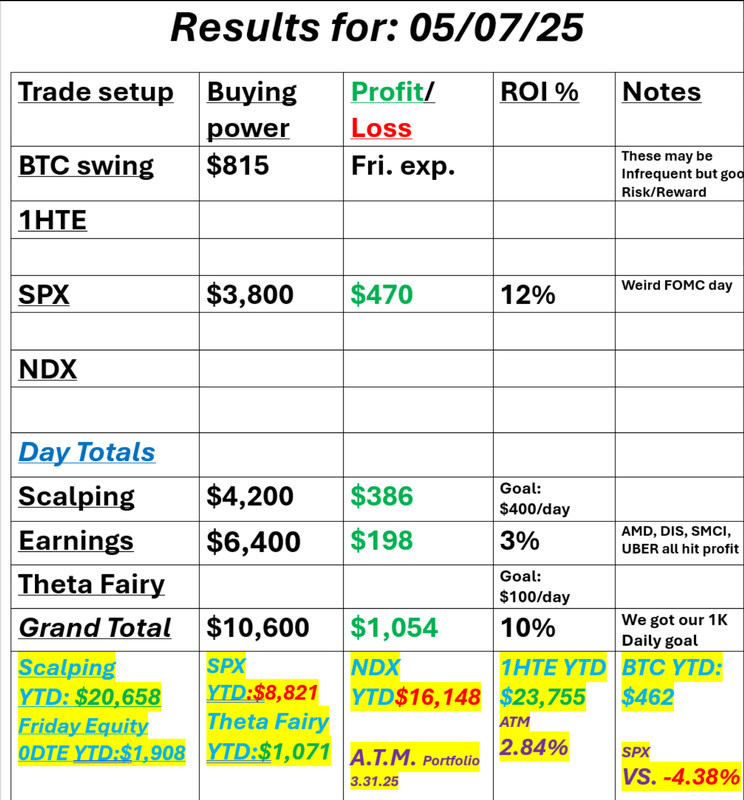

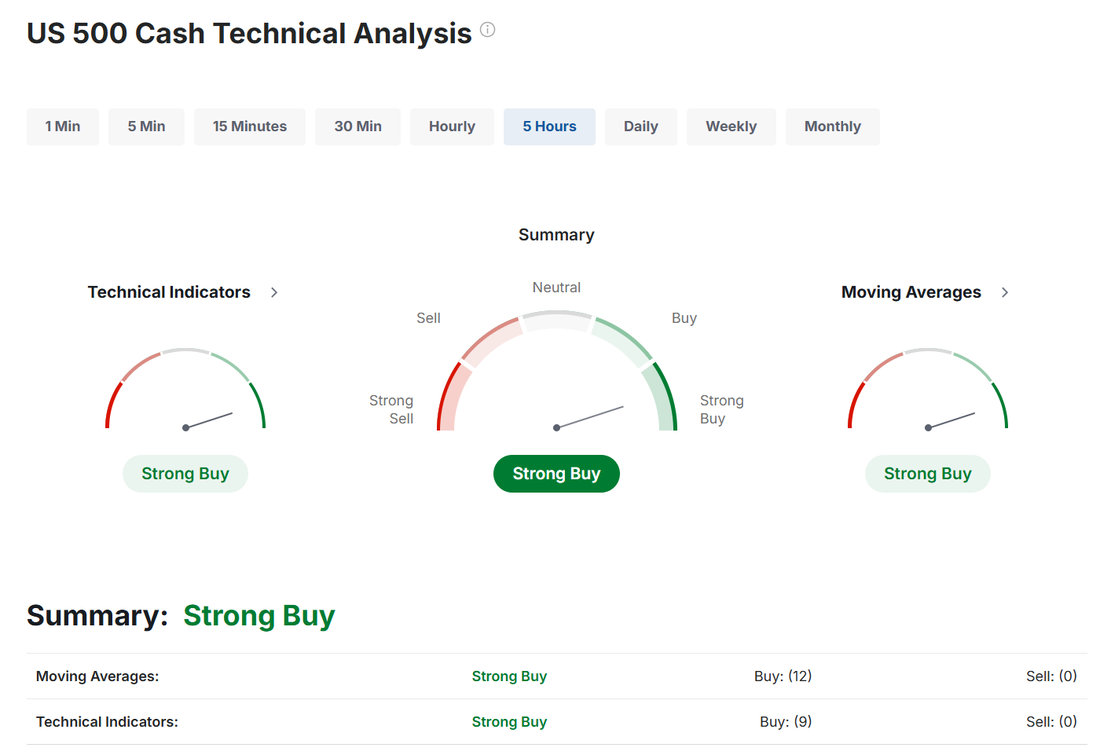

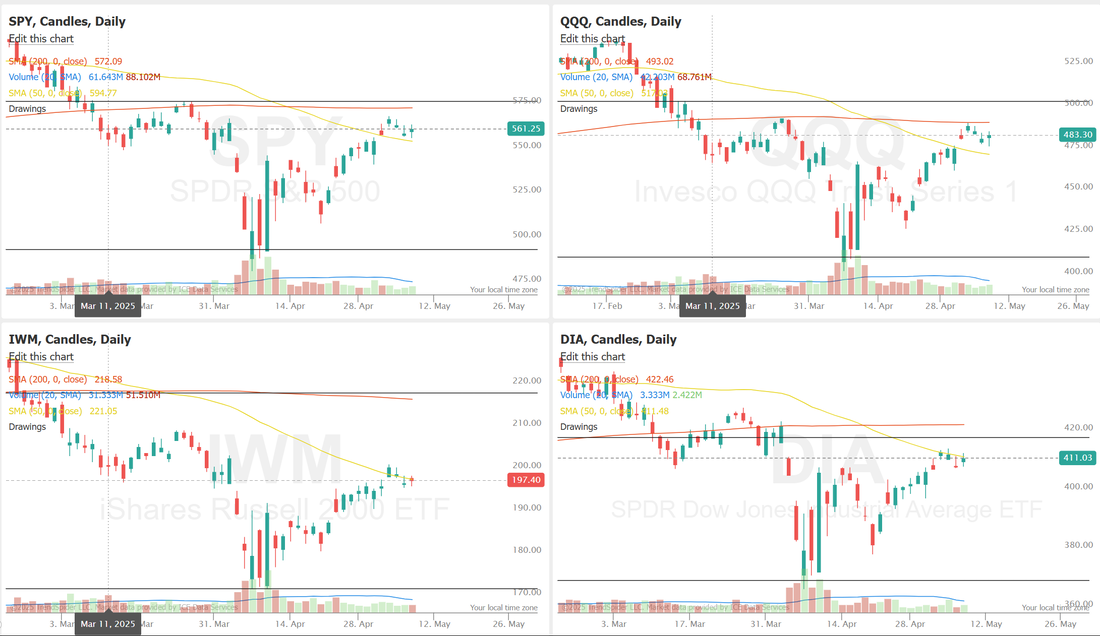

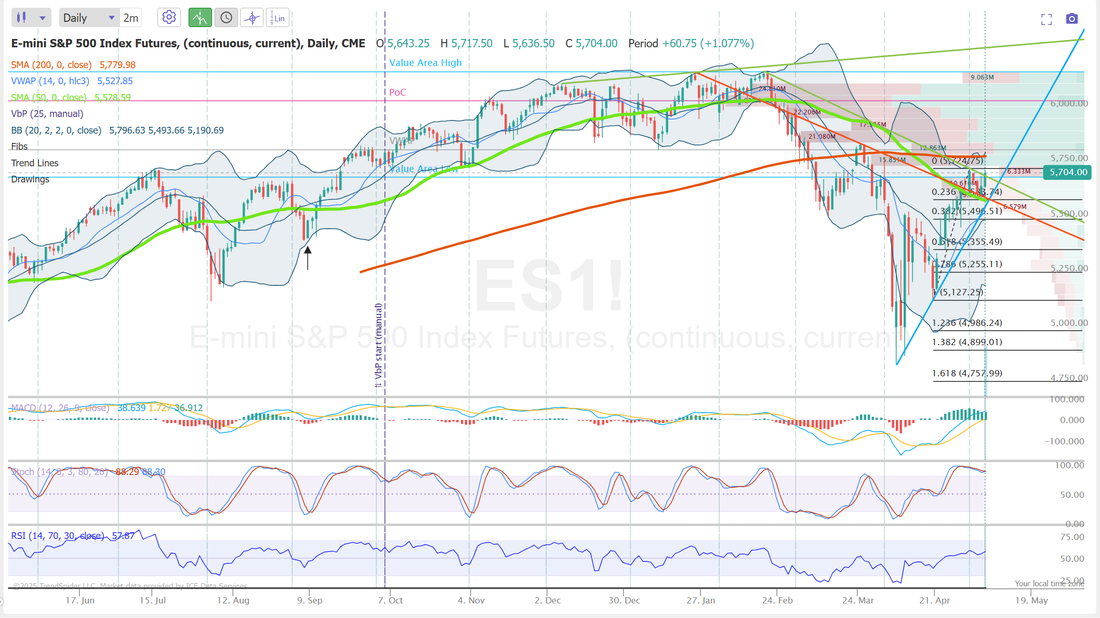

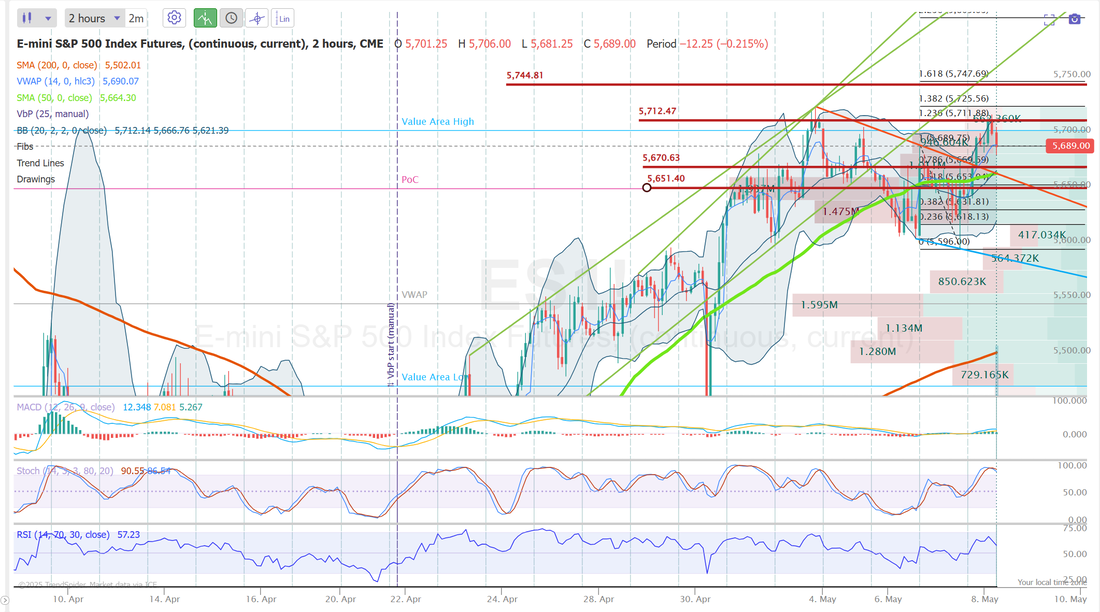

Trade deals coming?They say every dog has it's day. The Tariffs have knocked the market down but now here are starting to see some deals getting closer. Trump's talk of the first deal getting done with the UK has spiked the futures this morning. Are we out of the woods? Too early to tell, I think. We are adding a bullish zebra setup to our ATM portfolio this morning. FOMC has come and gone. It was a strange one, price action wise. Not as much movement as I thought we'd get and while we finished pretty flat on the day, I took it as bullish. Powell didn't sound like he had any answers other than "we just don't know" and "we'll need to be patient and see". Generally you'd see that tank the markets. I called it yesterday at the close that even though the market didn't shoot up, I thought it was bullish. We had a good day yesterday, however muted it was. Here's a look at my day. We got our $1,000 dollar profit goal...just barely. We've got a bullish scalp going this morning with /MNQ long and call options with an /NQ cover. We also have ARM, CVNA, DASH, SHOP earnings plays that should print profits for us at the open. Let's take a look at this "new" market. We start the dayf with a slight bullish buy signal. The indices are certainly trying to clear some key hurdles to the upside. They've all cleared their 50DMA. The next big hurdle? The 200DMA. June S&P 500 E-Mini futures (ESM25) are up +1.06%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.35% this morning as sentiment got a boost after U.S. President Donald Trump said the U.S. has reached a trade agreement with the U.K. In a Truth Social post on Wednesday night, President Trump announced plans to unveil a “major” trade deal on Thursday, without disclosing the name of the country. Bloomberg reported that the administration is likely to announce a deal with the United Kingdom. On Thursday morning, Mr. Trump confirmed in a post on his social media platform that the deal was indeed with the U.K. “The agreement with the United Kingdom is a full and comprehensive one that will cement the relationship between the United States and the United Kingdom for many years to come,” Trump wrote in a post. Futures linked to the tech-heavy Nasdaq 100 outperformed as chip stocks climbed in pre-market trading after the Commerce Department said it doesn’t intend to implement the AI Diffusion rule. Nvidia (NVDA), Broadcom (AVGO), and Micron Technology (MU) are up more than +1%. As widely anticipated, the Federal Reserve held interest rates steady yesterday. The Federal Open Market Committee voted unanimously to keep the federal funds rate in a range of 4.25%-4.50% for the third consecutive meeting. In a post-meeting statement, officials said that “uncertainty about the economic outlook has increased further,” adding that “the risks of higher unemployment and higher inflation have risen.” At a press conference, Fed Chair Jerome Powell stated that policymakers are in no rush to adjust interest rates, noting that tariffs could lead to higher inflation and unemployment. “The effects on inflation could be short-lived, reflecting a one-time shift in the price level,” he said, while warning that it’s “also possible that the inflationary effects could instead be more persistent.” “The Fed is content to stand pat until there is economic data that compels them to change interest rates. With inflation already elevated and expected to move higher, it will take evidence of a material downturn in the job market before the Fed resumes cutting interest rates,” said Greg McBride at Bankrate. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Charles River Laboratories (CRL) surged over +18% and was the top percentage gainer on the S&P 500 after the drug development contractor raised its full-year adjusted EPS guidance and announced a strategic review of its business. Also, chip stocks gained ground after Bloomberg reported that the Trump administration plans to rescind Biden-era AI chip curbs, with Nvidia (NVDA) and Qualcomm (QCOM) rising more than +3%. In addition, Walt Disney (DIS) climbed over +10% and was the top percentage gainer on the Dow after the media and entertainment conglomerate posted upbeat FQ2 results and lifted its full-year adjusted EPS guidance. On the bearish side, Alphabet (GOOGL) slumped more than -7% and was the top percentage loser on the S&P 500 after Bloomberg reported that Apple is “actively looking” at reshaping the Safari browser on its devices to focus on AI-powered search engines amid the potential breakdown of its deal with Google. Economic data released on Wednesday showed that U.S. March consumer credit rose by $10.17B, stronger than expectations of $9.80B. Meanwhile, U.S. rate futures have priced in a 79.8% probability of no rate change and a 20.2% chance of a 25 basis point rate cut at the next central bank meeting in June. First-quarter corporate earnings season continues, with market participants anticipating fresh reports from prominent companies today, including Shopify (SHOP), ConocoPhillips (COP), Monster Beverage (MNST), Coinbase Global (COIN), and Kenvue (KVUE). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 231K, compared to last week’s number of 241K. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q1 Unit Labor Costs to be +5.3% q/q and Nonfarm Productivity to be -0.4% q/q, compared to the fourth-quarter numbers of +2.2% q/q and +1.5% q/q, respectively. U.S. Wholesale Inventories data will be released today as well. Economists expect the final March figure to be +0.5% m/m, compared to +0.3% m/m in February. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.299%, up +0.56%. The trade docket for today continues with earnings setups. COIN, DKNG, AKAM, LYFT, YELP, AFMN, MARA are all possibilities. We will continue to work our bullish /MNQ scalp. SPX 0DTE and I think we can get a few 1HTE's working today. My bias or lean today is bullish. The UK announcement obviously helps but the price action yesterday off Powells less than impressive testimony is what really turned my bullish. Futures are already up 52+ points on /ES so I'm not sure how much upside it has for today but it certainly all looks like we are set for an up day. Let's look at the intra-day levels that I'll be watching today. Looking at the daily chart it's a very confusing set of signals. Sure...it's been a nice bullish move off the bottoms with that impressive 9 day bullish run. Yes, we are above the 50DMA but... and These are some big "buts". That 200DMA looms large. Add to that, the fact that all our indicators seem to be flashing "over bought" and look to be rolling over with sell signals. I think today may be bullish as in, we finish in the green but mostly getting a retrace off the big futures move this morning. Futures just took a bit of a hit with the announcement that 10% tariff will stay in place with US-UK deal. Looking at a 2hr. chart we have a couple key levels. 5712 is a key resistance. Above that we could get some good upside to 5744. 5370 is also a key support. Below that we start to run into the 50DMA and if we lose that we could easily see 5651. It should be another interesting day in the markets. It's not boring right now, that's for sure.

I'll see you all in the trading room shortly! Let's make it a great day!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |