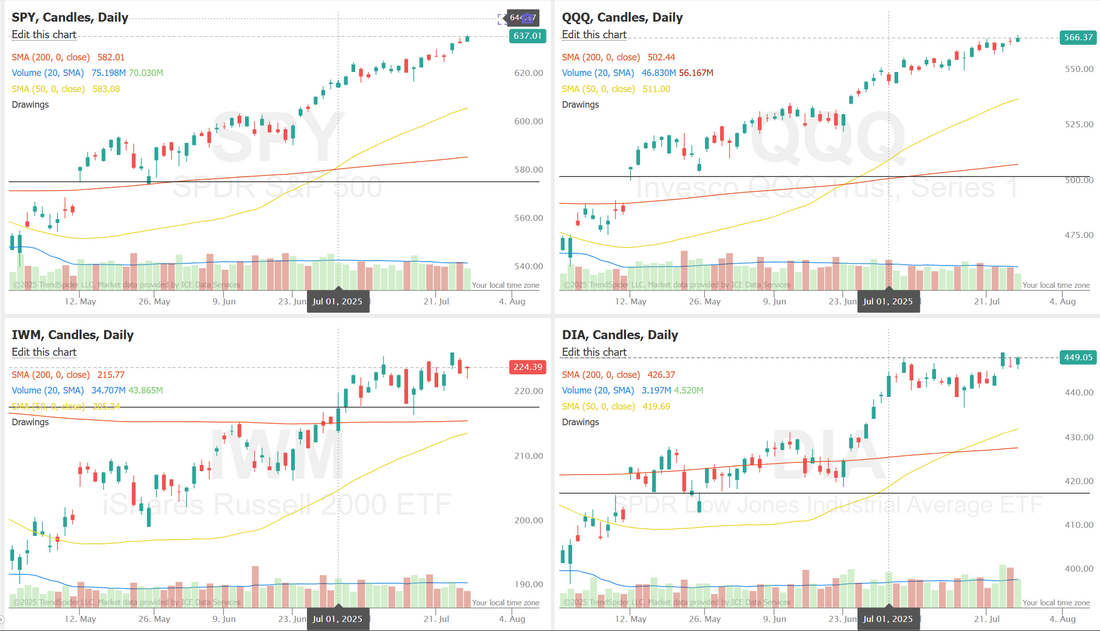

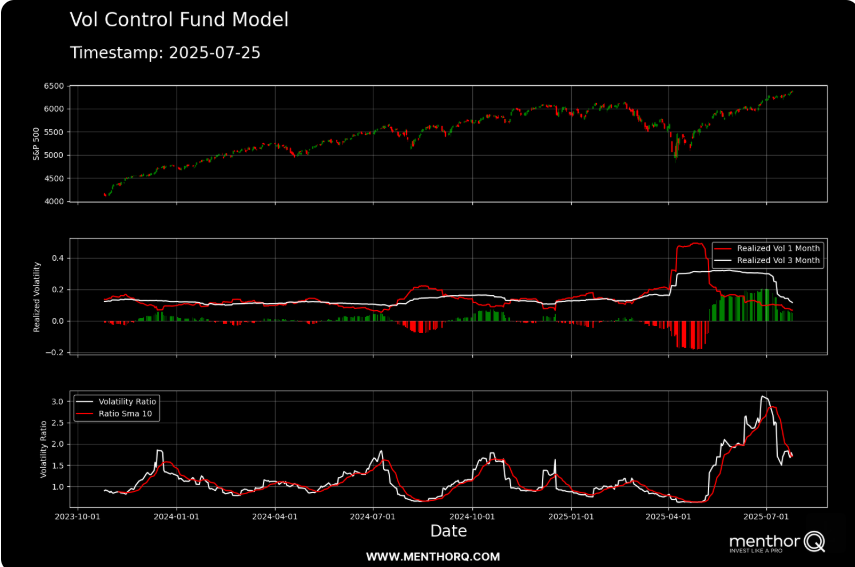

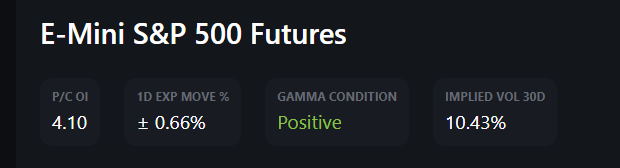

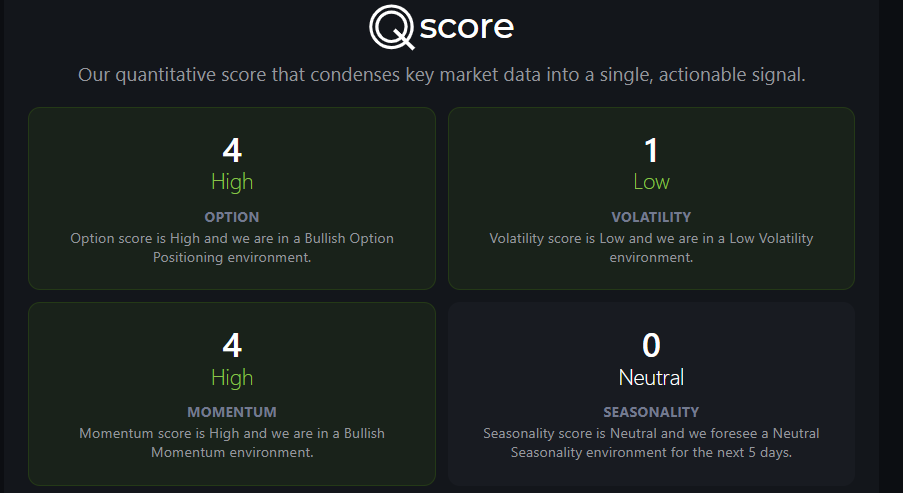

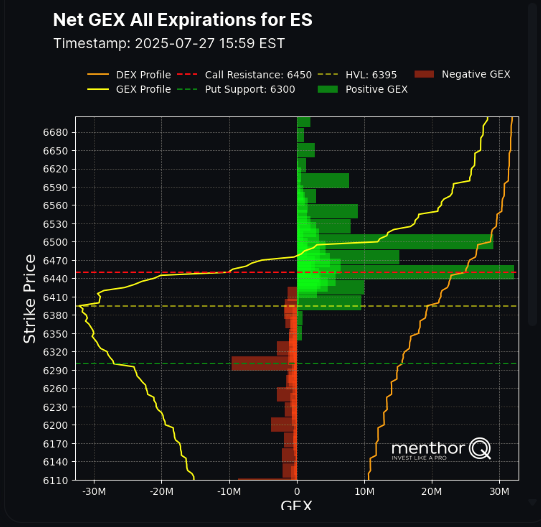

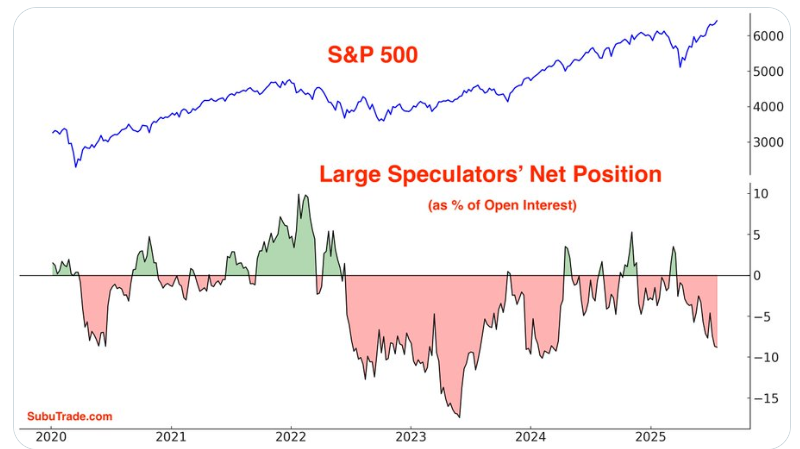

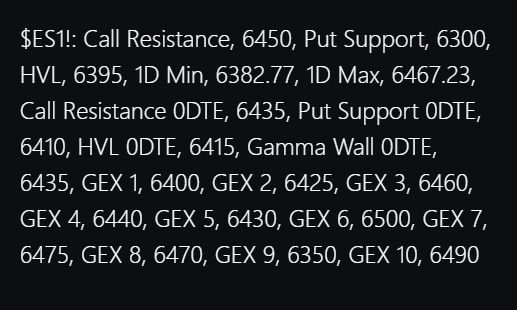

Trade deals, FOMC and EarningsWelcome back traders. We had another great week last week. Our net liq went up nearly every day and we ended Friday at our weekly high. Nearly a repeat of the previous week.. I had a nice week up in the mountains the family. I'm sunburned and glad to be back but what a great week. In trade news this week we got a big bump in futures Sunday night with news of the EU trade deal. We've got FOMC Weds. and lots and lots of earnings this week. Our results Friday weren't amazing, off the charts but our net liq was up $1,400 with the help of our copper trade. Take a look below: Let's take a look at some of the market metrics: Technicals are still bullish. We continue to still up at these ATH's. When will the push end? The Vol Control Fund Model for SPX as of July 25, 2025, highlights a recent decline in both 1-month and 3-month realized volatility after a notable spike earlier this quarter. The top panel shows continued strength in the S&P 500 price action, with the index trending higher and approaching new highs. Meanwhile, the lower panel indicates that the volatility ratio (1-month vs. 3-month realized vol) has dropped from elevated levels but remains above the long-term average, suggesting a cooling period following a burst of market movement. In the short term, this easing in realized volatility could imply reduced pressure on volatility-targeting strategies, potentially allowing for more stability or even incremental re-risking behavior. However, market participants may want to stay alert to any reversal in this ratio trend, which could signal shifting dynamics in risk-adjusted exposures. Gamma structure is still bullish The Quant score is still very bullish Net GEX levels haven't changed much from Fridays levels. With all this bullishness there are some things I'd like you to keep in the back of your mind. Asset managers are selling into the rally. Everyone is trying to anticipate a pullback and no one believes the breakout over all time highs. Large Speculators / Hedge Funds are the most net short S&P 500 futures in over a year. This is a blow off top now. The TSI closed above 42. This is the 3rd time that happened in the last 5 years. The other cases topped at 51 in Sep 2020, 51 in Dec 2023 and 49 in Jul 2024. Dec 2023 isn't comparable. The 2020 and 2024 cases were followed by 10% corrections. Nasdaq 100 now priced at a critical juncture relative to M2 (Money Supply). As history suggest, a crash is imminent Just some things to think about. I don't know when or by how much markets will fall but they will...they always do. September S&P 500 E-Mini futures (ESU25) are up +0.28%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.46% this morning, pointing to a higher open on Wall Street after U.S. President Donald Trump reached a trade deal with the European Union. President Trump and European Commission President Ursula von der Leyen announced the EU agreement on Sunday at his golf club in Turnberry, Scotland. The U.S. would impose a baseline tariff of 15% on European goods, including automobiles. The new tariff rate will take effect on August 1st, according to a U.S. official. Mr. Trump said tariffs on steel and aluminum, which are currently at 50%, would remain unchanged. He also said the EU had agreed as part of the deal to purchase $750 billion worth of American energy products, invest an additional $600 billion in the U.S., and buy “vast amounts” of military equipment. In addition, U.S. goods shipped to Europe won’t be charged tariffs. This week, market participants look ahead to earnings reports from major tech names, the Federal Reserve’s interest rate decision, as well as key economic data, including the jobs report, the Fed’s favorite inflation gauge, and the first estimate of second-quarter GDP. In Friday’s trading session, Wall Street’s major equity averages ended higher, with the S&P 500 and Nasdaq 100 notching new all-time highs. Deckers Outdoor (DECK) surged over +11% and was the top percentage gainer on the S&P 500 after the company posted upbeat FQ1 results and provided solid FQ2 EPS guidance. Also, Newmont (NEM) climbed more than +6% after the gold miner reported stronger-than-expected Q2 results. In addition, Centene (CNC) rose over +6% after the health insurer unveiled a plan to address issues in its Affordable Care Act business to ensure profitability in 2026. On the bearish side, Charter Communications (CHTR) tumbled more than -18% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company posted weaker-than-expected Q2 EPS. Economic data released on Friday showed that U.S. durable goods orders slumped -9.3% m/m in June, better than expectations of -10.4% m/m, while core durable goods orders, which exclude transportation, rose +0.2% m/m, stronger than expectations of +0.1% m/m. “The pace of earnings so far this month has been positive, economic data has been hanging in there, and we’re even starting to get some sense of clarity on tariffs. You can’t fault investors for being optimistic,” said Bespoke Investment Group. Second-quarter corporate earnings season continues in full force, and investors await fresh reports from high-profile companies this week, including Microsoft (MSFT), Meta Platforms (META), Apple (AAPL), Amazon.com (AMZN), Mastercard (MA), Visa (V), Arm (ARM), Qualcomm (QCOM), KLA Corp. (KLAC), Procter & Gamble (PG), United Parcel Service (UPS), Exxon Mobil (XOM), and Chevron (CVX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. Market watchers will also focus on the Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference. The central bank is widely expected to leave the Fed funds rate unchanged in a range of 4.25% to 4.50%. The decision comes amid criticism of Mr. Powell by President Trump and repeated calls for the central bank to lower interest rates. Powell and other Fed officials have emphasized the importance of patience as the Trump administration’s tariffs pose a risk of reigniting inflation. “We believe this [Fed] meeting will be a non-event with rates left on hold and quantitative tightening likely left unchanged,” ING analysts said in a note. This week’s top-tier U.S. economic data will offer insight into whether the Fed may be justified in lowering interest rates in the coming months. The advance estimate of second-quarter U.S. gross domestic product, the July Nonfarm Payrolls report, and the latest reading of the core personal consumption expenditures price index will be the main highlights. Any indications of a cooling labor market or slowing economy could boost the likelihood of rate cuts resuming in September or October. Other noteworthy data releases include the U.S. JOLTs Job Openings, the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., ADP Nonfarm Employment Change, Pending Home Sales, the Employment Cost Index, Initial Jobless Claims, Personal Income, Personal Spending, the Chicago PMI, Average Hourly Earnings, the Unemployment Rate, the S&P Global Manufacturing PMI, Construction Spending, the ISM Manufacturing PMI, and the University of Michigan’s Consumer Sentiment Index. Meanwhile, the August 1st deadline for the U.S. to impose reciprocal tariffs also takes center stage. Optimism has been building that the U.S. will reach trade agreements with multiple countries before the deadline. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.373%, down -0.30%. Trade docket today is busy: We'll be working our Gold 0DTE. Our Copper trade expires today and should result in an O.K. return. The profit projection is the same but BP has increased and cut down ROI. /MNQ scalping again today. LULU covered call. QQQ 0DTE. SPX 0DTE. Possible NDX 0DTE later in the day. UNH, MRK, BA, PYPL earnings trades. My lean or bias today is bullish. Once again, at some point we'll get a change of direction but for now, everything continues to look bullish. Futures have retraced a bit from Sunday's high but we are still looking to open up. Let's take a look at the intra-day /ES levels: 6442, 6456, 6474 are todays resistance levels. 6435, 6423, 6412, 6402 are support levels. Gamma levels for 0DTE: Today should be a good day with our Gold 0DTE already cash flowing and our Copper trade take profit coming shortly. I'll see you all back on Zoom this morning! Looking forward to it.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |