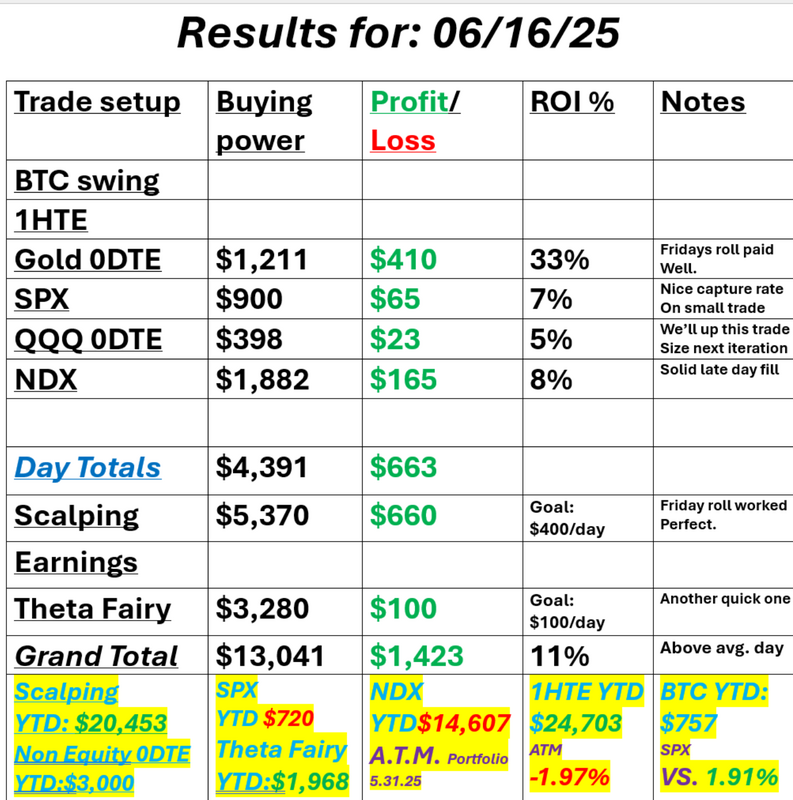

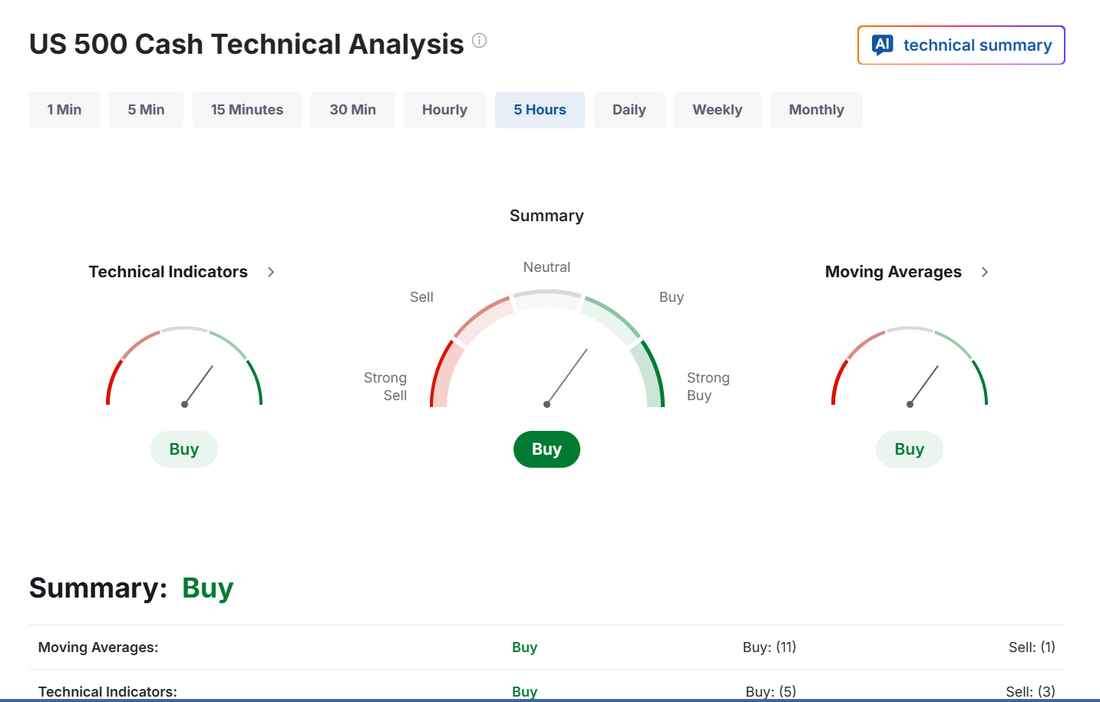

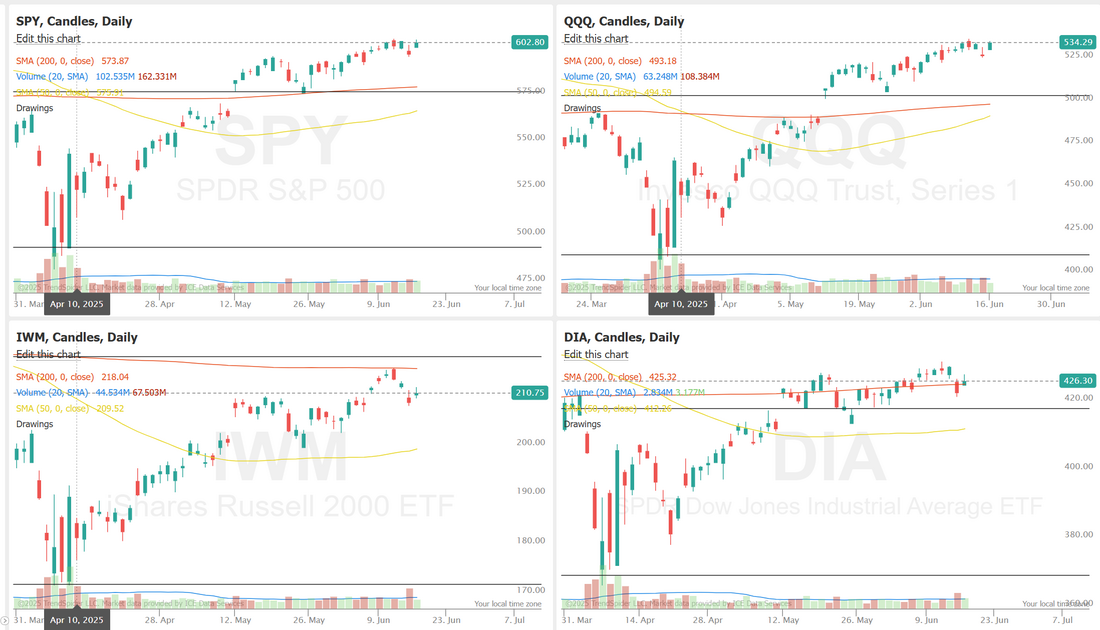

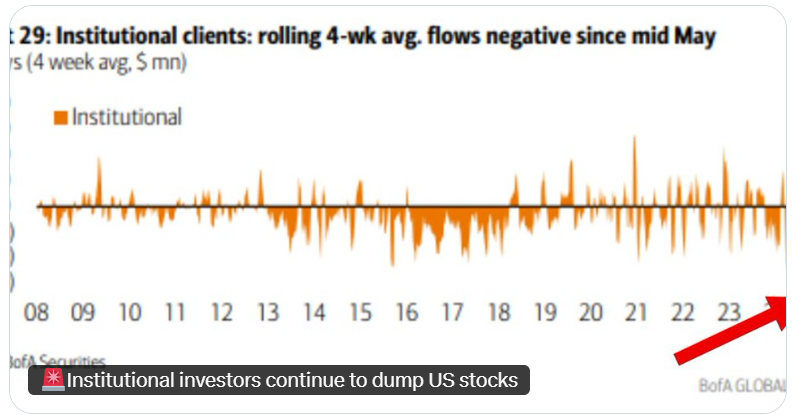

Planted seeds brought fruitWe had an excellent day yesterday and most of it was from trades we setup last Friday. We timed the rebound just right. Here's a look at our day: As the war drags on we'll see if the market fatigues or shrugs it off. FOMC is coming into focus and that should keep traders focus for the next couple days. Let's look at the markets. Still holding to a slight bullish bias. We find ourselves right back to the upper resistance band that we've been hitting up against for a while. My lean or bias today is more neutral, which probably means no debit entries. Trade docket for today: /MNQ scalp. LEN earnings. QQQ 0DTE. 1HTE BTC entry. SPX 0DTE, PX, SLP, UNFI long pair replacements. une S&P 500 E-Mini futures (ESM25) are trending down -0.46% this morning as the Israel-Iran conflict entered its fifth day, dimming investors’ hopes for a quick de-escalation between the two nations. Risk sentiment deteriorated after U.S. President Donald Trump called for the evacuation of Tehran, in comments that clashed with earlier optimism that Israel-Iran tensions would not escalate into a broader conflict. As Israel and Iran continued to trade missile strikes, President Trump abruptly ended his G-7 visit but stated that his return to Washington “has nothing to do with” a ceasefire. Trump said in a social media post on Tuesday that he had not contacted Iran for peace talks “in any way, shape or form.” “The degree of uncertainty is very high. So far, the market hasn’t captured an escalation of the conflict. Now we’re sailing in the fog,” said Laurent Lamagnere, head of development at AlphaValue. Investors also await the start of the Federal Reserve’s two-day policy meeting and a slew of U.S. economic data, with a particular focus on the retail sales report. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Chip stocks rallied, with Advanced Micro Devices (AMD) surging over +8% to lead gainers in the Nasdaq 100 and ON Semiconductor (ON) climbing more than +5%. Also, Roku (ROKU) gained over +10% after announcing an exclusive partnership with Amazon.com, enabling advertisers to tap into the largest authenticated Connected TV footprint in the U.S. through Amazon DSP. In addition, EchoStar (SATS) soared more than +49% after Bloomberg reported that U.S. President Trump stepped in to help settle the dispute between the FCC and the company regarding its spectrum licenses. On the bearish side, Sarepta Therapeutics (SRPT) cratered over -42% after suspending shipments of Elevidys for infusions in non-ambulatory patients following the death of a second patient from acute liver failure. Economic data released on Monday showed that the Empire State manufacturing index unexpectedly fell to -16.00 in June, weaker than expectations of -5.90. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to keep the Fed funds rate on hold in a range of 4.25% to 4.50% on Wednesday. Investors will follow Chair Jerome Powell’s post-policy meeting press conference for hints on what could ultimately prompt the central bank to make a move on interest rates and when that might happen. The Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC members’ forecasts regarding the path of interest rates, will also be closely watched. “[Powell] may describe recent inflation developments as encouraging, but also downplay their relevance given uncertainty ahead due to tariffs, fiscal policy, and the recent spike in the oil price due to geopolitical developments,” said David Doyle at Macquarie Group. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that May Retail Sales will stand at -0.5% m/m, compared to the April figure of +0.1% m/m. Investors will also focus on U.S. Core Retail Sales data, which came in at +0.1% m/m in April. Economists expect the May figure to be +0.2% m/m. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists expect May Industrial Production to be unchanged m/m and Manufacturing Production to be +0.1% m/m, compared to the April figures of unchanged m/m and -0.4% m/m, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to be -0.1% m/m and the import price index to be -0.2% m/m in May, compared to the previous figures of +0.1% m/m and +0.1% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.427%, down -0.52%. Institutional investors have been selling US stocks almost every week in 2025: Professional investors sold $4.2 BILLION in US equities in the first week of June. The 4-week average of selling reached $2.0 billion. They continue to dump stocks Let's take a look at the key intra-day levels I'll be watching today: The 6000-6003 area continues to be a key support level. Below that and bears could build momentum. 6017 is the first resistance. If bulls can clear that 6048 could be the next upward target. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |