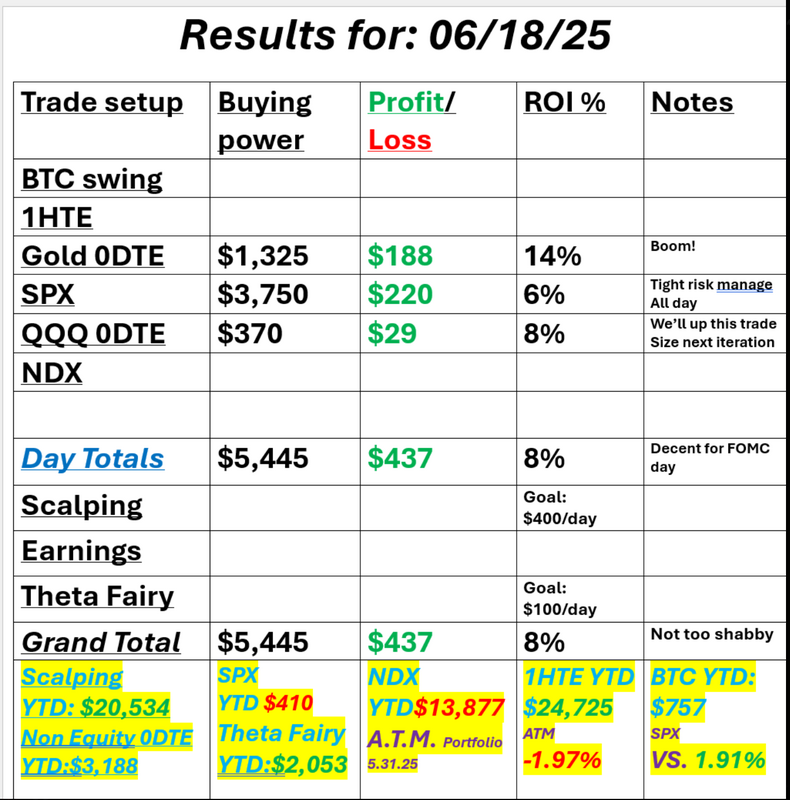

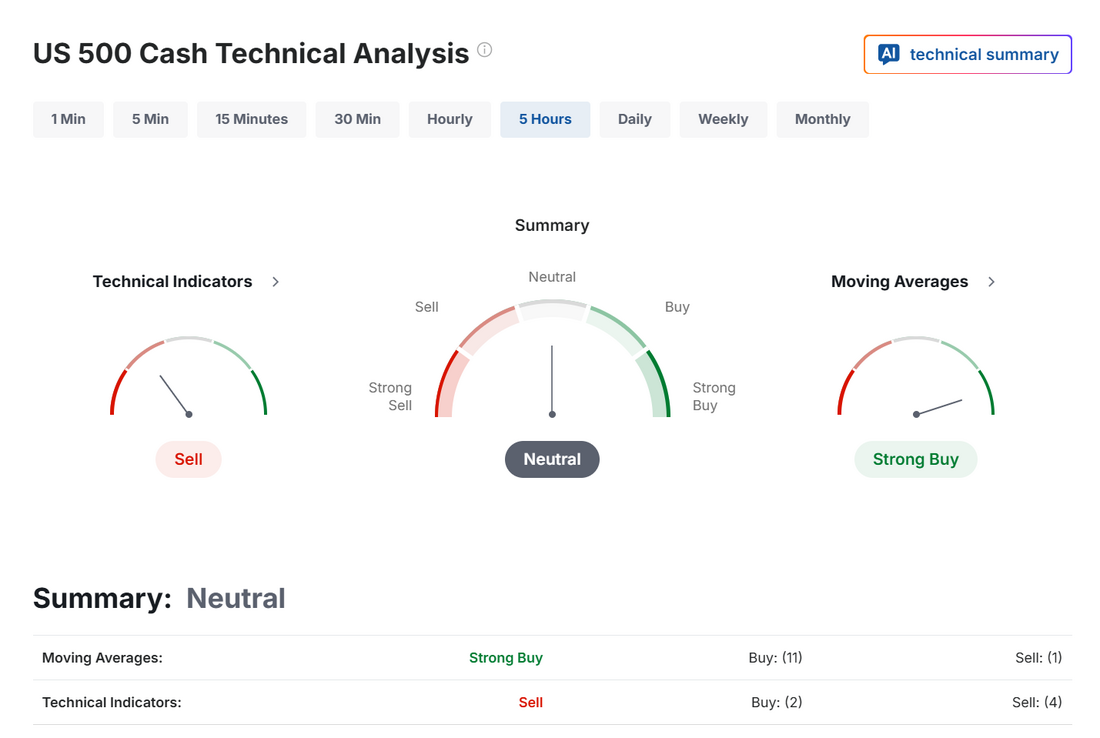

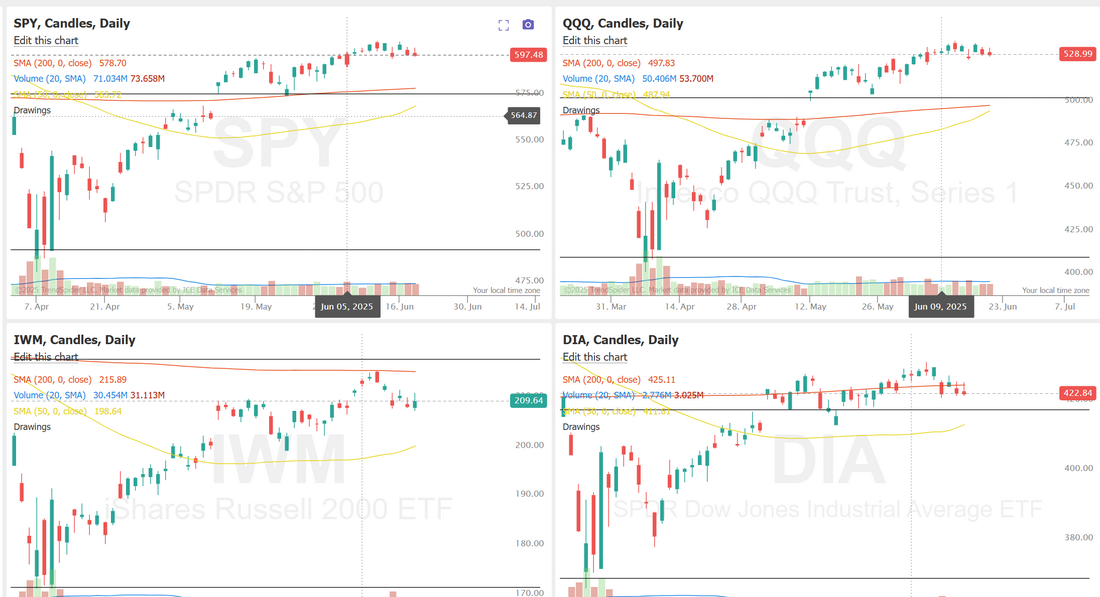

Triple witching and IranWelcome to Friday! Today could be an interesting one or...just a dud. It's a Friday. It's triple witching and we've got Iran news. Technicals are neutral and we are still stuck in the same range we've been in for over a month! As some point we'll break out of this consolidation zone. Tariff talk. The Fed. Iran war....none of it has been able to shake us out of this tight range. I'm not sure if today will be the day but it's coming...at some point. We've got our overnight Vampire trade expiring this morning and it looks like a profit which is a nice way to start the day. We weren't able to get anything working with scalping nor 1HTE's on Weds. so that hurt our potential for a $1,000+ profit day but it still ended up solid for us. Here's a look at our results. June S&P 500 E-Mini futures (ESM25) are trending up +0.15% this morning as cash trading resumed after the Juneteenth holiday, with investors digesting the White House’s signal that President Trump would delay a decision to launch strikes against Iran. The conflict between Israel and Iran entered its second week, with Israel hitting more nuclear sites in Iran on Thursday and warning that its strikes could bring down Tehran’s leadership, as both sides awaited a decision from U.S. President Donald Trump on whether to join the offensive. On Thursday afternoon, White House press secretary Karoline Leavitt said that President Trump would decide within two weeks whether the U.S. would participate in strikes against Iran, while noting there was a “substantial chance” of reaching a negotiated settlement. The news alleviated immediate concerns of U.S. military escalation, providing some relief to investors. As widely expected, the Federal Reserve left interest rates unchanged on Wednesday. The Federal Open Market Committee voted unanimously to keep the federal funds rate in a range of 4.25%-4.50% for the fourth consecutive meeting. In a post-meeting statement, officials said that “uncertainty about the economic outlook has diminished but remains elevated.” Policymakers also released updated quarterly rate projections and economic forecasts, lowering their estimates for economic growth this year while projecting higher inflation and unemployment. While the median projection for two rate cuts this year remained unchanged, officials now anticipate fewer cuts in 2026 and 2027. At a press conference, Fed Chair Jerome Powell reiterated his view that the central bank was “well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.” Powell also stated that rising tariffs are likely to push prices higher, cautioning that their impact on inflation could be more persistent. “They are clearly in wait-and-see mode. They are sitting on their hands, waiting to see if tariffs increase inflation or the jobs market starts to falter, and whichever part of their dual mandate is impacted first will likely guide whichever direction they take,” said Chris Zaccarelli at Northlight Asset Management. In Wednesday’s trading session, Wall Street’s major indexes ended mixed. Mastercard (MA) slid more than -5% to lead losers in the S&P 500, and Visa (V) fell over -4% to lead losers in the Dow amid continued worries about the impact of stablecoins on credit-card issuers. Also, Zoetis (ZTS) slid more than -4% after Stifel downgraded the stock to Hold from Buy. In addition, La-Z-Boy (LZB) fell over -1% after the furniture maker posted weaker-than-expected FQ4 adjusted EPS and issued soft FQ1 revenue guidance. On the bullish side, Coinbase (COIN) surged more than +16% and was the top percentage gainer on the S&P 500 after the Senate passed the Genius Act, legislation aimed at regulating stablecoins, and the company introduced Coinbase Payments, a stablecoin payments stack for commerce platforms. The Labor Department’s report on Wednesday showed that the number of Americans filing for initial jobless claims in the past week fell -5K to 245K, compared with the 246K expected. Also, U.S. May housing starts plunged -9.8% m/m to a 5-year low of 1.256M, weaker than expectations of 1.350M, while building permits, a proxy for future construction, fell -2.0% m/m to 1.393M, weaker than expectations of 1.420M. Meanwhile, Wall Street is bracing for a quarterly event known as “triple-witching,” during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. According to an estimate from Citi, $5.8 trillion of notional open interest across equities is set to expire today, including $4.2 trillion of index options, $708 billion of bets on U.S. ETFs, and $819 billion of single stock options. Rocky Fishman, founder of research firm Asym 500, estimated a larger figure of roughly $6.5 trillion, which also includes the notional value of options on equity index futures expiring today. On the economic data front, investors will focus on the U.S. Philadelphia Fed Manufacturing Index, which is set to be released in a couple of hours. Economists, on average, forecast that the June Philly Fed manufacturing index will stand at -1.7, compared to last month’s value of -4.0. The Conference Board’s Leading Economic Index for the U.S. will also be released today. Economists expect the May figure to be -0.1% m/m, compared to the previous number of -1.0% m/m. On the earnings front, notable companies like Accenture (ACN), Kroger (KR), Darden Restaurants (DRI), and CarMax (KMX) are slated to release their quarterly results today. U.S. rate futures have priced in a 91.7% chance of no rate change and an 8.3% chance of a 25 basis point rate cut at the next central bank meeting in July. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.403%, up +0.16%. Let's take a look at the markets. Technicals are a solid neutral to start the day. Not much to read into it. We see a tight range. A heavy overhang of resistance. A slight attempt to rollover but, still no definable trend. My lean or bias today is every so slightly bullish. Generally with neutral rated days we get a switch to bullish or bearish by the end of the day. Iran just said it was willing to come to the negotiation table and that popped the futures a bit. I'll be patient today with new 0DTE's. We've already got a Gold 0DTE and the Vampire 0DTE expiring today. Trade docket for today: We'll be unwinding our Gold 0DTE. Holy smoke these have been good. ACN, KMX, KR earnings trades should all print profits for us right at the open. LULU needs some work. Most of us got assigned the longs. I'd like to keep it but will need to scale down the size to be properly position sized. ORCL puts expire. QQQ will close today. /MNQ scalp is our focus in the scalping program and I believe we can get a 1HTE started this morning. Let's take a look at the intra-day levels on /ES. My levels are the same as Weds. 6047 is the resistance level and if bulls can push through that it could be what they need to start a new bullish uptrend. 6017 is support. It's pretty strong. Below that is the massive 6003 level that we've been trading around for what seems like an eternity. Let's have a great finish to a great week folks. See you in the trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |