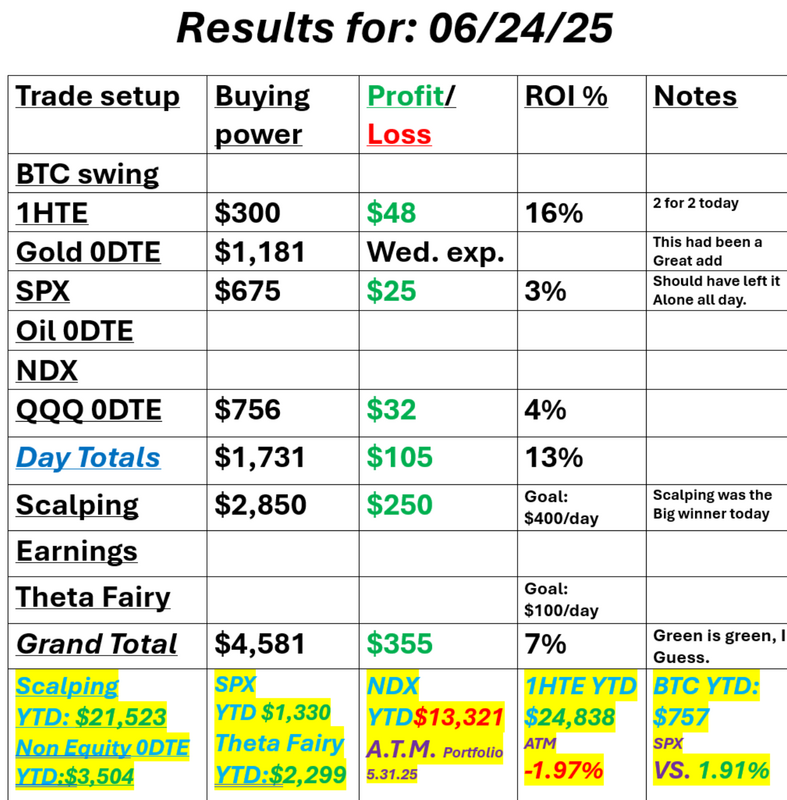

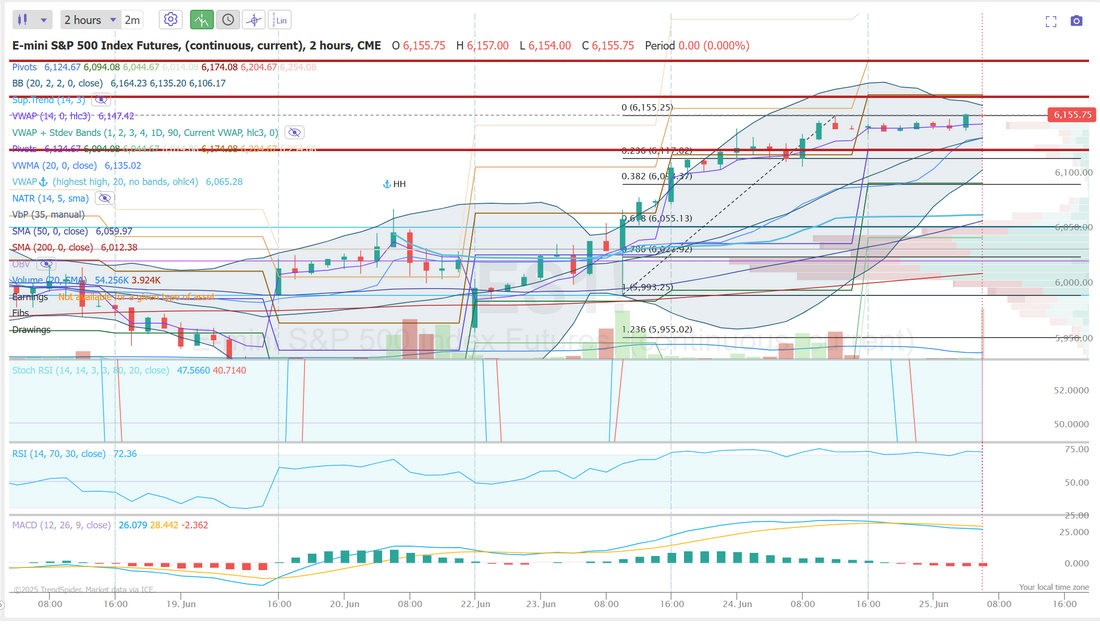

The power of gratitudeIt's interesting how each trading day is so different. Sunday night we were going full steam and that flowed into Monday. Everything was clicking and there were opportunities a plenty. Yesterday was the opposite for me. Even before the market opened I wasn't liking the futures action and didn't see anything that excited me. Ironically our ROI yesterday was amazing but I just never found anything that I was willing to put substantive buying power into. It was a long (very long), boring day. I wasn't stoked when the dust settled but...we made money. I'm big on gratitude. It's important to express gratitude daily because if you don't the negative will take you focus, and there's always negative! I've committed to myself that any day that is green is a good day and yesterday we were green. Here's our results: The path to higher valuations seems to be happening. After almost three weeks of consolidation the market seems to be having some success in pushing higher. With focus shifting away from the Israel-Iran war back to the economy, the FED and Tariffs. I'm bullish today. We've already setup a long /MNQ scalp to work around today. September S&P 500 E-Mini futures (ESU25) are trending up +0.01% this morning as investors shift their focus to fundamentals, with Federal Reserve Chair Jerome Powell’s congressional testimony set to resume later in the day. The ceasefire brokered by U.S. President Donald Trump between Iran and Israel appeared to be holding on Wednesday, with both sides declaring victory in the war. Trump’s Middle East envoy said late on Tuesday that talks between the U.S. and Iran were “promising” and that Washington remained hopeful for a long-term peace agreement. Investors are now turning their attention back to the U.S. economy and how trade tensions and fiscal pressures could impact corporate earnings and growth. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. Chip stocks rallied, with Intel (INTC) and Advanced Micro Devices (AMD) climbing over +6%. Also, DexCom (DXCM) surged more than +9% and was the top percentage gainer on the Nasdaq 100 after U.S. Health and Human Services Secretary Robert F. Kennedy Jr. announced that his agency is launching one of the largest campaigns in history to promote the use of wearable health devices. In addition, Uber Technologies (UBER) gained over +7% after the company announced that it would begin offering driverless Waymo rides to its customers in Atlanta. On the bearish side, Dollar General (DG) fell more than -1% after Goldman Sachs downgraded the stock to Neutral from Buy. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index unexpectedly fell to 93.0 in June, weaker than expectations of 99.4. Also, the U.S. April S&P/CS HPI Composite - 20 n.s.a. eased to +3.4% y/y from +4.1% y/y in March, weaker than expectations of +4.0% y/y. In addition, the U.S. Richmond Fed manufacturing index unexpectedly rose to -7 in June, stronger than expectations of -10. Fed Chair Jerome Powell told lawmakers on Tuesday that the central bank is not in a hurry to cut interest rates as officials await greater clarity on the economic effects of President Trump’s tariffs. “The effects of tariffs will depend, among other things, on their ultimate level,” Powell said in remarks before the House Financial Services Committee. “For the time being, we are well-positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.” Should inflation come in below expectations or the labor market weaken, Powell said, the Fed could cut rates sooner. Cleveland Fed President Beth Hammack said that interest rates are only modestly restrictive and that policymakers may keep borrowing costs steady “for quite some time.” Also, New York Fed President John Williams said that “maintaining this modestly restrictive stance of monetary policy is entirely appropriate to achieve our maximum employment and price stability goals,” while policymakers assess the full impact of U.S. policy changes. In addition, Boston Fed President Susan Collins said that monetary policy is in the right place, emphasizing that the “modestly restrictive” stance of monetary policy is “necessary.” Finally, Fed Governor Michael Barr stated that he expects tariffs to push inflation higher and voiced support for maintaining a wait-and-see approach on interest rates. Meanwhile, U.S. rate futures have priced in an 81.4% chance of no rate change and an 18.6% chance of a 25 basis point rate cut at the July FOMC meeting. Today, investors will closely watch Fed Chair Jerome Powell’s semi-annual monetary policy testimony before the Senate Banking Committee. On the economic data front, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists foresee this figure coming in at 694K in May, compared to 743K in April. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.200M, compared to last week’s value of -11.473M. On the earnings front, notable companies like Micron Technology (MU), Paychex (PAYX), General Mills (GIS), and Jefferies Financial (JEF) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.287%, down -0.07%. Trade docket for today: We have four 0DTE's for today. Oil (/CL), SPX, QQQ, Gold (/GC). FDX earnings, MU earnings, LULU and ORCL, 1HTE BTC . We are continuing to scalp with the /MNQ long this morning. Let's take a look at our new intra-day levels. We've finally had some movement. The first key resistance is where we sit right now, as I type. 6155. We are literally pinned on that right now. Above 6155 comes 6173 with 6204 above that. What can the bulls do with these levels today? Support is 6124. I look forward to seeing you all again in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |