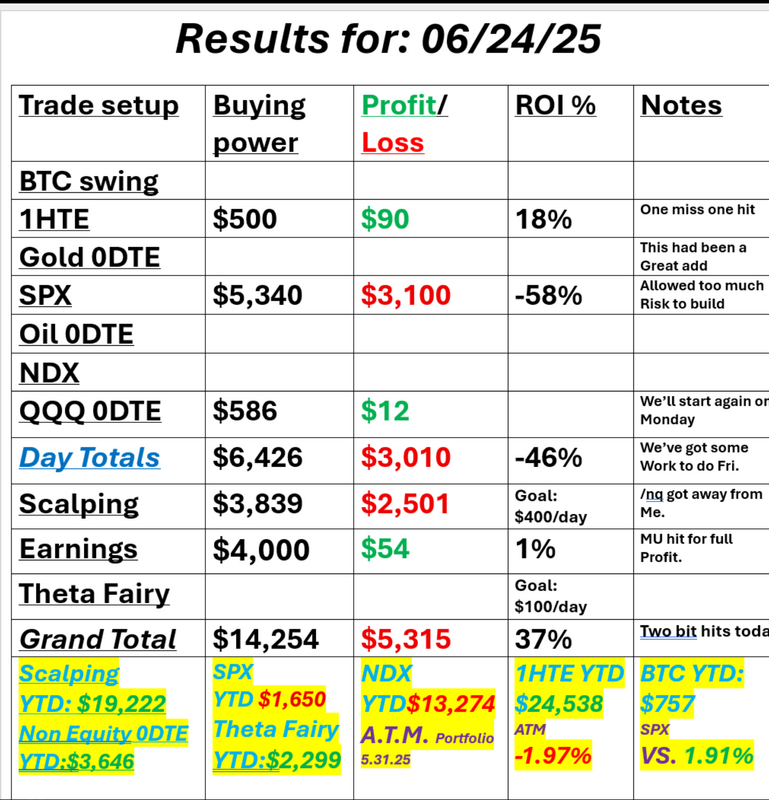

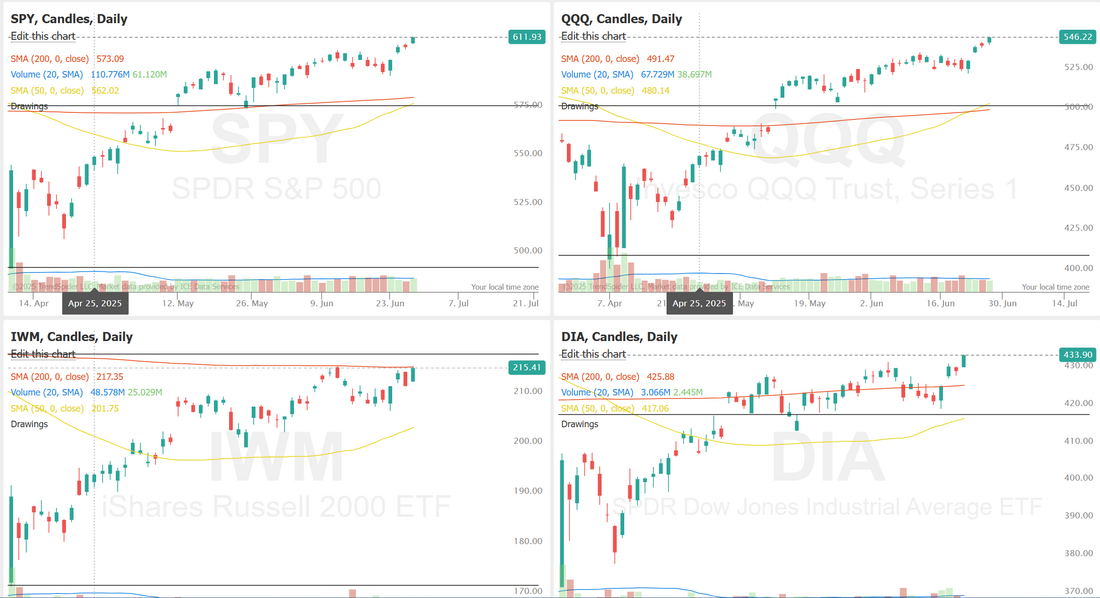

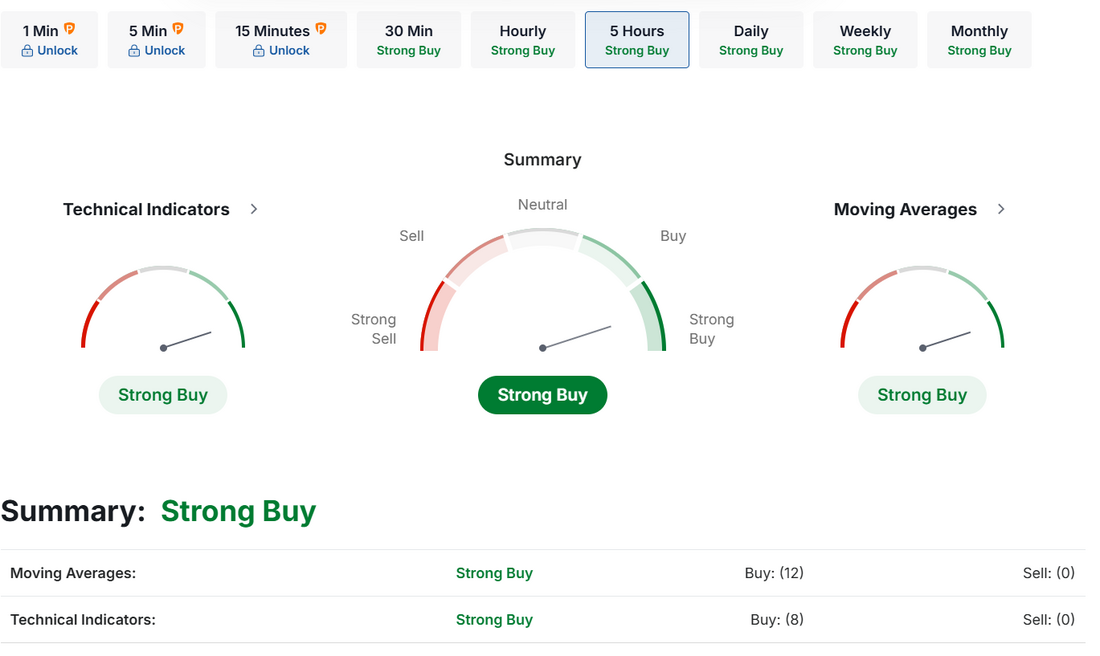

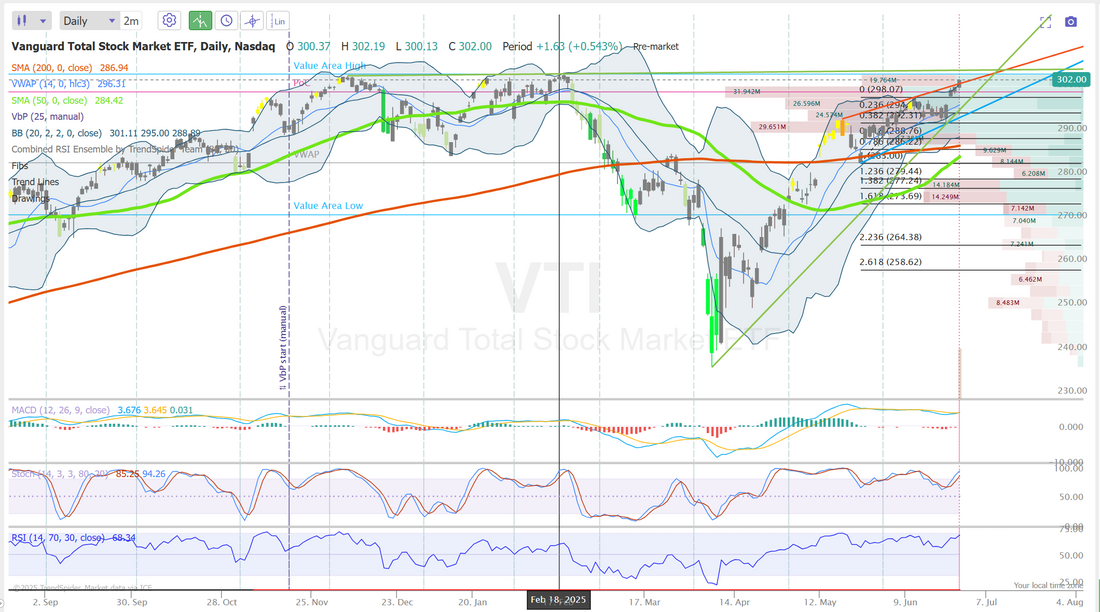

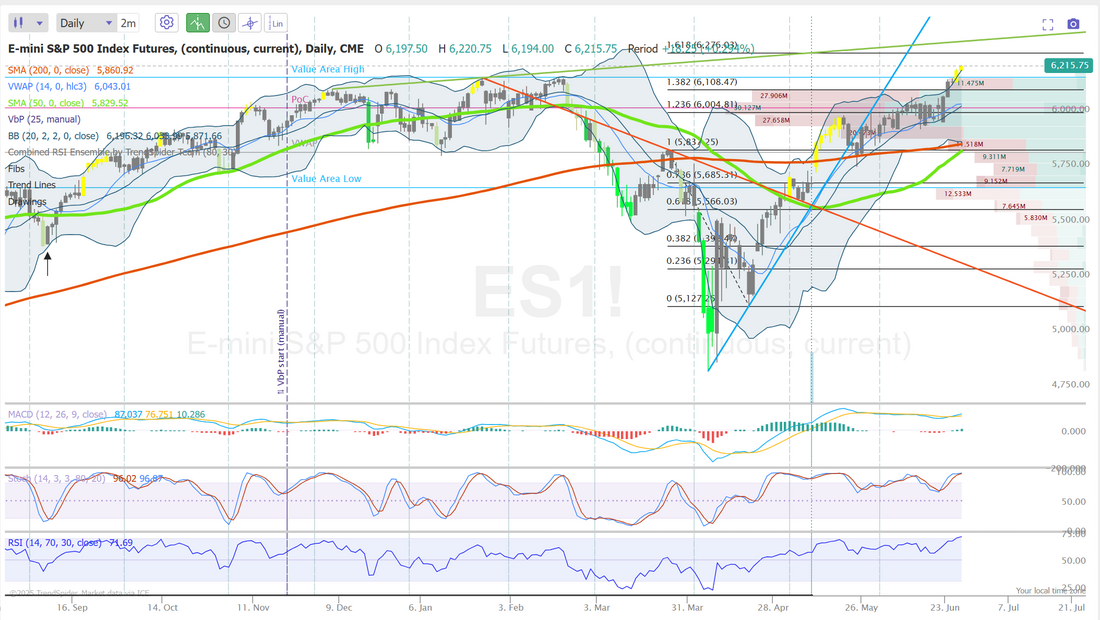

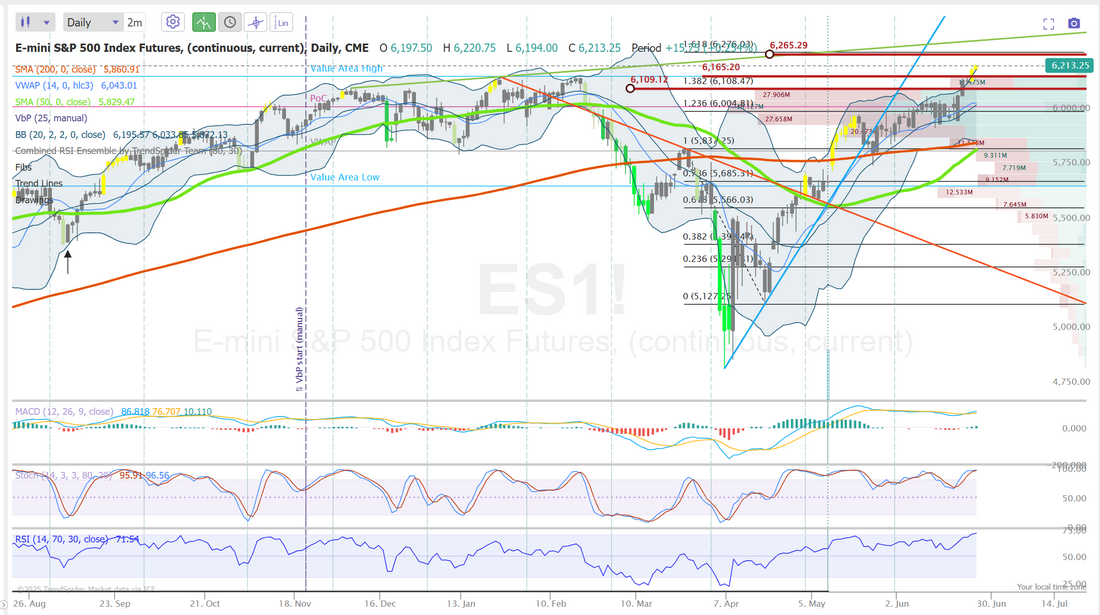

Time for some 1DTE'sWe've been missing some good setups lately because all the gains have come overnight. We talked about moving to some more 1DTE setups and that's what we'll be doing today. I'll focus on a 1DTE (actually 3DTE since it will be a Monday expiration) coupled with a 0DTE component on SPX. Yesterday was bad as I let risk get too far out of whack. I'll work to be better on that today. Here's a look at my day yesterday. September S&P 500 E-Mini futures (ESU25) are trending up +0.28% this morning amid renewed optimism about trade deals, while investors await the release of the Federal Reserve’s first-line inflation gauge. U.S. Commerce Secretary Howard Lutnick said late on Thursday that the U.S. and China had finalized an understanding on trade, and added that the White House is close to reaching agreements with 10 major trading partners ahead of a July 9th deadline when reciprocal tariffs are set to take effect. Also, the Treasury Department announced an agreement with G-7 allies that will exempt U.S. companies from certain foreign-imposed taxes in exchange for dropping the “revenge tax” provision from U.S. President Donald Trump’s tax bill. In yesterday’s trading session, Wall Street’s major indices closed higher. Enphase Energy (ENPH) surged over +12% and was the top percentage gainer on the S&P 500 on signs that Congress may not eliminate tax credits for rooftop solar panels. Also, chip stocks gained ground, with Marvell Technology (MRVL) climbing more than +5% to lead gainers in the Nasdaq 100 and Broadcom (AVGO) rising over +2%. In addition, McCormick & Co. (MKC) gained more than +5% after the spice maker posted better-than-expected FQ2 adjusted EPS and reaffirmed its full-year guidance. On the bearish side, Equinix (EQIX) slumped over -9% and was the top percentage loser on the S&P 500 after BMO Capital and Raymond James downgraded the stock. The U.S. Bureau of Economic Analysis’ third estimate showed on Thursday that the economy contracted at a 0.5% annualized pace in the first quarter, revised from the prior estimate of -0.2%. Also, U.S. durable goods orders shot up +16.4% m/m in May, stronger than expectations of +8.6% m/m, while core durable goods orders, which exclude transportation, rose +0.5% m/m, stronger than expectations of +0.1% m/m. In addition, U.S. pending home sales rose +1.8% m/m in May, stronger than expectations of +0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week fell -10K to 236K, compared with the 244K expected. “The economy is slowing, but remains resilient. While the numbers as a whole don’t necessarily make a compelling case for bulls or bears, for the time being, the market appears fixated on tech strength and the S&P 500’s potential return to record levels,” said Chris Larkin at E*Trade from Morgan Stanley. Richmond Fed President Tom Barkin said on Thursday that he expects tariffs to exert upward pressure on prices, and with significant uncertainty still lingering, the central bank should wait for greater clarity before making any changes to interest rates. Also, Chicago Fed President Austan Goolsbee said the central bank could resume rate cuts if inflation shows a clear path toward the policymakers’ 2% target and uncertainty surrounding the economic outlook diminishes. In addition, San Francisco Fed President Mary Daly said she’s observing increasing evidence that tariffs may not trigger a significant or sustained inflation spike, supporting the argument for a rate cut in the fall. Meanwhile, U.S. rate futures have priced in a 79.3% chance of no rate change and a 20.7% chance of a 25 basis point rate cut at July’s monetary policy meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.1% m/m and +2.6% y/y in May, compared to the previous figures of +0.1% m/m and +2.5% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate May Personal Spending to rise +0.1% m/m and Personal Income to grow +0.3% m/m, compared to the April figures of +0.2% m/m and +0.8% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be reported today as well. Economists expect the final June figure to be revised slightly lower to 60.4 from the preliminary reading of 60.5. In addition, market participants will be looking toward speeches from New York Fed President John Williams, Fed Governor Lisa Cook, and Cleveland Fed President Beth Hammack. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.270%, up +0.42%. The rare earth metals agreement with China is also helping lift the futures. Let's take a look at the technicals. New ATH's continuing to come in. Technicals are strongly bullish Trade docket is focused today: LULU and NKE with the main focus on a 3DTE/0DTE SPX setup. Let's take a look at the market levels: A look at the daily chart on VTI looks like clear sailing right now for bulls. The /ES futures look bullish as well albeit they do seem to be moving into an overbought zone. Let's see if we can define some zones to look at intra-day on /ES. This is always a bit tough when we are working in ATH areas. 6265 is the top resistance zone with 6165 working as support. 6109 is the next level down. This is a wide zone and while everything looks bullish we are overstretched. A bearish or neutral play may be in the cards for me today. I'll see you all in the live trading room! Let's get our risk right and let the trade do what it will do!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |