|

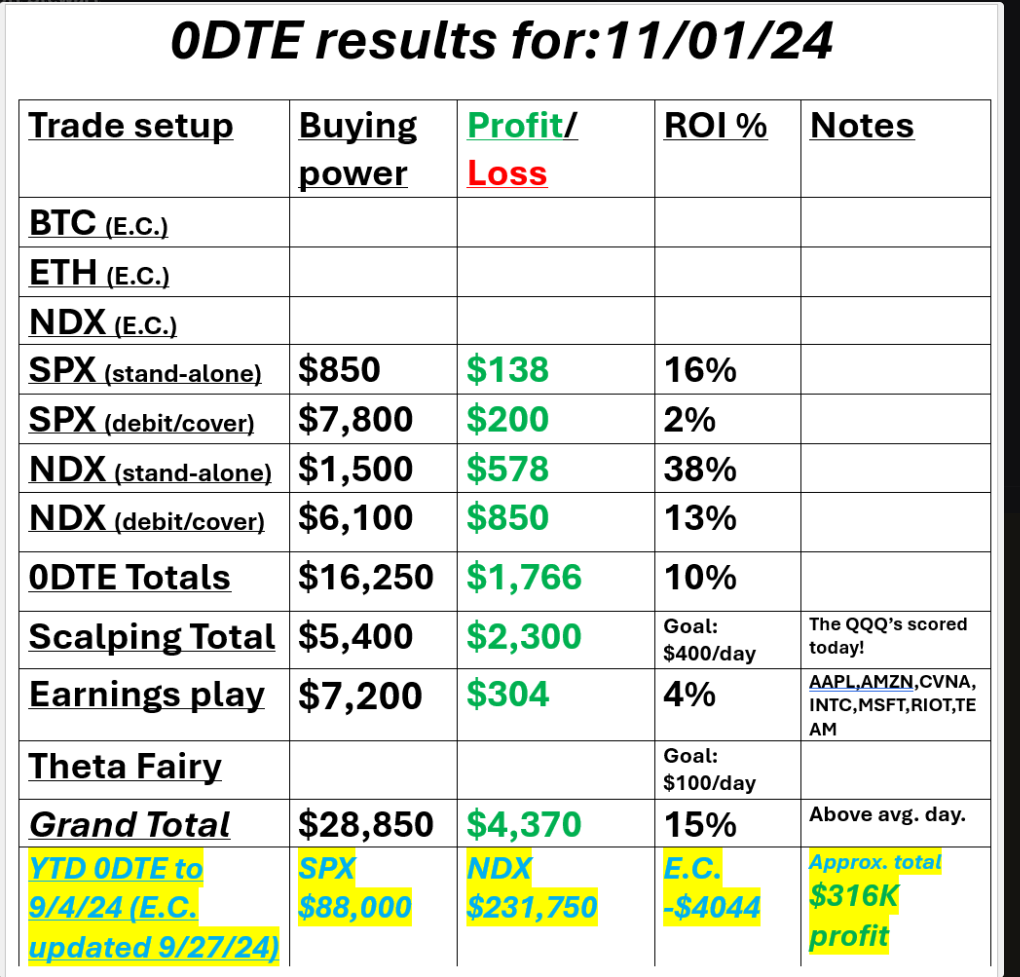

Welcome back traders! New week with lots of catalysts, not the least of which is the U.S. presidential election along with the Fed on Thurs. We are going to focus the start of our week with non-equity correlated trades then move into our normal setups Thursday. We'll also plan to be scalping Tues. evening all night long, if possible off the Presidentail results. We had a fantastic Friday and scalping again was the big winner for us. See our results below. This week should give us all the opportunity we need to scalp. If we can't make money scalping this week it will all be on us...not the market. Let's take a look at the markets to start off the week: Technicals are still in sell mode. Talk about a tenuous position! Most all the indices we trade and track are sitting on and just clinging to their 50DMA. It's such a key level. We've been waiting for a clear directional signal. We may get one this week. We either hold here and move higher and confirm those support levels or we break below. That could mean significatnt downside. The week started off quietly for the SPY, but after a gap down on Thursday which saw the price break below the multi-month rising wedge, the index closed sharply lower at $571.04 (-1.39%). All eyes are now on the 50-day SMA, which acted as key support on Thursday’s rout. Despite knockout earnings from five of the most important companies in the index, the QQQ once again stalled just below its summer high, correcting sharply on Thursday and closing the week at $487.43 (-1.54%). The price now hangs in the balance, between support at the 50-day SMA below and resistance at the bottom of a rising wedge above. The IWM held up the best of the major indices, going inside on the week and closing in lockstep with last week’s close at $218.98 (+0.03%). Still, the setup on small caps mirrors that of their large-cap counterparts, as the price hovers at the 50-day SMA after slipping below the multi-month rising wedge. Let's take a look at the expected moves this week: Are we pricing in a big move? Uh, yes we are! The one day VIX is elevated coming into this week. December S&P 500 E-Mini futures (ESZ24) are down -0.02%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.10% this morning as market participants awaited the outcome of one of the most closely contested elections in U.S. history, a fresh batch of corporate earnings reports, and the Federal Reserve’s policy meeting later in the week. In Friday’s trading session, Wall Street’s major averages closed in the green. Amazon.com (AMZN) gained over +6% after the e-commerce and cloud giant reported stronger-than-expected Q3 results and provided solid guidance for the holiday quarter. Also, Intel (INTC) climbed more than +7% and was the top percentage gainer on the Dow after the semiconductor giant reported better-than-expected Q3 revenue and gave an upbeat Q4 revenue forecast. In addition, Atlassian (TEAM) surged about +19% and was the top percentage gainer on the Nasdaq 100 after the software firm posted better-than-expected FQ1 results and issued above-consensus FQ2 revenue guidance. On the bearish side, Apple (AAPL) slid more than -1% after the iPhone maker reported weaker-than-anticipated quarterly sales in China and offered a tepid FQ1 sales forecast. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls increased by a mere 12K in October, weaker than expectations of 106K and the smallest increase in 3-3/4 years. Also, the U.S. October unemployment rate was unchanged at 4.1%, in line with expectations. In addition, U.S. average hourly earnings came in at +0.4% m/m and +4.0% y/y in October, compared to expectations of +0.3% m/m and +4.0% y/y. Finally, the U.S. October ISM manufacturing PMI unexpectedly fell to a 15-month low of 46.5, weaker than expectations of 47.6. “We’re in the midst of a hectic stretch with economic data, earnings, the Fed, and the US election,” said Bret Kenwell at eToro. “There’s been some additional volatility around these events, but so far nothing has changed the big-picture view. Until that changes, the long-term drivers of the bull market remain intact.” Meanwhile, the U.S. presidential election that is set to culminate on Tuesday will draw significant attention from market watchers, with the outcome expected to influence the economy’s direction over the next four years. Harris received some positive signs from an ABC News and Ipsos poll that gave her a 49%-46% lead nationally over Trump in the White House race, while the New York Times/Siena survey released Sunday placed the Democratic nominee ahead in five of seven swing states. Market participants will also be closely watching the U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference this week. Fed officials are expected to lower interest rates by a quarter percentage point on Thursday as inflation continues to move closer to their 2% target. Investor attention will likely center on Powell’s press conference, where he is anticipated to offer guidance on the Fed’s trajectory for interest rate cuts in the upcoming quarters. Third-quarter earnings season continues, and investors await new reports from notable companies this week, including Qualcomm (QCOM), Palantir (PLTR), Arm Holdings (ARM), Gilead Sciences (GILD), Marriott International (MAR), NXP Semiconductors (NXPI), Take-Two Interactive (TTWO), CVS Health (CVS), Arista Networks (ANET), Yum! Brands (YUM), Airbnb (ABNB), Warner Bros. Discovery (WBD), and Duke Energy (DUK). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. In addition, investors will monitor a spate of economic data releases this week, including the U.S. S&P Global Composite PMI, the S&P Global Services PMI, the ISM Non-Manufacturing PMI, Trade Balance, Exports, Imports, Crude Oil Inventories, Initial Jobless Claims, Nonfarm Productivity (preliminary), Unit Labor Costs (preliminary), Wholesale Inventories, Consumer Credit, and the University of Michigan’s Consumer Sentiment Index (preliminary). Today, investors will focus on U.S. Factory Orders data, which is set to be released in a couple of hours. Economists, on average, forecast that September Factory Orders will stand at -0.4% m/m, compared to the previous figure of -0.2% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.303%, down -1.38%. It seems foolish and just a waste of time to state a lean or bias for today or this week. The Algos will drive us where ever they will take us. We'll try to be patient and wait for opportunities to open up. Trade docket for today: /MNQ, /6A, /6C, /6J, /HG, VRTX, PLTR, O, FANG, WYNN, SMCI, TEAM, 0DTE's. Let;s take a look at our intra-day levels: /ES; Two key levels for me today. 5808 is resistance and also the 50 period M.A. on 2hr. chart. 5735 is support. Below that is considerable downside. /NQ: Same approach. Two key levels. 20353 is resistance with 20004 is support. That's a big support level. Below that is a big volume space that could create a big downside. BTC; Bitcoin has been in a bit of a retrace after getting oh so close to a new ATH. 72,227 is resistance with 67,624 as support. Let's trade light and be patient this week. Trades should come to us if we can be sit on our hands long enough.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |