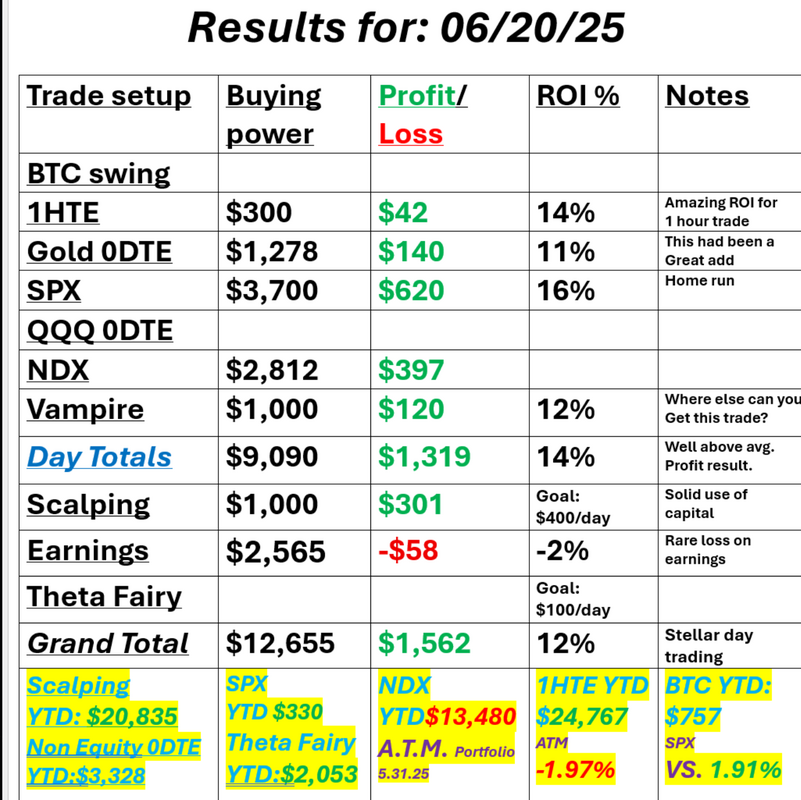

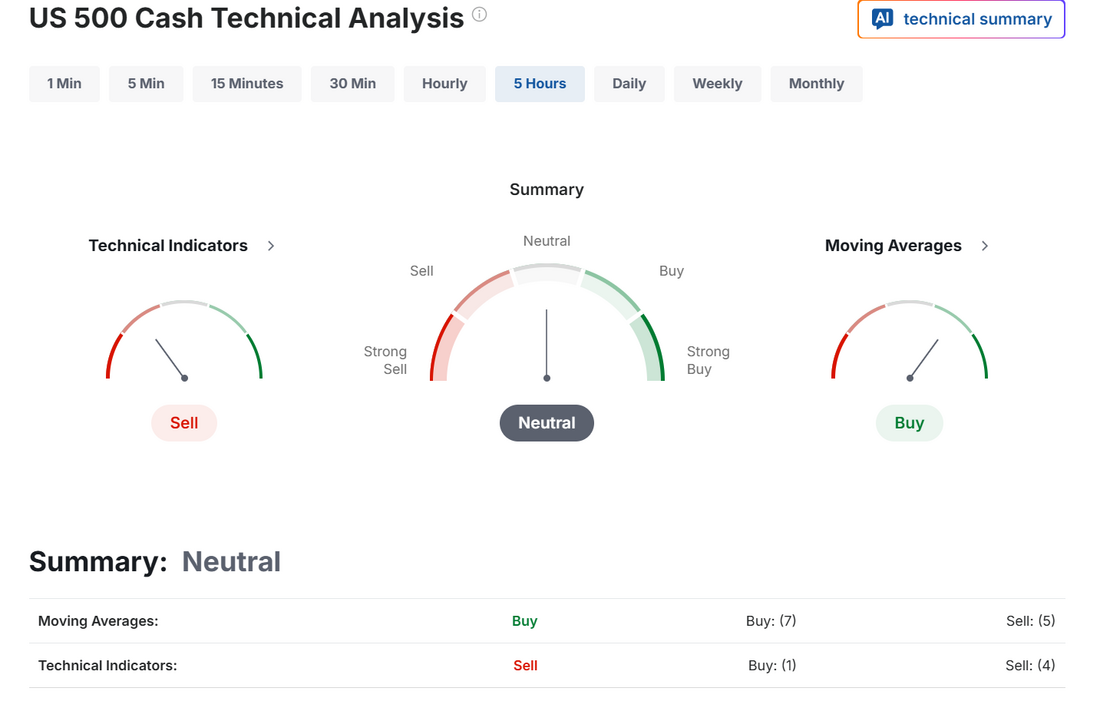

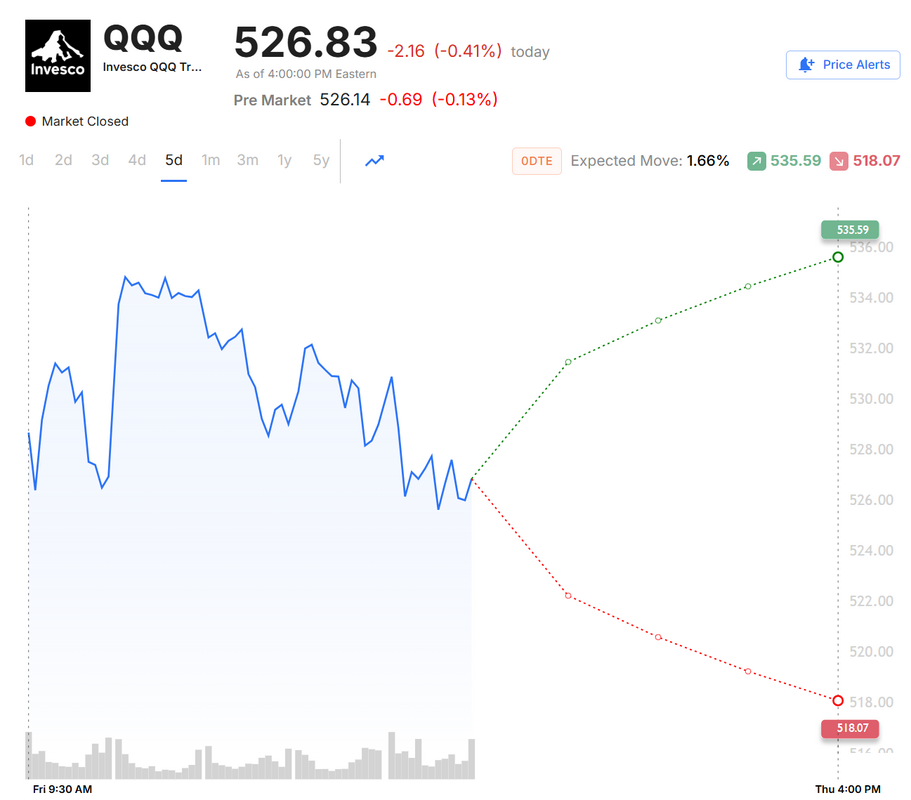

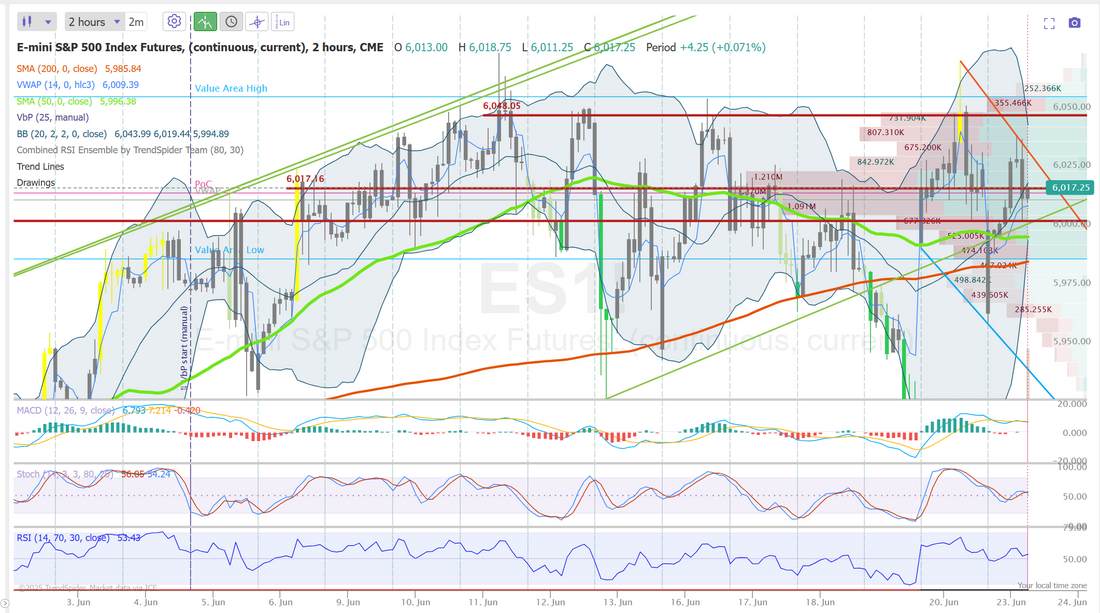

Do you trade on Sundays?One of the things I'm most proud about our trading room is that our trading week starts Sunday evening. Our daily profit goal is $1,000+ dollars of profit. Sometimes that's easy and sometimes it just seems like an impossible goal but getting a head start to the week certainly helps. We put over $500 dollar profit in our pockets Sunday night being on top of the Iran news. Starting today already half way to our profit goal is certainly nice and takes a bit of pressure off for today. Here's a look at our results from Friday. It was a well above goal, profit day, even with a rare overall loss on our earnings trades. September S&P 500 E-Mini futures (ESU25) are down -0.22%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.23% this morning, pointing to a slightly lower open on Wall Street as investors cautiously await Tehran’s response after the U.S. struck Iran’s nuclear facilities. The U.S. struck three Iranian sites over the weekend that form the backbone of the country’s nuclear infrastructure. U.S. President Donald Trump hailed the strikes as a “spectacular military success” in a Saturday night address, while cautioning that more could follow if “peace does not come quickly.” Investors are watching for Iran’s response to the airstrike, as it could drive sentiment. Tehran has stated that all options are on the table, including trade disruptions through the Strait of Hormuz, a key route for 20% of global oil and gas shipments. Still, crude prices gave up earlier gains amid speculation that the threat of oil trade disruption may not materialize. Analysts noted that Iran will likely avoid a full-scale retaliation. “Markets are still waiting to see what Iran will do next. Hormuz is still open, trade is flowing, Iran’s crude production facilities were untouched,” said analysts at Peak Trading Research. Investor focus this week is also on Federal Reserve Chair Jerome Powell’s congressional testimony, earnings reports from several high-profile companies, and the release of the Fed’s preferred inflation gauge and other key economic data. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Chip stocks retreated after The Wall Street Journal reported that the U.S. might revoke waivers for allies with semiconductor plants in China, with KLA Corp. (KLAC) sliding over -2% and Lam Research (LRCX) falling more than -1%. Also, Accenture (ACN) slumped over -6% and was the top percentage loser on the S&P 500 after the IT services company reported weaker-than-expected FQ3 new bookings. In addition, Smith & Wesson Brands (SWBI) tumbled more than -19% after the gunmaker posted downbeat FQ4 results. On the bullish side, Kroger (KR) surged over +9% and was the top percentage gainer on the S&P 500 after the retailer reported better-than-expected Q1 adjusted EPS and raised its full-year same-store sales guidance. Economic data released on Friday showed that the U.S. Philly Fed manufacturing index came in at -4.0 in June, weaker than expectations of -1.7. Also, the Conference Board’s leading economic index for the U.S. fell -0.1% m/m in May, in line with expectations. Fed Governor Christopher Waller said on Friday that the central bank could cut interest rates as early as next month, reaffirming his view that the inflationary impact of tariffs is likely to be short-lived. At the same time, San Francisco Fed President Mary Daly said that lowering interest rates this fall looks more appropriate than making a move when policymakers meet in July. “For me, I look more to the fall. By then, we’ll have quite a bit more information, and businesses are telling me that’s what they’re going to look to for some resolution,” Daly said. Meanwhile, U.S. rate futures have priced in an 85.5% probability of no rate change and a 14.5% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting. This week, the May reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight, as it may provide clues on the path for interest rates. The Conference Board’s consumer confidence survey for June will also be closely monitored amid recent weak sentiment indicators that have been moving markets due to tariff concerns. Other noteworthy data releases include U.S. GDP (third estimate), the S&P/CS HPI Composite - 20 n.s.a., Current Account, the Richmond Fed Manufacturing Index, Building Permits, New Home Sales, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Income, Personal Spending, and the University of Michigan’s Consumer Sentiment Index. Fed Chair Jerome Powell’s semi-annual monetary policy testimony on Capitol Hill will also be in focus this week. Powell will testify before the House Financial Services Committee on Tuesday and the Senate Banking Committee on Wednesday. The Fed chief will likely stress that although rate cuts are possible this year, policymakers seek greater clarity on the economic effects of U.S. trade policy. President Trump has relentlessly attacked Powell for the central bank’s reluctance to cut interest rates, a criticism that may be echoed by some lawmakers. In addition to Mr. Powell delivering the Fed’s policy report, a host of other Fed officials, including Goolsbee, Bowman, Kugler, Williams, Hammack, Barr, Barkin, and Cook, are scheduled to speak this week. Market participants will be watching earnings reports from several high-profile companies as well, with shoemaker Nike (NKE), package delivery service FedEx (FDX), and chipmaker Micron Technology (MU) scheduled to report their quarterly results this week. Today, all eyes are focused on S&P Global’s flash U.S. purchasing managers’ surveys, as they serve as an important gauge of economic growth. The data come amid concerns over President Trump’s tariff policy and the ongoing conflict between Israel and Iran. Economists, on average, forecast that the June Manufacturing PMI will come in at 51.1, compared to last month’s value of 52.0. Also, economists expect the June Services PMI to be 52.9, compared to 53.7 in May. U.S. Existing Home Sales data will be released today as well. Economists foresee the May figure standing at 3.96M, compared to 4.00M in April. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.387%, up +0.27%. There's not a lot to read into the markets here. Bombs dropping all over the Mid east and the market just doesn't care. Neutral rating to start the day. I'd say we still look a bit more bearish than anything. The SPY closed the week lower at $594.28 (-0.45%) as rising geopolitical risks pressured risk appetite. A bearish RSI divergence is emerging while price clings to key support at the 8/21 EMA cloud, which aligns with a prominent high-volume node. If this bearish divergence plays out, the unfilled gap below stands out as the next likely downside target. QQQ ended the week relatively flat at $526.83 (-0.03%), as many of the big tech names like $NVDA and $MSFT finished in the green. Despite the ETF holding strong, a war catalyst could trigger a further rotation out of risk assets into safe havens and oil, potentially causing the bearish RSI divergence to play out. For bulls, the key test lies at the volume shelf and the 8/21 EMA cloud. If these support levels fail, the bears could take control and target the gap below. Small caps remained resilient this week as IWM closed at $209.21 (+0.14%). With large-caps near all-time highs, investors may be looking to diversify as the IWM sits at a high volume node and EMA cloud support. The ETF has already filled its gap below and does not have a bearish RSI divergence, potentially giving bulls a bit more confidence that these support levels will hold. My bias or lean today is slightly bullish. The market likes certainty and as backwards as it seems, the U.S. dropping bombs removes some uncertainty. I think we finish green today. Let's check out the expected moves for the week. 1.46% for the SPY. 1.66% for QQQ. This means once again that there is not a premium in NDX. We've had some good late day setups with it but it's not our main focus. Trade docket for today: Lot's of 0DTE's today! Gold (/GC) 0DTE. Oil (/CL) 0DTE, SPX 0DTE, /NQ scalp, We've already booked a MASSIVE profit on our Theta fairy. /ZS (soybeans) trade. LULU trade, ORCL? 1HTE BTC trade. Let's take a look at the intra-day levels: Surprise, surprise, it's the same levels from Friday. 6017 is first resistance with 6048 the next upside target. 6003 continues to be support. Below 6003 we've got some good downside potential. I love it when the day hasn't even started and we are already half way to our income goal! See you all in the live trading room shortly!

1 Comment

Michael W Bolas

6/23/2025 08:03:58 am

can you post the results for 6/19 please thanks Mike

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |