|

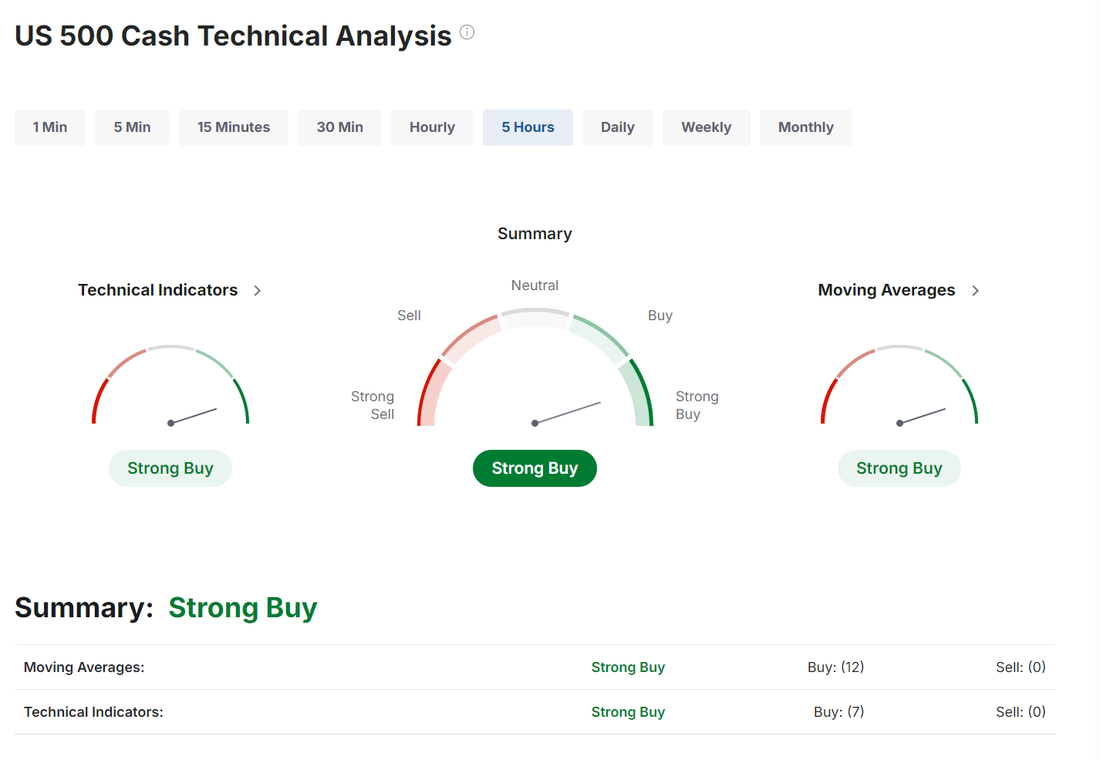

Welcome to Friday folks. Yesterday was a much better result for us than Weds. We got about $489 out of scalping. About $2,300 profit from NDX and $1,100 from SPX. Our KR and SIG earnings trades hit for almost full profits. We booked an early profit on our RH earnings trade and our ADBE earnings trade for today looks like we can add some additional profit potential on the call side. All in all it was about a $4,000 day total. Nice to get back on track. Trade docket is light today, as it is every Friday as we look to de-risk, lock in any profits we have and get buying power back for next week so we can do it all over again. /MNQ will continue to be the scalping vehicle. We'll get back to adding the QQQ's on Monday when I'm back in the office. ADBE earnings play. Put side looks good. We may be able to add the call side today. QQQ. We'll work this into next weeks expiration. This was our only hot spot from yesterday. SPX/NDX 0DTE's. Markets coninued their bullish price action yesterday. Futures are starting off the day looking a little tired but, that's what it's looked like that last two days and somehow it manages to finish strong by the close My lean today is more neutral. There's nothing, catalyst wise that should stop this bull run of four days. We aren't overstretched on our indicators but...We have some big overhead resistance coming into play and, as I say, we have been up four days in a row now. Let's take a look at some key intra-day levels for me today in preparation for our 0DTE entries. /ES: 5625 is first resistance. 5633 is next and 5662 is the big overhang. 5599 is first support with 5588 next. 5575 is the 200 period M.A. on the 2 hr. chart and should be the barrier today in defense of the bulls. We break that and we could get some downside. /NQ: 19486 is the first resistance. 19497 is next. Resistance levels look really tight today. 19376 is first support then comes 19302 which is the 200 period M.A. on the 2hr. chart. Ranges are really compressed today. September S&P 500 E-Mini futures (ESU24) are up +0.23%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.08% this morning, while Treasury yields slumped after fresh U.S. economic data left investors uncertain about the size of an anticipated interest rate cut from the Federal Reserve next week. In yesterday’s trading session, Wall Street’s major averages ended in the green. Warner Bros. Discovery (WBD) climbed over +10% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company announced the early renewal of its multiyear distribution partnership with Charter Communications. Also, Kroger (KR) advanced more than +7% after raising the lower end of its full-year sales guidance. In addition, Roku (ROKU) gained over +5% after Wolfe Research upgraded the stock to Outperform from Peer Perform with a price target of $93. On the bearish side, Moderna (MRNA) plunged more than -12% and was the top percentage loser on the S&P 500 and Nasdaq 100 after announcing plans to reduce its research and development budget by about 20% over the next three years, aiming for a $1.1 billion decrease in its annual R&D expenses by 2027. Also, Micron Technology (MU) slid over -3% after Exane BNP Paribas double-downgraded the stock to Underperform from Outperform with a price target of $67. Economic data released on Thursday showed that the U.S. producer price index for final demand increased by +0.2% m/m in August, exceeding the +0.1% m/m anticipated and accelerating from 0.0% m/m in July (revised from +0.1% m/m). On an annual basis, headline PPI rose +1.7% in August, slightly below the +1.8% increase expected and slowing from the +2.1% gain in the previous month (revised from +2.2%). Also, core PPI, which excludes volatile food and energy prices, stood at +0.3% m/m and +2.4% y/y in August, compared to expectations of +0.2% m/m and +2.5% y/y. In addition, the number of Americans filing for initial jobless claims in the past week unexpectedly rose +2K to 230K, compared with the 227K expected. “With PPI basically repeating [Wednesday’s] CPI reading and jobless claims in line with expectations, the decks have been cleared for the Fed to kick off a rate-cutting cycle,” said Chris Larkin at E*Trade from Morgan Stanley. Meanwhile, market participants are now anticipating a rate cut from the Federal Reserve next week, though investors remain split on whether it will be a quarter- or half-point reduction. Former New York Fed President William Dudley stated at a forum in Singapore on Friday that he sees potential for a half-point rate cut at next week’s meeting. “I think there’s a strong case for 50,” Dudley said. “I know what I’d be pushing for.” U.S. rate futures have priced in a 57.0% chance of a 25 basis point rate cut and a 43.0% chance of a 50 basis point rate cut at next week’s monetary policy meeting. In other news, Deutsche Bank lifted its year-end target for the benchmark S&P 500 index to 5,750 from 5,500, attributing the adjustment to rising stock buybacks, solid corporate earnings, and strong inflows. Today, all eyes are focused on the preliminary reading of the U.S. Michigan Consumer Sentiment Index, set to be released in a couple of hours. Economists, on average, forecast that the Michigan consumer sentiment index will come in at 68.3 in September, compared to last month’s value of 67.9. U.S. Export and Import Price Indexes for August will also be reported today. Economists anticipate the export price index to be -0.1% m/m and the import price index to be -0.2% m/m, compared to the previous figures of +0.7% m/m and +0.1% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.635%, down -1.13%. Let's get a strong finish to the week folks. Yesterday felt good to get back on track.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |