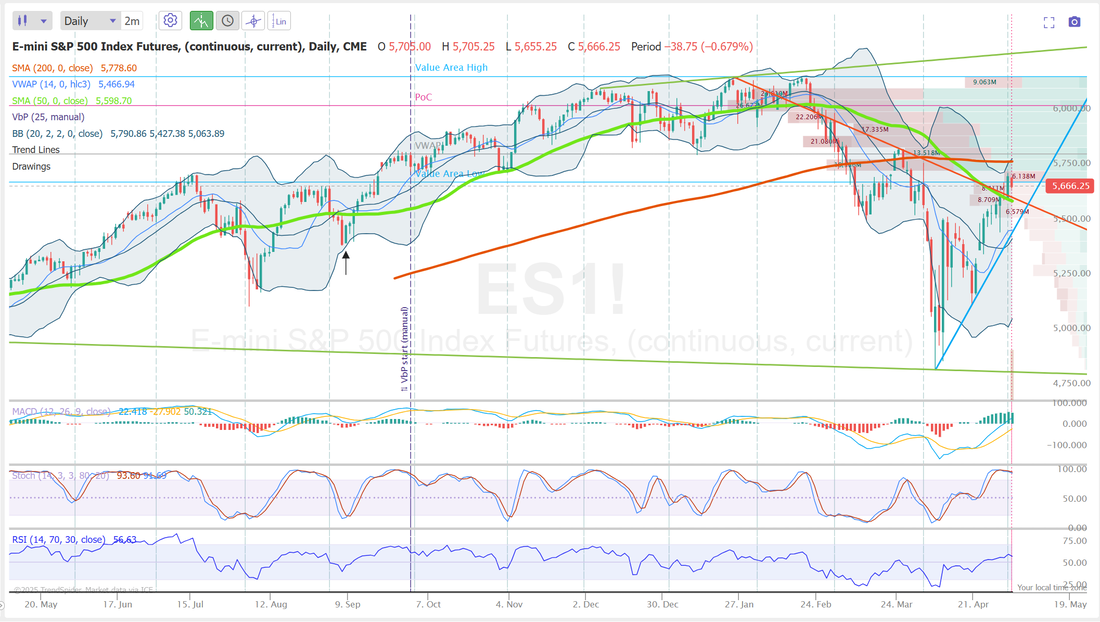

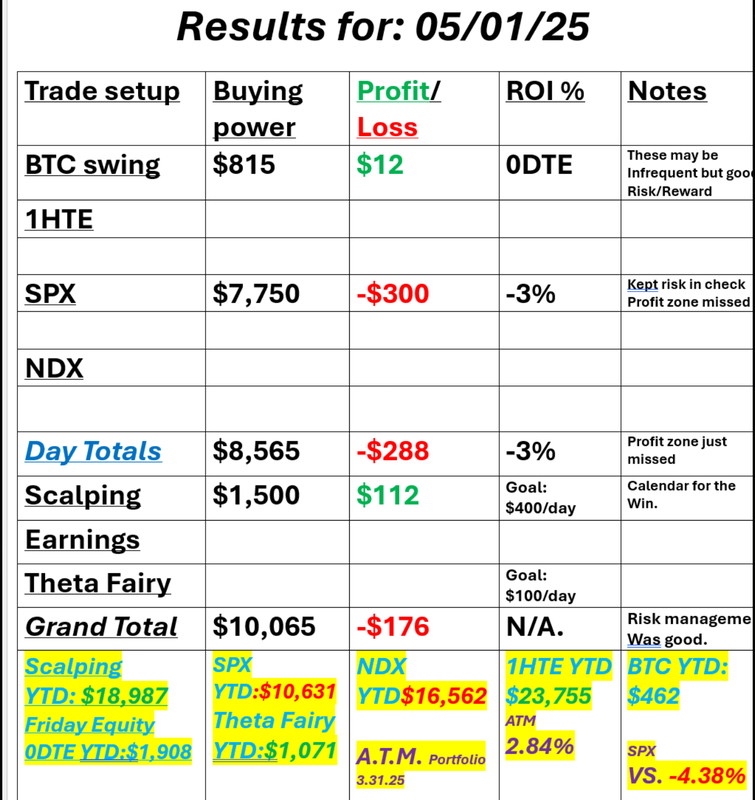

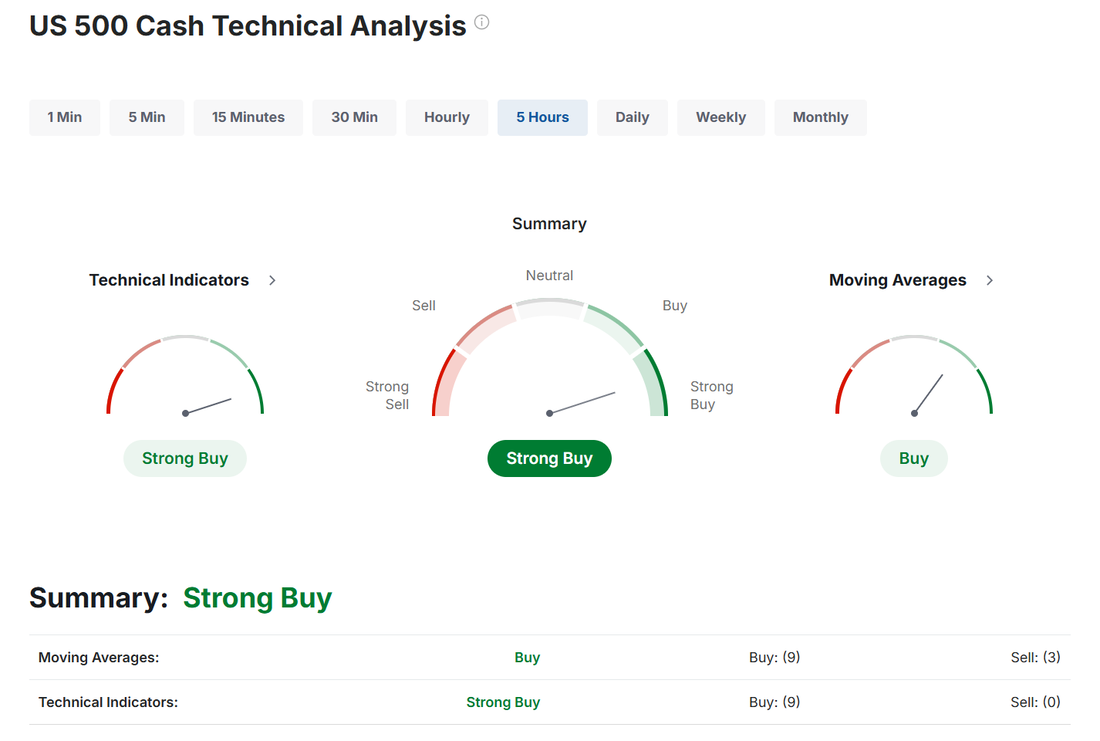

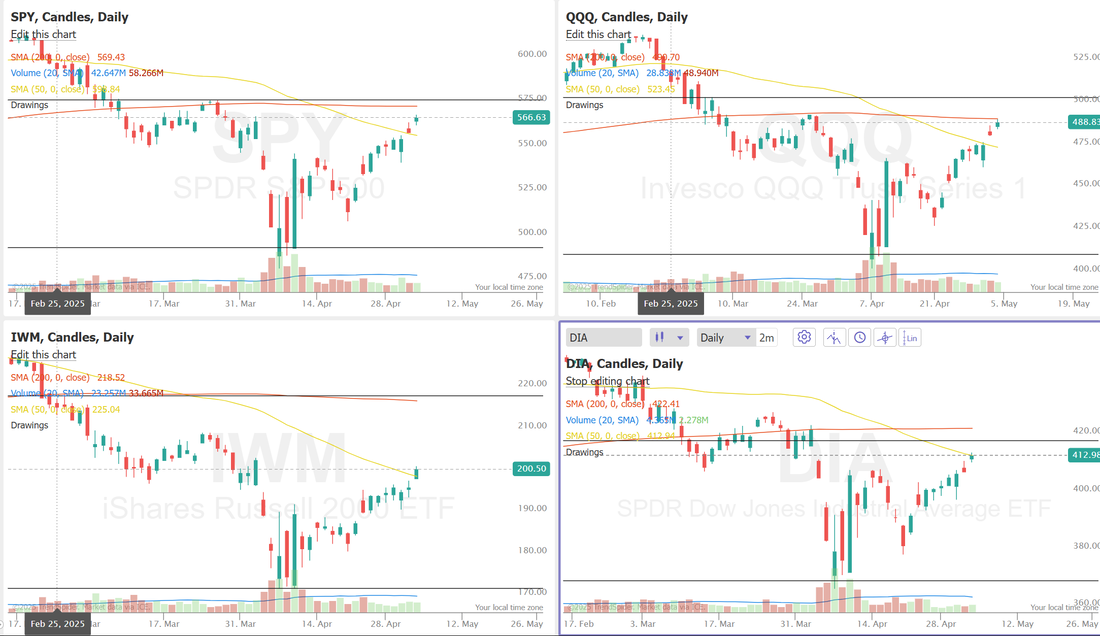

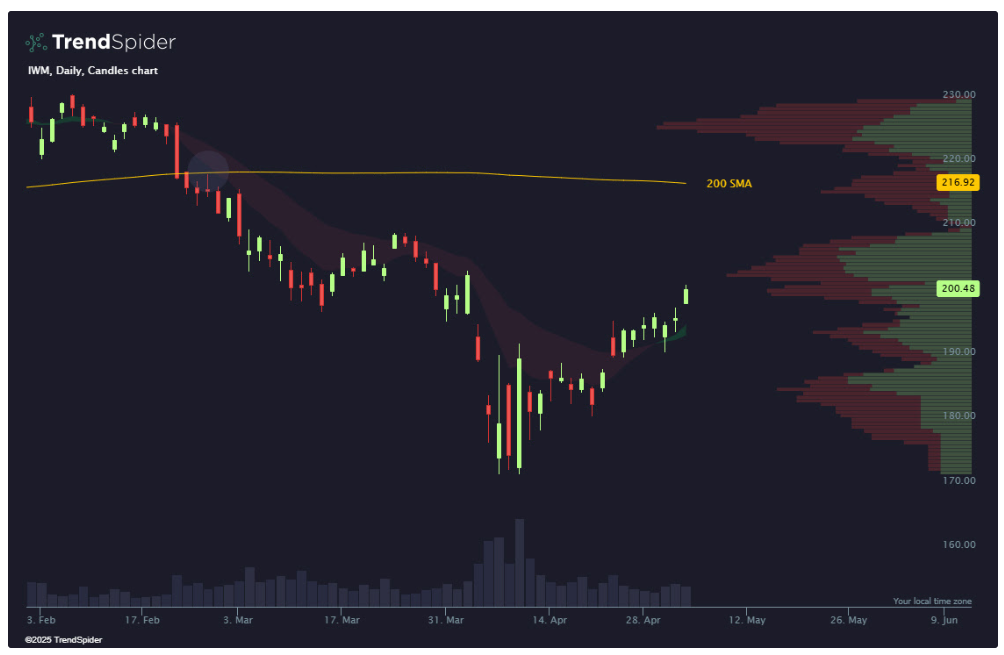

FOMC week= volatilityWelcome back traders. We get FOMC and Powell on Weds. this week. That should be the main news catalyst barring any Tariff news, which I'm sure will pop up at some inopportune time. The market is at a key level for me. I've been pointing this level out for some time to our ATM portfolio holders. It's not an easy call here. On the one hand, we've had one heck of a long rally with nine days straight up. On the other hand we are still in a death cross signal and while we've gotten back above the 50DMA we are still below the key 200DMA. Add to that, all our indicators appear to be very overstreched to the overbought zone. We are holding a lot of cash in the ATM program until Powell speaks. That should give us some directional help. Our day Friday was...O.K. Our SPX lost but we kept our risk low (below our $500 dollar goal) and the profit potential was huge...it just didn't hit for us. Scalping brought in a bit of income but our bearish puts from Friday should cash flow for us this morning with futures currently down. Let's take a look at the market: Futures are selling off this morning but not enough to change the technical outlook from bullish to bearish. The trend is surely up and bullish lately however, SPY and QQQ are now sitting below their respective 200DMA. This is a big line in the sand and with Powell speaking Weds. it could be a key area to watch. June S&P 500 E-Mini futures (ESM25) are down -0.75%, and June Nasdaq 100 E-Mini futures (NQM25) are down -1.02% this morning, pointing to a lower open on Wall Street as uncertainty about U.S. trade policy weighed on investors’ risk appetite. U.S. President Donald Trump on Sunday announced a 100% tariff on foreign-produced films imported into the U.S., tempering last week’s optimism about a potential easing of trade tensions. Also, President Trump stated that he had no plans to speak with his Chinese counterpart, Xi Jinping, this week, though he indicated that trade agreements with other unspecified partners could be announced as early as this week. This week, investors look ahead to the Federal Reserve’s interest rate decision as well as a fresh batch of U.S. economic data and corporate earnings reports. In Friday’s trading session, Wall Street’s major equity averages closed higher, with the S&P 500 and Nasdaq 100 notching 5-week highs and the Dow posting a 1-month high. DexCom (DXCM) surged over +16% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the medical devices maker reported better-than-expected Q1 revenue. Also, chip stocks rallied, with Arm Holdings (ARM) climbing more than +6% and ON Semiconductor (ON) gaining over +5%. In addition, Duolingo (DUOL) soared more than +21% after the mobile learning platform posted upbeat Q1 results and raised its full-year bookings guidance. On the bearish side, Apple (AAPL) fell over -3% and was the top percentage loser on the Dow after the iPhone maker reported weaker-than-expected revenue from Greater China in FQ2. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose 177K in April, stronger than expectations of 138K. Also, U.S. April average hourly earnings rose +0.2% m/m and +3.8% y/y, weaker than expectations of +0.3% m/m and +3.9% y/y. In addition, the U.S. unemployment rate was unchanged at 4.2% in April, in line with expectations. Finally, U.S. March factory orders rose +4.3% m/m, slightly weaker than expectations of +4.4% m/m. “A lot of people — based on Liberation Day and the events since — have forecast economic Armageddon, and every time economic Armageddon doesn’t happen, it’s good news. Maybe it’s just too early. A lot of the phenomenon that people fear haven’t really had time to sink into the data yet,” said Lawrence Creatura, a fund manager at PRSPCTV Capital LLC. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage this week. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%, despite recent pressure from President Trump to lower interest rates. Market watchers’ attention will be on any indications of whether rates might be lowered later this year to support the economy amid tariff-related pressures. The Fed is growing more concerned about economic growth and will likely “cut interest rates as soon as it can be reasonably sure that inflation is not spiraling out of control,” according to Commerzbank analysts. First-quarter corporate earnings season continues, and investors await new reports from notable companies this week, including Advanced Micro Devices (AMD), Arm (ARM), Palantir Technologies (PLTR), Arista Networks (ANET), Uber Tech (UBER), Ford (F), Walt Disney (DIS), Applovin (APP), DoorDash (DASH), and Shopify (SHOP). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. In addition, investors will continue to monitor economic data for signs of how tariffs and the uncertainty they create are affecting economic activity. This week’s noteworthy data releases include U.S. Unit Labor Costs (preliminary), Nonfarm Productivity (preliminary), Initial Jobless Claims, Wholesale Inventories, Exports, Imports, Trade Balance, and Consumer Credit. On Friday, the Fed’s blackout period ends, with Fed officials Williams, Kugler, Goolsbee, Waller, and Cook set to deliver remarks. Today, investors will focus on the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI, set to be released in a couple of hours. Economists forecast the April ISM services index to be 50.2 and the S&P Global services PMI to be 51.4, compared to the previous values of 50.8 and 54.4, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.324%, up +0.09%. We've got several earning setups we'll look to work this week with AMD, ARM, PLTR, UBER, DIS, DASH, SHOP. We'll focus today on 1HTE's , SPX 0DTE, NDX 0DTE, BITO, trades. SPY closed the week in the green at $566.76 (+2.94%), breaking above a key resistance zone at its year-to-date high-volume node, a level that was initially rejected on Thursday. Notably, the ETF triggered its first bullish 8/21 EMA cross since January, adding fuel to the upside momentum. The next major hurdle lies at the 200-day moving average, a key level that could determine whether trend-following traders decide to get back in the markets. Powered by strong tech earnings, QQQ ended the week on a high note at $488.83 (+3.67%). It closed right below its 200-day moving average, the same level it rejected in late March. A bullish 8/21 EMA cross at its year-to-date high-volume node adds further weight to the shift in momentum favoring the bulls. With macro headwinds like tariffs and weak growth unable to overpower strong tech earnings, traders are beginning to ask: has the bad news already been priced in? With all eyes on big tech last week, IWM quietly finished in the green at $200.48 (+3.28%). Still lagging behind its large-cap peers, the ETF sits 8% below its 200-day moving average. As it pushes toward the upper boundary of its March trading range, bulls face a key challenge: reclaiming this pivotal high-volume node and flipping resistance into support Let's look at the weekly expected moves and I.V. 1.75% for SPY and 2.06% for QQQ, it's down a bit from last week but still high enough we should get decent premium. SPY is still close enough to QQQ that our main 0DTE focus of the SPX should continue. My lean or bias today is bearish. Futures are down, as I type. Trump has said there may be trade deals signed this week but I don't think we see it today. Traders are going to be cautious coming into Powells testimony on Weds. I always look forward to FOMC week. It's generally been very good to us and we've got lots of good earnings setups as well. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |