|

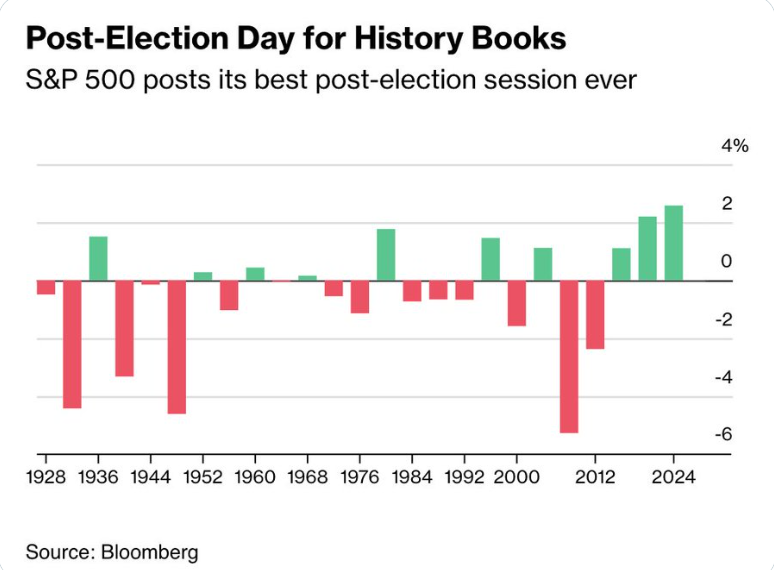

Welcome to Thurs and FOMC day! Todays blog will be another short and sweet one. We had a solid day yesterday. I ended up with a $400 loss on scalping. Earnings went well with four wins out of four trades. We only did SPX stand alone and SPX debit. That gave us about $750 in total profit. December S&P 500 E-Mini futures (ESZ24) are up +0.27%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.33% this morning, extending their post-Election Day gains, while investors looked ahead to the Federal Reserve’s interest rate decision. In yesterday’s trading session, Wall Street’s major indexes ended sharply higher, with the benchmark S&P 500, the blue-chip Dow, and the tech-heavy Nasdaq 100 notching new all-time highs. Tesla (TSLA) surged over +14% and was the top percentage gainer on the Nasdaq 100 amid speculation that the company could be a major beneficiary of Trump’s return to the White House. Also, bank stocks jumped on expectations that the Trump administration would relax regulations for the industry, with Discover Financial Services (DFS) climbing more than +20% to lead gainers in the S&P 500 and Goldman Sachs (GS) rising over +13% to lead gainers in the Dow. In addition, Qualys (QLYS) soared more than +24% after the company posted upbeat Q3 results and boosted its full-year guidance. On the bearish side, Super Micro Computer (SMCI) plummeted about -18% and was the top percentage loser on the S&P 500 and Nasdaq 100 after reporting mixed preliminary FQ1 results and providing below-consensus FQ2 guidance. “For now, investor sentiment is pro-growth, pro-deregulation, and pro-markets,” said David Bahnsen, chief investment officer at The Bahnsen Group. “There is also an assumption that M&A activity will pick up and that more tax cuts are coming or the existing ones will be extended. This creates a strong backdrop for stocks.” Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. Fed officials are widely expected to lower their benchmark interest rate by a quarter percentage point as inflation continues to move closer to the 2% target. They have projected another quarter-point reduction this year in December and an additional full point of cuts in 2025, according to the median estimate released in September. Investor attention will also be on Powell’s press conference, where he is anticipated to offer guidance on the Fed’s trajectory for interest rate cuts in the upcoming quarters. On the earnings front, notable companies like Arista Networks (ANET), Airbnb (ABNB), Warner Bros. Discovery (WBD), The Trade Desk (TTD), Monster Beverage (MNST), Block (SQ), Datadog (DDOG), Hershey (HSY), and Duke Energy (DUK) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists estimate this figure to arrive at 223K, compared to last week’s number of 216K. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q3 Unit Labor Costs to be +1.1% q/q and Nonfarm Productivity to stand at +2.6% q/q, compared to the second-quarter numbers of +0.4% q/q and +2.5% q/q, respectively. U.S. Wholesale Inventories data will come in today. Economists expect the September figure to be -0.1% m/m, compared to +0.1% m/m in August. U.S. Consumer Credit data will be reported today as well. Economists forecast this figure to be $12.20B in September, compared to the previous figure of $8.93B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.422%, down -0.20%. Yesterday was a blow out day: The RUT had it's biggest, one day point gain every. The SP500 also had it's best, post-election day gain ever. Today is FOMC so we sit on our hands most of the day then pounce once Powell starts speaking. Trade docket for today: ABNB, '/HQ, /MNQ, /ZN, SQ, ARM, DJT, FDX, FSLR, LYFT, MRK/MRNA, QCOM , SPCE, TTWO, 0DTE's. At new ATH's where do we go from here? A retrace seems likely but the strength of this move has been nothing but impressive.

I'll see you all in the live zoom today. FOMC days are usually pretty good to us.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |