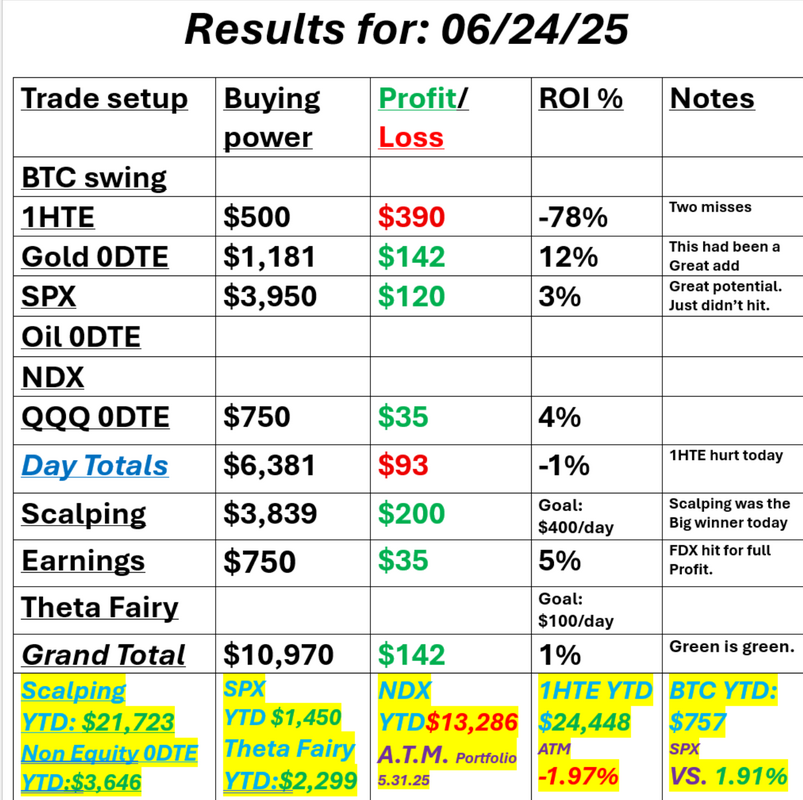

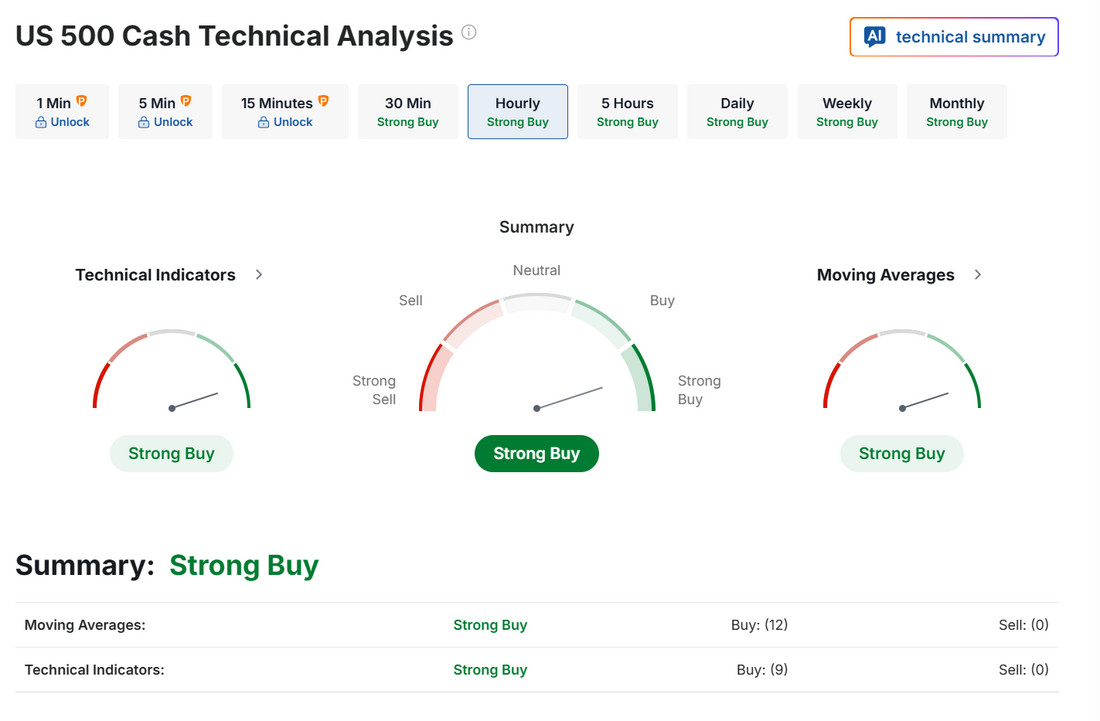

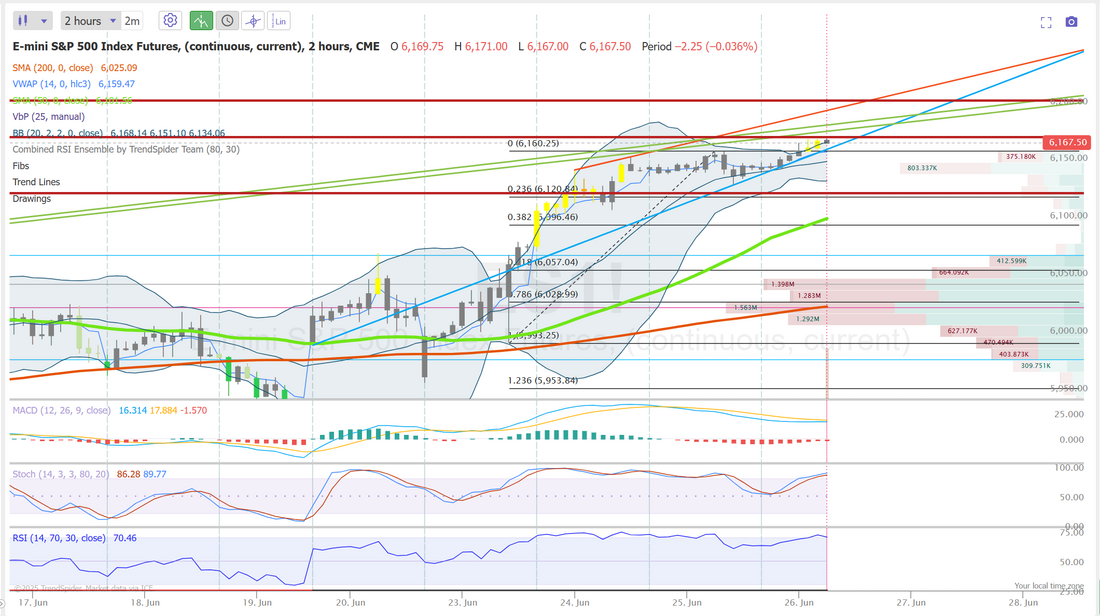

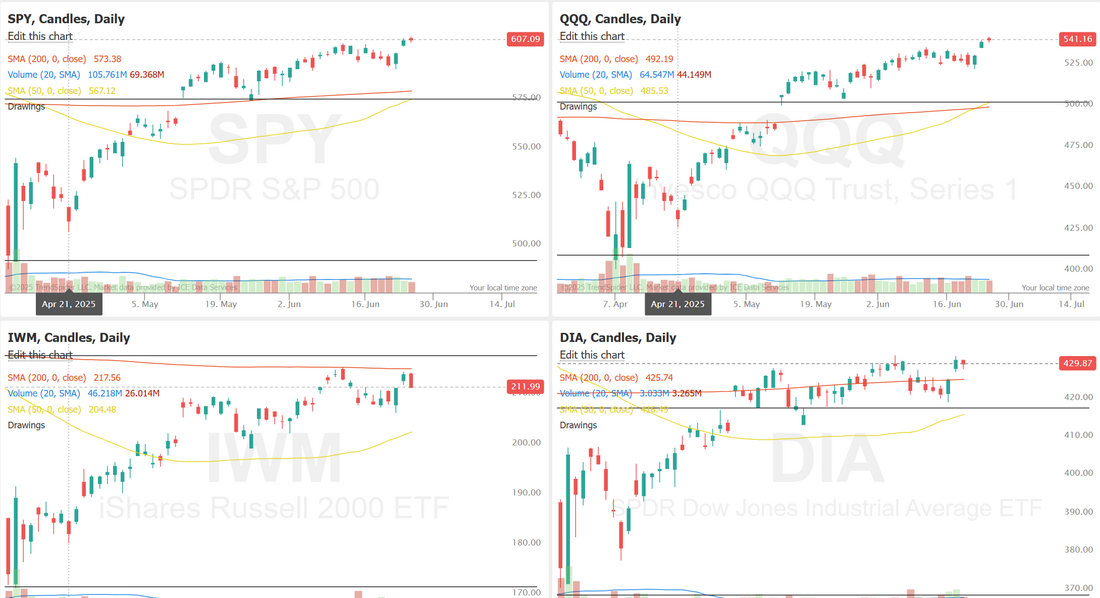

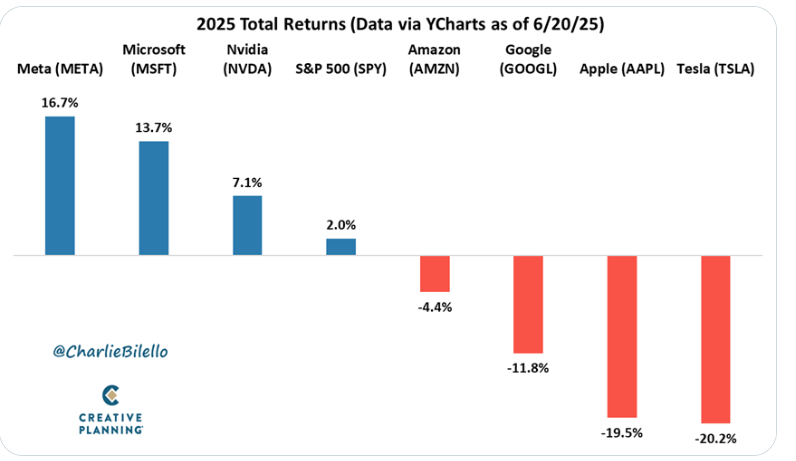

New highs incoming?Markets are finally breaking out and pushing up. Can we establish new highs? Well, eventually we always do right? It's hard to juxtapose the hightented risk economically that we face with the bullish price action but right now the market seems to want to stretch its legs. We had an o.k. day yesterday. We had two rare misses on 1HTE's which hurt and we didn't make much on our SPX 0DTE but I'm o.k. with all of that because we build our SPX for over $1,110 profit potential IF it hit. As long as we can build for big gains and keep our risk low if it doesn't hit then I'm happy. Our risk went a bit too high yesterday on our SPX but that happens from time to time. Here's a look at our day: Let's take a look at the market. Buy mode is fully engaged here. My intra-day levels are the same for me today as yesterday. 6171 is current resistance with 6205 next. 6123 is support. Indices are pushing towards those new ATH's. September S&P 500 E-Mini futures (ESU25) are up +0.33%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.41% this morning amid speculation that U.S. interest rate cuts could arrive earlier than expected, following a report that U.S. President Donald Trump may nominate the next Federal Reserve chair early. The Wall Street Journal reported that President Trump is considering announcing his pick to replace Jerome Powell as early as September amid his frustration over the Fed’s cautious pace on rate cuts. Typically, a Fed chair is nominated 3-4 months before taking office, and with Powell’s tenure not concluding until May 2026, this could effectively result in a shadow central bank chair with the ability to influence sentiment. OCBC strategists said, “Some believe that this may allow for the chair-in-waiting to influence market expectations about the potential path for rates.” Investors now await a flurry of U.S. economic data, including the third estimate of first-quarter GDP and jobless claims figures, remarks from Federal Reserve officials, and an earnings report from shoemaker Nike. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Super Micro Computer (SMCI) climbed over +8% and was the top percentage gainer on the S&P 500 after GF Securities Ltd initiated coverage of the stock with a Buy rating and a price target of $59. Also, Nvidia (NVDA) rose more than +4% and was the top percentage gainer on the Nasdaq 100 and Dow after Loop Capital raised its price target on the stock to $250 from $175, citing what it described as a “$2 trillion AI data center opportunity” by 2028. In addition, QuantumScape (QS) jumped over +30% after the company announced it had successfully integrated its advanced Cobra separator process into baseline cell production. On the bearish side, Paychex (PAYX) plunged more than -9% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company reported in-line FQ4 results. Economic data released on Wednesday showed that U.S. new home sales fell -13.7% m/m to a 7-month low of 623K in May, weaker than expectations of 694K. Fed Chair Jerome Powell said during a Senate Banking Committee hearing on Wednesday that the central bank is still struggling to determine the impact of tariffs on consumer prices. “The question is, who’s going to pay for the tariffs?” Powell told lawmakers in response to a question on the second day of his semi-annual testimony to Congress. “How much of it does show up in inflation. And honestly, it’s very hard to predict that in advance.” The Fed chief also stated that the U.S. has the world’s strongest economy and that moving cautiously is appropriate during periods of uncertainty. “If it were not for the uncertainty created by shifting trade policy, the Fed may have been able to cut interest rates this summer,” said Carol Schleif at BMO Private Wealth. “The Fed’s pause on interest-rate cuts is tariff-induced, and not necessarily reflective of economic progress. We expect one to two cuts in 2025, starting most likely in September.” U.S. rate futures have priced in a 75.2% probability of no rate change and a 24.8% chance of a 25 basis point rate cut at the next central bank meeting in July. Today, all eyes are focused on the U.S. Commerce Department’s final estimate of gross domestic product. Economists expect the U.S. economy to contract at an annual rate of 0.2% in the first quarter. Investors will also focus on U.S. Durable Goods Orders and Core Durable Goods Orders data. Economists expect May Durable Goods Orders to be +8.6% m/m and Core Durable Goods Orders to be +0.1% m/m, compared to the prior figures of -6.3% m/m and +0.2% m/m, respectively. U.S. Pending Home Sales data will be reported today. Economists foresee the May figure coming in at +0.2% m/m, compared to the previous figure of -6.3% m/m. U.S. Wholesale Inventories data will come in today. Economists forecast the preliminary May figure at +0.2% m/m, the same as in April. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 244K, compared to 245K last week. In addition, market participants will parse comments today from Richmond Fed President Tom Barkin, Cleveland Fed President Beth Hammack, Fed Governor Michael Barr, and Minneapolis Fed President Neel Kashkari. Meanwhile, notable companies like Nike (NKE), McCormick & Company (MKC), and Walgreens Boots Alliance (WBA) are set to report their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.283%, down -0.16%. My lean or bias is a bit contrary today. Technicals are all bullish. Price action is bullish. Indices are pushing to new ATH's. We've basically been trending up since May 23rd! That's a long, nice run. I think we may be getting a bit tired here. /NQ futures are up 100+ points as I type. I think we either hold these levels or give some back today. Trade docket for today: We've got our MU earnings trade to book profits on this morning. NKE will be our new earnings trade today. Three 0DTE's today with QQQ, SPX and Gold. LULU and ORCL continued work. 1HTE attempt again. We are continuing to scalp with a long /MNQ (/NQ cover). The mag seven are losing their leadership status in the market. I look forward to seeing you all in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |