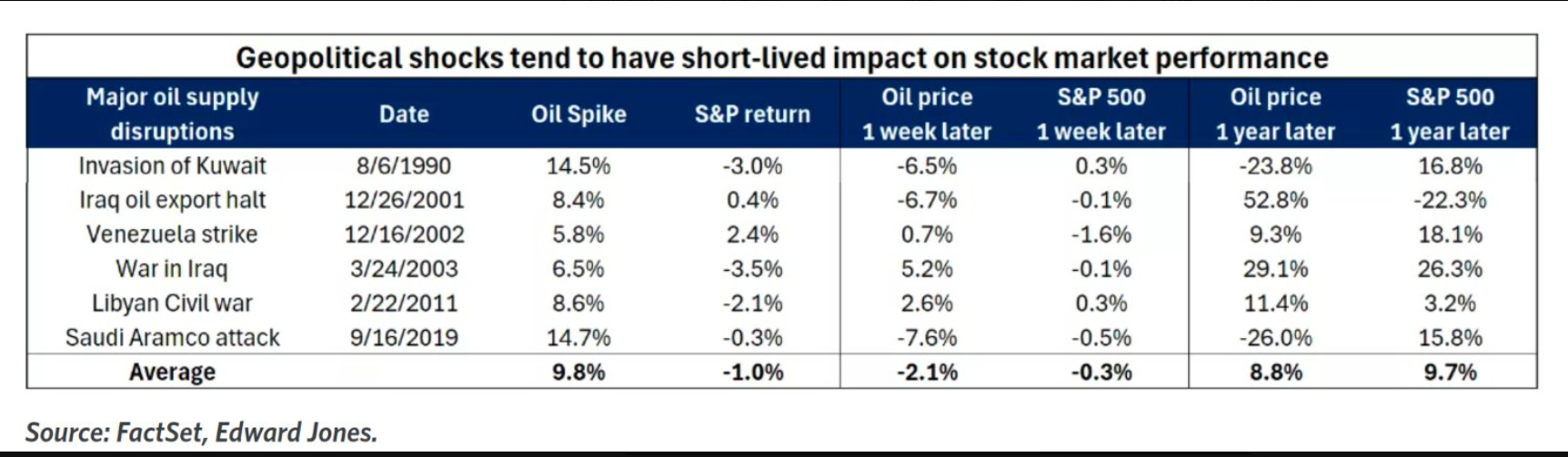

When bombs drop, markets pop...eventually.Welcome back to another holiday shortened trading week. It's been quite the year what with markets starting off with a correction. Then liberation day and tariffs. Now with the Iran/Israel war. We did well on Friday playing the rebound and we are already set for a good day today, having rolled a bullish /NQ scalp and a bearish /GC gold play to today. Those alone could give us our $1,000+ profit goal for the day. We also got a killer Theta fairy on last night, We started with the put side and it moved so fast we hit our take profit level before we could even get the call side on! I talked a lot of Friday about the undercut setup and we certainly took it to heart and have jumped all over it. Geo political events usually have little effect on markets, in the longer term. These are generally buying opportunities.

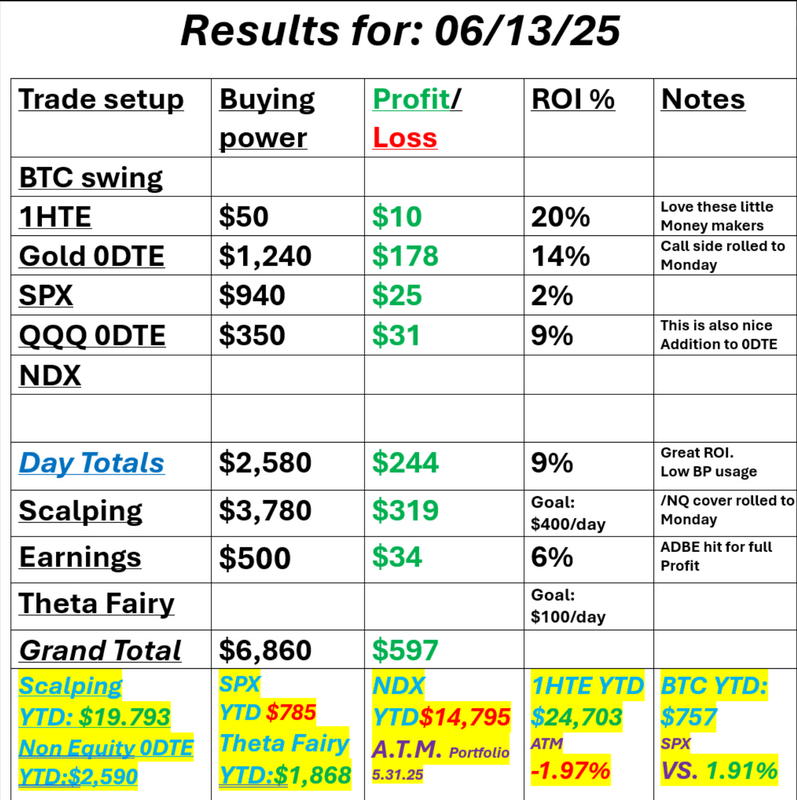

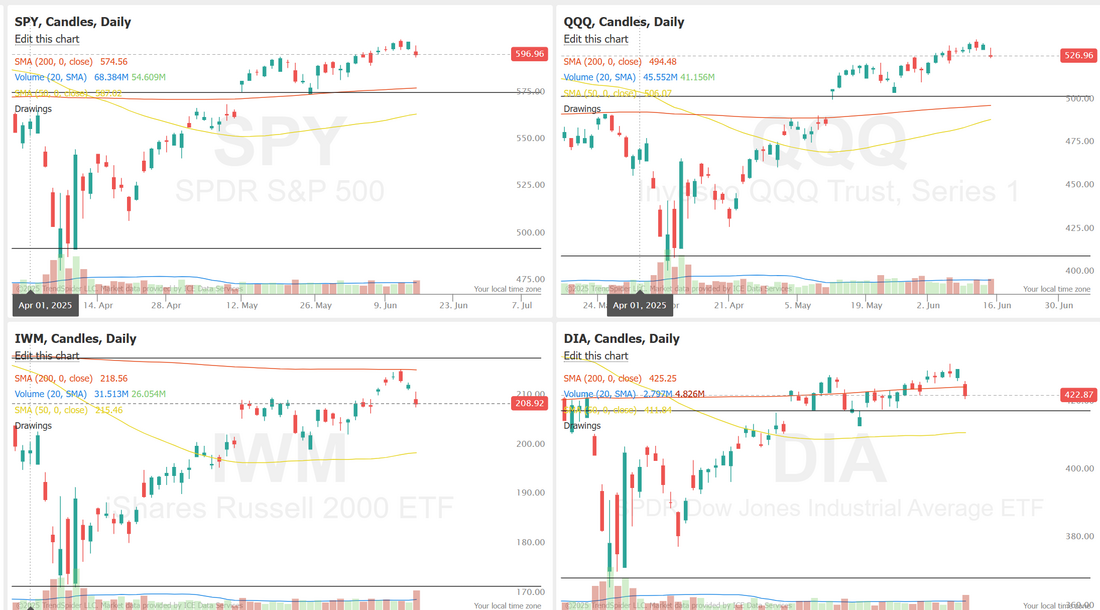

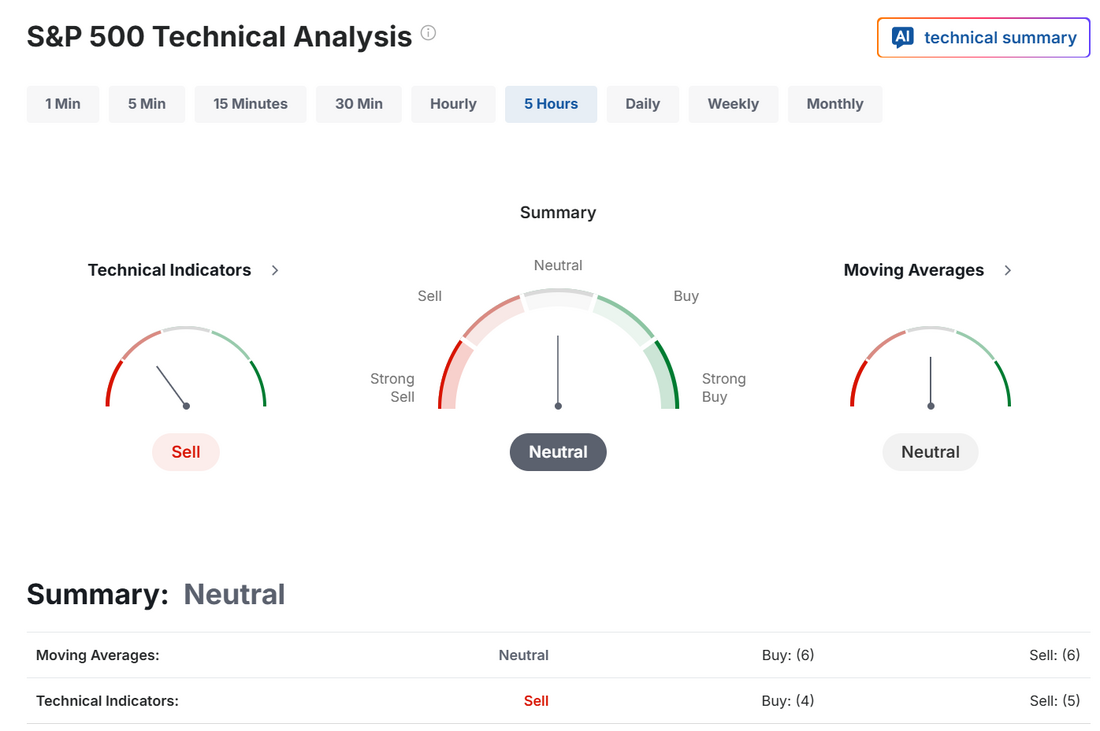

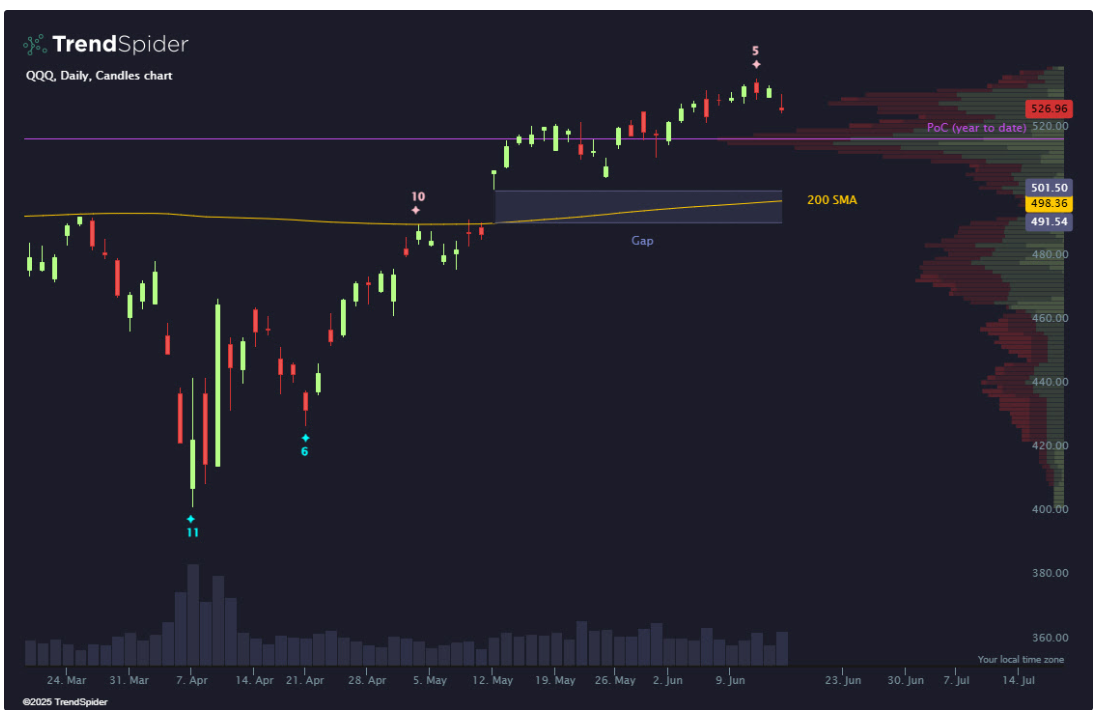

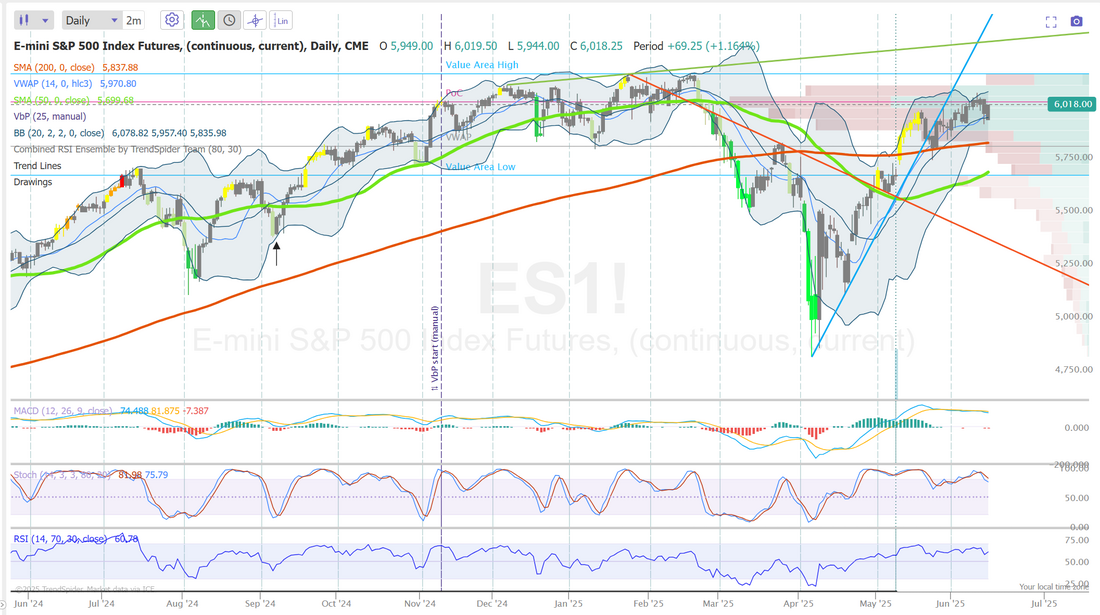

I've said this over and over. THE MARKET DOES NOT CARE ABOUT WARS! It cares greatly about uncertainty. Uncertainty is the boogie man to the stock market. It can deal with recessions, pandemics, wars, etc. It's the uncertainty of the future that it hates. We are set up for a banner day today but that is largely due to staring down the barrel of some scary news on Friday. We traded small on Friday as I thought that was appropriate. Here's a look at our day: Let's take a look at the markets. Indices are rolling over but we don't quite have a solid sell signal yet. Technicals this morning are back to neutral bias as it appears Israel will have largely accomplished it's mission to "de-nuke" Iran. SPY closed the week lower at $597.00 (-0.34%) as geopolitical tensions escalated with the outbreak of conflict between Israel and Iran. The recent peak coincided with a signal from TrendSpider CEO Dan Ushman’s custom QX QSB Score Markers Indicator, which integrates data from 14 technical indicators to identify overbought and oversold conditions. With 8 of the 14 signaling oversold territory, traders should watch closely to see if the high-volume node below can provide meaningful support. QQQ also ended the week in the red at $526.96 (-0.56%), but with a bit more optimistic signal from the QX QSB Score Markers Indicator. Only 5 of the 14 component indicators registered overbought conditions, suggesting tech may be showing relatively stronger momentum. Still, with global tensions elevated and a gap aligning with the 200-day SMA just below, bears could find an opening to press the index lower. Small caps took the hardest hit this week, with IWM closing at $208.89 (-1.41%). The index was firmly rejected at the 200-day SMA, coinciding with a 9-handle on the QX QSB Score Markers Indicator, making it the most bearish signal among the major indexes. With price now testing its YTD volume point of control, it’s up to the bulls to put in another higher low and flip prior resistance into support. Let's take a look at the daily on /ES. It still looks a little like a roll over to me. Just too early to tell. My lean or bias today is bullish. This was largely establish last Friday as we set up a bearish Gold trade and a bullish /NQ scalp. Trade docket for today: Most of our heavy hitter setups for today were put in place last Friday. We are already cash flowing this morning with a nice Theta fairy entry last night. It hit our profit target so fast we couldn't get the call side on. Our /GC, gold trade looks great this morning as we were looking for a pullback. We'll work to get a put side added today. Our bullish /NQ scalp looks set to be our biggest winner today. GNE DCA. LULU needs a bit more work. ORCL will also be worked again today. Our QQQ 0DTE will start us off today. We may also get a 1HTE BTC working today. We have one earnings play today in LEN. une S&P 500 E-Mini futures (ESM25) are up +0.40%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.45% this morning, signaling a partial rebound from Friday’s sell-off on Wall Street as investors dialed back some risk-off positioning sparked by the hostilities between Israel and Iran. Investors continued to keep a close eye on tensions between Israel and Iran, which showed no signs of easing. Iranian missiles hit Israel’s Tel Aviv and the port city of Haifa before dawn on Monday, marking the latest in a series of tit-for-tat attacks that began last week. Iran also warned that it may close the Strait of Hormuz, a key chokepoint for global oil shipments. Still, investors stepped in to buy the dip on Monday, expecting the conflict would be unlikely to draw in more parties. This week, investors look ahead to the Federal Reserve’s interest rate decision as well as a fresh batch of U.S. economic data, with a particular focus on the retail sales report. In Friday’s trading session, Wall Street’s major equity averages closed lower. Most of the Magnificent Seven stocks retreated amid risk-off sentiment, with Nvidia (NVDA) falling over -2% and Apple (AAPL) dropping more than -1%. Also, airline stocks lost ground as the jump in oil prices sparked concerns about rising fuel costs, with American Airlines Group (AAL) and United Airlines Holdings (UAL) sliding over -4%. In addition, Visa (V) and Mastercard (MA) slumped more than -4% after the Wall Street Journal reported that major retailers, including Amazon and Walmart, are exploring ways to use or issue stablecoins to bypass credit card fees. On the bullish side, RH (RH) climbed over +6% after the luxury furniture company maintained its full-year guidance. Economic data released on Friday showed that the preliminary University of Michigan’s U.S. consumer sentiment index rose to 60.5 in June, stronger than expectations of 53.5. Also, the University of Michigan’s U.S. June year-ahead inflation expectations fell to 5.1% from 6.6% in May, better than expectations of 6.4%, while 5-year implied inflation expectations edged down to 4.1% from 4.2% in May, in line with expectations. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage in this holiday-shortened week. The central bank is widely expected to keep the Fed funds rate on hold in a range of 4.25% to 4.50%. Focus will center on any indications of when policymakers might lower interest rates. Recent softer-than-expected consumer and producer inflation data led many market participants to bring forward their expectations for the next rate cut. Market watchers will closely monitor the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC members’ forecasts regarding the path of interest rates. “The Fed will continue to prioritize the risk of higher inflation expectations, but as the unemployment rate moves further from the full employment rate level, they will pivot toward supporting the economy and labor market,” according to Scott Anderson, chief U.S. economist at BMO Capital Markets. Investors will also focus on a spate of economic data releases this week. The retail sales report for May will be the main highlight, as it will serve as another gauge of the economy’s health. Wells Fargo’s team of economists stated that the report is expected to indicate “the consumer has yet to run out of steam.” Other noteworthy data releases include U.S. Industrial Production, Manufacturing Production, the Export Price Index, the Import Price Index, Business Inventories, Building Permits (preliminary), Housing Starts, Initial Jobless Claims, Crude Oil Inventories, the Philadelphia Fed Manufacturing Index, and the Conference Board’s Leading Economic Index. In addition, several notable companies like homebuilder Lennar (LEN), accounting firm Accenture (ACN), grocery chain Kroger (KR), and online used car seller CarMax (KMX) are scheduled to release their quarterly results this week. Investors are also watching the G7 summit for potential responses to global flashpoints, including the conflict in the Middle East, the war in Ukraine, and ongoing trade tensions. Meanwhile, the U.S. stock markets will be closed on Thursday in observance of the Juneteenth federal holiday. The markets will reopen on Friday. Today, investors will focus on the Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists foresee this figure coming in at -5.90 in June, compared to -9.20 in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.432%, up +0.18%. I look forward to seeing you all in the live trading room shortly. Most of our work was put in on Friday. Today we just need to harvest it.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |