|

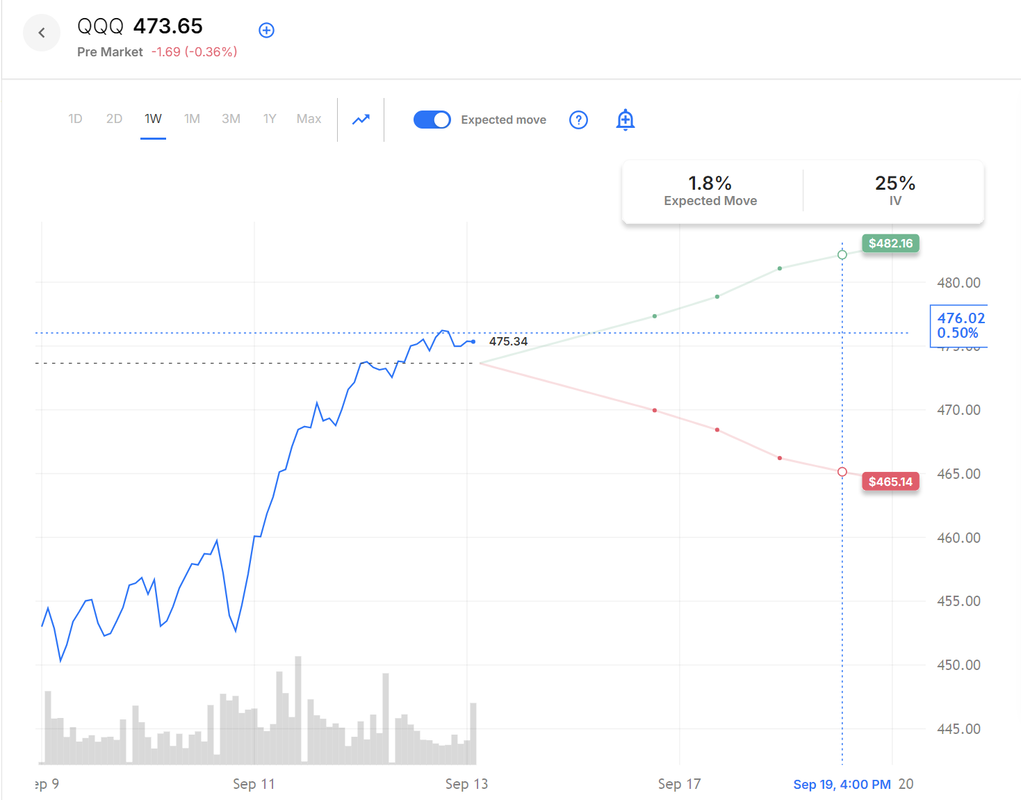

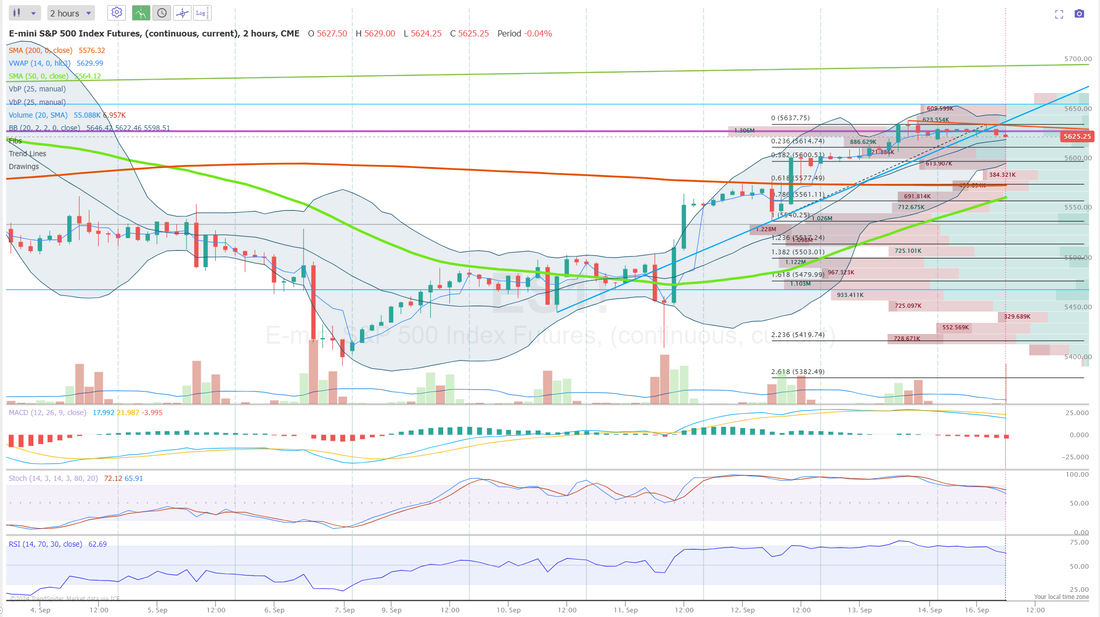

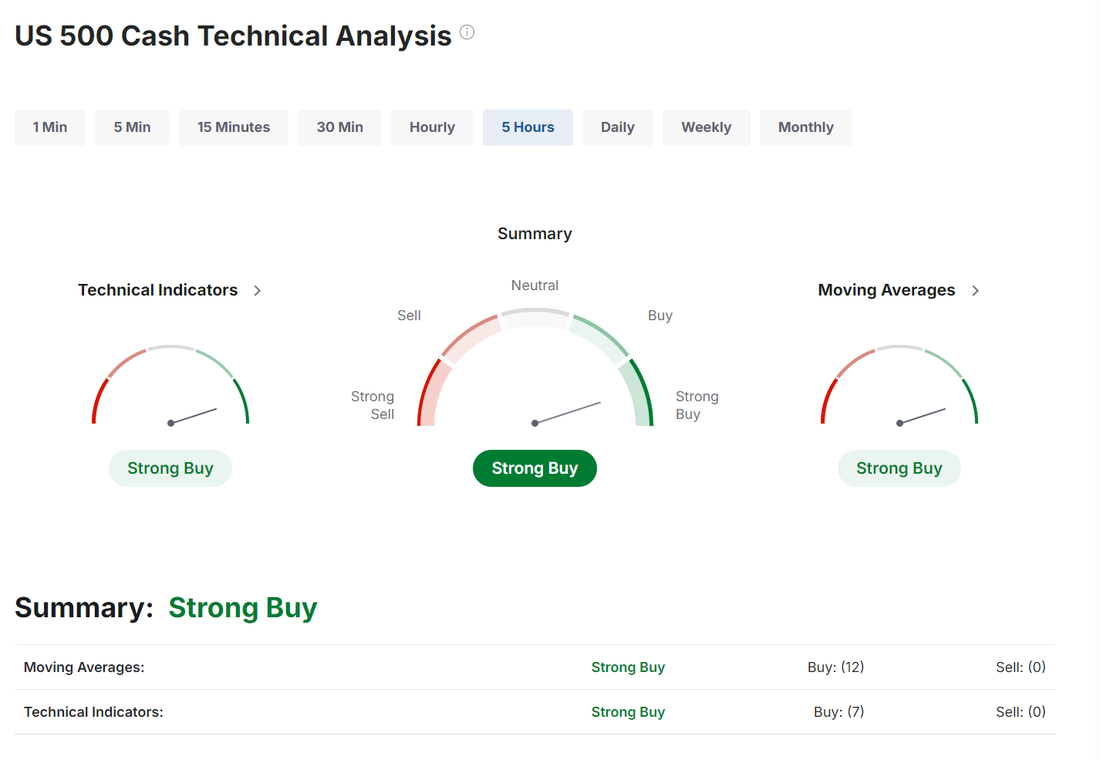

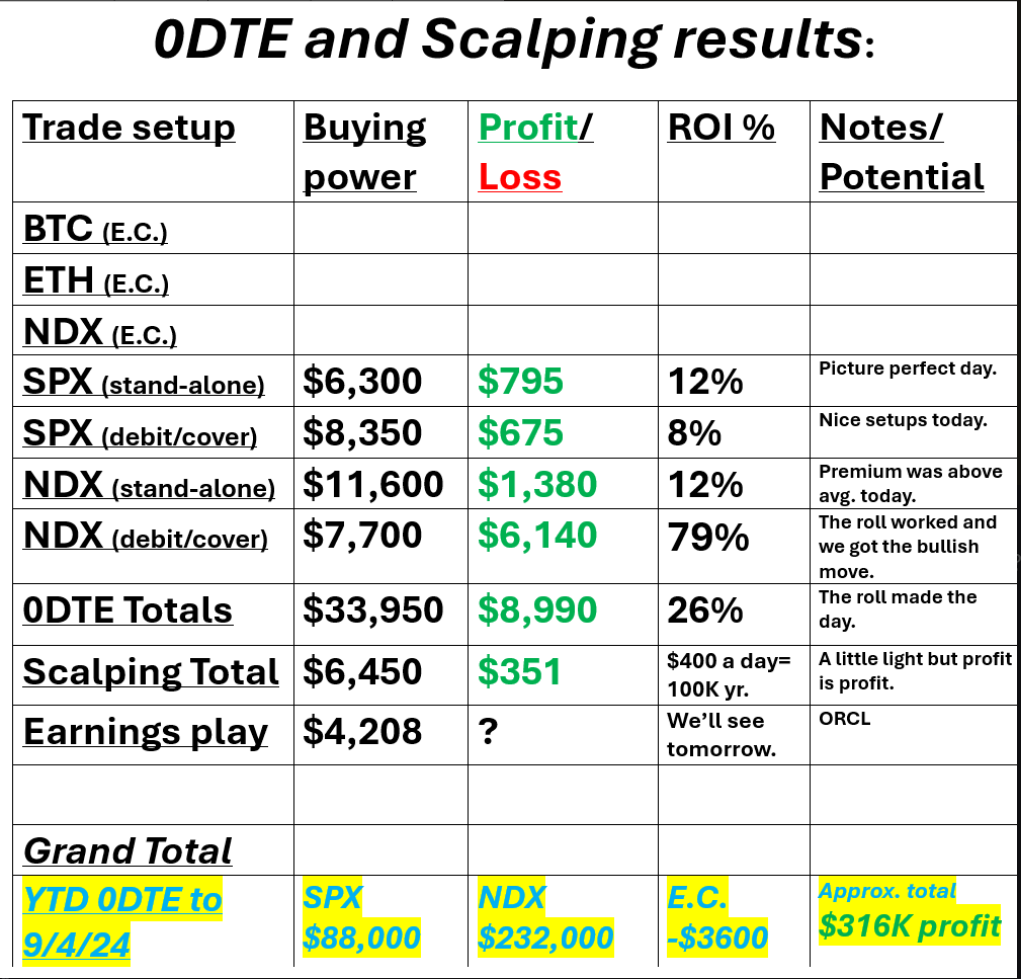

Welcome back to FOMC week! We had a really solid day last Friday. All four of our 0DTEs hit for profits tun the tune of about $2,400. That's a solid day. Sometimes I have to step back and put what we are doing in the live trading room back into perspective. We are generally very upset if we can't find opportunities to make at least $1,000 a day. I just think thats amazing. We've also put on three Theta fairy's in the last week! Two in one day on Weds. and we've got one working right now from last night that's just moving into the profit zone. We also had another couple home runs with our earnings trades on RH and ADBE. Let's take a look at the markets: We are still clinging to that bullish bias. It wouldn't take much though to flip it and, well... Weds. and FOMC are coming soon! Premiums are juicy, as you would expect on an FOMC week. Expected moves are up there. It's interesting to note the SPY has almost as much percentage range cooked in as the QQQ. It’s Fed week! This Wednesday, the Federal Reserve will almost surely cut interest rates for the first time in four-and-a-half years—but by how much is still an open question. Last week’s higher-than-expected Consumer Price Index report was supposed to be the final data point that swayed the U.S. central bank one way or the other. A 25-basis point cut was the expectation with inflation running slightly hotter than hoped in August. But a Wall Street Journal article published late last week suggested that a 50-basis point cut was still a possibility, causing traders to raise the odds of a bigger reduction. Fed Rate Cut: 25 or 50 Basis Points?Currently, there is a 53% chance of a 25-basis point cut and a 47% chance of a 50-basis point cut, according to the pricing of fed funds futures. The current rate is 525-550 basis points, although the Fed has not raised the interest rate since last July as inflation inched down, albeit more stubbornly than central bankers had hoped. A hot jobs market has also bedeviled the Fed, which has vowed repeatedly in recent months to make their decision data dependent. Will Retail Sales Be a Factor?Tuesday’s retail sales data is the last significant piece of economic data to come out before the Fed makes its decision. A month-over-month decline of 0.2% is anticipated for August retail sales, while a month-over-month increase of 0.2% is expected for retail sales ex autos. Retails sales are usually not a decisive factor when it comes to rate decisions, but the latest figures could have an outsized impact given the timing of their release and the razor thin margin between the two rate cut options. But regardless of what the Fed ultimately decides to do, for investors, it might not matter much. What’s more important is the trajectory of interest rates beyond where they stand this Wednesday. Six months from now, will rates be 100 basis points lower or 200 basis points? And what will economic growth look like? September S&P 500 E-Mini futures (ESU24) are up +0.09%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.01% this morning as market participants braced for the Federal Reserve to lower interest rates, with opinion divided on the size of this week’s cut. Investors were also evaluating the implications of a second assassination attempt on former President Donald Trump. Trump is safe after his Secret Service detail opened fire on a man brandishing an assault rifle at his West Palm Beach, Florida, golf course on Sunday, in what the Federal Bureau of Investigation described as an apparent assassination attempt. In Friday’s trading session, Wall Street’s main stock indexes closed higher, with the benchmark S&P 500, blue-chip Dow, and tech-heavy Nasdaq 100 notching 2-week highs. Uber Technologies (UBER) climbed over +6% after the ride-share provider said it would expand its partnership with Alphabet’s Waymo to bring autonomous ride-hailing to Austin and Atlanta next year. Also, Arm (ARM) advanced more than +5% after Raymond James initiated coverage of the stock with an Outperform rating and a price target of $160. In addition, RH (RH) surged over +25% after the company reported stronger-than-expected Q2 results. On the bearish side, Adobe (ADBE) slid more than -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company provided below-consensus Q4 revenue guidance. Also, Boeing (BA) fell over -3% and was the top percentage loser on the Dow after its largest labor union went on strike, and Moody’s Ratings placed the company’s debt rating on review for a potential downgrade to junk. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index rose to a 4-month high of 69.0 in September, stronger than expectations of 68.3. Also, the University of Michigan’s September year-ahead inflation expectations ticked down for the fourth consecutive month to 2.7% from 2.8% in August, better than expectations of no change at 2.8%. In addition, the U.S. import price index fell -0.3% m/m in August, better than expectations of -0.2% m/m. The U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference will take center stage in the coming week. The Federal Open Market Committee is widely expected to lower interest rates for the first time in four years on Wednesday, with anxious investors discussing whether officials will consider a quarter-point cut sufficient for an economy showing signs of slowing, or whether they will decide on a half-point reduction instead. Investor attention will also be on the central bank’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC member forecasts regarding the path of interest rates. Meanwhile, U.S. rate futures have priced in a 41.0% chance of a 25 basis point rate cut and a 59.0% chance of a 50 basis point rate cut at the upcoming monetary policy meeting. “If pricing stays where it is currently, it would be the first meeting in years where there’s serious uncertainty about the rates decision,” Deutsche Bank analysts said in a note. Market participants will also be monitoring a spate of economic data releases this week, including U.S. Retail Sales, Core Retail Sales, Industrial Production, Manufacturing Production, Business Inventories, Building Permits (preliminary), Housing Starts, Crude Oil Inventories, Initial Jobless Claims, Current Account, Philadelphia Fed Manufacturing Index, Existing Home Sales, and Leading Index. On the earnings front, notable companies like FedEx (FDX), General Mills (GIS), Darden Restaurants (DRI), and Lennar (LEN) are set to report their quarterly figures this week. Today, investors will likely focus on the U.S. NY Empire State manufacturing index, set to be released in a couple of hours. Economists, on average, forecast that the September NY Empire State manufacturing index will stand at -4.10, compared to last month’s value of -4.70. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.644%, down -0.08%. My lean or bias today is slightly bearish. The markets had a nice five day run to the upside. Friday saw buyers backing off for the first time is a week. Trade docket for today: With FOMC this week we'll wait to entry some of our weekly credit strangles and ladder trades. We'll keep our trade duration closer to 0 or 1 DTE until Thursday. We will have four potential earnings plays this week with FDX,GIS, DRI, LEN. These earnings setups have been great for us. Today we'll focus on /ES (theta fariy) take profit from last night. /MCL ladder, /NG, IWM, QQQ, 0DTE's including our two event contracts on NDX and Bitcoin with a possible ETH as well. Let's take a look at the markets: The SPY surged this week, coming within striking distance of August’s high and closing just below the top of the ascending triangle at $562.01 (+3.99%). With the price reclaiming the critical 8/21 EMAs and a bullish MACD cross to end the week, this index looks poised for a powerful upward move in the sessions to come. This week, the QQQ was the top performer, posting a bullish MACD cross on Thursday and closing at the upper boundary of its symmetrical triangle at $475.34 (+5.94%). While price compression continues within the triangle, the recent bullish signals from both the MACD and the 8/21 EMAs indicate that this index is positioned for a potential breakout, especially with next Wednesday’s FOMC announcement on the horizon. Similar to its peers, the price action of the IWM continued to contract this week, closing near the top of its symmetrical triangle, just above the 8 and 21 EMAs at $216.83 (+4.29%). However, unlike the other indexes, bullish crosses on the MACD and EMAs have yet to materialize. This cautious price action reflects traders’ sensitivity to next week’s FOMC decision, given the outsized impact rate changes have on small caps. It's a little tough to see but that yellow line on the charts is the 50DMA. It's a huge line in the sand. Above is considered bullish and below is bearish. We are just clinging to it. Let's tak a look at our intra-day 0DTE levels, starting with /ES. 5639/5657/5695 are the three next resistance levels. 5614/5601/5578 are the support levels. 5578 is important as it's the 200 period M.A. on the 2 hr. chart. /NQ: 19510/19578/19663 are the next resistance levels. 19403//19351/19287 are the next support levels with 19287 being critical. Its close to a convergence of both the 50 and 100 Period M.A. Bitcoin: We are back on Bitcoin and possibly ETH as well with our event contract 0DTE's! BTC took a huge dive Aug. 1st. and has been struggling ever since. BTC; 60,618 is resistence and 57398 is support. Let's have a great day out there folks. Remember...

0 Comments

Welcome to Friday folks. Yesterday was a much better result for us than Weds. We got about $489 out of scalping. About $2,300 profit from NDX and $1,100 from SPX. Our KR and SIG earnings trades hit for almost full profits. We booked an early profit on our RH earnings trade and our ADBE earnings trade for today looks like we can add some additional profit potential on the call side. All in all it was about a $4,000 day total. Nice to get back on track. Trade docket is light today, as it is every Friday as we look to de-risk, lock in any profits we have and get buying power back for next week so we can do it all over again. /MNQ will continue to be the scalping vehicle. We'll get back to adding the QQQ's on Monday when I'm back in the office. ADBE earnings play. Put side looks good. We may be able to add the call side today. QQQ. We'll work this into next weeks expiration. This was our only hot spot from yesterday. SPX/NDX 0DTE's. Markets coninued their bullish price action yesterday. Futures are starting off the day looking a little tired but, that's what it's looked like that last two days and somehow it manages to finish strong by the close My lean today is more neutral. There's nothing, catalyst wise that should stop this bull run of four days. We aren't overstretched on our indicators but...We have some big overhead resistance coming into play and, as I say, we have been up four days in a row now. Let's take a look at some key intra-day levels for me today in preparation for our 0DTE entries. /ES: 5625 is first resistance. 5633 is next and 5662 is the big overhang. 5599 is first support with 5588 next. 5575 is the 200 period M.A. on the 2 hr. chart and should be the barrier today in defense of the bulls. We break that and we could get some downside. /NQ: 19486 is the first resistance. 19497 is next. Resistance levels look really tight today. 19376 is first support then comes 19302 which is the 200 period M.A. on the 2hr. chart. Ranges are really compressed today. September S&P 500 E-Mini futures (ESU24) are up +0.23%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.08% this morning, while Treasury yields slumped after fresh U.S. economic data left investors uncertain about the size of an anticipated interest rate cut from the Federal Reserve next week. In yesterday’s trading session, Wall Street’s major averages ended in the green. Warner Bros. Discovery (WBD) climbed over +10% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company announced the early renewal of its multiyear distribution partnership with Charter Communications. Also, Kroger (KR) advanced more than +7% after raising the lower end of its full-year sales guidance. In addition, Roku (ROKU) gained over +5% after Wolfe Research upgraded the stock to Outperform from Peer Perform with a price target of $93. On the bearish side, Moderna (MRNA) plunged more than -12% and was the top percentage loser on the S&P 500 and Nasdaq 100 after announcing plans to reduce its research and development budget by about 20% over the next three years, aiming for a $1.1 billion decrease in its annual R&D expenses by 2027. Also, Micron Technology (MU) slid over -3% after Exane BNP Paribas double-downgraded the stock to Underperform from Outperform with a price target of $67. Economic data released on Thursday showed that the U.S. producer price index for final demand increased by +0.2% m/m in August, exceeding the +0.1% m/m anticipated and accelerating from 0.0% m/m in July (revised from +0.1% m/m). On an annual basis, headline PPI rose +1.7% in August, slightly below the +1.8% increase expected and slowing from the +2.1% gain in the previous month (revised from +2.2%). Also, core PPI, which excludes volatile food and energy prices, stood at +0.3% m/m and +2.4% y/y in August, compared to expectations of +0.2% m/m and +2.5% y/y. In addition, the number of Americans filing for initial jobless claims in the past week unexpectedly rose +2K to 230K, compared with the 227K expected. “With PPI basically repeating [Wednesday’s] CPI reading and jobless claims in line with expectations, the decks have been cleared for the Fed to kick off a rate-cutting cycle,” said Chris Larkin at E*Trade from Morgan Stanley. Meanwhile, market participants are now anticipating a rate cut from the Federal Reserve next week, though investors remain split on whether it will be a quarter- or half-point reduction. Former New York Fed President William Dudley stated at a forum in Singapore on Friday that he sees potential for a half-point rate cut at next week’s meeting. “I think there’s a strong case for 50,” Dudley said. “I know what I’d be pushing for.” U.S. rate futures have priced in a 57.0% chance of a 25 basis point rate cut and a 43.0% chance of a 50 basis point rate cut at next week’s monetary policy meeting. In other news, Deutsche Bank lifted its year-end target for the benchmark S&P 500 index to 5,750 from 5,500, attributing the adjustment to rising stock buybacks, solid corporate earnings, and strong inflows. Today, all eyes are focused on the preliminary reading of the U.S. Michigan Consumer Sentiment Index, set to be released in a couple of hours. Economists, on average, forecast that the Michigan consumer sentiment index will come in at 68.3 in September, compared to last month’s value of 67.9. U.S. Export and Import Price Indexes for August will also be reported today. Economists anticipate the export price index to be -0.1% m/m and the import price index to be -0.2% m/m, compared to the previous figures of +0.7% m/m and +0.1% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.635%, down -1.13%. Let's get a strong finish to the week folks. Yesterday felt good to get back on track.

Welcome back traders. Thurs. brings us PPI and Jobless claims, following up CPI's report from yesterday. I've always said, CPI can be a bigger catalyst than FOMC. The move yesterday was something to behold, even if I was caught on the wrong side near the close. Three sigma moves (or close to that) are rare and tough to trade with credit trades. I got beat up to the tune of about a $12,000 loss. Part of that was a -$1,100 loss on scalping. It looks like I'm up about $500 now on our long /MNQ so hopefully I can regain some of that loss today. A look at the price action from yesterday shows the big reversal. The day started off well with not one but two successful Theta fairy trades, thanks to the CPI premium. All three of our earnings trades on GME, PLAY and WOOF ended up profitable as well but it wasn't enough to counter the calls on SPX and NDX that got overrun. It was a travel day for me yesterday so I purposely waited until later in the day to initiate our 0DTE setups. We had already recovered from the morning swoon when I put the call side on but obviously I didn't wait long enough. I'll be more patient today. Futures have been treading water overnight. PPI and Jobless claims will likely lead the way this morning. September S&P 500 E-Mini futures (ESU24) are up +0.24%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.27% this morning as investors braced for crucial U.S. producer inflation data while also awaiting the European Central Bank’s interest rate decision. In yesterday’s trading session, Wall Street’s major indices closed in the green. Solar stocks soared after Wall Street largely declared Vice President Kamala Harris, who is viewed as a supporter of the energy transition, the winner of Tuesday night’s debate with former President Donald Trump, with First Solar (FSLR) surging over +15% to lead gainers in the S&P 500 and Enphase Energy (ENPH) rising more than +5%. Also, chip stocks gained ground, with Arm (ARM) climbing over +10% to lead gainers in the Nasdaq 100 and Nvidia (NVDA) advancing more than +8%. In addition, Albemarle (ALB) gained over +13% after a Reuters report indicated that Chinese battery producer CATL plans to cut lithium production levels. On the bearish side, GameStop (GME) tumbled about -12% after the videogame retailer reported weaker-than-expected Q2 revenue. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices increased +0.2% m/m in August, in line with expectations. On an annual basis, headline inflation cooled to +2.5% in August from +2.9% in July, in line with expectations and the smallest increase in 3-1/2 years. At the same time, the core CPI, which excludes volatile food and fuel prices, advanced +0.3% m/m and +3.2% y/y in August, compared to expectations of +0.2% m/m and +3.2% y/y. “This isn’t the CPI report the market wanted to see,” said Seema Shah at Principal Asset Management. “The number is certainly not an obstacle to policy action next week, but the hawks on the committee will likely seize on [the August] CPI report as evidence that the last mile of inflation needs to be handled with care and caution.” Meanwhile, U.S. rate futures have priced in an 87.0% probability of a 25 basis point rate cut and a 13.0% chance of a 50 basis point rate cut at the upcoming monetary policy meeting. Today, all eyes are focused on the U.S. Producer Price Index, set to be released in a couple of hours. Economists, on average, forecast that the U.S. August PPI will come in at +0.1% m/m and +1.8% y/y, compared to the previous figures of +0.1% m/m and +2.2% y/y. The U.S. Core PPI will also be closely watched today. Economists expect August figures to be +0.2% m/m and +2.5% y/y, compared to the previous numbers of 0.0% m/m and +2.4% y/y. U.S. Initial Jobless Claims data will be reported today as well. Economists predict this figure will hold steady at 227K, consistent with last week’s number. On the earnings front, Photoshop maker Adobe (ADBE) is scheduled to report its Q3 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.676%, up +0.69%. Most of our indicators from yesterday have turned bullish. There's still some overhang with the 50DMA. The SPY and DIA have recaptured it and the QQQ's are close. Today is very much a continuation of yesterday, for me. PPI usuallly confirms the CPI numbers of the previous day but lately that has not been the case. I abstain from looking at levels today as well as the algos are going to run the show. I do believe today is a critical one for developing directional bias. #1. We are still fighting to establish the 50DMA's as a true support level. #2. While not trying to define support/resistance levels for today, it is important to note on the /ES 2 hr. chart a couple key areas. The red line is the 200 period M.A. and has worked as resistance overnight. The purple line is the Point of Control and has been the big resistance zone for quite some time now. If the market can clear both of these resistance levels then we enter fresh bullish territory. It won't be an easy task if past attempts are to be extrapolated into today. Never the less, I continue with my bullish bias today and most likely will stick with that unless we can break back down below the 50DMA (Green line). Our trade docket for today: Continue working our IWM setup. We should be booking a profit on our two earnings plays from yesterday in KR and SIG. Continue working our QQQ trade and booking our profit on our SPY trade. We also have two more potential earnings setups in RH and ADBE. We'll work our NDX and SPX 0DTE's again. Hopefully today I'll be quicker to adjust, if needs be. With no zoom feed today, here's a rundown of our model portfolio: #1. Oil. /MCL We are continuing to hold our positions. Oil is getting down to a three year low. Our call side looks to be almost fully profitable and I'm planning on taking a long assignment on the three put contracts we have working. We'll look at them closer as we near expiration for a potential roll but I think this is a good level to get long oi. #2. /MNQ. I'm still using the /MNQ long futures contract for scalping today. The cover on it cost me a loss of $1,100 yesterday so I'm looking to get some back today. I'll wait until about mid day to cover it. #3. /NG. Nat gas hasn't moved much lately. We've covered our long about as aggressively as I'd like with this much time left. Next week we can look at adding a bit more cash flow potential to it but $900 a month is about the upper limit without over leveraging too much. #4. /ZC. Corn continues to just hover around our short strike on our CCS. There's plenty of extrinsic in this position so as long as it doesn't push much higher I'll just let that work. #5. IWM. Premium is good and we'll keep working that strangle today for more income potential. #6. KR. Should be a book profit at the open. #7. LEVI. We need about $1,000 more income to get the trade to a reasonable profit level. We've cash flowed it quite a bit. Just waiting for earnings to hit. #8. NDX/SPX. I'll wait...agian, until later today to start the 0DTE setups. It didn't help me yesterday but I believe visability is more important than tryng to grab the most premium right out of the gate. #9. QQQ: We started our QQQ 4DTE late this week. We'll add to it again today. #10. SIg. Should be a book profit right out of the gate today. #11. SPY. Our 4DTE SPY trade was started Monday with a bullish zebra at it's core. That's been very successful for us this week and we are well beyond our profit target so I'll be looking to lock that profit in today. As mentioned above, we have ADBE and RH as new potential earnings plays as well. Let's see if I can get a better result today. Yesterday was not a fun one for me!

We had a rock solid day yesterday. We had to chase it a bit but it ended up great. Check out our results below: We added in our earnings plays since we do about 20 a month and most end up being day trades. We should be booking profits on PLAY, GME and WOOF this morning. We also got a Theta fairy take profit this morning! Thanks #CPI day! Always nice to start the day off with a crisp $100 dollars in your pocket before the market even opens. Trade docket today will be slightly altered as today is a travel day for me. No zoom feeds until next Monday. We'll be trading in the trading rooms. Scalping will focus soley on the /MNQ part. We'll start today by booking profits on our earnings setups of GME, PLAY, WOOF and then add to our SPY. Setup a new QQQ. Later in the day we'll look at /MCL and the 0DTE's with KR and SIG as possible new earnings plays. September S&P 500 E-Mini futures (ESU24) are trending down -0.31% this morning as market participants refrained from making any big bets ahead of a key U.S. inflation report. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. Oracle (ORCL) surged over +11% and was the top percentage gainer on the S&P 500 after the IT giant reported stronger-than-expected Q1 results. Also, Broadcom (AVGO) climbed more than +5% and was the top percentage gainer on the Nasdaq 100 after KeyBanc Capital Markets stated that Apple’s iPhone 16 launch is favorable for the semiconductor and software giant due to all models being upgraded to Wi-Fi 7. In addition, Tesla (TSLA) gained over +4% after Deutsche Bank named the stock a “Top Pick” with a Buy rating and a price target of $295. On the bearish side, Hewlett Packard Enterprise (HPE) plunged more than -8% and was the top percentage loser on the S&P 500 after announcing a $1.35 billion offering of Series C mandatory convertible preferred stock in an underwritten registered public offering. Also, JPMorgan Chase (JPM) slid over -5% and was the top percentage loser on the Dow after the bank’s president indicated that analysts’ projections for next year’s expenses and net interest income might be overly optimistic. The debate between Vice President Kamala Harris and former President Donald Trump was also in the spotlight, covering topics such as their economic plans, U.S.-China relations, and immigration, though market responses were limited. As the debate concluded, Harris’ chances of winning the election rose to 56% on the betting site PredictIt, up from 53% before the debate. Today, all eyes are focused on the U.S. consumer inflation report, set to be released in a couple of hours. Economists, on average, forecast that the U.S. August CPI will come in at +0.2% m/m and +2.5% y/y, compared to the previous numbers of +0.2% m/m and +2.9% y/y. The U.S. Core CPI will also be closely watched today. Economists anticipate the August core CPI to remain unchanged from July at +0.2% m/m and +3.2% y/y. A survey conducted by 22V Research showed that 48% of investors expect a “mixed/negligible” market reaction to the consumer inflation report, 32% predict “risk-on,” and only 20% foresee “risk-off.” U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be 0.900M, compared to last week’s value of -6.873M. “A 25-basis point interest rate cut seems perfectly reasonable ... there might be a little bit of a risk of overreaction if the Fed were to go 50 bps,” said Lara Castleton, U.S. head of portfolio construction and strategy at Janus Henderson Investors. U.S. rate futures have priced in a 67.0% chance of a 25 basis point rate cut and a 33.0% probability of a 50 basis point rate cut at the September FOMC meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.610%, down -0.95%. CPI and oil inventory numbers will be the two big drivers for our trading today. No lean or bias on CPI days. The algos will do what they will do. We are back to a neutral rating to start the day, which seems spot on for a CPI catalyst day. While the last few days have been bullish, most of the indices we trade are still trying to recover their 50DMA. The DIA being the one exception. Again, no intra-day levels for me on CPI days but it's clear looking at the /ES daily chart that we have been pinching and squeezing for a while now and a big move could be incoming very soon. Day's like today (travel days) tend to be pretty good for us. Being forced to wait until later in the day to start our 0DTE's is not always a bad thing. I'll see you all in the trading room shortly!

Almost a 1% expected move in the SPY today. That should provide us plenty of premium to work with even later in the day. Welcome back traders. We had a solid day yesterday. Our NDX roll from Friday paid off nicely and everything else we worked added to the green on the day. See our results below: Our trading room is built by and for our trading members and one comment was to start showing our earnings plays results. I replaced the Theta Fairy column since we rarely get the premium to do those anymore. Even with yesterdays rally we are still holding on to a neutral rating. Most of the indices are still working on their 50DMA. My bias and lean today is bullish, once again. I liked the price action we got yesterday and think we've got a shot at continuing it today. CPI on Weds. appears to be the next big news catalyst. September S&P 500 E-Mini futures (ESU24) are down -0.07%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.27% this morning as investors looked ahead to the U.S. presidential debate between Donald Trump and Kamala Harris, while also awaiting Wednesday’s release of a key U.S. inflation report. In yesterday’s trading session, Wall Street’s major indexes closed higher. Super Micro Computer (SMCI) climbed over +6% and was the top percentage gainer on the S&P 500 after GlassHouse Research revealed a long position in the artificial intelligence server company, citing a “highly favorable” risk-reward at current levels. Also, Boeing (BA) advanced more than +3% on optimism that a labor agreement with its largest union will prevent a strike at its Seattle-area factories. In addition, Palantir Technologies (PLTR) surged over +14%, and Dell Technologies (DELL) rose more than +3% after S&P Global announced the inclusion of both companies in the benchmark S&P 500 index, effective before the opening of trading on September 23rd. On the bearish side, shares of health insurers offering Medicare Advantage plans retreated after Leerink Partners released a report indicating that these plans might struggle to achieve high-quality “star ratings” necessary for bonus payments, with Humana (HUM) sliding over -3% and CVS Health (CVS) falling more than -2%. “We’re seeing mostly technical dip-buying,” said Tom Essaye at The Sevens Report. “Economic growth is undoubtedly and clearly losing momentum, but a soft landing remains more likely than a hard landing. This week focus turns back to inflation.” Economic data released on Monday showed that U.S. consumer credit increased by +$25.45B in July, stronger than expectations of +$12.30B. Also, U.S. July wholesale inventories came in at +0.2% m/m, compared to the preliminary estimate of +0.3% m/m and the +0.2% m/m rise recorded in June. Meanwhile, U.S. political risk has returned to the spotlight, with former President Donald Trump set to face off in a debate with Vice President Kamala Harris later today. Investors are awaiting the U.S. consumer inflation report for August, scheduled for release on Wednesday, for indications on the size of the Federal Reserve’s upcoming interest rate cut. The CPI is expected to ease to +2.6% y/y from +2.9% y/y in July, marking the smallest increase since 2021, while the core CPI is projected to remain unchanged from July at +3.2% y/y. “With the Fed now in its media blackout period ahead of next Wednesday’s almost certain first cut in the cycle, it looks to us that 25bps is just the more likely based on what the Fed has been telling us,” Deutsche Bank’s Jim Reid said. U.S. rate futures have priced in a 73.0% chance of a 25 basis point rate cut and a 27.0% probability of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. The U.S. economic data slate is mainly empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.710%, up +0.33%. Market internals look fairly solid. Trade docket for today: /MCL, ETH, ORCL, GME, PLAY, WOOF, SPY, 0DTE's. Let's take a look at the intra-day 0DTE levels: /ES; 5493 is the first resistance then comes 5504. Above 5504 there is some room to run. 5455 is first support and then 5431. /NQ; First resistance is 18790 then 18873. Support is at 18911 the 18499. Let's have a great day traders! $1,500 dollars.... We don't need 9K days every day. $1,500 dollars would be a good "work day" for us today. Let's see what we can produce!

Welcome back traders! Scalping and a roll on NDX debit drug me down, results wise on Friday but our NDX roll looks like its got a great shot at bringing in the green today. Here's my results from Friday. September is generally not a great month for the markets. This month seems to have started out in that typical fashion. We've got a bullish setup on both the NDX and SPX coming into this new week. The trend has been bearish and the technicals are all still bearish, as well. There are still a couple big support levels down below current levels that could come into play but...I believe we are at a good entry point for longs. My bias going into this trading day but more importantly, this week is swingning back to bullish. Technicals are still bearish. As you can see from the price action, we are back to key consolidation zones. The bearish MACD cross was the tell this week, as the SPY sold off heavily and closed at $540.36 (-4.12%). The GoNoGo indicator is signaling a neutral reading while the price hovers just above a volume pocket that’s buttressed by the 100-SMA and the aVWAP from the April low. Bulls will want to see this area hold if it gets tested in the sessions to come. The QQQ appears to be in the worst shape of the major indexes, closing below the 100-SMA and aVWAP from the April low and ending the week at $448.69 (-5.79%). Like the SPY, the bearish MACD cross was the tell, and the ‘strong no-go’ reading from the GoNoGo indicator says bulls should remain on the sidelines for now. IWM is at a critical juncture, having broken below the aVWAP from the April low and closed at $207.90 (-5.50%). Support was found on Friday at the 100-SMA, but the bearish MACD cross and the ‘no-go’ reading from the GoNoGo indicator cautions the potential for more downside risk. September S&P 500 E-Mini futures (ESU24) are up +0.74%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.95% this morning, partially rebounding from Friday’s losses driven by weaker-than-expected U.S. payroll numbers, while investors looked ahead to the release of U.S. inflation data later in the week. In Friday’s trading session, Wall Street’s major averages ended in the red, with the benchmark S&P 500 dropping to a 3-1/2 week low, the blue-chip Dow falling to a 3-week low, and the tech-heavy Nasdaq 100 sliding to a 4-week low. Broadcom (AVGO) plunged over -10% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the semiconductor and software giant issued weaker-than-expected Q4 revenue guidance. Also, megacap technology stocks lost ground, with Tesla (TSLA) slumping more than -8% and Amazon.com (AMZN) falling over -3% to lead losers in the Dow. In addition, Super Micro Computer (SMCI) slid more than -6% after JPMorgan downgraded the stock to Neutral from Overweight. On the bullish side, Samsara (IOT) surged over +13% after the company posted upbeat Q2 results and raised its full-year guidance. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls increased by 142K in August, up from the 89K added in July (revised from 114K), but still falling short of the 164K consensus estimate. Also, the U.S. August unemployment rate ticked down to 4.2% from 4.3% in July, in line with expectations. In addition, U.S. average hourly earnings came in at +0.4% m/m and +3.8% y/y in August, stronger than expectations of +0.3% m/m and +3.7% y/y. “August employment data continue the portrayal of an economy running out the string, nearing an inflection point,” said Steven Blitz at TS Lombard. “Whether inflection turns into recession, or something less negative, depends upon how aggressive the Fed counters current negative momentum. Does the Fed go 25 or 50?” New York Fed President John Williams stated on Friday that the central bank should now lower interest rates, given the progress in reducing inflation and a slowdown in the labor market. “With the economy now in equipoise and inflation on a path to 2%, it is now appropriate to dial down the degree of restrictiveness in the stance of policy by reducing the target range for the federal funds rate,” Williams said. Also, Fed Governor Christopher Waller said that it is crucial for the central bank to start reducing interest rates this month due to increasing risks of further weakening in the labor market. Waller noted he is also “open-minded” about the possibility of a larger rate cut and would support one if deemed appropriate. “The balance of risks has shifted toward the employment side of our dual mandate, and that policy needs to adjust accordingly,” he said. U.S. rate futures have priced in a 75.0% chance of a 25 basis point rate cut and a 25.0% probability of a 50 basis point rate cut at the Fed’s monetary policy committee meeting next week. In the coming week, the U.S. consumer inflation report for August will be the main highlight. Also, market participants will be monitoring other economic data releases, including the U.S. PPI, Core PPI, Crude Oil Inventories, Initial Jobless Claims, Export Price Index, Import Price Index, and Michigan Consumer Sentiment Index (preliminary). Several notable companies like Adobe (ADBE), Oracle (ORCL), Kroger (KR), and GameStop (GME) are set to report their quarterly figures this week. Meanwhile, the first U.S. Presidential debate between former President Donald Trump and Vice President Kamala Harris is set to take place on Tuesday. Today, investors will focus on U.S. Consumer Credit data, which is scheduled to be released later in the day. Economists, on average, forecast that July Consumer Credit will stand at $12.30B, compared to the previous figure of $8.93B. U.S. Wholesale Inventories data will be reported today as well. Economists expect July’s figure to be +0.3% m/m, compared to +0.2% m/m in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.759%, up +1.45%. Let's look at the expected moves this week: There looks to be plenty of I.V. If we can't make some decent money this week, it won't be the fault of the premium we are bringing in. Trade docket today: /MNQ, QQQ scalping, DELL, FSLR, F, /MCL, SPY 4dte, ORCL earnings play. 0DTE's. A couple notes on our trade setups. Kalshi has been working on some new stikes and setups for our crypto and NDX 0DTE's. We should be back on those, next week. Let's take a deep dive into the intra-day levels I'll be watching today for 0DTE setups. /ES; Looking at the daily chart you can see that most signals are still bearish however, Stoc is way oversold territory and RSI is actually headed back up. 5295 is PoC and the next big support zone. That's about 150 points lower than current levels so clearly there is a threat of more downside to come but we never try to catch the exact bottoms or tops. /ES; 2 hr. chart. 5480 is the first resistance then comes 5501. Support is at 5425 then 5394. /NQ; Showing some selling exhaustion here. Technicals look oversold. PoC is 18258. We are very close to it. That would be the next big support level. /NQ 2 hr. chart. 18730 would be first resistance. 18834 is next. Resistance is quite a ways up. Support is 18488 the 18345. Schedule note: This Weds. will be a travel day for me. We'll be able to get some earnings trades and longer term setup working but no 0DTE's. Thurs and Friday we'll be trading but no zoom feeds. Back to normal schedule the following Monday.

Let's have a great day folks! We had another good day yesterday. In hindsight, my three day losing streak may have just come from swinging too big. Our trades these past few days have not been massive, yet we've managed to bring in around $3,000 a day in profits. It's important to note that our last piece of our three day losing streak that started last Thurs. ended yesterday. Our NDX roll expired at a full loss of -11K. It was already reflected in our net liq as it's been worthless for several days but we do need to record that result. Our day trades worked out well though and we are set up well to start the day with our /MNQ scalping. There is $750 dollars of profit potential sitting in that trade for the day. I want to talk up our scalping results, once again. $400 dollars a day is close to a six-figure annual income and that's what we are on track for. Need an extra 100K a year? Check out our daily scalping results. Here's our results from our day trades from yesterday: Sell mode continues for the market. No surprise here. Something interesting if you look at the four major indices we trade. They are ALL at very critical levels of either support/resistance or consolidation zones. The next few days of trading could usher in some big directional moves. NFP is the key catalyst for today. September S&P 500 E-Mini futures (ESU24) are trending down -0.65% this morning as investors geared up for the highly anticipated U.S. jobs report to gauge the extent of the Federal Reserve’s easing. In yesterday’s trading session, Wall Street’s major indices closed mixed. McKesson (MCK) plunged over -9% and was the top percentage loser on the S&P 500 after the medical distributor issued below-consensus Q2 adjusted EPS guidance. Also, Copart (CPRT) slid more than -6% and was the top percentage loser on the Nasdaq 100 after reporting weaker-than-expected Q4 EPS. In addition, C3.ai (AI) slumped over -8% after the enterprise software maker reported weaker-than-expected Q1 subscription revenue. On the bullish side, Tesla (TSLA) climbed more than +4% after announcing plans to roll out its Full Self Driving system in China and Europe in the first quarter of next year, subject to regulatory approvals. Also, Amazon.com (AMZN) rose over +2% and was the top percentage gainer on the Dow after Cantor Fitzgerald initiated coverage of the stock with an Overweight rating and a $230 price target. The ADP National Employment report released on Thursday showed that U.S. private nonfarm payrolls increased by 99K in August, significantly lower than the consensus figure of 144K and the smallest increase in 3-1/2 years. Also, the U.S. August ISM services index unexpectedly rose to 51.5, stronger than expectations of 51.3. In addition, U.S. Q2 nonfarm productivity was revised upward to +2.5% q/q from +2.3% q/q, while Q2 unit labor costs were revised lower to +0.4% q/q from +0.9% q/q. Finally, the number of Americans filing for initial jobless claims in the past week fell -5K to 227K, compared with the 231K expected. “[Friday’s] payroll report could be softer than expected given the slowdown in ADP estimates,” said Jeffrey Roach at LPL Financial. “If the payroll report surprises investors and comes in weaker than expected, the likelihood of a 50 basis-point cut increases at the upcoming Fed meeting.” Meanwhile, U.S. rate futures have priced in a 57.0% chance of a 25 basis point rate cut and a 43.0% probability of a 50 basis point rate cut at the Fed’s September meeting. Today, all eyes are focused on the U.S. monthly payroll report, set to be released in a couple of hours. Economists, on average, forecast that August Nonfarm Payrolls will come in at 164K, compared to July’s figure of 114K. A survey conducted by 22V Research showed that 44% of investors expect a “risk-on” market reaction to the jobs report, 27% anticipate “risk-off,” and 29% foresee a “negligible/mixed” response. U.S. Average Hourly Earnings data will also be closely watched today. Economists expect August figures to be +0.3% m/m and +3.7% y/y, compared to the previous numbers of +0.2% m/m and +3.6% y/y. The U.S. Unemployment Rate will be reported today as well. Economists expect this figure to ease to 4.2% in August from 4.3% in July. In addition, market participants will be looking toward speeches from New York Fed President John Williams and Fed Governor Christopher Waller. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.701%, down -0.84%. Trade docket for today: /MNQ, QQQ scalping. DELL, DIA, DOCU, FSLR, IWM, 0DTE's. Let's see if we can knock down another $3,000 profit day. That would be a nice finish to the week. My bias today: Bearish. NFP is the catalyst and could shoot us higher but, if the "the trend is your friend", then you are bearish right now. Intra-day 0DTE levels: /ES; Two key levels for me today. Above 5570 the bulls have a chance Below 5469 the bears continue to pounce. /NQ: Same with the Nasdaq. Above 18979 the bulls have a chance. Below 18698 the bear push continues. Let's get that solid finish to the week traders! See you in the trading room shortly.

Welcome to Thursday! Sometimes you just need a reset. I had a very small trade docket yesterday. I slimmed down my trade size and just wanted to log some "green" by the end of the day. We got back to our knitting, so to speak yesterday and scored some wins. It was a nice turn around from three consecutive down days. Here's my results. My goals are really the same for today and Friday. Let's just print some green on a short list of trades. The Market is getting more and more bearish, it seems. Technicals are bearish. Most of the indices are back to threatening or breaching their 50DMA. We've got some potential news catalysts today. September S&P 500 E-Mini futures (ESU24) are down -0.10%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.15% this morning as market participants awaited a new round of U.S. economic data, with particular attention on the ADP National Employment figures. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Dollar Tree (DLTR) plummeted over -22% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the discount store operator posted downbeat Q2 results and cut its full-year guidance. Also, Zscaler (ZS) tumbled more than -18% after the cybersecurity company provided a below-consensus FY25 forecast. In addition, Super Micro Computer (SMCI) slid over -4% after Barclays downgraded the stock to Equal Weight from Overweight with a price target of $438. On the bullish side, Gitlab (GTLB) surged more than +21% after the DevOps company posted upbeat Q2 results and lifted its FY25 guidance. Also, Advanced Micro Devices (AMD) gained over +2% after appointing former Nvidia executive Keith Strier as its senior vice president of global AI markets. A Labor Department report on Wednesday showed that the U.S. JOLTs job openings fell to a 3-1/2 year low of 7.673M in July, compared to an expected figure of 8.090M. Also, the U.S. July trade deficit widened to -$78.80B from -$73.00B in June (revised from -$73.10B), the largest deficit in 2 years. At the same time, U.S. factory orders rose +5.0% m/m in July, stronger than expectations of +4.7% m/m and the largest increase in 4 years. “The markets may not be as nervous as they were a month ago, but they’re still looking for confirmation the economy isn’t cooling off too much,” said Chris Larkin at E*Trade from Morgan Stanley. “So far this week, they haven’t gotten it.” Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that economic activity was flat or declining in most U.S. regions in recent weeks. The report noted that economic activity grew slightly in three districts but declined or remained flat in nine, compared to five in the previous period. Employment levels were mostly flat or showed a slight increase. While layoffs were infrequently reported, some companies mentioned reducing shifts and hours, leaving advertised positions vacant, or decreasing headcount through attrition. “Employers were more selective with their hires and less likely to expand their workforces, citing concerns about demand and an uncertain economic outlook,” according to the Beige Book. In addition, the report stated that “Consumer spending ticked down in most districts, having generally held steady during the prior reporting period.” San Francisco Fed President Mary Daly stated on Wednesday that the central bank needs to reduce interest rates to maintain a healthy labor market, but the extent of the cut will depend on incoming economic data. “As inflation falls, we’ve got a real rate of interest that’s rising into a slowing economy; that’s a basic recipe for over-tightening,” Daly told Reuters in an interview. U.S. rate futures have priced in a 59.0% chance of a 25 basis point rate cut and a 41.0% chance of a 50 basis point rate cut at the September FOMC meeting. On the earnings front, notable companies like Broadcom (AVGO), DocuSign (DOCU), Samsara (IOT), UiPath (PATH), and Smith & Wesson (SWBI) are set to report their quarterly earnings today. Today, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, set to be released in a couple of hours. Economists, on average, forecast that the August ADP Nonfarm Employment Change will stand at 144K, compared to the previous number of 122K. Investors will also focus on the U.S. ISM Non-Manufacturing PMI and the U.S. S&P Global Services PMI. Economists foresee the August ISM Non-Manufacturing PMI to arrive at 51.3 and the August S&P Global Services PMI to be 55.2, compared to the previous values of 51.4 and 55.0, respectively. U.S. Unit Labor Costs and Nonfarm Productivity data will be reported today. Economists forecast Q2 Unit Labor Costs to be at +0.9% q/q and Q2 Nonfarm Productivity to stand at +2.3% q/q, compared to the first-quarter numbers of +4.0% q/q and +0.2% q/q, respectively. U.S. Initial Jobless Claims data will come in today. Economists predict this figure will hold steady at 231K, consistent with last week’s number. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -0.600M, compared to last week’s value of -0.846M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.771%, up +0.08%. My bias today is bearish...again. They say the "trend is your friend". Well, the trend is down. Trade docket for today is light again and should be tomorrow also. /MCL, /MNQ and QQQ scalping, DELL, DIA, DLTR, FSLR, IWM, 0DTE's. One trade we try to work each week is NVDA. It's been tough to get a trade on this week. Here's some interesting stats on NVDA. Nvidia shed $279 billion in market value Tuesday, the largest one-day decline in U.S. stock history, as concerns about a slowing economy sent jitters across Wall Street. Prior to the carnage, Meta was the record-holder for the steepest market capitalization drop in a single trading session with a $252 billion sell-off in February 2022.

Let's take a look at some intra-day 0DTE levels I'll be watching. /ES: If we look on the daily chart you can see that yesterday, the final shoe dropped with MACD kicking in on the sell rating. For now the overall trend is a sell to the downside. /ES: on an intra-day basis, 5540 is near term resistance and 5509 is support. Inside this zone is just chop to me and meaningless. Above or below could create some movement. /NQ; Daily chart is a issuing a pretty clear sell signal. On the 2 hr. chart the chop zone is 200 points wide. 19029 is resistance and 18828 is support. Between here we don't get any signal change. Above or below these levels could see some additional trending. Let's put up another day like yesterday. Simple, slow, focused effort and, if we do it well we should have four figures of green staring at us at the end of the day!

Welcome to Weds. traders. I had another bad day yesterday. That's three in a row for me and starting to get a little old! Here's my results from yesterday. Markets seem to be rolling over here. We went, very quickly from a neutral to sell rating. Maybe most telling is the QQQ which has, once again, broke down below it's 50DMA. September S&P 500 E-Mini futures (ESU24) are down -0.30%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.46% this morning, extending yesterday’s slump amid worries about a slowing U.S. economy, while investors awaited the latest reading on U.S. job openings. In yesterday’s trading session, Wall Street’s main stock indexes closed in the red, with the benchmark S&P 500 posting a 2-week low and the tech-heavy Nasdaq 100 posting a 2-1/2 week low. Boeing (BA) slumped over -7% after Wells Fargo downgraded the stock to Underweight from Equal Weight with a price target of $119. Also, chip stocks lost ground, with Nvidia (NVDA) sliding more than -9% and Intel (INTC) dropping over -8% to lead losers in the Dow. In addition, U.S. Steel (X) fell more than -6% after Democratic presidential candidate Kamala Harris expressed opposition to the $14.1 billion sale of the steelmaker to Japan’s Nippon Steel, stating that the company should stay domestically owned. On the bullish side, Unity Software (U) gained about +2% after Morgan Stanley upgraded the stock to Overweight from Equal Weight with an unchanged price target of $22. Economic data released on Tuesday showed that the U.S. ISM manufacturing index rose to 47.2 in August, although it fell short of expectations of 47.5. Also, the U.S. August ISM price paid sub-index unexpectedly rose to 54.0, stronger than expectations of a decline to 52.1. In addition, the U.S. S&P Global manufacturing PMI was revised downward to 47.9 in August, marking its first decline in seven months and missing the consensus of 48.0. Finally, U.S. July construction spending unexpectedly fell -0.3% m/m, weaker than expectations of +0.1% m/m and the biggest decline in 1-3/4 years. “The trepidation regarding the recent rise in the unemployment rate will leave the market on edge until Friday morning’s data is in hand,” said Ian Lyngen and Vail Hartman at BMO Capital Markets. “ISM Manufacturing underwhelmed in August. Overall, there wasn’t anything encouraging in the data, but this isn’t particularly new for the U.S. manufacturing sector.” Investor focus this week will center on Friday’s monthly payroll report for August, which is anticipated to reveal that payrolls in the world’s largest economy increased by 164,000, up from 114,000 in July. “This week’s jobs report, while not the sole determinant, will likely be a key factor in the Fed’s decision between a 25 or 50 bps rate cut,” said Jason Pride and Michael Reynolds at Glenmede. Meanwhile, U.S. rate futures have priced in a 61.0% chance of a 25 basis point rate cut and a 39.0% chance of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. On the earnings front, notable companies like Hewlett Packard Enterprise (HPE), Dollar Tree (DLTR), Dick’s Sporting Goods (DKS), Casey’s General Stores (CASY), Copart (CPRT), and C3.ai (AI) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. JOLTs Job Openings data, set to be released in a couple of hours. Economists, on average, forecast that the July JOLTs Job Openings will come in at 8.090M, compared to June’s figure of 8.184M. Also, investors will focus on U.S. Factory Orders data, which arrived at -3.3% m/m in June. Economists foresee the July figure to be +4.7% m/m. U.S. Trade Balance data will be reported today as well. Economists forecast this figure to stand at -$78.80B in July, compared to the previous figure of -$73.10B. Later today, the Federal Reserve will release its Beige Book survey of regional business contacts, which includes anecdotes and commentary on business conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.819%, down -0.58%. Trade docket today: Very light. DLTR, DJT, IWM and getting our SPX and NDX debit 0DTE anchors back in place. Let's take a look at some key levels today. Both the NDX and SPX blew through my support levels from yesterday. /ES; On the daily chart its all bearish. Bearish candle. Below the 50DMA. Selling vol increasing. Stoc and RSI flashing sell signals and MACD looking to confirm today if we get continued weakness. Intra-day on /ES; Resistance levels are pretty clear. 5546 then 5570 to the upside. 5507 is the first support with 5475 below that. Below 5475 we could open up some downside potential. /NQ; price action looks ugly. All indicators are flashing sell. I'd put the target at PoC on the daily chart which is 18,286. This is also just above the 200DMA. Lots of potential downside here. /NQ: intra-day. 19,157/19,351 to the upside. 18,837/18632 to the downside. My bias today: Bearish. Hard not to be. Let's see if we can put up some green today, for a change!

Welcome back to a shortened holiday trading week. Friday was another bad day for me. That's two days in a row of losses so I'll be working to get back on track today. Here's my results from Friday. PMI should be the big news catalyst for today. September S&P 500 E-Mini futures (ESU24) are down -0.46%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.69% this morning as trading resumed after the Labor Day holiday, with investors looking ahead to a new batch of U.S. labor market data, particularly Friday’s nonfarm payrolls report. In Friday’s trading session, Wall Street’s major averages ended in the green, with the blue-chip Dow notching a new all-time high. Intel (INTC) climbed over +9% and was the top percentage gainer on the S&P 500 and Dow after Bloomberg News reported the company was considering various scenarios, including a split of its product design and manufacturing businesses. Also, MongoDB (MDB) soared more than +18% and was the top percentage gainer on the Nasdaq 100 after the company reported stronger-than-expected Q2 results and raised its FY25 guidance. In addition, Marvell Technology (MRVL) advanced over +9% after the semiconductor infrastructure company reported upbeat Q2 results and provided above-consensus Q3 revenue guidance. On the bearish side, Ulta Beauty (ULTA) fell about -4% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q2 results and cutting its FY24 forecast. Data from the U.S. Department of Commerce on Friday showed that the core PCE price index, a key inflation gauge monitored by the Federal Reserve, came in at +0.2% m/m and +2.6% y/y in July, compared to expectations of +0.2% m/m and +2.7% y/y. Also, U.S. July personal spending climbed +0.5% m/m, in line with expectations, while July personal income grew +0.3% m/m, stronger than expectations of +0.2% m/m. In addition, the U.S. Chicago PMI unexpectedly rose to 46.1 in August, stronger than expectations of 45.0. Finally, the University of Michigan U.S. consumer sentiment index was revised upward to 67.9 in August, stronger than expectations of 67.8. “Investors are seeing another sign of being in a soft landing,” said Cameron Dawson, chief investment officer at Newedge Wealth. “It’s another one of those Goldilocks kind of reports really threading a needle right down the center. The market is really getting exactly what it wanted.” Meanwhile, U.S. rate futures have priced in a 69.0% probability of a 25 basis point rate cut and a 31.0% chance of a 50 basis point rate cut at the Fed’s monetary policy committee meeting later this month. The highlight of this holiday-shortened week will be the U.S. Nonfarm Payrolls report for August. Also, market participants will be eyeing a spate of other economic data releases, including U.S. JOLTs Job Openings, Factory Orders, Trade Balance, Exports, Imports, ADP Nonfarm Employment Change, Initial Jobless Claims, Nonfarm Productivity, Unit Labor Costs, S&P Global Composite PMI, S&P Global Services PMI, ISM Non-Manufacturing PMI, Crude Oil Inventories, Average Hourly Earnings, and Unemployment Rate. Several notable companies like Broadcom (AVGO), Hewlett Packard Enterprise (HPE), Zscaler (ZS), DocuSign (DOCU), Dollar Tree (DLTR), and Dick’s Sporting Goods (DKS) are slated to release their quarterly results this week. In addition, the Federal Reserve will release its Beige Book survey of regional business contacts this week, which includes anecdotes and commentary on business conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. New York Fed President John Williams and Fed Governor Christopher Waller will be making appearances this week. Today, all eyes are focused on the U.S. ISM Manufacturing PMI, set to be released in a couple of hours. Economists, on average, forecast that the August ISM manufacturing PMI will come in at 47.5, compared to July’s value of 46.8. Also, investors will focus on the U.S. S&P Global Manufacturing PMI, which stood at 49.6 in July. Economists foresee the August figure to be 48.0. U.S. Construction Spending data will be reported today as well. Economists foresee this figure to stand at +0.1% m/m in July, compared to the previous number of -0.3% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.912%, up +0.08%. Technicals have swung into the dangerous neutral zone. From a price action standpoint you can see we remain stuck in a consolidation zone. The DIA and SPY continue the battle to get to a new ATH. I don't have much of a bias or lean today. Neutral rated days are typically filled with knee jerk reactions and are tougher to trade than a trend day. Let's take a look at the expected move this shortened trading week. Moves and I.V. are right in line with last week. Our trade docket today: A little lighter on the weekly credit strangles since we have a shortened week. It hurts our premium collection. DLTR, /MCL, DELL, DIA, DJT, FSLR, GLD/NEM?, SMCI, 0DTE's, Scalping. Let's look at some intra-day levels for 0DTE trading today: /ES; 5638/5649/5664 are resistance levels. 5620/5609/5593 are support. /NQ; 19534/19595/19616 (PoC on 2hr. chart) are resistance levels. 19478 (200 period M.A.", 19446,19371 are support. Let's see if I can put a winning day together are two losers in a row.

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |