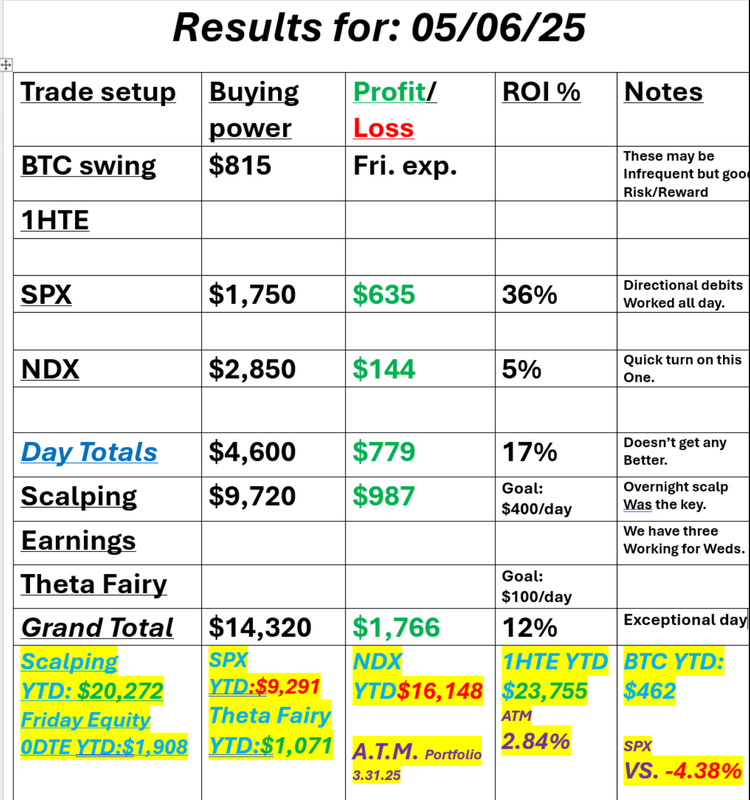

FOMC dayToday is the infamous FOMC day. We'll get the FED minutes from the recent meeting and most important, Powell will speak. It's his speech and the algos that trigger off of key words that he may or may not say that make today tricky. A lot of very good traders, that I respect, simply take today off. We love it and embrace it. We have an approach that usually works well for us. We started last night with an /NQ scalp that we'll likely cash flow all the way up to the minutes release. Once the cash markets open we'll start an SPX 0DTE that's rich in theta erosion and low risk. We take that off before the news catalyst and then we put another on once Powell starts speaking. Our day yesterday was amazing. Everything, and I mean everything we touched turned to gold. We played mostly directional setups in SPX which all worked. We doubled our money in a butterfly late in the day. Scalping brought in almost $1,000 in profit. We've got three earnings trades from yesterday which look to all be profitable this morning. We are in a really nice sweet spot right now in the market. I.V. (and premiums) are still elevated but the market price action is not as unpredictable as it has been. It's not back to "normal" by any means but it's tradable. This times (great premium/predictable moves) don't last. Enjoy it while we have it. Here's a look at our results from yesterday. I would also be remiss if I didn't mention our passive, asset allocation portfolio, The A.T.M. program. 2022 was our last bearish year and it was a banner year for us. This year looks even better! It was very gratifying yesterday to see our portfolio rise by 3.5% while the markets were tanking. The legendary investor, Paul Tudor Jones who, by the way, has an impressive track record of calling down markets said yesterday that the market will continue to push to "new lows". Who knows what the future holds but I do feel strongly that if you have a retirement fund or any portfolio that only has longs (can only make money if the market goes up) you are exposing yourself to a tremendous risk. Why put money in a place that only works in one direction? Our ATM portfolio can be a safe haven. Check it out. une S&P 500 E-Mini futures (ESM25) are up +0.58%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.64% this morning as optimism around U.S.-China trade talks boosted sentiment. U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer will head to Switzerland on Thursday for trade negotiations with China, led by Vice Premier He Lifeng, fueling optimism that tensions between the world’s two largest economies may be easing. The trip was disclosed in statements issued Tuesday by both the Chinese and U.S. governments. It will mark the first confirmed trade talks between the nations since U.S. President Donald Trump imposed steep tariffs of 145% on China, which were met with retaliatory duties of 125% from Beijing. Investor focus is now on the Federal Reserve’s policy decision and Chair Jerome Powell’s comments. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the red. Moderna (MRNA) plunged over -12% and was the top percentage loser on the S&P 500 after the U.S. FDA appointed Vinay Prasad, a prominent critic of the drug industry and COVID-19 boosters, to lead the agency’s vaccine regulation division. Also, Palantir Technologies (PLTR) tumbled more than -12% and was the top percentage loser on the Nasdaq 100 after the data analytics company’s Q1 results fell short of investors’ loftiest expectations. In addition, Vertex Pharmaceuticals (VRTX) slumped over -10% after the drugmaker reported weaker-than-expected Q1 results. On the bullish side, Upwork (UPWK) soared more than +18% after the platform for freelancers posted upbeat Q1 results. Economic data released on Tuesday showed that the U.S. trade deficit was a record -$140.50B in March, wider than expectations of -$136.80B. “You have Trump, who’s locked in on tariffs; you have the Fed, who’s locked in on not cutting rates. That’s not good for the stock market,” said Paul Tudor Jones, founder of macro hedge fund Tudor Investment Corp. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. The Federal Open Market Committee is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%, despite recent pressure from President Trump to cut interest rates. Market watchers will closely follow Chair Jerome Powell’s post-policy meeting press conference for clues on the path ahead. However, economists stated that Powell is unlikely to provide specific details about the policy-setting FOMC’s plans. “We expect the main message from Chair Powell’s press conference to be that the Committee is well-positioned to wait for greater clarity before making any changes to policy,” said Michael Feroli, J.P. Morgan’s chief U.S. economist. First-quarter corporate earnings season rolls on, and investors await new reports from high-profile companies today, including The Walt Disney Company (DIS), Uber Technologies (UBER), Arm Holdings (ARM), MercadoLibre (MELI), Applovin (APP), and Fortinet (FTNT). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on U.S. Consumer Credit data, which is set to be released later today. Economists, on average, forecast that March Consumer Credit will stand at $9.80B, compared to the previous figure of -$0.81B. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.700M, compared to last week’s value of -2.696M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.329%, up +0.25%. Today is FOMC day. It's a unique day for us. It's not a day that we look at levels or technicals. This will largely be an Algo driven day. Our plan is to start a large theta trade last night with the expectation that we get little movement as traders await the Fed. We started that last night in our scalping room and that trade looks to cash flow for us right out of the gate this morning. We then move to a very asymmetric, "high theta" low risk, high reward trade that we will take off before FOMC minutes release. We then sit patiently, waiting for Powell to speak. Usually somewhere in the first 10-20 minutes of his speech the Algos will catch something he says and the high frequency computer trading will kick off and move the market. Many times the first move is a head fake. The next move is where we pounce. Today is a lot of sitting around waiting for Powell. It take a stoic trader to trade today. Our daily income goal remains the same. Come trade with us and see if you can put some profits in your pocket today. Trade docket today: We've got our overnight scalp on /NQ that we'll need to book our profit on. We also have AMD, UBER, DIS, SMCI earnings trades to close. They all look profitable, pre-market. We've got new earnings setups in ARM, DASH and SHOP and CVNA. We'll work QQQ scalps later in the day after Powell starts speaking and We'll focus primarily on SPX today for 0DTE with a small chance of a dip into the NDX near the close. I'll see you all in the live trading room shortly! I have absolutely no question that we'll have the opportunity in todays market to put $1,000+ in our pockets. It's just up to us, as traders to make the right choices and make it happen.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |