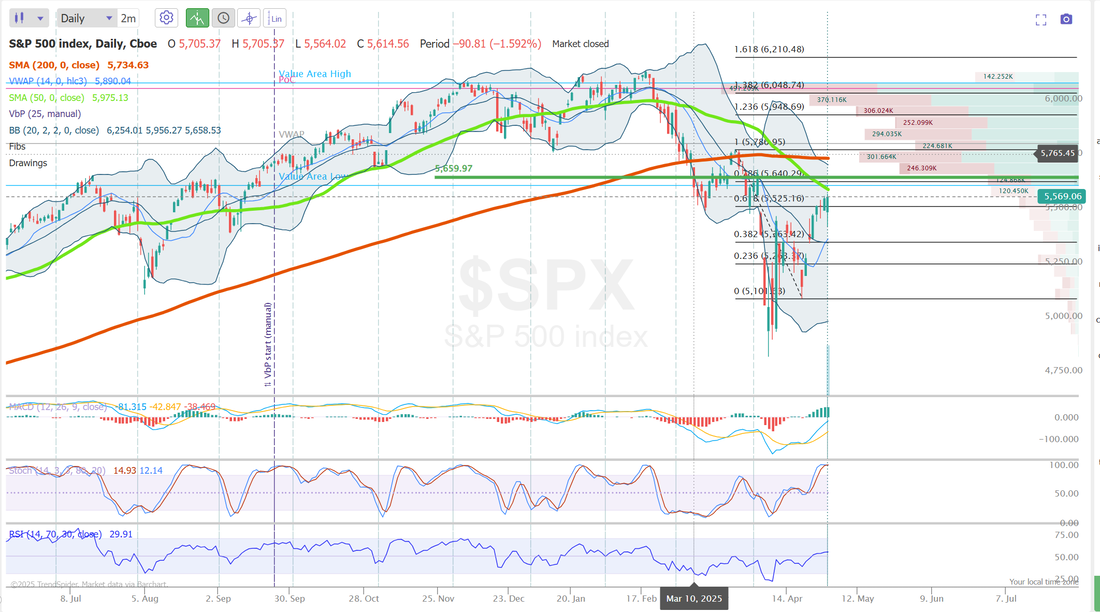

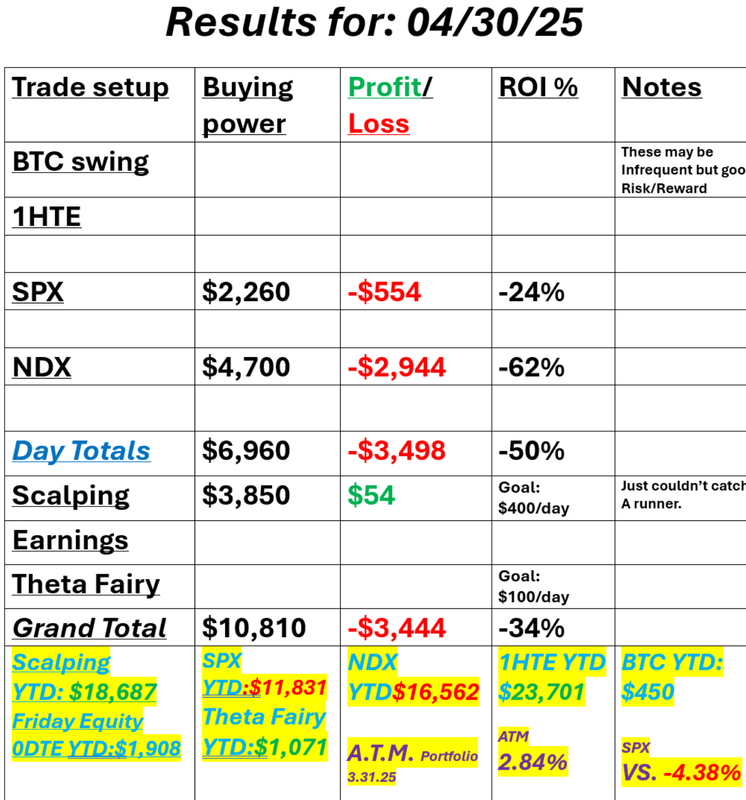

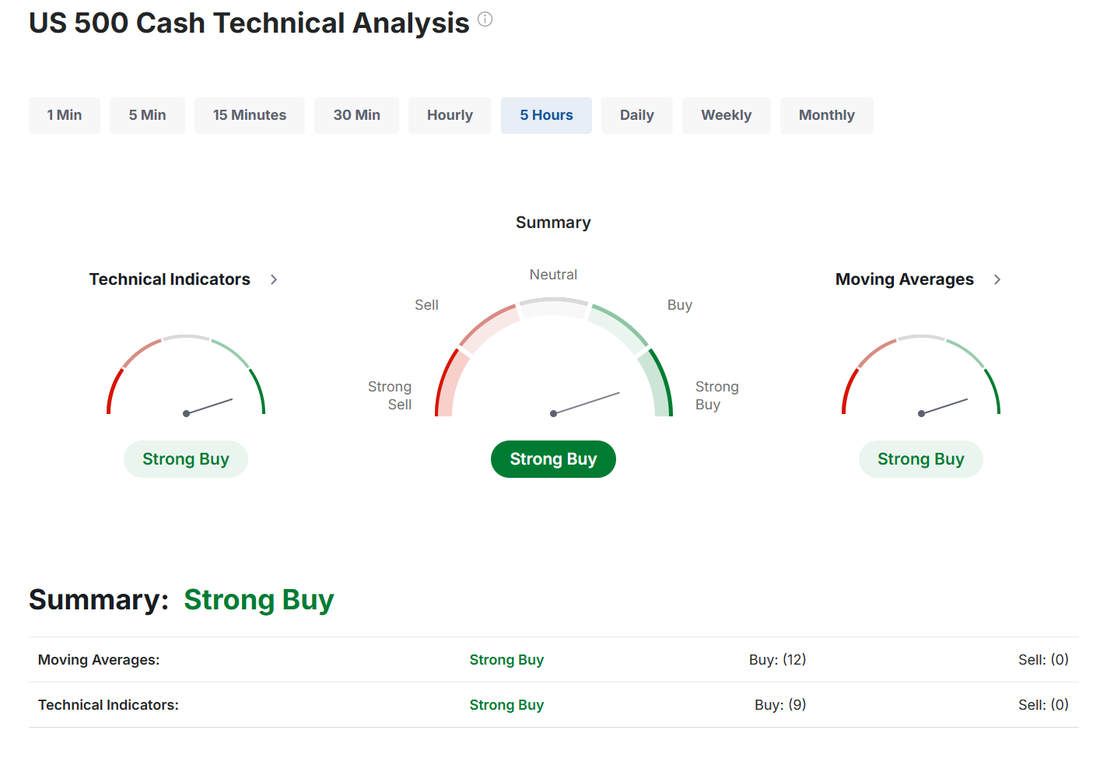

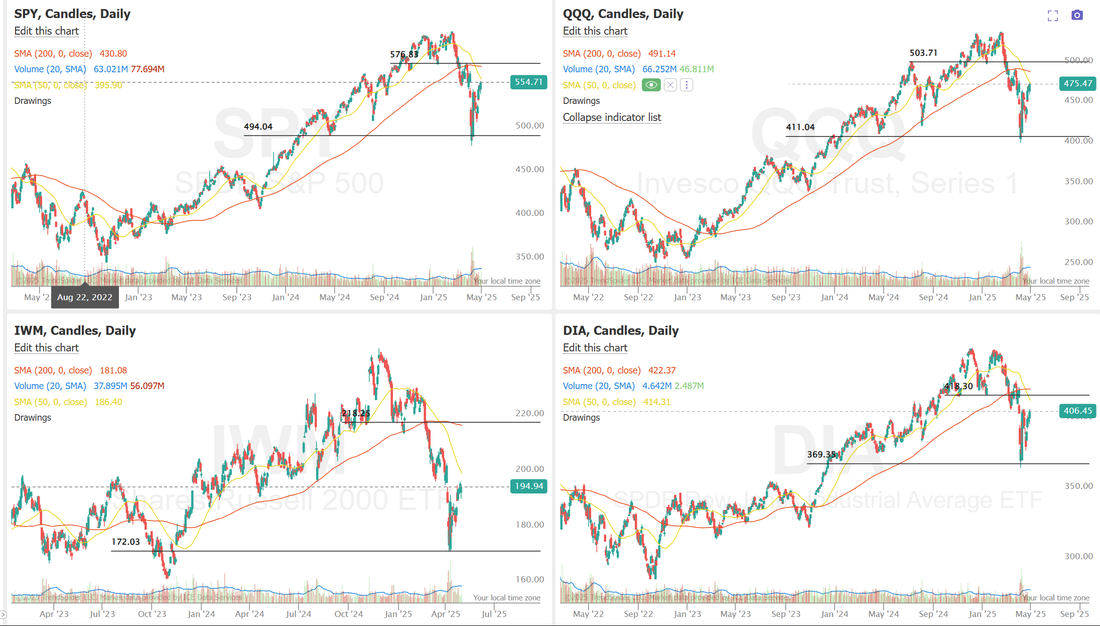

Recession = Rally?The market kicked off the morning yesterday with a swoon to the downside as GDP came in negative. Two consecutive quarters of negative numbers and you know what that means. The talk of recession is getting real however, later in the day the soft numbers (vs. the hard numbers) showed that a lot of imports were being front run to avoid tariffs and the market shrugged it all off to finish in a major blast higher. META and MSFT earnings post market looked solid and that's pushed the futures up even more this morning. So which is it? I think it's still too early to tell but the bulls are making their case right now. 5650 is the next upward target on SPX and then the big one...the 200DMA. The bulls seem ready to run today. We has AAPL and AMZN earning after the bell. I suspect they may not be as rosy as META and MSFT were but we will see. My day yesterday was a losing day for me. I kept my risk in line with SPX but the NDX trade blew up as the market surged at the end of the day. The solution for 0DTE's is pretty simple and I know it. We've talked about it over and over. Win, lose or draw...just close it out before the power hour. That's when all the crazyness happens. We know that. It's not a surprise. The irony of it all was that we were in the middle of a training on how important it is to take losses early! That irony is not lost on me. I'll work to be more focused on sticking to our rules. Here's a look at my day yesterday: We are starting a new month. Let's look at the markets: Technicals are firmly bullish. The indices are all pushing higher now. This certainly appears more than just a snap back rally. Does it have the legs to breach the next resistance level? We may know that as early as today. My lean or bias today is bullish. This is a market that, while still jittery, wants to go higher. Trade docket for today: We may be able to get some 1HTE's today . I'll focus on the SPX 0DTE along with AAPL and AMZN earnings. Scalping will start with a QQQ focus. June S&P 500 E-Mini futures (ESM25) are up +1.18%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.68% this morning as forecast-beating quarterly results from Microsoft and Meta boosted sentiment. Microsoft (MSFT) surged over +8% in pre-market trading after the world’s largest software maker reported stronger-than-expected FQ3 results and provided an upbeat FQ4 revenue growth forecast for the Azure cloud unit. Also, Meta Platforms (META) climbed more than +6% in pre-market trading after the maker of Facebook and Instagram posted upbeat Q1 results. Also lifting sentiment were signs that the Trump administration could be nearing an announcement of the first round of trade deals to lower planned tariffs. On Wednesday, U.S. President Donald Trump’s trade representative stated that the nation was close to announcing a first tranche of trade agreements under which the White House would reduce planned tariffs on its trading partners. Investors now await a new round of U.S. economic data and earnings reports from “Magnificent Seven” companies Apple and Amazon. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Seagate Technology (STX) surged over +11% and was the top percentage gainer on the S&P 500 after the data storage company posted upbeat FQ3 results. Also, Western Digital (WDC) climbed more than +7% after the company issued solid FQ4 guidance. In addition, Booking Holdings (BKNG) rose over +3% after reporting better-than-expected Q1 results. On the bearish side, Super Micro Computer (SMCI) plunged more than -11% and was the top percentage loser on the S&P 500 after the artificial intelligence server maker reported weaker-than-expected preliminary FQ3 results. Economic data released on Wednesday reinforced concerns about an economic slowdown. The U.S. Bureau of Economic Analysis’ advance estimate showed that the economy contracted at a 0.3% annualized pace in the first quarter, weaker than expectations of +0.2% q/q and the steepest pace of contraction in 3 years. Also, the U.S. ADP employment change rose by 62K in April, weaker than expectations of 114K and the smallest increase in 9 months. At the same time, the U.S. core PCE price index, a key inflation gauge monitored by the Fed, came in at unchanged m/m and +2.6% y/y in March, compared to expectations of +0.1% m/m and +2.6% y/y. “Weak data could hasten Fed cuts. The Fed is now more likely to step in sooner with its rate cuts to support an ailing economy, while the weakness in data could also encourage Trump to ease off on tariffs and make deals, quicker,” said Fawad Razaqzada at City Index and Forex.com. Meanwhile, U.S. rate futures have priced in a 95.0% chance of no rate change and a 5.0% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting next week. First-quarter corporate earnings season continues in full swing, and market participants await reports today from high-profile companies such as Apple (AAPL), Amazon (AMZN), Eli Lilly (LLY), Mastercard (MA), McDonald’s (MCD), Amgen (AMGN), and CVS Health Corp. (CVS). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, all eyes are focused on the U.S. ISM Manufacturing PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the April ISM manufacturing PMI will be 48.0, compared to the March figure of 49.0. Investors will also focus on the U.S. S&P Global Manufacturing PMI, which stood at 50.2 in March. Economists expect the final April figure to be 50.5. U.S. Construction Spending data will be reported today. Economists foresee this figure coming in at +0.2% m/m in March, compared to +0.7% m/m in February. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 224K, compared to last week’s number of 222K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.143%, down -0.77%. Let's look at the intra-day levels: On the daily chart, this has been a very strong bull run. 5680 is the next fib level and the comes the 200DMA. We are hovering around the 50DMA now. These are all potential resistance areas. On the 2hr. chart we are looking a bit overstretched to the upside. This 5680-5684 level is the first real resistance area. Above that is all blue sky and we could push to 5772. Support is 5630 and then 5598. These are the levels I'll be focusing on today. BTC: Bitcoin is getting some more movement now. It's still a tight range. 97,289 seems to be solid resistance with 95,781 working as support. I'll see you all in the trading rooms shortly. Let's get an early start and and early exit today on our 0DTE so we can just grab some popcorn and watch the PH on the sidelines!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |