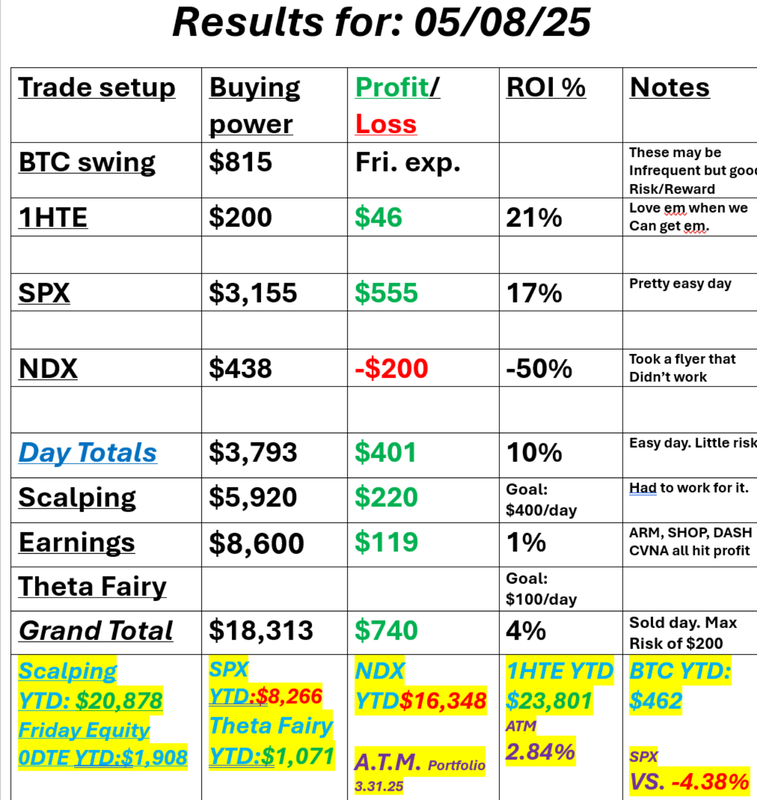

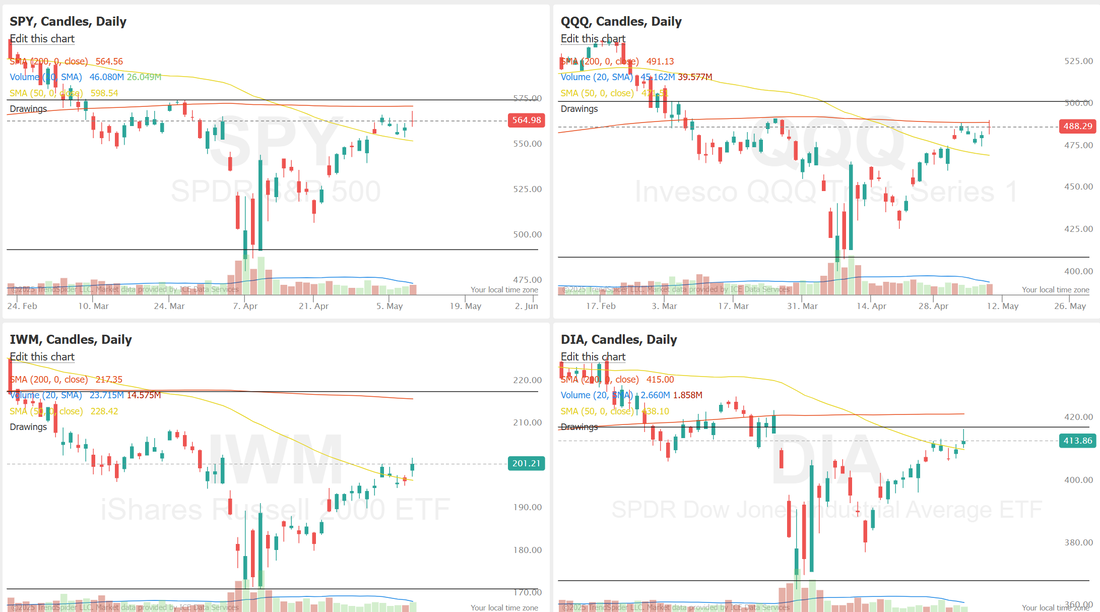

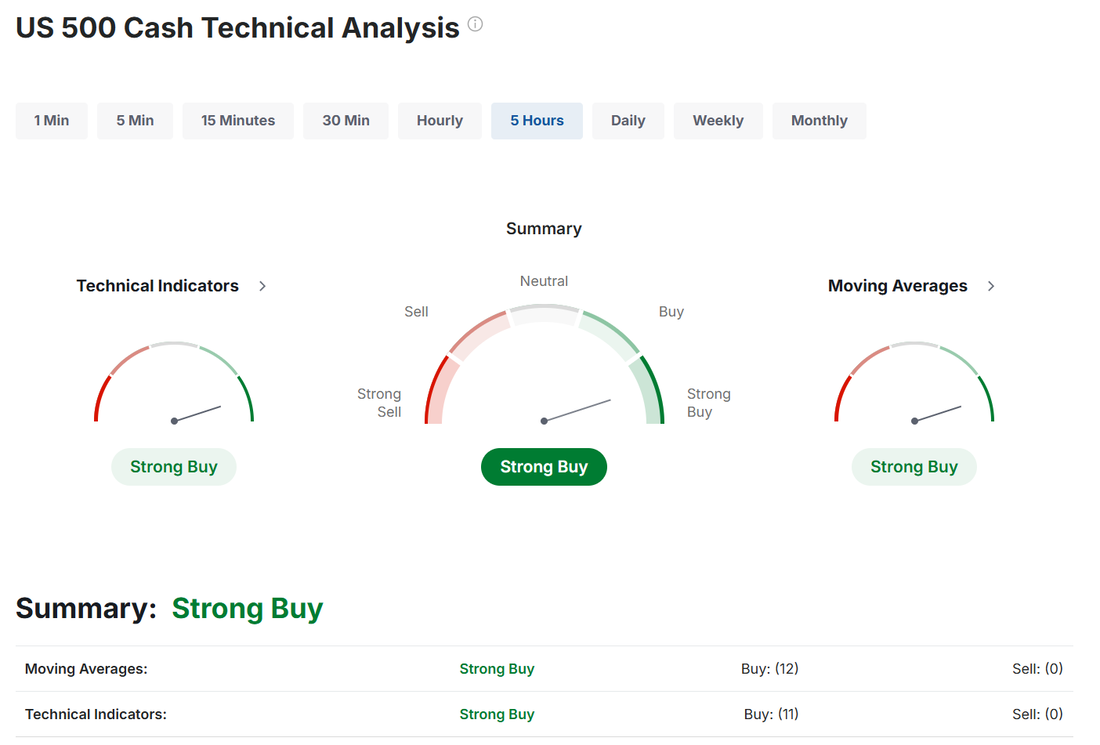

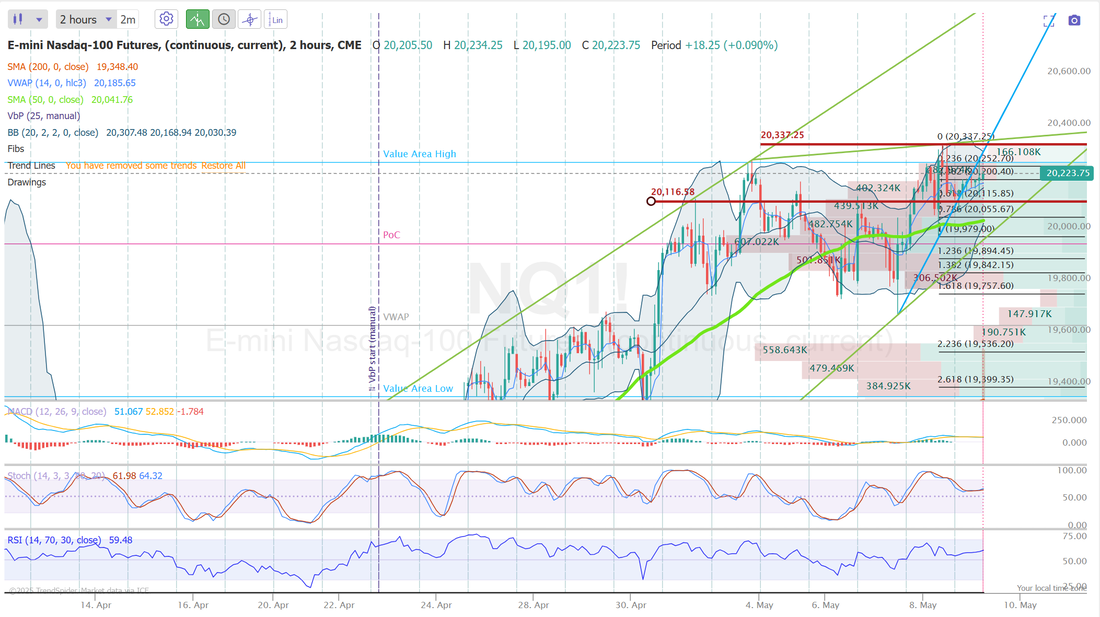

Are you trading with fear?Look, I get it. Ever since "Liberation day" trading has not been easy. In fact, it's been downright hard! It's also been mostly to the downside. Don't get me wrong. I vastly prefer a downward market to an upward trend. Bigger moves. Better premium. Easier to find things to short than long, etc. Most traders, however, are built to look for up trends. All this has had a mental effect on so many traders. The traders in our trading room are not exempt. From time to time we experience "performance drift". This phenomenon is seen when a large percentage of a unified trading group is experiencing different results (usually much worse results) than the "official" trade is producing. This week has been a breeze for us. Every day has not only got us close or surpassed our daily income goal of $1,000+ dollars but they've been pretty easy days. Very little work and very little risk. That is, if the trade was followed. Many of our traders skipped trades. Altered trades. Only did partial trades and not surprisingly, lost money. This coming Monday I'll be doing a two-hour training on Trading Psychology and how to overcome fear in your trading. I encourage you to tune in live or watch the recording at your leisure. As I mentioned, it's been a solid week of gains for us. Yesterday was no different. Our max risk all day was $200 dollars on an NDX flyer I took in the last hour of trading. I said this at the start of the week...we are in a real nice sweet spot right now in the market. We've still got great I.V. but the moves are more fluid and less erratic. Here's a look at our day yesterday (for those that followed the trades). I took a flyer on NDX going into the close. Had we left it, it would have made us $600 dollars but $200 dollars was all I was willing to risk. June S&P 500 E-Mini futures (ESM25) are trending up +0.13% this morning as investors refrain from making big bets ahead of trade negotiations between Washington and Beijing. Investors are eagerly awaiting the upcoming trade talks between the U.S. and China, set to take place in Switzerland this weekend, which President Trump expects to be “substantive.” U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer are set to meet with Chinese Vice Premier He Lifeng. Trump stated that if the talks go well, he may consider reducing the 145% tariff he has imposed on numerous Chinese goods. Bloomberg reported on Friday that the U.S. side has set an initial goal of lowering tariffs to below 60%, a move they believe China may be willing to match. Progress during the two days of scheduled talks could lead to those tariff reductions being implemented as early as next week, according to the report. “As we ... find out how much progress the U.S. and China are making towards the most important trade deal this weekend, it should give investors some more clarity about how much of an impact the trade issue will have on the U.S. and global economy going forward,” said Matt Maley at Miller Tabak + Co. In yesterday’s trading session, Wall Street’s major indices closed higher. Axon Enterprises (AXON) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted upbeat Q1 results and raised its full-year revenue guidance. Also, chip stocks advanced after the Commerce Department said it doesn’t intend to implement the AI Diffusion rule, with Intel (INTC) and Micron Technology (MU) rising more than +3%. In addition, Applovin (APP) climbed over +11% after the digital advertising company reported stronger-than-expected Q1 results and provided upbeat Q2 advertising revenue guidance. On the bearish side, Match Group (MTCH) slid more than -9% and was the top percentage loser on the S&P 500 after the company issued below-consensus Q2 adjusted operating income guidance and announced a 13% workforce reduction. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell -13K to 228K, compared with the 231K expected. Also, U.S. Q1 nonfarm productivity fell -0.8% q/q, weaker than expectations of -0.4% q/q, while unit labor costs climbed +5.7% q/q, stronger than expectations of +5.3% q/q. In addition, U.S. March wholesale inventories were revised slightly lower to +0.4% m/m from the advance estimate of +0.5% m/m. Meanwhile, U.S. rate futures have priced in an 83.0% chance of no rate change and a 17.0% chance of a 25 basis point rate cut at the next FOMC meeting in June. The U.S. economic data slate is empty on Friday. However, investors will focus on a batch of speeches from Fed officials Williams, Kugler, Barkin, Goolsbee, Waller, and Cook. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.372%, down -0.02%. Trade docket today: BITO, we are looking at taking assignment on this. Booking profits on COIN, DKNG, LYFT. This makes 10 for 10 this week on profitable earnings setups! 1HTE. I think we can get another one working today. SPX 0DTE and a late day NDX 0DTE. In our scalping room we have a big neutral position working on the /NQ. This position alone has more than enough profit potential to get us our $1,000/day profit goal. My lean or bias today is bullish. We started a bullish SPY zebra position yesterday in our ATM portfolio. We then added a covered call to it for cash flow. We are now building more buying power to add a ratio cover to it. Ultimately this will be a 29K trade that yields $1,200 a month in cash flow. Let's take a look at the market. Well, well, well. SPY and QQQ are banging on the door of their respective 200DMA. IWM is in a nice upward trend and DIA is almost back to a key consolidation zone. Technicals are hanging on to a bullish bias. Let's take a look at the intra-day levels /ES: Levels are not too much different from yesterday. 5712 and 5741 are resistance with 5672 and 5653 working as support. /NQ: Two key levels for me today. 20,337 is resistance. Above that the bulls are in charge. 20,116 is support. Below that the bears are running the show. BTC: Bitcoin is rocking again! We got one 1HTE on yesterday and have one working right now, as I type. 106,349 is resistance and 98,000 is support. Its a wide range today. I look forward to finishing the week strong with you all today. Trade smart. Follow our rules based approach. I'll see you all in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |