|

Welcome back traders. I had a mxed day yesterday. My QQQ puts that I carried over from Friday didn't hit...again and while our ROI on our day trades was right in line with expectations, it was a low oonviction day and thus, not a lot of capital got committed. Here's our results below: Let's take a look at the markets: The technical buy rating continues to hold but we did get a bit of a pause yesterday. Certainly not enough to get a sell signal but, it is the first pause in the "Trump rally" that we've seen. Futures are soft this morning so we'll see if it can turn the market direction. December S&P 500 E-Mini futures (ESZ24) are down -0.20%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.21% this morning as investors assessed the potential policy impact of Donald Trump’s cabinet selections, while also awaiting comments from Federal Reserve officials, the next round of quarterly results, as well as Wednesday’s release of a key U.S. inflation report. In yesterday’s trading session, Wall Street’s main stock indexes closed higher. Bristol Myers Squibb (BMY) climbed over +10% and was the top percentage gainer on the S&P 500 after rival AbbVie plummeted on news that its two mid-stage trials of a schizophrenia drug failed to meet their primary endpoints. Also, Tesla (TSLA) advanced more than +8% and was the top percentage gainer on the Nasdaq 100, building on last week’s +26% surge amid expectations that the incoming Trump administration will support the company. In addition, Salesforce (CRM) rose over +6% and was the top percentage gainer on the Dow after CEO Marc Benioff announced the company would hire 1,000 workers to capitalize on the “amazing momentum” for its AI product. On the bearish side, Monolithic Power Systems (MPWR) tumbled about -15% and was the top percentage loser on the S&P 500 after Edgewater said the company’s Blackwell allocation was at risk. Meanwhile, investors have raised their exposure to the U.S. equities benchmark to the highest level in three years following Trump’s victory, indicating that the rally might lose momentum, according to Citigroup analysts. The new administration is expected to include prominent China hawks, and strategists are considering the possibility that Trump’s economic policies could drive inflation and influence the Federal Reserve’s interest rate trajectory. Market participants are looking ahead to the U.S. consumer inflation report for October, which is scheduled for release on Wednesday. The CPI is expected to accelerate to +2.6% y/y from +2.4% y/y in September, while the core CPI is projected to remain unchanged from September at +3.3% y/y. “With the election and another rate cut in the rear-view mirror, the question is whether bulls can keep pushing the market to new highs,” said Chris Larkin at E*Trade from Morgan Stanley. “Aside from any potential profit-taking after such a strong surge, this week’s inflation data may determine whether the market pads its gains.” U.S. rate futures have priced in a 68.5% chance of a 25 basis point rate cut and a 31.5% chance of no rate change at the next central bank meeting in December. On the earnings front, notable companies like Home Depot (HD), Shopify (SHOP), Spotify (SPOT), Sea Limited (SE), Occidental Petroleum (OXY), and Flutter Entertainment (FLUT) are set to report their quarterly figures today. The U.S. economic data slate is mainly empty on Tuesday. However, investors will focus on speeches from Fed Governor Christopher Waller, Richmond Fed President Thomas Barkin, Minneapolis Fed President Neel Kashkari, and Philadelphia Fed President Patrick Harker. In addition, the Fed’s Senior Loan Officer Opinion Survey on Bank Lending Practices will be released today. The SLOOS report will provide updates on the conditions, supply, and demand of bank loans extended to U.S. customers. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.368%, up +0.39%. Volume should pick up today after the light day yesterday but with no big news catalyst today it may be another listless day. Our trade docket for today: /MNQ, /MCL, /NG, /SI, /ZN, SHOP?, OXY, SPOT, MARA, 0DTE's. Let's take a look at the intra-day levels: /ES: 6037, 6044, 6050 are resistance. 6022, 6011 are support. Below 6011 there is downside potential. /NQ: The Nasdaq is more a focus for me today. 21247, 21289, 21339 are resistance with 21207 being PoC on the 2 hr. chart. 21156 and 21097 are support. Below 21097 is some downside potential. BTC: We are finally getting a bit of a pause in Bitcoin. 90,728 is resistance (and near ATH), 84,480 is support. It's admittedly a wide range that belies the volatility and extreme moves we've had this past week. We've got some good trade opportunities lined up for us today so let's go make it happen!

0 Comments

Welcome back to a new week traders! We had a pretty good Friday with the exception of scalping, once again, dragging down my results. Still...net liq was up and we made money on our day trades so it qualifies as an "excellent" day for us. Let's take a look at the market. Bulls continue to push. ATH's continue to become new, ATH's. Bitcoin exploded even higher over the weekend. The people talking about 100,000 price before the end of the year don't look as foolish now. December S&P 500 E-Mini futures (ESZ24) are up +0.33%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.29% this morning as Donald Trump’s election victory continued to boost risk appetite, while investors looked ahead to U.S. inflation data, a fresh batch of corporate earnings reports, as well as remarks from Federal Reserve Chair Jerome Powell and other Fed officials. In Friday’s trading session, Wall Street’s major averages ended in the green, with the benchmark S&P 500, the blue-chip Dow, and the tech-heavy Nasdaq 100 notching new all-time highs. Axon Enterprise (AXON) surged over +28% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q3 results and raised its full-year revenue guidance. Also, Fortinet (FTNT) climbed about +10% and was the top percentage gainer on the Nasdaq 100 after reporting better-than-expected Q3 results and providing above-consensus annual adjusted EPS guidance. In addition, Upstart Holdings (UPST) jumped more than +46% after the company reported stronger-than-expected Q3 results and issued upbeat Q4 revenue guidance. On the bearish side, Akamai Technologies (AKAM) plunged over -14% and was the top percentage loser on the S&P 500 after the cybersecurity and cloud computing firm cut its full-year guidance. Also, Airbnb (ABNB) slid more than -8% and was the top percentage loser on the Nasdaq 100 after reporting weaker-than-expected Q3 EPS. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index rose to a 7-month high of 73.0 in November, stronger than expectations of 71.0. Also, the University of Michigan’s November year-ahead inflation expectations eased to a 3-3/4 year low of 2.6% from 2.7% in October, better than expectations of no change at 2.7%, while 5-year implied inflation expectations rose to 3.1% from 3.0% in October, stronger than expectations of no change at 3.0%. Minneapolis Fed President Neel Kashkari stated Saturday that a strong economy and higher productivity growth might lead the U.S. central bank to cut interest rates less than anticipated. “I have been surprised at how resilient the economy has been,” Kashkari said in an interview on Fox News. “If that is sustained and we are in a structurally more productive economy going forward, that tells me we wouldn’t end up cutting as far.” He also indicated that it was premature to assess whether policies from the incoming Trump administration and the new Congress would fuel inflation. U.S. rate futures have priced in a 68.5% chance of a 25 basis point rate cut and a 31.5% chance of no rate change at the conclusion of the Fed’s December meeting. Third-quarter earnings season rolls on, and investors await fresh reports from prominent companies this week, including The Walt Disney Company (DIS), Home Depot (HD), Cisco (CSCO), Applied Materials (AMAT), Shopify (SHOP), and Spotify (SPOT). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, the U.S. consumer inflation report for October will be the main highlight in the coming week. Also, market participants will be keeping an eye on other economic data releases, including U.S. Retail Sales, Core Retail Sales, PPI, Core PPI, Initial Jobless Claims, Crude Oil Inventories, the NY Empire State Manufacturing Index, the Export Price Index, the Import Price Index, Industrial Production, Manufacturing Production, and Business Inventories. Meanwhile, Fed Chair Jerome Powell is set to deliver a speech about the economy at an event hosted by the Dallas Regional Chamber on Thursday. A slew of other Fed officials will also be making appearances throughout the week, including Waller, Barkin, Kashkari, Harker, Williams, Logan, Schmid, and Kugler. The U.S. economic data slate is empty on Monday. U.S. bond markets are closed today in observance of the Veterans Day holiday. The SPY has demonstrated notable resilience over the past few months and has now arrived at a critical resistance level: the golden Fibonacci extension derived from this summer’s high-to-low range. Closing at $598.19 (+4.74%), this level could potentially prompt traders to consider reallocating to technology or small caps, both of which have underperformed in comparison to SPY’s recent strength. Tech bulls celebrated this week as the QQQ finally reached new all-time highs, closing at $514.14 (+5.48%). With a decisive bullish MACD cross signaling momentum and solid support from the 50-day SMA, QQQ may be poised to narrow the gap with SPY’s performance. The 1.618 golden Fibonacci extension from the summer high-to-low sits at $553, suggesting potential upside of approximately 8%. IWM emerged as the standout performer this week, with the presidential decision propelling the previously lagging index to impressive gains and its highest single-day volume since February. With the price closing at $238.12 (+8.73%), and a bullish MACD cross confirming, the small caps seem poised to play a little catch-up to their peers, with an initial target at the golden Fibonacci extension from the summer high to low, around $250. If you buy into the mantra, "Be greedy when others are fearful and fearful when others are greedy" now might be a time of caution. We are back to our "normal" I.V. levels to start this week. My lean or bias today: Bullish. I've been looking for a bearish retrace ever since the election. Clearly that hasn't happened. Euphoria rules right now. "Go with the flow" or "Trade the trade" or, "The trend is your friend" usually works...until it doesn't. Trade docket for today: /MNQ scalping, DJT, FDX, META, PLTR, WYNN, UPST, ORCL, IWM, PYPL, SHOP, SPY/QQQ, 0DTE's, HD, PLUG, AZN, /SI. Let's take a look at intra-day levels for our 0DTE trading. /ES: Pulling back to a daily chart. There are two key levels I'm focused on. Both Fib levels. 6050 on resistance and 6003 on support. /NQ: A little bit more refined range on the Nasdaq. 21429 resistance and 21263 on support. Bitcoin. I've never been a big "crypto guy" but I'm starting to become a believer. Funny how that works with something that's making you money! BTC exploded higher over the weekend. Hitting a new ATH. I feel about BTC like I felt about Tesla a decade ago. It's either going to the moon or going bankrupt. While that may have been decided with Tesla, I think where Bitcoin goes is still up in the air (see what I did there?). I'm along for the ride. 83,139 resistance and 81,454 support. Let's have a great day. Let's follow our plan and we should have a good shot at making some money today.

Welcome to Friday. It's been quite a week to be sure. Today should be a big more mild. Yesterday was a good day for us in that we locked in the gain on our SPX debit setup. We'll re-set that trade next Monday. Scalping hurt me once again. Four days in a row looking for a pullback that never happened. See our results below: We've got a lot of potentail take profit trades today. Six earnings trades all look like they should go out fully profitable. Trade docket for today: /MNQ scalping, /HG, ABNB, AFRM, DKNG, MRNA/MRK, RIVN, SQ, SMCI, MSTR, 0DTE's, New /ZN. Let's take a look at the markets: It looks like the markets are taking a pause this morning but it's hard to argue with the heavy bullish price action this week. December S&P 500 E-Mini futures (ESZ24) are down -0.10%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.13% this morning as investors took a breather at the end of an eventful week that saw Donald Trump reclaim the U.S. presidency and the Federal Reserve cut rates. As widely expected, the Federal Reserve cut its benchmark interest rate by a quarter percentage point yesterday. The Federal Open Market Committee voted unanimously to reduce the federal funds rate to a range of 4.50% to 4.75%, marking its second consecutive rate cut. Fed officials adjusted their language to note that “labor market conditions have generally eased” and reiterated that “the unemployment rate has moved up but remains low.” In addition, the statement eliminated the reference to “further” inflation progress, instead noting that inflation “has made progress toward the committee’s 2% objective but remains somewhat elevated.” “This further recalibration of our policy stance will help maintain the strength of the economy and the labor market and will continue to enable further progress on inflation as we move toward a more neutral stance over time,” Fed Chair Jerome Powell said in a press conference. The Fed Chair noted that recent indicators suggest the U.S. economy continues to expand solidly, adding that he does not rule “out or in” a rate cut in December. Powell also stated that the U.S. presidential election will have “no effects” on the Fed’s policy decisions in the near term. “No skip signs here. I believe that it is a good thing that the Fed did not lay the blame on the recent labor market slowdown on the hurricanes or strikes. They are just sticking with have generally eased. This statement does not put a December skip in play,” said Neil Dutta at Renaissance Macro Research. In yesterday’s trading session, Wall Street’s major indices closed mostly higher, with the benchmark S&P 500 and the tech-heavy Nasdaq 100 notching new all-time highs. EPAM Systems (EPAM) climbed over +14% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q3 results and issued strong Q4 guidance. Also, Arm Holdings (ARM) gained more than +4% after the semiconductor design company reported better-than-expected FQ2 results. In addition, Warner Bros. Discovery (WBD) surged over +11% after posting a surprise Q3 profit. On the bearish side, Match Group (MTCH) tumbled more than -17% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q3 revenue and providing below-consensus Q4 revenue guidance. Also, MercadoLibre (MELI) plunged over -16% and was the top percentage loser on the Nasdaq 100 after the company posted weaker-than-expected Q3 adjusted EBITDA. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose by +3K to 221K, compared with the 223K expected. Also, U.S. Q3 nonfarm productivity rose +2.2% q/q, missing the +2.6% q/q consensus, while Q3 unit labor costs increased +1.9% q/q, stronger than expectations of +1.1% q/q. In addition, U.S. consumer credit rose +$6.00B in September, weaker than expectations of +$12.20B. Meanwhile, U.S. rate futures have priced in a 71.3% chance of a 25 basis point rate cut and a 28.7% chance of no rate change at the next central bank meeting in December. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast the preliminary November figure to be 71.0, up from last month’s figure of 70.5. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.301%, down -0.95%. My bias or lean today is more neutral. The trend is obviously bullish but I think we are due for a pause. Let's take a look at the /ES and /NQ for todays setups: /ES: Pretty simple levels for me today. 6011 is the key resistance and ATH zone. Bulls need to break that to keep the party going. 5942 to the downside. /NQ: Same principal applies here. 21266 is the high that needs to be broken for bulls to coninue up. 20982 is support. We've got some good things working going into today. If we can get a solid result out of scalping and our 0DTE's it should be a nice finish to the week.

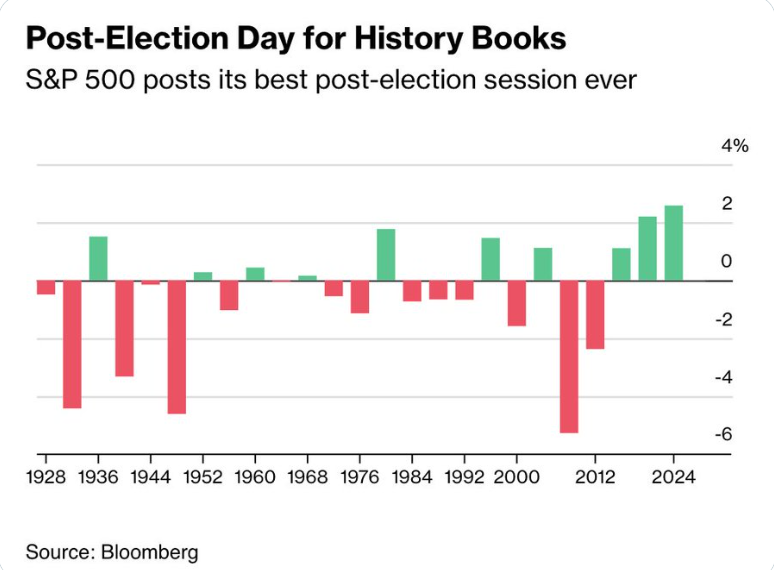

Welcome to Thurs and FOMC day! Todays blog will be another short and sweet one. We had a solid day yesterday. I ended up with a $400 loss on scalping. Earnings went well with four wins out of four trades. We only did SPX stand alone and SPX debit. That gave us about $750 in total profit. December S&P 500 E-Mini futures (ESZ24) are up +0.27%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.33% this morning, extending their post-Election Day gains, while investors looked ahead to the Federal Reserve’s interest rate decision. In yesterday’s trading session, Wall Street’s major indexes ended sharply higher, with the benchmark S&P 500, the blue-chip Dow, and the tech-heavy Nasdaq 100 notching new all-time highs. Tesla (TSLA) surged over +14% and was the top percentage gainer on the Nasdaq 100 amid speculation that the company could be a major beneficiary of Trump’s return to the White House. Also, bank stocks jumped on expectations that the Trump administration would relax regulations for the industry, with Discover Financial Services (DFS) climbing more than +20% to lead gainers in the S&P 500 and Goldman Sachs (GS) rising over +13% to lead gainers in the Dow. In addition, Qualys (QLYS) soared more than +24% after the company posted upbeat Q3 results and boosted its full-year guidance. On the bearish side, Super Micro Computer (SMCI) plummeted about -18% and was the top percentage loser on the S&P 500 and Nasdaq 100 after reporting mixed preliminary FQ1 results and providing below-consensus FQ2 guidance. “For now, investor sentiment is pro-growth, pro-deregulation, and pro-markets,” said David Bahnsen, chief investment officer at The Bahnsen Group. “There is also an assumption that M&A activity will pick up and that more tax cuts are coming or the existing ones will be extended. This creates a strong backdrop for stocks.” Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. Fed officials are widely expected to lower their benchmark interest rate by a quarter percentage point as inflation continues to move closer to the 2% target. They have projected another quarter-point reduction this year in December and an additional full point of cuts in 2025, according to the median estimate released in September. Investor attention will also be on Powell’s press conference, where he is anticipated to offer guidance on the Fed’s trajectory for interest rate cuts in the upcoming quarters. On the earnings front, notable companies like Arista Networks (ANET), Airbnb (ABNB), Warner Bros. Discovery (WBD), The Trade Desk (TTD), Monster Beverage (MNST), Block (SQ), Datadog (DDOG), Hershey (HSY), and Duke Energy (DUK) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists estimate this figure to arrive at 223K, compared to last week’s number of 216K. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q3 Unit Labor Costs to be +1.1% q/q and Nonfarm Productivity to stand at +2.6% q/q, compared to the second-quarter numbers of +0.4% q/q and +2.5% q/q, respectively. U.S. Wholesale Inventories data will come in today. Economists expect the September figure to be -0.1% m/m, compared to +0.1% m/m in August. U.S. Consumer Credit data will be reported today as well. Economists forecast this figure to be $12.20B in September, compared to the previous figure of $8.93B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.422%, down -0.20%. Yesterday was a blow out day: The RUT had it's biggest, one day point gain every. The SP500 also had it's best, post-election day gain ever. Today is FOMC so we sit on our hands most of the day then pounce once Powell starts speaking. Trade docket for today: ABNB, '/HQ, /MNQ, /ZN, SQ, ARM, DJT, FDX, FSLR, LYFT, MRK/MRNA, QCOM , SPCE, TTWO, 0DTE's. At new ATH's where do we go from here? A retrace seems likely but the strength of this move has been nothing but impressive.

I'll see you all in the live zoom today. FOMC days are usually pretty good to us. oWelcome back traders. Apologies for a late and abbreviated review today. We had a blast last night, scalping the moves in the futures. It brought back memories of four years ago. We were wishing we could get an election every day but that probably would be a bad thing as we'd never sleep! I stayed up until about midnight scalping then left my positions on...got back up at 2:00 A.M. to adjust them for some more potential and then got back up again at 4:00 A.M. so that's my excuse. We should end up with over $2,000 of profit to show for our effort. One thing you can never say about our trading room is that we don't give you plenty of opportunities to trade! Here's our results for yesterday with the late night election scalping trade still working. Fututres have pushed us into new bullish territory. The question now for today is, does this rally continue? Does it fade out today? What does FOMC tomorrow bring? The action continues! All major indices are now firmly above their 50DMA. Trade docket for today. Busy: /6A, /6C /6J, /MNQ,/NQ scalping continues, /ZN?, CVS, DVN, LRN, LUMA, PLTR, SMCI, UAL, QCOM, ARM, TTWO, LYFT, BYND, SPCE, AMC, 0DTE's. December S&P 500 E-Mini futures (ESZ24) are trending up +2.24% this morning after Republican Donald Trump won the U.S. presidential election. Donald Trump was elected the 47th president of the United States on Wednesday, achieving a remarkable political comeback in one of the most divisive contests for the White House in U.S. history. With a victory in Wisconsin, Trump surpassed the 270 electoral votes needed to win the presidency. Along with Wisconsin, Trump secured wins in the other critical battleground states of Pennsylvania, Georgia, and North Carolina. The Republican party also gained control of the U.S. Senate, and made advances in the House of Representatives in its bid to retain control there, heightening the possibility of a so-called “Red Sweep.” In yesterday’s trading session, Wall Street’s main stock indexes closed in the green. Palantir Technologies (PLTR) soared over +23% and was the top percentage gainer on the S&P 500 after the data analytics firm posted upbeat Q3 results and raised its full-year revenue guidance. Also, GlobalFoundries (GFS) surged more than +14% and was the top percentage gainer on the Nasdaq 100 after the company reported stronger-than-expected Q3 results and offered a solid Q4 forecast. In addition, Cummins (CMI) climbed over +8% after reporting better-than-expected Q3 results. On the bearish side, Celanese Corp. (CE) plummeted more than -26% and was the top percentage loser on the S&P 500 after the company posted downbeat Q3 results and said it would cut its quarterly dividend by 95% starting in the first quarter of 2025. Also, NXP Semiconductors N.V. (NXPI) slumped over -5% after the semiconductor manufacturing and design company provided below-consensus Q4 guidance. Economic data released on Tuesday showed that the U.S. ISM services index unexpectedly rose to a 2-1/4 year high of 56.0 in October, stronger than expectations of 53.8. At the same time, the U.S. October S&P Global services PMI was revised lower to 55.0 from the 55.3 preliminary reading. In addition, the U.S. trade deficit stood at -$84.40B in September, wider than expectations of -$83.80B and the largest deficit in nearly 2-1/2 years. The Federal Reserve kicks off its two-day meeting later in the day. Fed officials are widely expected to lower interest rates by a quarter percentage point when their meeting concludes on Thursday as inflation continues to move closer to the 2% target. Investor attention will likely center on Powell’s press conference, where he is anticipated to offer guidance on the Fed’s trajectory for interest rate cuts in the upcoming quarters. Third-quarter earnings season rolls on, and market participants anticipate new reports from notable companies today, including Qualcomm (QCOM), Arm Holdings (ARM), Gilead Sciences (GILD), MercadoLibre (MELI), CVS Health (CVS), and Take-Two Interactive (TTWO). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, investors will likely focus on U.S. Crude Oil Inventories data, which is set to be released in a couple of hours. Economists estimate this figure to be 0.300M, compared to last week’s value of -0.515M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.437%, up +3.43%. I'll see you all in the trading room. Let's put our Scalps to bed today and lock in some sweet gains!

No matter who you voted for let's all pray that good decisions are made and prosperity reins. rWelcome back traders. Today is Tuesday so you know what that means. Election day. It's hard to say if we get any appreciable movement in the cash market but this evening in the futures market? That may be a different story. We'll have our live scalping feed running this evening in case we get some movement. We'll be ready. Yesterday was a good day. Pretty mellow. We are keeping some buying power in reserve for Scalping tonight, Potential moves tomorrow and the FED catalyst on Thursday. Here's a look at how my day went. We'll look to trade small again today. Trade docket: /MNQ, LUMN, DVN, CVS PLTR, SMCI, VRTX, /6A, /6C, /6J, 0DTE's. Nothing really changed yesterday in terms of market makeup. We are still clinging on to the 50DMA with the exception of the DIA which is slipping below. This could just be the calm before the storm. We've been waiting for some substantive movement for a while. The next could days could give it to us. Technicals are still flashing a slight sell signal. It's hard to say how meaningful it is on a day like today. December S&P 500 E-Mini futures (ESZ24) are up +0.21%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.27% this morning as investors braced for the closely contested U.S. presidential election, while also awaiting a new round of economic data and corporate earnings reports. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended lower. Constellation Energy (CEG) plunged over -12% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the Federal Energy Regulatory Commission rejected the proposal that would have increased the amount of power supplied to an Amazon.com data center. Also, megacap technology stocks lost ground, with Alphabet (GOOGL) and Meta Platforms (META) sliding more than -1%. In addition, Marriott International (MAR) fell over -1% after the hotel operator cut its full-year adjusted EPS guidance. On the bullish side, Fox Corp. (FOXA) gained more than +2% after the company posted better-than-expected FQ1 results. Economic data released on Monday showed that U.S. factory orders fell -0.5% m/m in September, weaker than expectations of -0.4% m/m. Meanwhile, market participants are focusing on the U.S. presidential election. Millions of Americans are beginning to head to the polls to elect their next president following one of modern history’s most tumultuous and dramatic presidential campaigns. With polls indicating a photo-finish outcome, the possibility of a disputed result could extend the vote count for days or even weeks, potentially leading to increased volatility. Investors are also keenly awaiting the Federal Reserve’s interest rate decision and Jerome Powell’s press conference on Thursday, where he is anticipated to offer guidance on the Fed’s trajectory for interest rate cuts in the upcoming quarters. “Of course, the U.S. election will play a prominent role in moving financial markets around this week. However, a Federal Reserve policy decision [on Thursday], some light economic releases throughout the week, and roughly 20% of the S&P 500 scheduled to report third-quarter results should also have their fair share of sway on directing stock traffic,” said Anthony Saglimbene at Ameriprise. Third-quarter earnings season continues in full flow, with investors awaiting fresh reports from notable companies today, including Apollo Global Management (APO), Emerson (EMR), Marathon Petroleum (MPC), Microchip (MCHP), Yum! Brands (YUM), and DuPont De Nemours (DD). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, all eyes are focused on the U.S. ISM Non-Manufacturing PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the October ISM Non-Manufacturing PMI will come in at 53.8, compared to September’s figure of 54.9. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 55.2 in September. Economists foresee the October figure to be 55.3. U.S. Trade Balance data will be reported today as well. Economists forecast this figure to stand at -$83.80B in September, compared to the previous figure of -$70.40B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.308%, down -0.05%. Intra-day levels haven't really changed from yesterday and I'm not sure how relavant they will be starting today through Thursday and FOMC.

Our plan, once again, is to trade small today just like we did yesterday and then see if we can jump on some movement tonight in the futures market. My hope for you today is three fold. #1. Please vote. It sometimes seems futile to me but I do it because it's important to voice you opinion. #2. Be kind. Anger, hostility and hatred don't serve any greater purpose. #3. Trade small today and come scalp with us tonight! That could be where the real action materializes today. Welcome back traders! New week with lots of catalysts, not the least of which is the U.S. presidential election along with the Fed on Thurs. We are going to focus the start of our week with non-equity correlated trades then move into our normal setups Thursday. We'll also plan to be scalping Tues. evening all night long, if possible off the Presidentail results. We had a fantastic Friday and scalping again was the big winner for us. See our results below. This week should give us all the opportunity we need to scalp. If we can't make money scalping this week it will all be on us...not the market. Let's take a look at the markets to start off the week: Technicals are still in sell mode. Talk about a tenuous position! Most all the indices we trade and track are sitting on and just clinging to their 50DMA. It's such a key level. We've been waiting for a clear directional signal. We may get one this week. We either hold here and move higher and confirm those support levels or we break below. That could mean significatnt downside. The week started off quietly for the SPY, but after a gap down on Thursday which saw the price break below the multi-month rising wedge, the index closed sharply lower at $571.04 (-1.39%). All eyes are now on the 50-day SMA, which acted as key support on Thursday’s rout. Despite knockout earnings from five of the most important companies in the index, the QQQ once again stalled just below its summer high, correcting sharply on Thursday and closing the week at $487.43 (-1.54%). The price now hangs in the balance, between support at the 50-day SMA below and resistance at the bottom of a rising wedge above. The IWM held up the best of the major indices, going inside on the week and closing in lockstep with last week’s close at $218.98 (+0.03%). Still, the setup on small caps mirrors that of their large-cap counterparts, as the price hovers at the 50-day SMA after slipping below the multi-month rising wedge. Let's take a look at the expected moves this week: Are we pricing in a big move? Uh, yes we are! The one day VIX is elevated coming into this week. December S&P 500 E-Mini futures (ESZ24) are down -0.02%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.10% this morning as market participants awaited the outcome of one of the most closely contested elections in U.S. history, a fresh batch of corporate earnings reports, and the Federal Reserve’s policy meeting later in the week. In Friday’s trading session, Wall Street’s major averages closed in the green. Amazon.com (AMZN) gained over +6% after the e-commerce and cloud giant reported stronger-than-expected Q3 results and provided solid guidance for the holiday quarter. Also, Intel (INTC) climbed more than +7% and was the top percentage gainer on the Dow after the semiconductor giant reported better-than-expected Q3 revenue and gave an upbeat Q4 revenue forecast. In addition, Atlassian (TEAM) surged about +19% and was the top percentage gainer on the Nasdaq 100 after the software firm posted better-than-expected FQ1 results and issued above-consensus FQ2 revenue guidance. On the bearish side, Apple (AAPL) slid more than -1% after the iPhone maker reported weaker-than-anticipated quarterly sales in China and offered a tepid FQ1 sales forecast. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls increased by a mere 12K in October, weaker than expectations of 106K and the smallest increase in 3-3/4 years. Also, the U.S. October unemployment rate was unchanged at 4.1%, in line with expectations. In addition, U.S. average hourly earnings came in at +0.4% m/m and +4.0% y/y in October, compared to expectations of +0.3% m/m and +4.0% y/y. Finally, the U.S. October ISM manufacturing PMI unexpectedly fell to a 15-month low of 46.5, weaker than expectations of 47.6. “We’re in the midst of a hectic stretch with economic data, earnings, the Fed, and the US election,” said Bret Kenwell at eToro. “There’s been some additional volatility around these events, but so far nothing has changed the big-picture view. Until that changes, the long-term drivers of the bull market remain intact.” Meanwhile, the U.S. presidential election that is set to culminate on Tuesday will draw significant attention from market watchers, with the outcome expected to influence the economy’s direction over the next four years. Harris received some positive signs from an ABC News and Ipsos poll that gave her a 49%-46% lead nationally over Trump in the White House race, while the New York Times/Siena survey released Sunday placed the Democratic nominee ahead in five of seven swing states. Market participants will also be closely watching the U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference this week. Fed officials are expected to lower interest rates by a quarter percentage point on Thursday as inflation continues to move closer to their 2% target. Investor attention will likely center on Powell’s press conference, where he is anticipated to offer guidance on the Fed’s trajectory for interest rate cuts in the upcoming quarters. Third-quarter earnings season continues, and investors await new reports from notable companies this week, including Qualcomm (QCOM), Palantir (PLTR), Arm Holdings (ARM), Gilead Sciences (GILD), Marriott International (MAR), NXP Semiconductors (NXPI), Take-Two Interactive (TTWO), CVS Health (CVS), Arista Networks (ANET), Yum! Brands (YUM), Airbnb (ABNB), Warner Bros. Discovery (WBD), and Duke Energy (DUK). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. In addition, investors will monitor a spate of economic data releases this week, including the U.S. S&P Global Composite PMI, the S&P Global Services PMI, the ISM Non-Manufacturing PMI, Trade Balance, Exports, Imports, Crude Oil Inventories, Initial Jobless Claims, Nonfarm Productivity (preliminary), Unit Labor Costs (preliminary), Wholesale Inventories, Consumer Credit, and the University of Michigan’s Consumer Sentiment Index (preliminary). Today, investors will focus on U.S. Factory Orders data, which is set to be released in a couple of hours. Economists, on average, forecast that September Factory Orders will stand at -0.4% m/m, compared to the previous figure of -0.2% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.303%, down -1.38%. It seems foolish and just a waste of time to state a lean or bias for today or this week. The Algos will drive us where ever they will take us. We'll try to be patient and wait for opportunities to open up. Trade docket for today: /MNQ, /6A, /6C, /6J, /HG, VRTX, PLTR, O, FANG, WYNN, SMCI, TEAM, 0DTE's. Let;s take a look at our intra-day levels: /ES; Two key levels for me today. 5808 is resistance and also the 50 period M.A. on 2hr. chart. 5735 is support. Below that is considerable downside. /NQ: Same approach. Two key levels. 20353 is resistance with 20004 is support. That's a big support level. Below that is a big volume space that could create a big downside. BTC; Bitcoin has been in a bit of a retrace after getting oh so close to a new ATH. 72,227 is resistance with 67,624 as support. Let's trade light and be patient this week. Trades should come to us if we can be sit on our hands long enough.

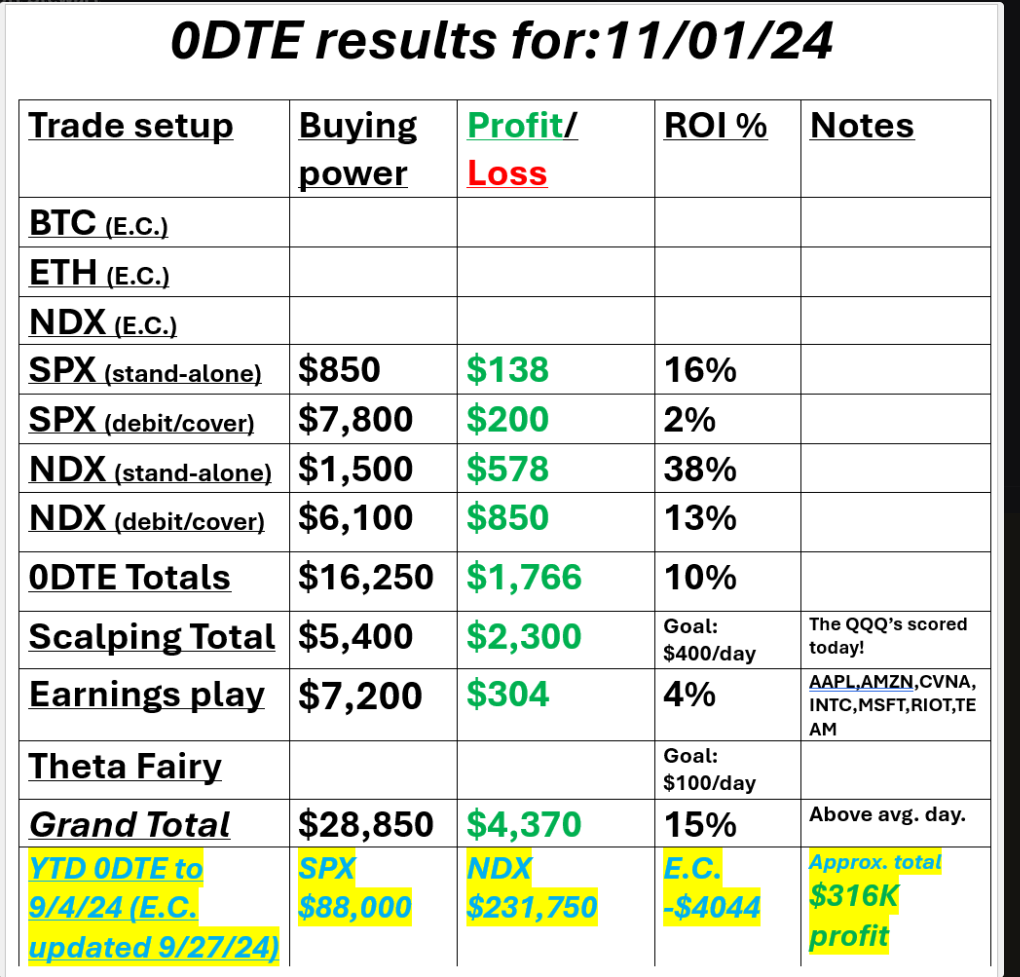

Yes that's right. We are into November! This summer went by so fast for me. Todays blog will be short and sweet. I had my left eye operation yesterday so eyesight is still fuzzy and I'm still feeling the drugs! Today is really just about capturing profits, de-risking the account and getting buying power back for next Monday so we can go out and do it all over again. The trade docket is deep today but most are just booking profits from our multiple earnings plays. Here's a look at how we did yesterday. We had a great day that was largely carried by our scalping results. When markets move there is nothing so powerful as a directional trade. Technicals place us in a key zone today. Most of the indices are sitting just on top of their 50DMA with the DIA actually below it. If this level doesn't hold I think we get some decent downside potential. Futures are up this morning. Let's see if they can fight back. December Nasdaq 100 E-Mini futures (NQZ24) are trending up +0.43% this morning as positive earnings from Intel and Amazon boosted sentiment, with the focus now shifting to the all-important U.S. jobs report that will help clarify the Federal Reserve’s interest rate trajectory. Amazon (AMZN) climbed over +5% in pre-market trading after the e-commerce and cloud giant reported stronger-than-expected Q3 results and provided solid guidance for the holiday quarter. Also, Intel (INTC) gained more than +5% in pre-market trading after the semiconductor giant reported better-than-expected Q3 revenue and issued an upbeat Q4 revenue forecast. In yesterday’s trading session, Wall Street’s major indexes closed lower. Huntington Ingalls Industries (HII) plummeted over -26% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q3 results. Also, Super Micro Computer (SMCI) tumbled about -12% and was the top percentage loser on the Nasdaq 100, adding to Wednesday’s -32% plunge, after accounting firm Ernst & Young LLP resigned as the company’s auditor. In addition, Microsoft (MSFT) slumped over -6% and was the top percentage loser on the Dow after the tech giant provided a disappointing FQ2 cloud revenue growth forecast. On the bullish side, Paycom Software (PAYC) soared more than +21% and was the top percentage gainer on the S&P 500 after posting upbeat Q3 results and raising the lower end of its annual revenue guidance. Data from the U.S. Department of Commerce released on Thursday showed that the core PCE price index, a key inflation gauge monitored by the Fed, came in at +0.3% m/m and +2.7% y/y in September, compared to expectations of +0.3% m/m and +2.6% y/y. Also, U.S. September personal spending rose +0.5% m/m, stronger than expectations of +0.4% m/m, while personal income grew +0.3% m/m, in line with expectations. In addition, the U.S. employment cost index, a key gauge of U.S. labor costs, rose +0.8% q/q in the third quarter, weaker than expectations of +0.9% q/q and the slowest pace of increase in 3 years. Finally, the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -12K to a 5-month low of 216K, compared with the 229K expected. “We view the data overall as suggesting that upside inflation risks from a strong economy and labor market remain to date muted, and while the Fed and investors will need to keep this under ongoing review given the strength in the data, it is fundamentally constructive for risk and for the ‘soft landing,’” Evercore ISI Vice Chairman Krishna Guha wrote in a note. Meanwhile, U.S. rate futures have priced in a 93.2% chance of a 25 basis point rate cut and a 6.8% chance of no rate change at the upcoming monetary policy meeting. On the earnings front, notable companies like Exxon Mobil (XOM), Chevron (CVX), Dominion Energy (D), Charter Communications (CHTR), and Wayfair (W) are set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that October Nonfarm Payrolls will come in at 106K, compared to September’s figure of 254K. Investors will also focus on the U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI. Economists foresee the October ISM Manufacturing PMI to arrive at 47.6 and the S&P Global Manufacturing PMI to be 47.8, compared to the previous values of 47.2 and 47.3, respectively. U.S. Average Hourly Earnings data will be closely watched today. Economists expect October figures to be +0.3% m/m and +4.0% y/y, compared to the previous numbers of +0.4% m/m and +4.0% y/y. U.S. Construction Spending data will come in today. Economists forecast this figure to be unchanged m/m in September, compared to the previous number of -0.1% m/m. The U.S. Unemployment Rate will be reported today as well. Economists foresee this figure to remain steady at 4.1% in October. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.300%, up +0.30%. Trade docket for today: /MNQ,QQQ scalping, /NQ, /ZN, AAPL, AMZN, CCL, CVNA, FDX, INTC, LRN, PLTR, QQQ, RIOT, SHOP, SPY, TEAM, UPST, WYNN, 0DTE's. Let's get these profits locked down today! See you in the trading room shortly.

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |