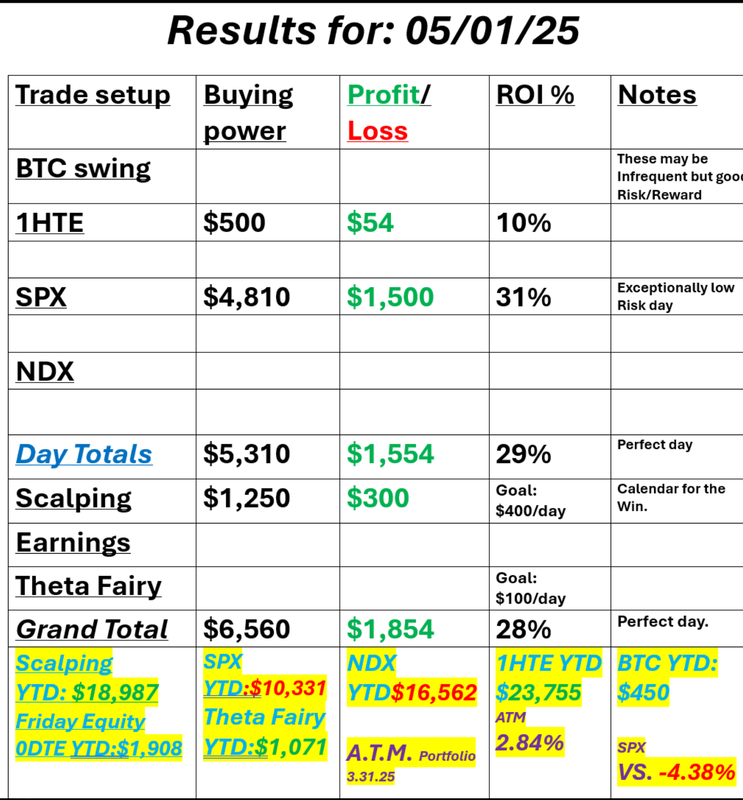

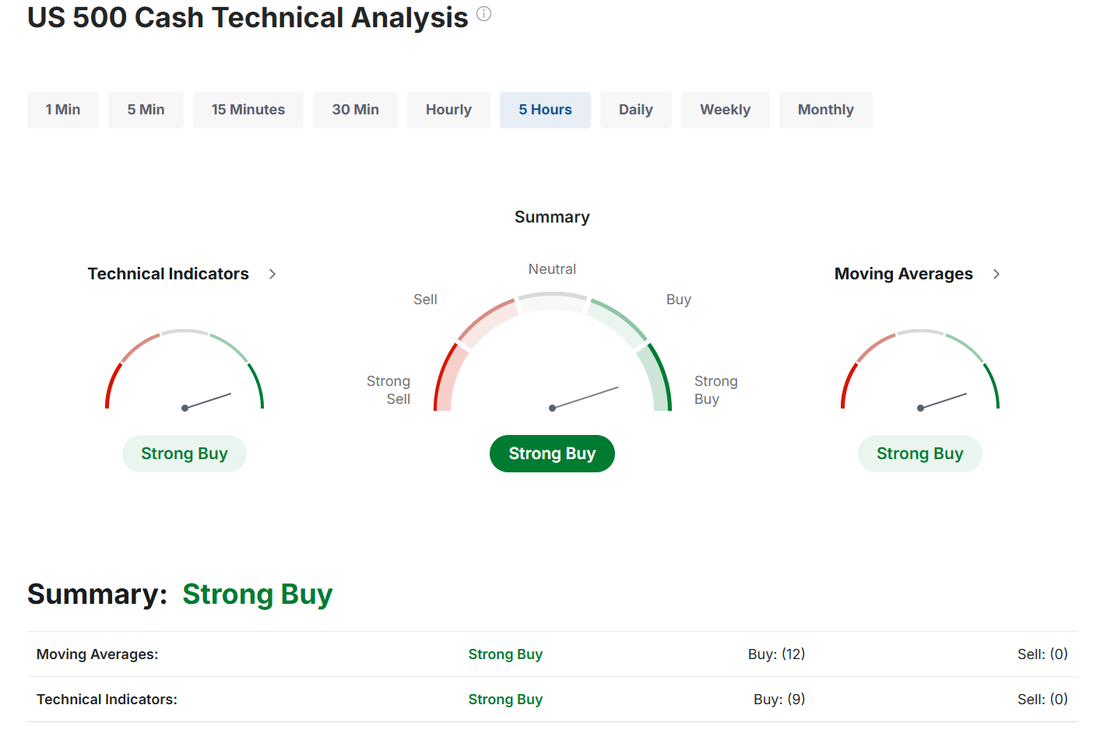

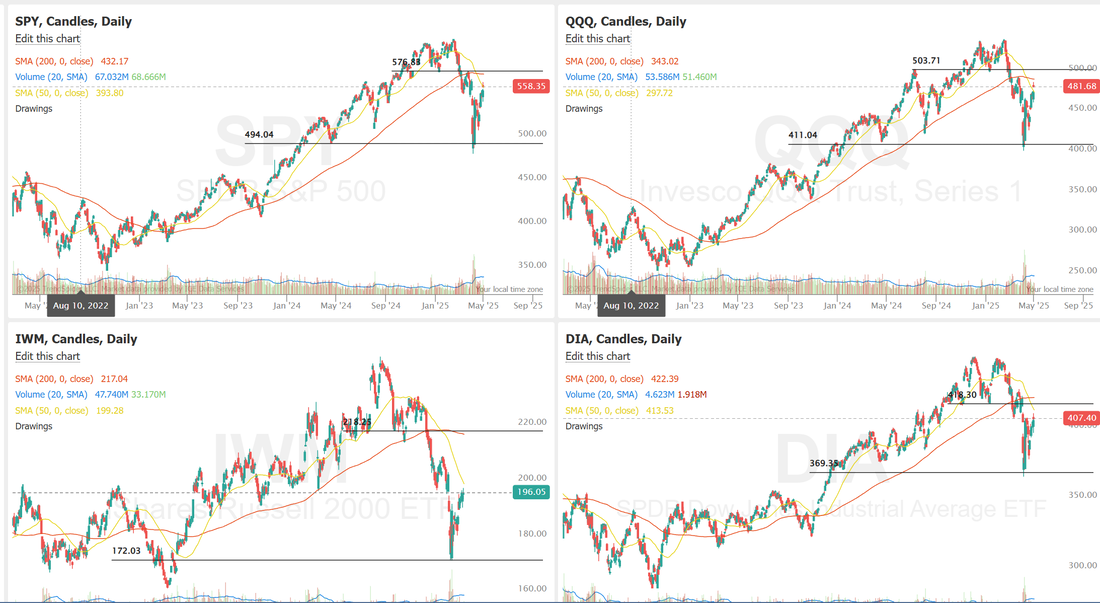

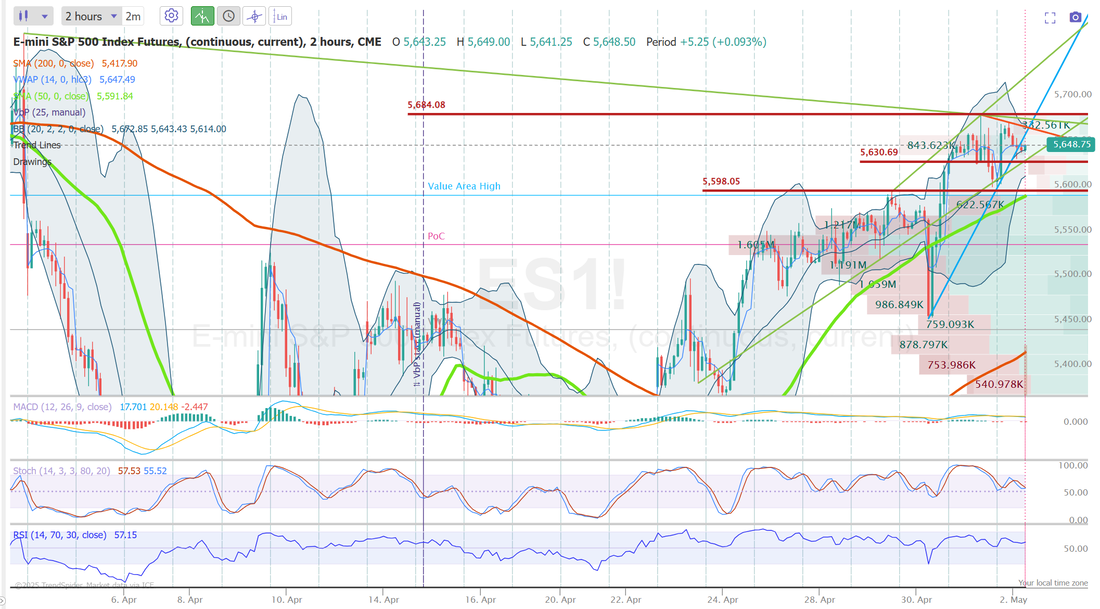

Markets still on edgeWeclome to Friday! Markets have had a nice bullish run to stave off what looked like an ugly bear market but, it still not healthy. Take a look at the close yesterday. We had an explosive out off strong META and MSFT earnings and then a 60 point sell off going into the close. This market is still jittery. Our day went almost perfectly for us. While we made more than our $1,000 per day profit goal it was really our risk management that I was most proud of. We never went above $240 risk all day. See our results below: Let's take a look at the markets. Technicals are still pointing bullish. The bull market stalled a bit yesterday with that late day sell off. My lean or bias today is neutral to bearish. We are working a bearish scalp on the QQQ. We took to view that AAPL and AMZN earnings would be a dissapointment and that looks to be the case. Futures are up, as I type but I'm looking for a flat to down day. June S&P 500 E-Mini futures (ESM25) are up +0.44%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.30% this morning as sentiment got a boost after China said it is assessing the possibility of trade talks with the U.S., with the focus now shifting to the key U.S. payrolls report. China’s Commerce Ministry stated on Friday that it had observed senior U.S. officials repeatedly voicing their readiness to engage with Beijing on tariffs, and called on Washington to demonstrate “sincerity” toward China. “The U.S. has recently sent messages to China through relevant parties, hoping to start talks with China. China is currently evaluating this,” the ministry added. However, disappointing earnings from Apple and Amazon limited gains in stock index futures. Apple (AAPL) fell over -2% in pre-market trading after the iPhone maker reported weaker-than-expected FQ2 sales in China. Also, Amazon.com (AMZN) slid more than -2% in pre-market trading after the world’s largest online retailer provided a below-consensus Q2 operating income forecast. In yesterday’s trading session, Wall Street’s major indices closed in the green, with the S&P 500 and Dow notching 4-week highs and the Nasdaq 100 posting a 5-week high. Microsoft (MSFT) surged over +7% and was the top percentage gainer on the Dow after the world’s largest software maker reported stronger-than-expected FQ3 results and provided an upbeat FQ4 revenue growth forecast for the Azure cloud unit. Also, Meta Platforms (META) climbed more than +4% after the maker of Facebook and Instagram posted upbeat Q1 results. In addition, Nvidia (NVDA) gained over +2% after Bloomberg reported that the U.S. was considering a possible relaxation of restrictions on the chipmaker’s sales to the United Arab Emirates. On the bearish side, Becton Dickinson & Co. (BDX) tumbled more than -18% and was the top percentage loser on the S&P 500 after cutting its annual adjusted EPS guidance. Also, Qualcomm (QCOM) slumped over -8% and was the top percentage loser on the Nasdaq 100 after the mobile chip designer provided a tepid FQ3 revenue forecast. Economic data released on Thursday showed that the U.S. ISM manufacturing index fell to a 5-month low of 48.7 in April, though it came in above expectations of 48.0. Also, U.S. March construction spending unexpectedly fell -0.5% m/m, weaker than expectations of +0.2% m/m and the largest decline in 6 months. In addition, the number of Americans filing for initial jobless claims in the past week rose +18K to a 2-month high of 241K, compared with the 224K expected. Meanwhile, U.S. rate futures have priced in a 93.2% probability of no rate change and a 6.8% chance of a 25 basis point rate cut at next week’s FOMC meeting. On the earnings front, notable companies like Exxon Mobil (XOM), Chevron (CVX), Cigna (CI), and Apollo Global Management (APO) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that April Nonfarm Payrolls will come in at 138K, compared to the March figure of 228K. U.S. Average Hourly Earnings data will also be closely watched today. Economists expect April figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.3% m/m and +3.8% y/y. U.S. Factory Orders data will be released today. Economists foresee this figure coming in at +4.4% m/m in March, compared to the previous number of +0.6% m/m. The U.S. Unemployment Rate will be reported today as well. Economists forecast that this figure will remain steady at 4.2% in April. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.202%, down -0.69%. NFP will be the main (planned) news catalyst today. We carried over our bearish QQQ scalp from yesterday. That has a lot of potential today if we choose to turn it back into a calendar spread. BTC doesn't have enough movement today to look at the 1HTE's. I'll focus our effort on SPX 0DTE and look for a late day entry to an NDX 0DTE. Let's take a look at /ES: I'm watching the 5684 resistance level. Above that I'm bullish. 5630 is first support. Below that comes 5598. Below that I'm bearish. We had a great day yesterday of solid risk management. Let's focus on that again today. See you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |