|

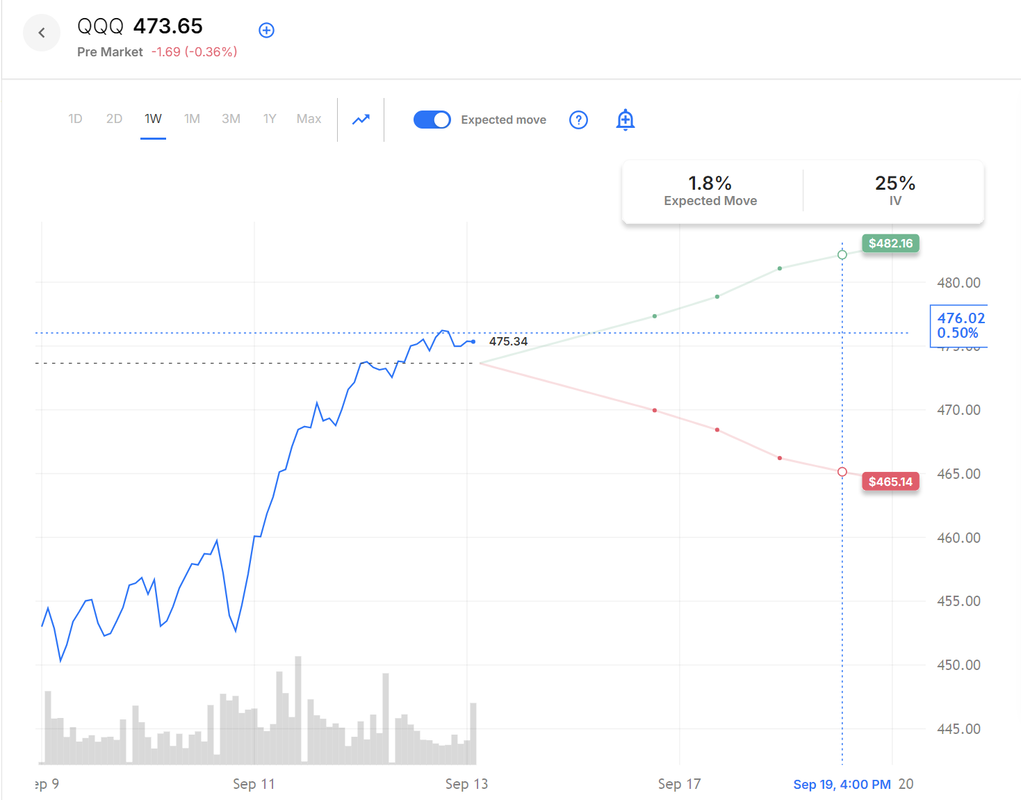

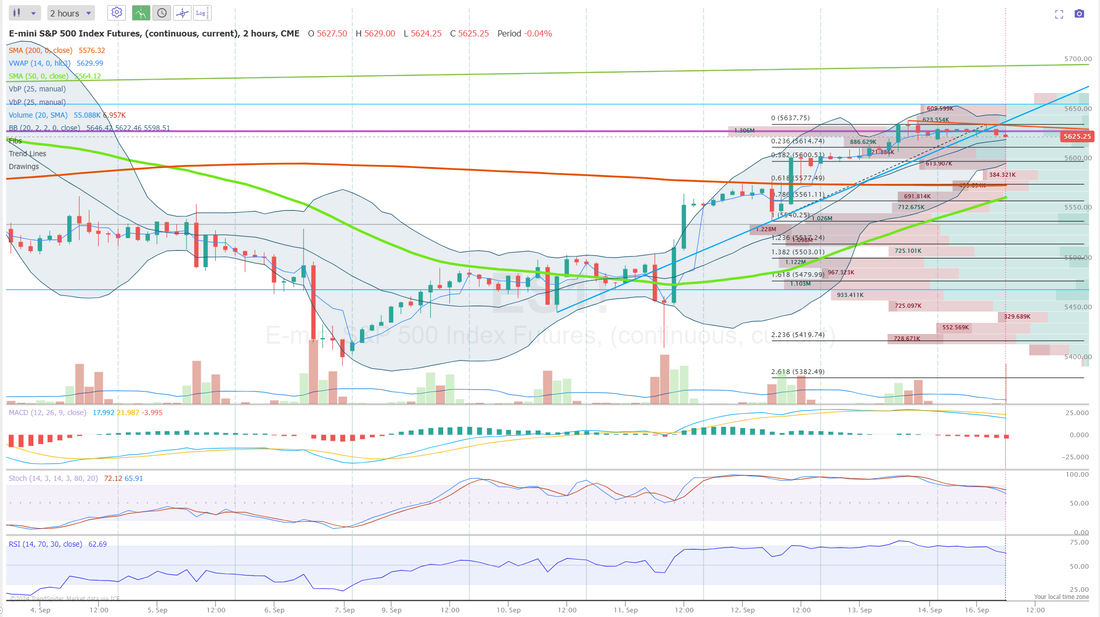

Welcome back to FOMC week! We had a really solid day last Friday. All four of our 0DTEs hit for profits tun the tune of about $2,400. That's a solid day. Sometimes I have to step back and put what we are doing in the live trading room back into perspective. We are generally very upset if we can't find opportunities to make at least $1,000 a day. I just think thats amazing. We've also put on three Theta fairy's in the last week! Two in one day on Weds. and we've got one working right now from last night that's just moving into the profit zone. We also had another couple home runs with our earnings trades on RH and ADBE. Let's take a look at the markets: We are still clinging to that bullish bias. It wouldn't take much though to flip it and, well... Weds. and FOMC are coming soon! Premiums are juicy, as you would expect on an FOMC week. Expected moves are up there. It's interesting to note the SPY has almost as much percentage range cooked in as the QQQ. It’s Fed week! This Wednesday, the Federal Reserve will almost surely cut interest rates for the first time in four-and-a-half years—but by how much is still an open question. Last week’s higher-than-expected Consumer Price Index report was supposed to be the final data point that swayed the U.S. central bank one way or the other. A 25-basis point cut was the expectation with inflation running slightly hotter than hoped in August. But a Wall Street Journal article published late last week suggested that a 50-basis point cut was still a possibility, causing traders to raise the odds of a bigger reduction. Fed Rate Cut: 25 or 50 Basis Points?Currently, there is a 53% chance of a 25-basis point cut and a 47% chance of a 50-basis point cut, according to the pricing of fed funds futures. The current rate is 525-550 basis points, although the Fed has not raised the interest rate since last July as inflation inched down, albeit more stubbornly than central bankers had hoped. A hot jobs market has also bedeviled the Fed, which has vowed repeatedly in recent months to make their decision data dependent. Will Retail Sales Be a Factor?Tuesday’s retail sales data is the last significant piece of economic data to come out before the Fed makes its decision. A month-over-month decline of 0.2% is anticipated for August retail sales, while a month-over-month increase of 0.2% is expected for retail sales ex autos. Retails sales are usually not a decisive factor when it comes to rate decisions, but the latest figures could have an outsized impact given the timing of their release and the razor thin margin between the two rate cut options. But regardless of what the Fed ultimately decides to do, for investors, it might not matter much. What’s more important is the trajectory of interest rates beyond where they stand this Wednesday. Six months from now, will rates be 100 basis points lower or 200 basis points? And what will economic growth look like? September S&P 500 E-Mini futures (ESU24) are up +0.09%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.01% this morning as market participants braced for the Federal Reserve to lower interest rates, with opinion divided on the size of this week’s cut. Investors were also evaluating the implications of a second assassination attempt on former President Donald Trump. Trump is safe after his Secret Service detail opened fire on a man brandishing an assault rifle at his West Palm Beach, Florida, golf course on Sunday, in what the Federal Bureau of Investigation described as an apparent assassination attempt. In Friday’s trading session, Wall Street’s main stock indexes closed higher, with the benchmark S&P 500, blue-chip Dow, and tech-heavy Nasdaq 100 notching 2-week highs. Uber Technologies (UBER) climbed over +6% after the ride-share provider said it would expand its partnership with Alphabet’s Waymo to bring autonomous ride-hailing to Austin and Atlanta next year. Also, Arm (ARM) advanced more than +5% after Raymond James initiated coverage of the stock with an Outperform rating and a price target of $160. In addition, RH (RH) surged over +25% after the company reported stronger-than-expected Q2 results. On the bearish side, Adobe (ADBE) slid more than -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company provided below-consensus Q4 revenue guidance. Also, Boeing (BA) fell over -3% and was the top percentage loser on the Dow after its largest labor union went on strike, and Moody’s Ratings placed the company’s debt rating on review for a potential downgrade to junk. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index rose to a 4-month high of 69.0 in September, stronger than expectations of 68.3. Also, the University of Michigan’s September year-ahead inflation expectations ticked down for the fourth consecutive month to 2.7% from 2.8% in August, better than expectations of no change at 2.8%. In addition, the U.S. import price index fell -0.3% m/m in August, better than expectations of -0.2% m/m. The U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference will take center stage in the coming week. The Federal Open Market Committee is widely expected to lower interest rates for the first time in four years on Wednesday, with anxious investors discussing whether officials will consider a quarter-point cut sufficient for an economy showing signs of slowing, or whether they will decide on a half-point reduction instead. Investor attention will also be on the central bank’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC member forecasts regarding the path of interest rates. Meanwhile, U.S. rate futures have priced in a 41.0% chance of a 25 basis point rate cut and a 59.0% chance of a 50 basis point rate cut at the upcoming monetary policy meeting. “If pricing stays where it is currently, it would be the first meeting in years where there’s serious uncertainty about the rates decision,” Deutsche Bank analysts said in a note. Market participants will also be monitoring a spate of economic data releases this week, including U.S. Retail Sales, Core Retail Sales, Industrial Production, Manufacturing Production, Business Inventories, Building Permits (preliminary), Housing Starts, Crude Oil Inventories, Initial Jobless Claims, Current Account, Philadelphia Fed Manufacturing Index, Existing Home Sales, and Leading Index. On the earnings front, notable companies like FedEx (FDX), General Mills (GIS), Darden Restaurants (DRI), and Lennar (LEN) are set to report their quarterly figures this week. Today, investors will likely focus on the U.S. NY Empire State manufacturing index, set to be released in a couple of hours. Economists, on average, forecast that the September NY Empire State manufacturing index will stand at -4.10, compared to last month’s value of -4.70. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.644%, down -0.08%. My lean or bias today is slightly bearish. The markets had a nice five day run to the upside. Friday saw buyers backing off for the first time is a week. Trade docket for today: With FOMC this week we'll wait to entry some of our weekly credit strangles and ladder trades. We'll keep our trade duration closer to 0 or 1 DTE until Thursday. We will have four potential earnings plays this week with FDX,GIS, DRI, LEN. These earnings setups have been great for us. Today we'll focus on /ES (theta fariy) take profit from last night. /MCL ladder, /NG, IWM, QQQ, 0DTE's including our two event contracts on NDX and Bitcoin with a possible ETH as well. Let's take a look at the markets: The SPY surged this week, coming within striking distance of August’s high and closing just below the top of the ascending triangle at $562.01 (+3.99%). With the price reclaiming the critical 8/21 EMAs and a bullish MACD cross to end the week, this index looks poised for a powerful upward move in the sessions to come. This week, the QQQ was the top performer, posting a bullish MACD cross on Thursday and closing at the upper boundary of its symmetrical triangle at $475.34 (+5.94%). While price compression continues within the triangle, the recent bullish signals from both the MACD and the 8/21 EMAs indicate that this index is positioned for a potential breakout, especially with next Wednesday’s FOMC announcement on the horizon. Similar to its peers, the price action of the IWM continued to contract this week, closing near the top of its symmetrical triangle, just above the 8 and 21 EMAs at $216.83 (+4.29%). However, unlike the other indexes, bullish crosses on the MACD and EMAs have yet to materialize. This cautious price action reflects traders’ sensitivity to next week’s FOMC decision, given the outsized impact rate changes have on small caps. It's a little tough to see but that yellow line on the charts is the 50DMA. It's a huge line in the sand. Above is considered bullish and below is bearish. We are just clinging to it. Let's tak a look at our intra-day 0DTE levels, starting with /ES. 5639/5657/5695 are the three next resistance levels. 5614/5601/5578 are the support levels. 5578 is important as it's the 200 period M.A. on the 2 hr. chart. /NQ: 19510/19578/19663 are the next resistance levels. 19403//19351/19287 are the next support levels with 19287 being critical. Its close to a convergence of both the 50 and 100 Period M.A. Bitcoin: We are back on Bitcoin and possibly ETH as well with our event contract 0DTE's! BTC took a huge dive Aug. 1st. and has been struggling ever since. BTC; 60,618 is resistence and 57398 is support. Let's have a great day out there folks. Remember...

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |