|

Welcome back to a new week of trading folks! We start this week with a little better I.V. than we've had lately. That's a hopeful sign! We've got our daily /MNQ trade working and we were finally able to get some good premium on the Thetafairy last week. We have a working order on a new one going as I type. Last Fridays results were a mixed bag for me. I took a big swing on Bitcoin that missed and scalping was a loss. I did carry over a small long scalp from Friday that looks to print profits at the open today. Here's a look at my results from Friday. Let's take a look at the market technicals. Futures are up smartly, as I type but technicals are still bearish. That makes sense as we've had over a week of nothing but down. SPY and QQQ are back to kety support levels and the parabolic upward moves on IWM and DIA have taken a breather. This week, the retreat from high-flying tech names into more rate-sensitive ones began to take hold, with both the Nasdaq and the S&P 500 posting their second-largest weekly losses of the year. This shift is driven by growing optimism among traders about potential interest rate cuts, which would favor small-cap stocks and companies facing higher financing costs. Notably, the CME FedWatch tool indicates a 95% probability that the Federal Reserve will reduce rates in September. In other news;

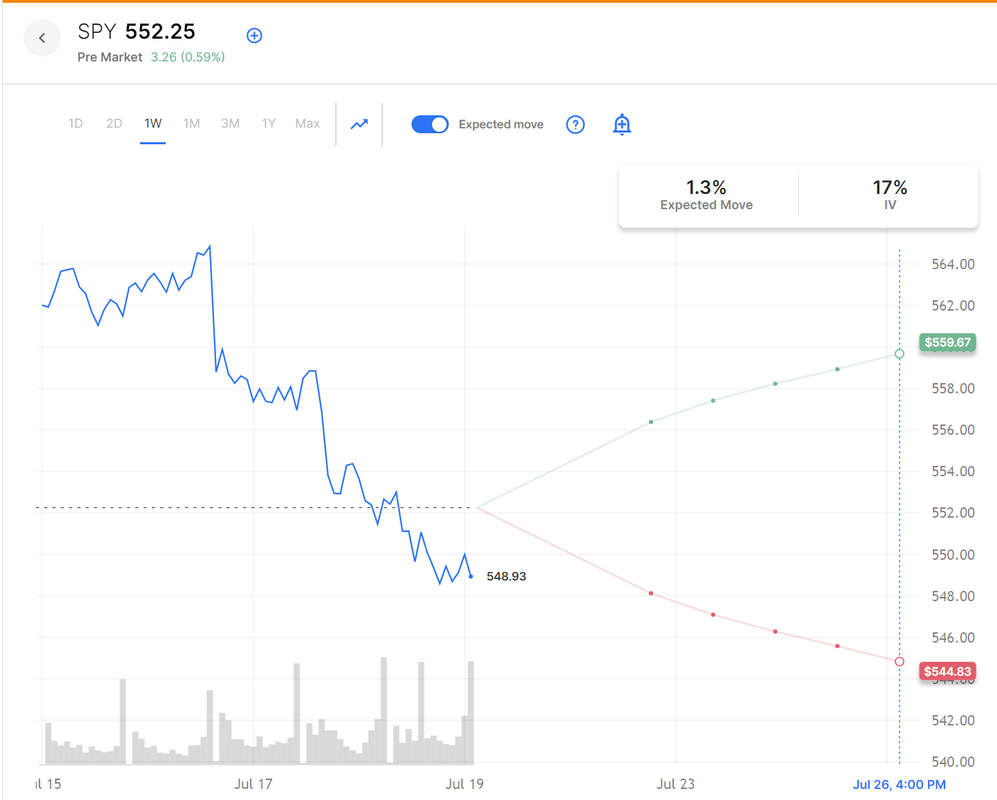

We’re now seven sessions into this rotation. Will small caps dig in and continue higher or was this just a flash in the pan? Let’s get into the charts and see how things are looking. After finding nearly perfect resistance at the 1.618 golden Fibonacci extension last week, the SPY reversed sharply lower to find itself at the bottom of the ascending channel, closing the week at $548.99 (-1.96%). A weekly bearish engulfing candle suggests the possibility of further downside, which is supported by the price closing below the daily 8/21 EMA cloud. The pain continued for the QQQ this week, which closed at $475.24 (-3.96%). With the price breaking down below the ascending channel and a seemingly imminent bearish 8/21 EMA cross on the horizon, the area of low volume looks primed for an eventual test. The rotation into small caps continued this week, gaining over 6% before a strong reversal on Wednesday. Despite this, the IWM closed higher for the second week in a row at $216.84 (+1.74%), but put in a concerning Shooting Star weekly candle as the price fell back into the ascending channel. Bulls will be looking for the 8/21 EMA cloud to act as support next week. A lot of the weakness in the overall indices can be traced to the semi's which just plain got beat up last week Here's a snapshot of the economic calendar for this week. Thurs. and Fri. are the days I'm targeting for this weeks biggest trade docket. September S&P 500 E-Mini futures (ESU24) are up +0.47%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.59% this morning as investors looked past Joe Biden’s exit from his presidential reelection campaign and awaited a slew of corporate earnings reports, with a particular focus on results from “Magnificent Seven” companies Tesla and Alphabet, as well as the release of the Fed’s preferred inflation gauge later in the week. U.S. President Joe Biden ended his reelection campaign on Sunday and endorsed Vice President Kamala Harris as the Democratic nominee. In a post on X, Biden said that he will stay in his role as President and Commander in Chief until his term ends in January 2025 and will address the nation later this week. “It has been the greatest honor of my life to serve as your President. And while it has been my intention to seek reelection, I believe it is in the best interest of my party and the country for me to stand down and to focus solely on fulfilling my duties as President for the remainder of my term,” Biden wrote. The move was widely anticipated following Biden’s poor debate performance in June and amid polls indicating a growing likelihood of an election win by former President Donald Trump in November. In Friday’s trading session, Wall Street’s major averages closed in the red, with the benchmark S&P 500 dropping to a 2-1/2 week low and the tech-heavy Nasdaq 100 falling to a 3-1/2 week low. CrowdStrike Holdings (CRWD) plunged over -11% and was the top percentage loser on the S&P 500 and Nasdaq 100 after a botched upgrade of its cybersecurity software brought down Microsoft’s systems and triggered a global IT outage. Also, chip stocks lost ground, with Intel (INTC) sliding more than -5%, ON Semiconductor (ON) dropping over -3%, and Nvidia (NVDA) falling more than -2%. In addition, Travelers Cos. (TRV) slumped over -7% and was the top percentage loser on the Dow after reporting weaker-than-expected Q2 revenue. On the bullish side, Intuitive Surgical (ISRG) surged more than +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company reported better-than-expected Q2 results. Also, Starbucks (SBUX) climbed over +6% following a report from the Wall Street Journal that activist investor Elliott Management has built a “sizeable” stake in the coffee chain. Second-quarter earnings season kicks into high gear this week, with investors awaiting fresh reports from major companies such as Tesla (TSLA), Alphabet (GOOGL), IBM (IBM), AT&T (T), Verizon (VZ), Comcast (CMCSA), ServiceNow (NOW), Texas Instruments (TXN), NXP Semiconductors N.V. (NXPI), Spotify Technology S.A. (SPOT), General Motors (GM), Ford (F), AbbVie (ABBV), Bristol-Myers Squibb Company (BMY), Visa (V), 3M Company (MMM), Coca-Cola (KO), Lockheed Martin (LMT), American Airlines Group (AAL), and United Parcel Service (UPS). On the economic data front, the June reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight in the coming week. Also, market participants will be monitoring a spate of other economic data releases, including the U.S. GDP (preliminary), S&P Global Composite PMI (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Existing Home Sales, Richmond Manufacturing Index, Building Permits, Goods Trade Balance, New Home Sales, Crude Oil Inventories, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Personal Income, Personal Spending, and Michigan Consumer Sentiment. Federal Reserve officials are in a blackout period before the Federal Open Market Committee meeting at the end of July, so they are prohibited from making public comments this week. Meanwhile, U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 91.7% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.236%, down -0.07% Let's take a look at I.V. and expected moves this week. We have a 1.3% expected move on the SPY with 17% I.V. Guess what? That's plenty to work with!!!! We've been waiting for this. With about 30% more IV we are finally back to a decent risk/reward ratio on credit trades. The QQQ's are even better. My bias today is back to bullish. Futures are up strong. We don't have any large economic or earnings results to drive us today. The market seems to like the Biden news. Trade docket for today: /ES, /MNQ, /NG, CRWD, GLD, IWM, LEVI, NVDA, SPY/QQQ 4DTE, All seven 0DTE's. I'm looking to get back to our normal weekly schedule of credit strangles and ladder setups Weds. or Thurs. of this week. Scalping should hold some better potential for us Thurs and Friday as well. Intra-day levels for me: /ES; 5594/5605/5615* (200 period M.A.)/5638*(PoC on 2hr. chart) to the upside. 5568/5557/5540/5522 to the downside. /NQ; 19976/20103*(big resistance area)/20183 to the upside. 19853/19783/19650*(large drop space below this) to the downside. Bitcoin. I swung big on the bitcoin 0DTE on Friday with a 38% ROI trade. It was close but close doesn't count. After a nice run late Friday and over the weekend Bitcoin looks stalled here to start the week. Resistance is now 68,717. We are slowly working our way back to the ATH's. Support is 66,666. Yes I know. I don't like the number either! Let's have a great day today and a great week. I think the market has given us all the tools we need for us to have a successful result.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |