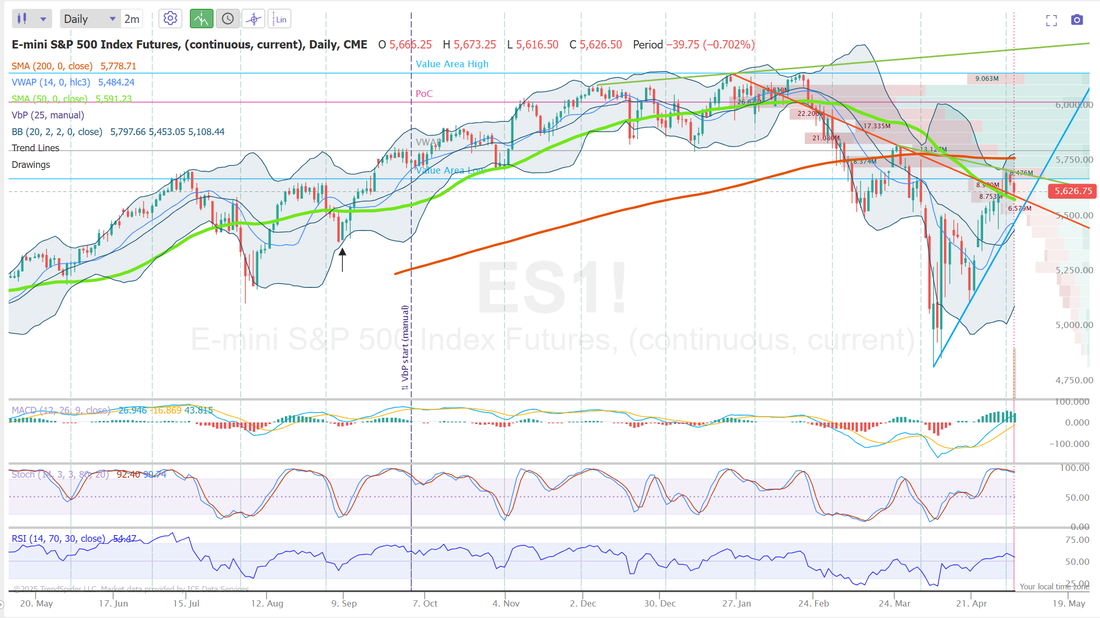

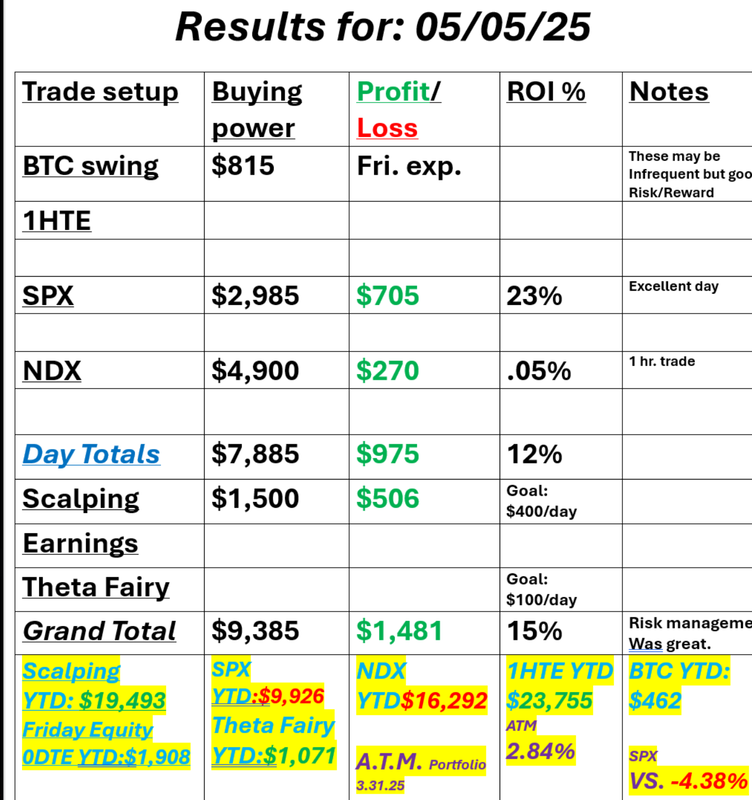

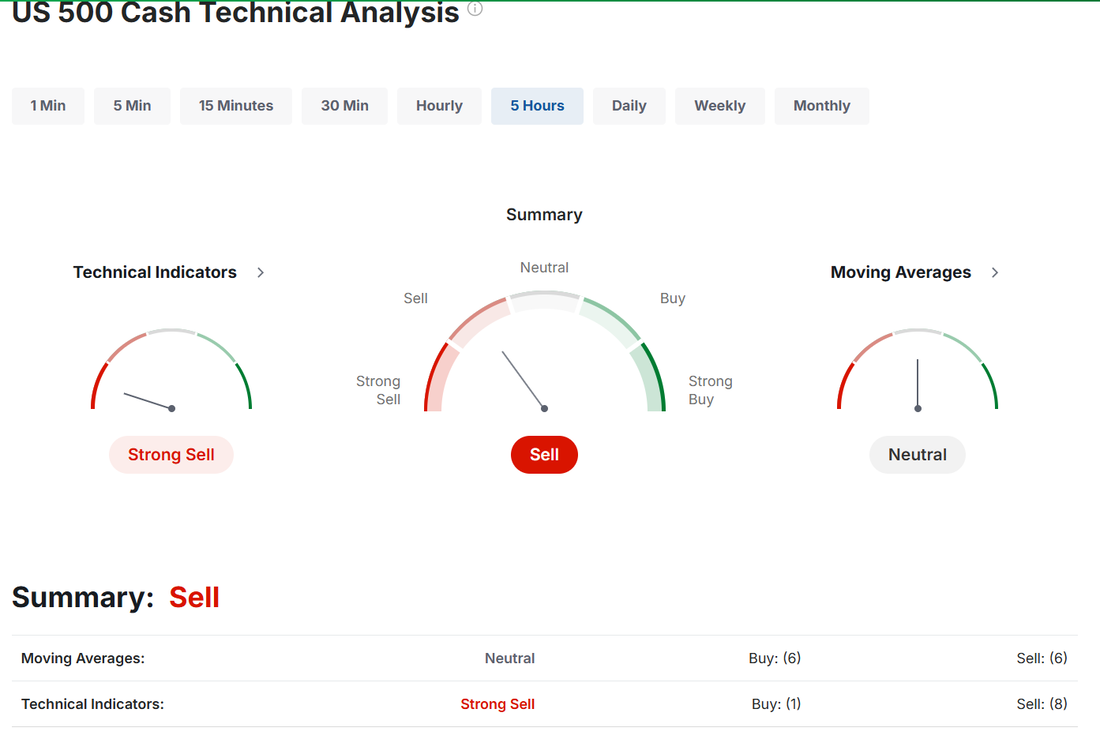

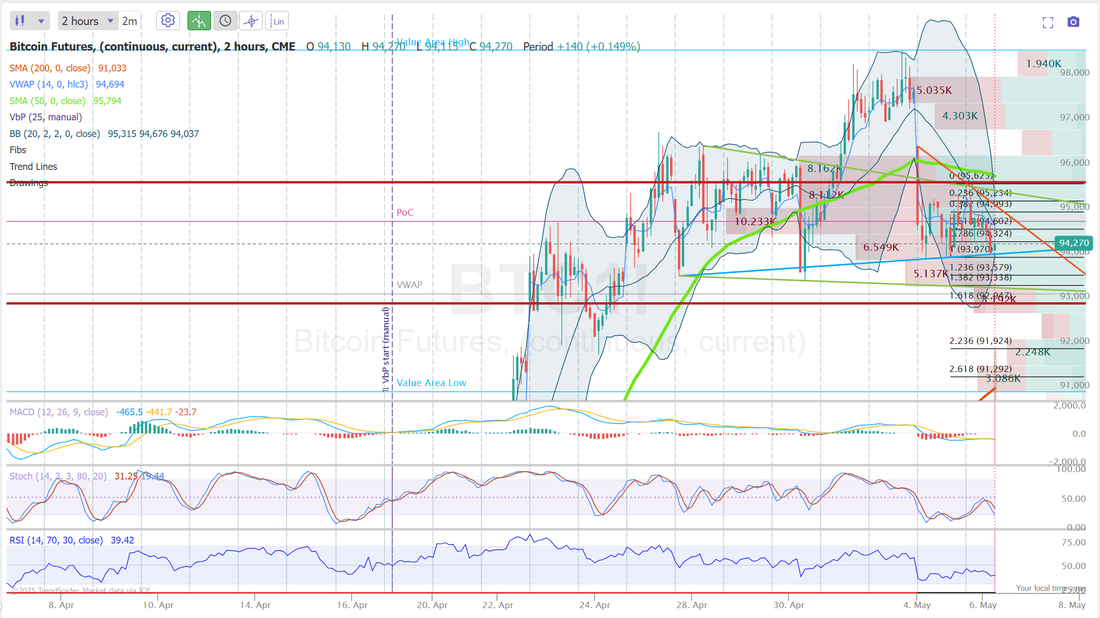

RejectedThe streak came to an end. I called for a bearish day yesterday and that's what we got. A nine day winning streak comes to an end. That 200DMA is a big overhang. I'm sure we'll get back to it eventually but right now its the demarcation point. The death cross is still in place. We are still below the 200DMA. We look close to retracing back below the 50DMA as well. Add to all this, we have FOMC coming tomorrow. With futures down this morning...again, it seems unlikely we'll get much bullish price action prior to Powell speaking. We had a really great day yesterday. Our profit matrix will show that we used $9,300 of capital to generate our results but in fact, we had already closed our SPX trade when we opened the NDX so it was closer to 6K used to generate $1,400 in profit. Most important, however, for us is the risk management. I don't think we ever went above $240 dollars of risk. Here's a look at our results. Let's take a look at the markets: Yesterdays drawdown didn't materially change anything. Techninals have turned slightly bearish after yesterdays retrace and this mornings futures selloff. I was looking for a bearish day yesterday and that's what we got. I think today will be more of the same. It seems like a big ask for buyers to set up in any substantial way with FOMC waiting in the wings. June S&P 500 E-Mini futures (ESM25) are trending down -0.82% this morning as the latest batch of corporate earnings reports heightened worries about the negative impact of U.S. tariffs on businesses and the global economy, while investors awaited the start of the Federal Reserve’s two-day policy meeting. Palantir Technologies (PLTR) slumped over -7% in pre-market trading after the data analytics company’s Q1 results fell short of investors’ loftiest expectations, while analysts pointed to weakness in its international sales division. Also, Ford (F) slid more than -2% in pre-market trading after the automaker withdrew its full-year guidance and said it expects a $1.5 billion EBIT impact from auto tariffs this year. U.S. President Donald Trump on Sunday announced a 100% tariff on foreign-produced films imported into the U.S., and a day later said he plans to unveil pharmaceutical tariffs within the next two weeks. Analysts noted that this marks a notable escalation in the trade saga, adding further uncertainty to the global trade outlook. In yesterday’s trading session, Wall Street’s main stock indexes ended lower. Zimmer Biomet Holdings (ZBH) plunged over -11% and was the top percentage loser on the S&P 500 after the orthopedic products company cut its full-year adjusted EPS guidance. Also, ON Semiconductor (ON) slumped more than -8% and was the top percentage loser on the Nasdaq 100 after the maker of power chips gave a weak Q2 adjusted gross margin forecast. In addition, Berkshire Hathaway (BRK.A) fell over -4% after legendary investor Warren Buffett said he would step down as CEO of the conglomerate at the end of the year. On the bullish side, EQT Corp. (EQT) rose over +3% after UBS upgraded the stock to Buy from Neutral with a price target of $64. Economic data released on Monday showed that the U.S. ISM services index unexpectedly rose to 51.6 in April, stronger than expectations of 50.2. At the same time, the final estimate of the U.S. April S&P Global services PMI was revised lower to 50.8 from the 51.4 preliminary reading. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50% on Wednesday, despite recent pressure from President Trump to cut interest rates. Market watchers’ attention will be on any indications of whether rates might be lowered later this year to support the economy amid tariff-related pressures. “Uncertainty rules amid a trade war and the ever-changing landscape of tariffs, but with the hard data on consumer spending and employment still hanging in there, the Fed will remain firmly planted on the sidelines,” said Greg McBride at Bankrate. On the earnings front, notable companies like Advanced Micro Devices (AMD), Arista Networks (ANET), Duke Energy (DUK), Constellation Energy (CEG), Marriott International (MAR), and American Electric Power (AEP) are set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on U.S. Trade Balance data, which is set to be released in a couple of hours. Economists expect the U.S. trade deficit to widen to -$136.80B in March from -$122.70B in February. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.365%, up +0.51%. Trade docket today: We're going to try again to land some 1HTE's. Scalping has an overnight /NQ trade on that we are trying to squeeze a $300-$600 profit out of. SPX an NDX 0DTE's. We've also got AMD, UBER, DIS potential earings trades today. Let's take a look at the intra-day levels: /ES: Lots of levels to look at today. Be nimble. 5623 is the first key level for me. Futures are down again this morning and we are sitting right above this critiacl level. Bulls really need to hold this level. Resistance is way up at 5701 so support levels are probably more important. Below 5623 is 5602/5592/5572. /NQ: 20,178 is resistance but much like the /ES, there is more activity on the support side. 19,756 is first support then comes 19,492. BTC: Bitcoin has not given us any real setups so far this week. We'll try again today. It's in a pretty tight range with 95,642 acting as resistance and 92,942 working as support. I look forward to seeing you all in the live trading room shortly. Let's see if we can get repeat of yesterday's profits.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |