|

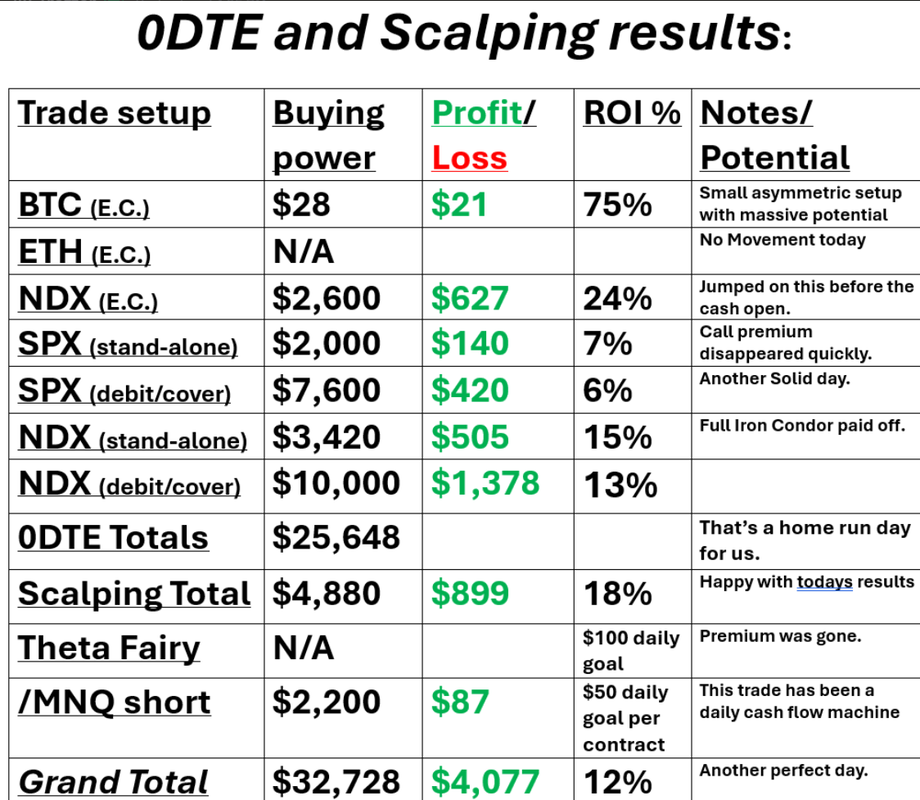

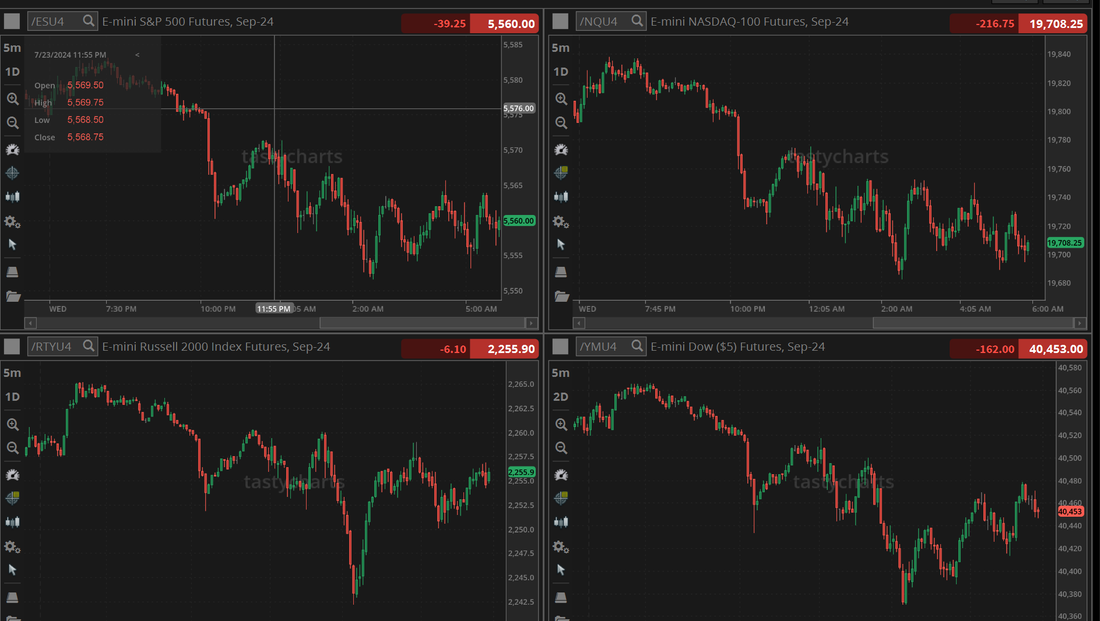

Welcome back my fellow traders! We had another stellar day yesterday. We generate enough trades, daily and weekly that our diversification is pretty strong but that can also eliminate "home run" type days as it's statistically difficult to have all your trades end up winners every day. Yesterday was another exception for us with everything working well. Not shown in our results is a last scalp we took going into the close. That resulted in a $600 profit so we are starting today off on the right foot. Take a look at our results for the day. Let's take a look at the markets. Technicals are back to sell mode after horrible Tesla earnings and poor reception to GOOG results. Futures are hammered down, as I said, based on poor tech earnings. I wouldn't be surprised to see a rebound today. September Nasdaq 100 E-Mini futures (NQU24) are trending down -1.04% this morning as Alphabet’s cautious outlook on AI progress and Tesla’s profit miss, coupled with a delay in its Robotaxi event, weighed on sentiment, while investors awaited U.S. business activity data and the next round of corporate earnings reports. Tesla (TSLA) slumped over -7% in pre-market trading after the electric vehicle giant reported weaker-than-expected Q2 adjusted EPS and postponed its Robotaxi event to October. Also, Alphabet (GOOGL) fell more than -3% in pre-market trading after the tech giant reported higher-than-expected Q2 capital spending, and its chief indicated that patience will be required to see concrete results from artificial intelligence investments. In yesterday’s trading session, Wall Street’s main stock indexes closed in the red. UPS (UPS) tumbled over -12% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q2 results. Also, NXP Semiconductors (NXPI) slid more than -7% after the company provided disappointing Q3 guidance. On the bullish side, Pentair (PNR) climbed +9% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q2 results and updated its full-year adjusted EPS guidance to around $4.25 from $4.15-$4.25. In addition, Arm (ARM) rose about +5% and was the top percentage gainer on the Nasdaq 100 following a note from M Science stating that all new Arm deployments in the first half of July were powered by Amazon Graviton GPUs. Economic data on Tuesday showed that U.S. existing home sales fell -5.4% m/m to 3.89M in June, weaker than expectations of 3.99M. Also, the July Richmond Fed manufacturing index came in at -17, weaker than expectations of -7. Second-quarter corporate earnings season rolls on, with investors awaiting fresh reports from notable companies today, including IBM (IBM), AT&T (T), Chipotle Mexican Grill (CMG), Thermo Fisher Scientific (TMO), General Dynamics (GD), Ford Motor (F), and Las Vegas Sands (LVS). On the economic data front, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, set to be released in a couple of hours. Economists, on average, forecast that the July Manufacturing PMI will come in at 51.7, compared to last month’s value of 51.6. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 55.3 in June. Economists foresee the preliminary July figure to be 54.7. U.S. New Home Sales data will be reported today. Economists foresee this figure to stand at 639K in June, compared to the previous number of 619K. The U.S. Building Permits data will come in today. Economists expect June’s figure to be 1.446M, compared to 1.399M in May. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -2.600M, compared to last week’s value of -4.870M. Meanwhile, investor focus also rests on the U.S. core personal consumption expenditures price index for June, the Fed’s first-line inflation gauge, which is set for release on Friday. The reading could provide insights into whether policymakers might lower interest rates in September. U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at next week’s monetary policy meeting and a 91.7% probability of a 25 basis point rate cut at the September meeting. My bias today is bullish! As I mentioned, I think we take some time this morning to absorb the poor TSLA/GOOG results and then work back higher. By bullish, I don't mean we neccessarily finish green. Just that we work our way back up from the NDX being down 220 points as the futures indicate right now. Trade docket for today: /MNQ, DJT, ENPH, GOOG, TSLA, V?, F, LUV,AAL, CMG, LVS, WM, 0DTE's, Scalping, We continue to be stuck around our currrent levels. We need a break out, either up or down, at this point, to establish a new trend. Price action from yesterday was more neutral in nature. Key economic indicator for us today is the PMI. With PMI out this morning I don't usually publish levels as day's like today are more Algo driven. Of note is the fact the the Ether ETF started trading. This isn't having the same impact as the BTC ETF's but should be overall positive for crypto. We should have a better chance today of getting all seven of our daily 0DTE's working.

Let's have a great day folks. If we can make half as much as we did yesterday I'll call that a success.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |