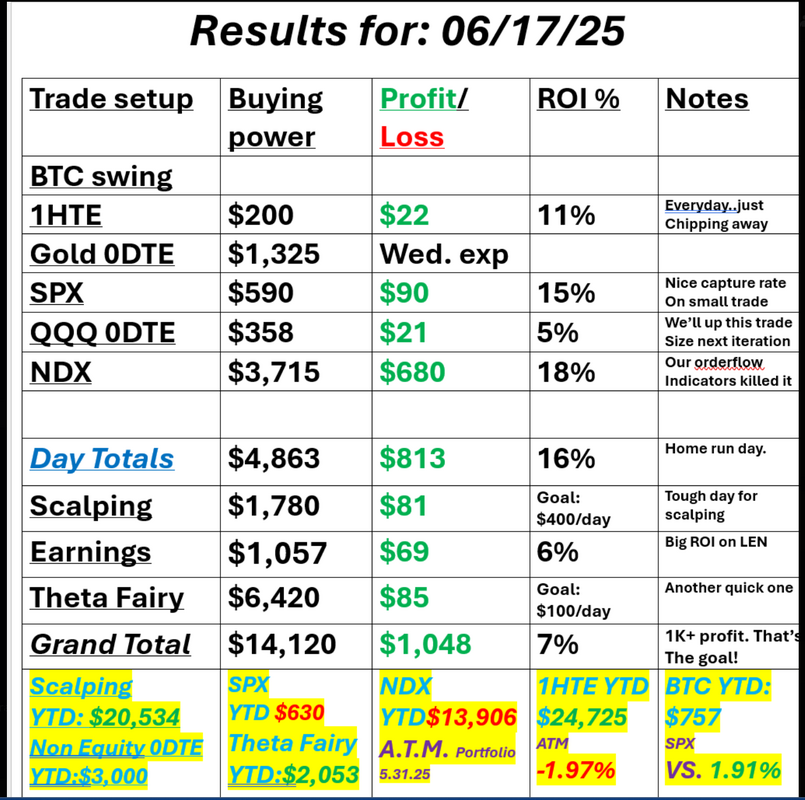

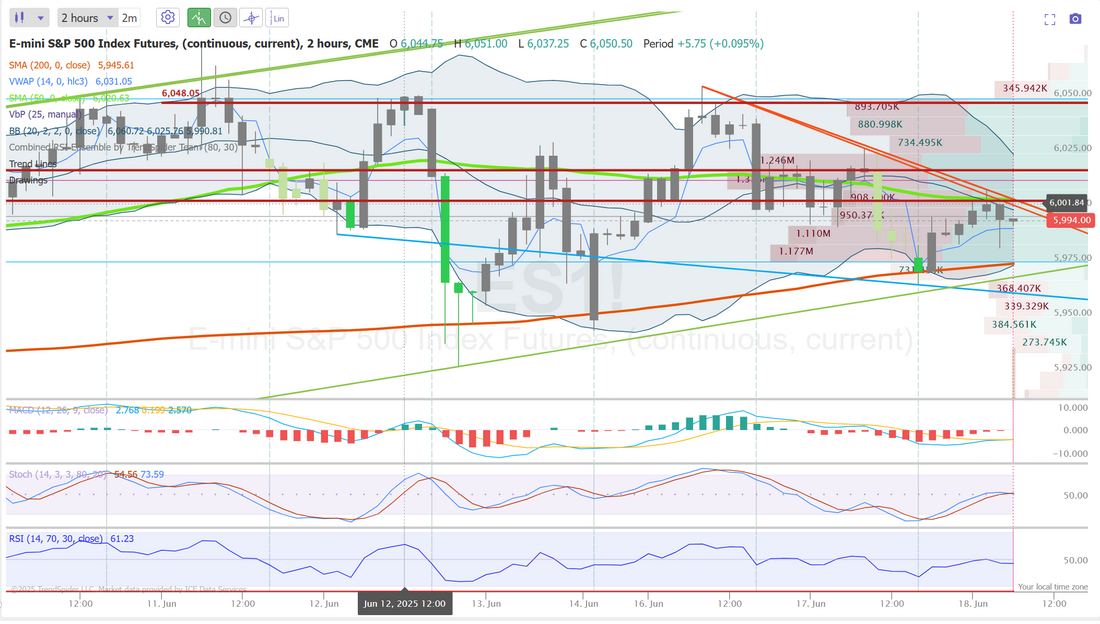

More mechanical = less emotionsTheirs two camps on trading approach. Mechanical and discretionary. Mechanical is simply having a set of triggers and rules that dictate action. There is no emotion or thought that goes into your actions. Discretionary is all "gut". It's just you "thinking" what's right and jumping on it. I prefer to use both. Admittedly some of recent good results were discretionary setups. Situations where I said, "look, I don't see anything definitive here. I'm going to take a stab at this setup and manage with a tight stop if I'm wrong." Yesterday started off that way. No real signals. I told everyone to be patient and maybe something would appear. Late in the day we got that with the NDX. Our daily zoom feed from our scalping room is invaluable. It gave us a perfect setup and we were able to get our $1,000+ profit day after all. What was the signal? The exponential Stoc turned up. The Squeeze indicator fired buy. The Parabolic Sar flipped bullish as well as the Supertrend indicator. The current high candle got taken out and our audible order flow tracker was all buys. It was an automatic long. No thinking. No emotion. Just pull the trigger. The more you can implement mechanical entries into your trading, the less emotional you'll be and the better your results will be. Work to add as many mechanical triggers as you can to your trading. It will help you establish a stoic equanimity in your trading. Here's a look at our results from yesterday: une S&P 500 E-Mini futures (ESM25) are up +0.20%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.33% this morning, pointing to a slightly higher open on Wall Street after yesterday’s drop, while investors await the Federal Reserve’s policy decision and updated projections, as well as Chair Jerome Powell’s remarks. Investors also await updates on whether the U.S. plans to become directly involved in the conflict in the Middle East. The conflict between Israel and Iran entered a sixth day on Wednesday, showing no signs of easing. Reuters reported that U.S. President Donald Trump and his team were weighing several options, including joining Israel in strikes against Iranian nuclear facilities. President Trump demanded Iran’s unconditional surrender on Tuesday and threatened a potential strike against the country’s leader. Iran’s Supreme Leader rejected President Trump’s demand for unconditional surrender in a statement read by a television presenter on Wednesday, warning that U.S. military action would have “serious and irreparable consequences.” In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Solar stocks cratered after Senate Republicans outlined revisions to President Trump’s tax-and-spending bill that would phase out solar, wind, and energy tax credits by 2028, with Sunrun (RUN) plummeting over -40%, and Enphase Energy (ENPH) tumbling more than -23% to lead losers in the S&P 500. Also, Lennar (LEN) slumped over -4% after the homebuilder posted weaker-than-expected FQ2 adjusted EPS. In addition, T-Mobile US (TMUS) slid over -4% after Bloomberg reported that shareholder SoftBank Group sold 21.5 million shares of the wireless network operator to finance its AI initiatives. On the bullish side, Jabil Circuit (JBL) climbed more than +8% and was the top percentage gainer on the S&P 500 after the supplier of electronic parts posted upbeat FQ3 results and raised its full-year revenue guidance. Economic data released on Tuesday showed that U.S. retail sales slumped -0.9% m/m in May, weaker than expectations of -0.5% m/m, while core retail sales, which exclude motor vehicles and parts, unexpectedly fell -0.3% m/m, weaker than expectations of +0.2% m/m. Also, U.S. May industrial production fell -0.2% m/m, weaker than expectations of no change m/m, while manufacturing production rose +0.1% m/m, in line with expectations. In addition, the U.S. import price index was unchanged m/m in May, stronger than expectations of -0.2% m/m. “Investors should still expect some volatility in economic data due to lingering effects of trade policy. The economy and the consumer are holding up for now, but there are signs of vulnerability. That could present risks in the second half of the year — particularly if we see a further slowdown in jobs or spending,” said Bret Kenwell at eToro. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. The Federal Open Market Committee is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%. Market watchers will follow Chair Jerome Powell’s post-policy meeting press conference for hints on what could ultimately prompt the central bank to make a move on interest rates and when that might happen. The Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC members’ forecasts regarding the path of interest rates, will also be closely watched. Economists expect the Fed’s rate forecasts to remain largely unchanged – two cuts this year, followed by additional policy rate reductions in 2026. A survey conducted by 22V Research showed that the current tariff environment would lead to 25 basis points of cuts this year. “Investors believe that if the dot plot stays at two cuts, it will be because the inflation forecast doesn’t move up,” said Dennis DeBusschere, founder of 22V. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 246K, compared to last week’s number of 248K. U.S. Building Permits (preliminary) and Housing Starts data will also be reported today. Economists forecast May Building Permits at 1.420M and Housing Starts at 1.350M, compared to the prior figures of 1.422M and 1.361M, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists foresee this figure standing at -2.300M, compared to last week’s value of -3.644M. Meanwhile, the U.S. stock markets will be closed tomorrow in observance of the Juneteenth federal holiday. The markets will reopen on Friday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.385%, down -0.11%. Trade docket for today is a bit different. With Thurs. being a holiday we'll get our Overnight Vampire trade started today. We have a Gold 0DTE today as well as a QQQ 0DTE. I'll also attempt to get three SPX 0DTE's working today. One at the open that is high theta and low prob. low risk that we can hopefully be able to take off in a couple hours. Another right before the FOMC min. release that we'll take back off right after the release and finally a third one after Powell starts speaking. ORCL will get some work. ACN, KR, KMX earnings trades. On FOMC days I don't provide a bias or levels as the algos will determine where we go today and we just need to remain flexible. There are a couple key levels I would keep and eye on, notwithstanding. 6003, 6017, 6047 are resistance levels. 5975 is support. Lot's to work on today. I'll see you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |