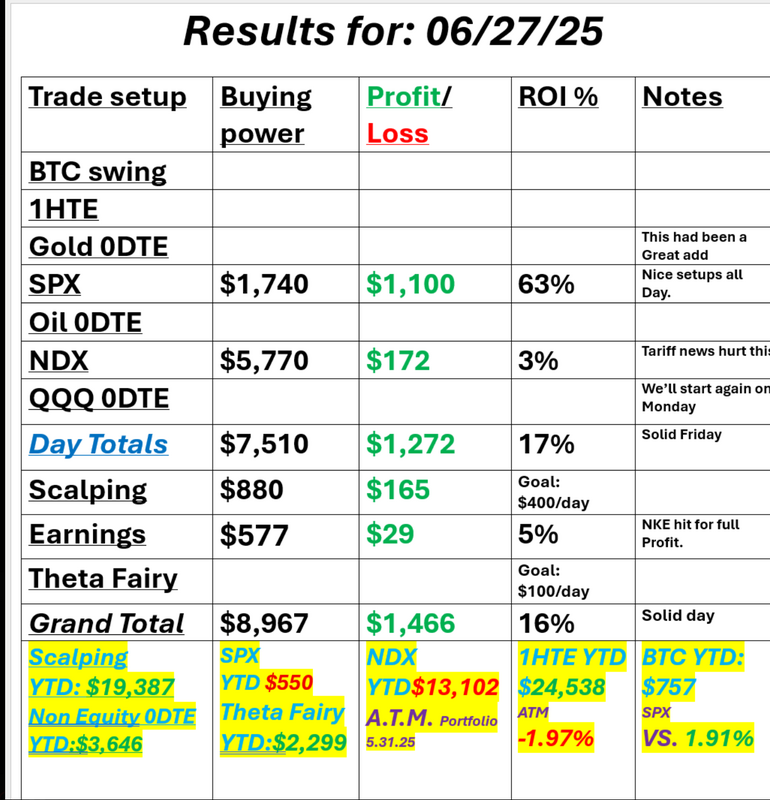

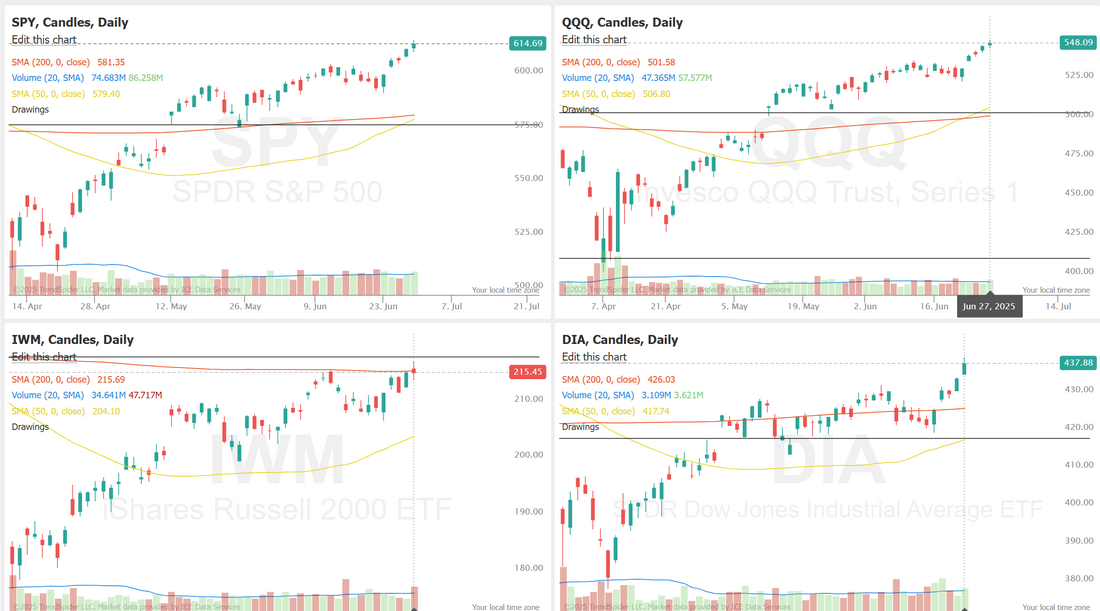

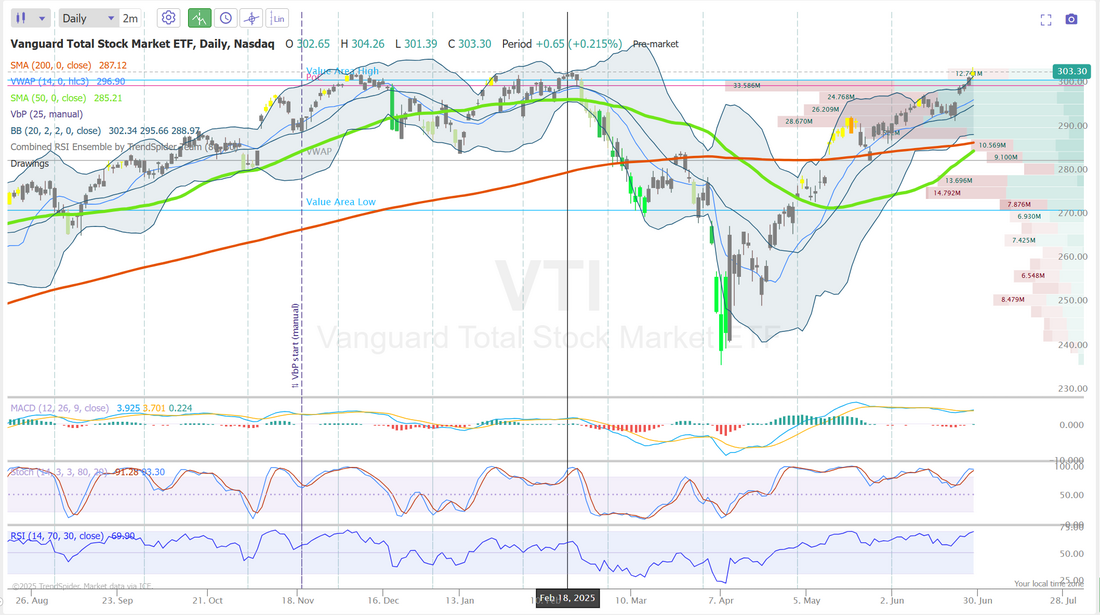

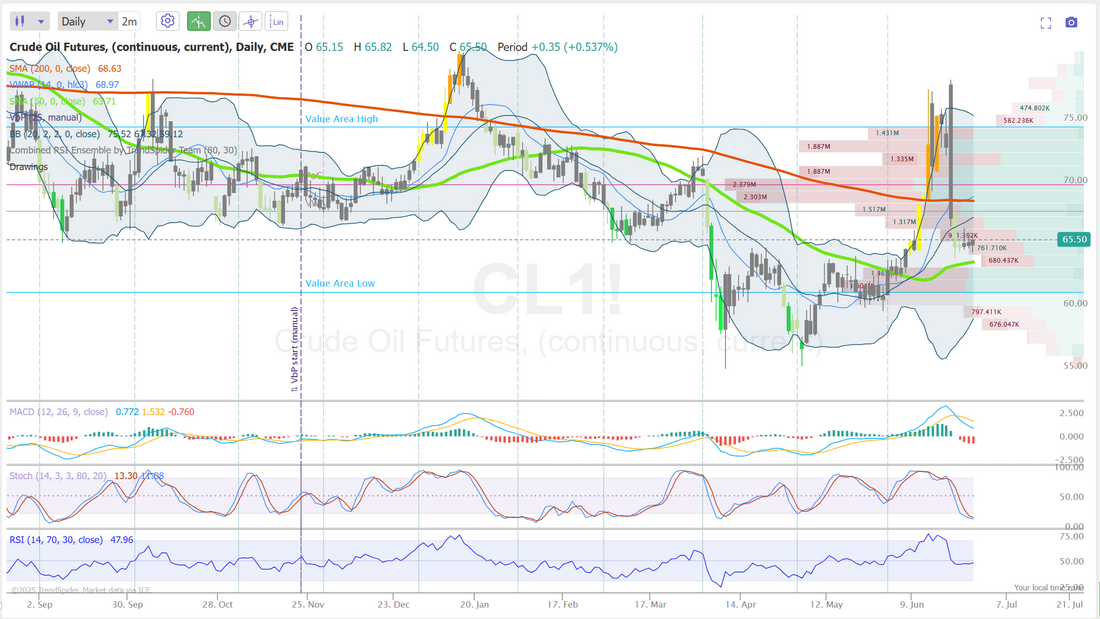

Golden Cross for QQQFriday not only got the markets pushing to new ATH's but in put in a strong golden cross for the QQQ's. It's an interesting chart right now. All the price action is bullish but CAPE ratio is back to overstretched. Stoch and RSI are flashing overbought. Futures are up strong this morning but as some point you'd think we are due for a pause. We had a good day Friday. Our NDX needed some work after the Canada tariff news dropped but it all ended well. Here's a look at our day. Let's take a look at the markets. ATH's across the board with IWM being the only index showing a bit of weakness. If we look at the VTI, our technicals are showing how overstretched it's looking. A retrace would be healthy at this point. Will it happen today? Way too early to tell. We had a bullish SPX and /MNQ scalp on. We've already taken our /MNQ profit off the table. September S&P 500 E-Mini futures (ESU25) are up +0.47%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.70% this morning, pointing to a higher open on Wall Street amid optimism over progress in trade negotiations between the U.S. and key partners. Japan’s top trade negotiator, Ryosei Akazawa, extended his stay in the U.S. for further talks, stating that negotiations have reached “a critical juncture.” Also, Bloomberg reported that India’s trade delegation prolonged its stay in Washington to iron out differences as both sides aim to finalize a deal ahead of the July 9th deadline. In addition, Canada withdrew its digital services tax on tech firms in an effort to restart trade negotiations with the U.S. Taiwan also said it has made “constructive progress” during a second round of trade negotiations with the U.S. Finally, French Finance Minister Eric Lombard stated that the European Union could reach some type of trade deal with the U.S. ahead of the July 9th deadline. This week, investors look ahead to remarks from Federal Reserve Chair Jerome Powell and a raft of U.S. economic data, with a particular focus on the nonfarm payrolls report. In Friday’s trading session, Wall Street’s major equity averages ended in the green, with the S&P 500 and Nasdaq 100 notching new all-time highs. Nike (NKE) surged over +15% and was the top percentage gainer on the S&P 500 and Dow after the sportswear company posted better-than-expected FQ4 results and said it expects the decline in sales and margins to ease in the current quarter. Also, Boeing (BA) climbed more than +5% after Redburn upgraded the stock to Buy from Neutral with a price target of $275. In addition, Alphabet (GOOGL) rose over +2% after Citizens JMP upgraded the stock to Outperform from Market Perform with a price target of $220. On the bearish side, Palantir Technologies (PLTR) slumped more than -9% and was the top percentage loser on the S&P 500 and Nasdaq 100 after Canada announced a tax on digital business from the U.S. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, came in at +0.2% m/m and +2.7% y/y in May, stronger than expectations of +0.1% m/m and +2.6% y/y. Also, U.S. May personal spending unexpectedly fell -0.1% m/m, weaker than expectations of +0.1% m/m, and personal income unexpectedly fell -0.4% m/m, weaker than expectations of +0.3% m/m. At the same time, the University of Michigan’s U.S. June consumer sentiment index was unexpectedly revised higher to 60.7, stronger than expectations of 60.4. Minneapolis Fed President Neel Kashkari said on Friday that he expects two 25-basis-point rate cuts to be likely this year, with the first possibly coming in September, but cautioned that tariffs could have a lagging effect on inflation and that officials should remain flexible. U.S. rate futures have priced in a 78.8% probability of no rate change and a 21.2% chance of a 25 basis point rate cut at the next FOMC meeting in July. In this holiday-shortened week, the U.S. June Nonfarm Payrolls report will be the main highlight, as signs of a weak labor market could bolster expectations that the Federal Reserve could lower interest rates sooner. The report is released on Thursday this month due to the U.S. Independence Day holiday falling on Friday. Ahead of the key jobs report, investors will monitor JOLTs job openings data for May on Tuesday and ADP private payrolls figures for June on Wednesday for further insights into the health of the U.S. job market. Other noteworthy data releases include the U.S. ISM Manufacturing PMI, the S&P Global Manufacturing PMI, Construction Spending, Average Hourly Earnings, Initial Jobless Claims, Trade Balance, the Unemployment Rate, the S&P Global Composite PMI, the S&P Global Services PMI, Factory Orders, and the ISM Non-Manufacturing PMI. “The Fed would likely need to see clearer evidence of softness in the form of subdued payrolls growth and a rising unemployment rate to trigger an early move,” ING chief international economist James Knightley said in a note. Market watchers will also be focused on remarks from Fed Chair Jerome Powell, who is set to participate in the European Central Bank’s annual forum in Sintra, Portugal, this week. Mr. Powell will speak on a panel alongside his counterparts from the Eurozone, Japan, South Korea, and the U.K. In addition, President Trump’s “One Big Beautiful Bill” will be in the spotlight. Negotiations over Trump’s tax-cut bill are ongoing as Republicans work to persuade remaining holdouts to back it for final passage. The president has demanded that Congress send him the bill by July 4th. The House also needs to vote on the latest version of the legislation before it can be sent to the White House for Trump’s signature. Meanwhile, the U.S. stock markets will close early at 1 p.m. Eastern Time on Thursday and remain closed on Friday for the Independence Day holiday. Today, investors will focus on the U.S. Chicago PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the Chicago PMI will stand at 42.7 in June, compared to the previous value of 40.5. Also, market participants will be anticipating speeches from Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.254%, down -0.09%. We've got a much shortened, holiday trading week with the markets closing early on Thurs and closed on Friday. My lean or bias is to flat to down today. Futures are up a solid 22+ on /ES and 125+ on /NQ. I think today is a day for a pause or slight retrace. I'll look to book our profit on our bullish SPX at the open and work a potential retrace later today. The SPY climbed sharply this week, closing at a record $614.91 (+3.48%) and entering price discovery mode. After holding key support at the 21 EMA and a major high-volume node, it pushed higher, with the gap below now protected by multiple technical levels. With bullish momentum intact, the 127.2% Fibonacci extension stands out as the next upside target. Tech led the charge this week, with QQQ closing at $548.09 (+4.04%) and reaching new all-time highs. Semiconductors drove much of the rally, helping QQQ extend its bounce off the 21 EMA and break out from a key high-volume node. With rate cut expectations gaining traction, tech bulls appear well-positioned to keep the momentum going. With small-caps looking to play catch-up, IWM ended the week at $215.48 (+2.99%). Having firmly held the 21 EMA support, the ETF now faces a low-volume area overhead, presenting a potential pathway back to its year-to-date highs. Small-caps tend to fare better with lower rates, making the imminent rate cuts even more important for small-cap traders to keep an eye on. I'll skip looking at the expected moves for this week since we only have three full trading days. There are some intra-day levels I'd like to look at for today. The first is gold. The second is oil Lastly, /ES 6264 is resistance with support at 6160. Trade docket for today. With just three full trading days it makes it a bit tougher for some of our normal trades. I'd like to get a 0DTE going on QQQ, SPX, /GC and /CL however, some of those may need to be 1 or 2 DTE's to get the setup we desire. We will have one earnings trade tomorrow with STZ. We will continue to scalp the /MNQ. See you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |