|

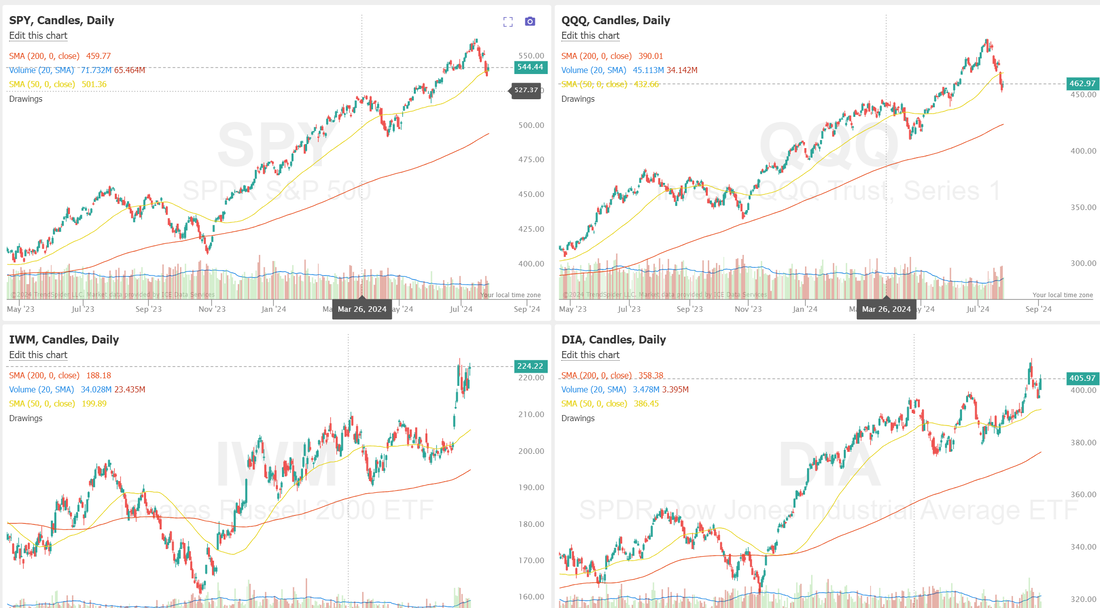

Welcome back to a new trading week! Last week was a tough one for a lot of traders. It did however bring back the I.V. we've been missing. We had a decent day on Friday with some of our rolled positions going out at a profit but our NDX rolls are still going. It looks like we can get a couple take profits on those today if the futures hold. Here's a look at our day last Friday. Let's take a look at the markets. Technicals are swinging back to buy mode this morning. It's really a tale of two different money flows. The SPY and QQQ are still stuck in a consolidation zone while the IWM and DIA continue to look to new bullish highs. After finding nearly perfect resistance at the 1.618 golden Fibonacci extension last week, the SPY reversed sharply lower to find itself at the bottom of the ascending channel, closing the week at $548.99 (-1.96%). A weekly bearish engulfing candle suggests the possibility of further downside, which is supported by the price closing below the daily 8/21 EMA cloud. The pain continued for the QQQ this week, which closed at $475.24 (-3.96%). With the price breaking down below the ascending channel and a seemingly imminent bearish 8/21 EMA cross on the horizon, the area of low volume looks primed for an eventual test. The rotation into small caps continued this week, gaining over 6% before a strong reversal on Wednesday. Despite this, the IWM closed higher for the second week in a row at $216.84 (+1.74%), but put in a concerning Shooting Star weekly candle as the price fell back into the ascending channel. Bulls will be looking for the 8/21 EMA cloud to act as support next week. Let's take a look at the expected moves for the week. I.V. looks solid for us. Let's see if it holds through the week. eptember S&P 500 E-Mini futures (ESU24) are up +0.29%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.38% this morning as market participants looked ahead to earnings reports from major tech names, the Federal Reserve’s policy meeting, as well as the release of the U.S. jobs report later in the week. In Friday’s trading session, Wall Street’s major averages ended in the green. 3M Company (MMM) soared about +23% and was the top percentage gainer on the S&P 500 and Dow after the company posted upbeat Q2 results and raised the lower end of its full-year adjusted EPS guidance. Also, Charter Communications (CHTR) surged more than +16% and was the top percentage gainer on the Nasdaq 100 after the cable and internet company reported better-than-expected Q2 results. In addition, Deckers Outdoor (DECK) climbed over +6% after the company reported stronger-than-expected Q1 results and raised its FY25 EPS guidance. On the bearish side, DexCom (DXCM) plummeted more than -40% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the diabetes device maker reported mixed Q2 results, issued below-consensus Q3 revenue guidance, and lowered its FY24 revenue outlook. Data from the U.S. Department of Commerce on Friday showed that the U.S. core PCE price index, a key inflation gauge monitored by the Federal Reserve, came in at +0.2% m/m and +2.6% y/y in June, compared to expectations of +0.2% m/m and +2.5% y/y. Also, U.S. June personal spending rose +0.3% m/m, in line with expectations, while U.S. June personal income rose +0.2% m/m, weaker than expectations of +0.4% m/m. In addition, the University of Michigan U.S. consumer sentiment index was revised upward to 66.4 in July, stronger than expectations of 66.0. The U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference will take center stage in the coming week. The Federal Open Market Committee is widely anticipated to maintain rates at the current range of 5.25% to 5.50%, with investors and economists believing that the central bank won’t adjust rates until its meeting in September. At the same time, economists surveyed by Bloomberg News expect the Fed to signal its intention to lower interest rates in September at the conclusion of its meeting on Wednesday. Meanwhile, U.S. rate futures have priced in a 99.6% chance of at least a 25 basis point rate cut at the September FOMC meeting and a 61.4% probability of a 25 basis point rate cut at the conclusion of the Fed’s November meeting. Second-quarter earnings season continues in full force, and investors anticipate fresh reports from major companies this week, including Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), Apple (AAPL), Starbucks (SBUX), McDonald’s (MCD), Boeing (BA), Mastercard (MA), Pfizer (PFE), Moderna (MRNA), Merck (MRK), Chevron (CVX), ExxonMobil (XOM), SoFi Technologies (SOFI), Advanced Micro Devices (AMD), Intel (INTC), and Qualcomm (QCOM). On the economic data front, the U.S. Nonfarm Payrolls report for July will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. CB Consumer Confidence Index, JOLTs Job Openings, S&P/CS HPI Composite - 20 n.s.a., ADP Nonfarm Employment Change, Employment Cost Index, Chicago PMI, Pending Home Sales, Crude Oil Inventories, Initial Jobless Claims, Nonfarm Productivity (preliminary), Unit Labor Costs (preliminary), S&P Global Manufacturing PMI, Construction Spending, ISM Manufacturing PMI, Average Hourly Earnings, Unemployment Rate, and Factory Orders. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.169%, down -0.77%. Our trade docket for today is fairly busy: /MNQ, /NG, /ZC, /ZN, DIA, DJT, F, IWM, NVDA, QQQ/SPY, UPST, ORCL, CCL, CRM, PLTR, PYPL, SHOP, MRK, PG, 0DTE's, Scalping. Intra-day levels for me: /ES; 5529/5536/5554* (key level bulls need to clear today)/5588 to the upside. 5507/5493/5478* (key level of support. If we lose this we have some downside potential)/5457. /NQ; 19329/19374* (key level of 50 period M.A.)/19396/19575/ to the upside. 19,266,19218,19153,19105 to the downside. BTC; Had a nice run up over the weekend. 73,000 is the new resistance and 68829 support. We needed this push up we are currently getting with the futures. If we could exit our SPY/QQQ trades and Some of our NDX puts today it would be a fantastic day for us. Let's go get some today traders!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |