|

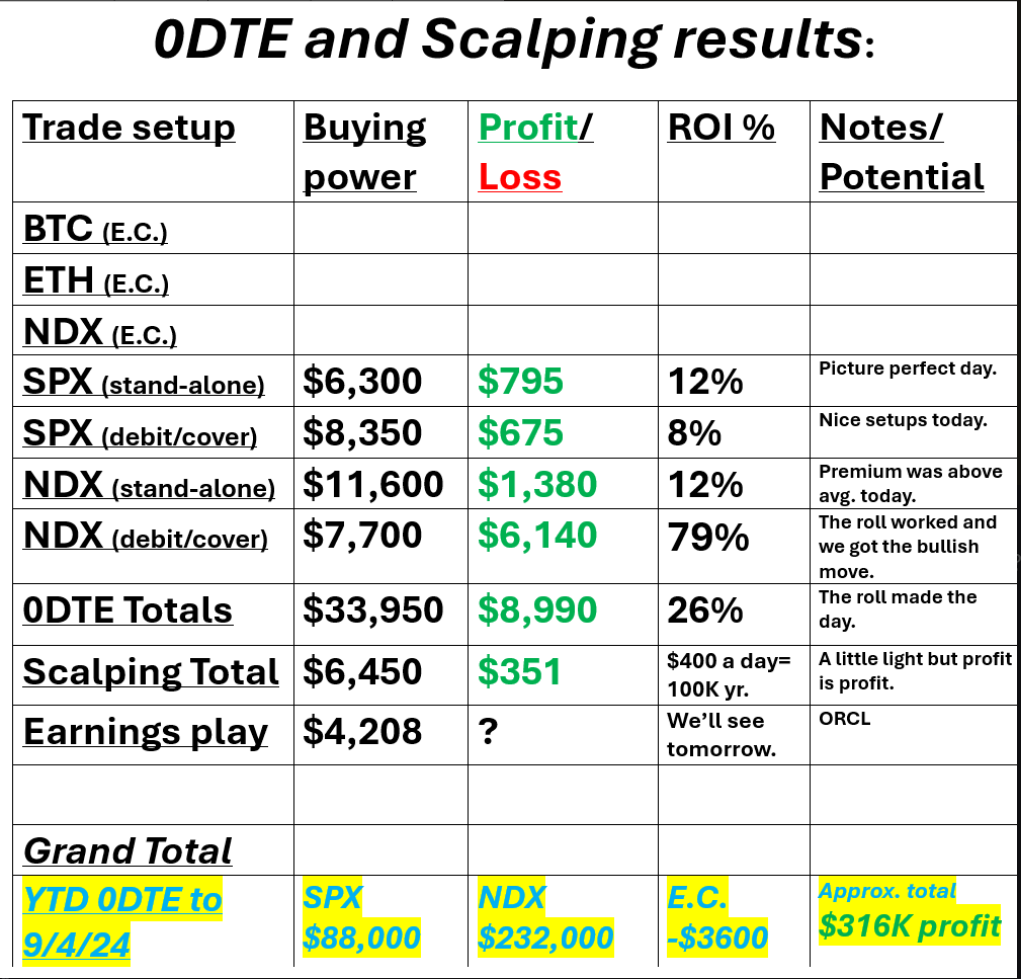

Welcome back traders. We had a solid day yesterday. Our NDX roll from Friday paid off nicely and everything else we worked added to the green on the day. See our results below: Our trading room is built by and for our trading members and one comment was to start showing our earnings plays results. I replaced the Theta Fairy column since we rarely get the premium to do those anymore. Even with yesterdays rally we are still holding on to a neutral rating. Most of the indices are still working on their 50DMA. My bias and lean today is bullish, once again. I liked the price action we got yesterday and think we've got a shot at continuing it today. CPI on Weds. appears to be the next big news catalyst. September S&P 500 E-Mini futures (ESU24) are down -0.07%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.27% this morning as investors looked ahead to the U.S. presidential debate between Donald Trump and Kamala Harris, while also awaiting Wednesday’s release of a key U.S. inflation report. In yesterday’s trading session, Wall Street’s major indexes closed higher. Super Micro Computer (SMCI) climbed over +6% and was the top percentage gainer on the S&P 500 after GlassHouse Research revealed a long position in the artificial intelligence server company, citing a “highly favorable” risk-reward at current levels. Also, Boeing (BA) advanced more than +3% on optimism that a labor agreement with its largest union will prevent a strike at its Seattle-area factories. In addition, Palantir Technologies (PLTR) surged over +14%, and Dell Technologies (DELL) rose more than +3% after S&P Global announced the inclusion of both companies in the benchmark S&P 500 index, effective before the opening of trading on September 23rd. On the bearish side, shares of health insurers offering Medicare Advantage plans retreated after Leerink Partners released a report indicating that these plans might struggle to achieve high-quality “star ratings” necessary for bonus payments, with Humana (HUM) sliding over -3% and CVS Health (CVS) falling more than -2%. “We’re seeing mostly technical dip-buying,” said Tom Essaye at The Sevens Report. “Economic growth is undoubtedly and clearly losing momentum, but a soft landing remains more likely than a hard landing. This week focus turns back to inflation.” Economic data released on Monday showed that U.S. consumer credit increased by +$25.45B in July, stronger than expectations of +$12.30B. Also, U.S. July wholesale inventories came in at +0.2% m/m, compared to the preliminary estimate of +0.3% m/m and the +0.2% m/m rise recorded in June. Meanwhile, U.S. political risk has returned to the spotlight, with former President Donald Trump set to face off in a debate with Vice President Kamala Harris later today. Investors are awaiting the U.S. consumer inflation report for August, scheduled for release on Wednesday, for indications on the size of the Federal Reserve’s upcoming interest rate cut. The CPI is expected to ease to +2.6% y/y from +2.9% y/y in July, marking the smallest increase since 2021, while the core CPI is projected to remain unchanged from July at +3.2% y/y. “With the Fed now in its media blackout period ahead of next Wednesday’s almost certain first cut in the cycle, it looks to us that 25bps is just the more likely based on what the Fed has been telling us,” Deutsche Bank’s Jim Reid said. U.S. rate futures have priced in a 73.0% chance of a 25 basis point rate cut and a 27.0% probability of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. The U.S. economic data slate is mainly empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.710%, up +0.33%. Market internals look fairly solid. Trade docket for today: /MCL, ETH, ORCL, GME, PLAY, WOOF, SPY, 0DTE's. Let's take a look at the intra-day 0DTE levels: /ES; 5493 is the first resistance then comes 5504. Above 5504 there is some room to run. 5455 is first support and then 5431. /NQ; First resistance is 18790 then 18873. Support is at 18911 the 18499. Let's have a great day traders! $1,500 dollars.... We don't need 9K days every day. $1,500 dollars would be a good "work day" for us today. Let's see what we can produce!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |