|

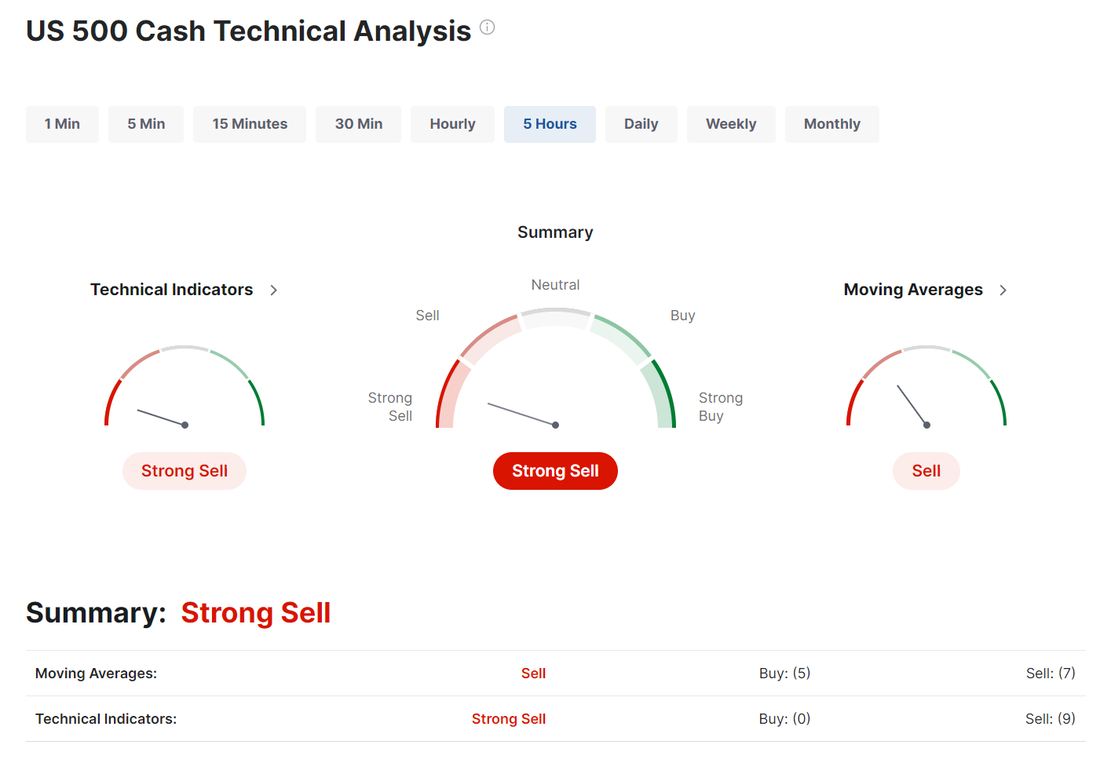

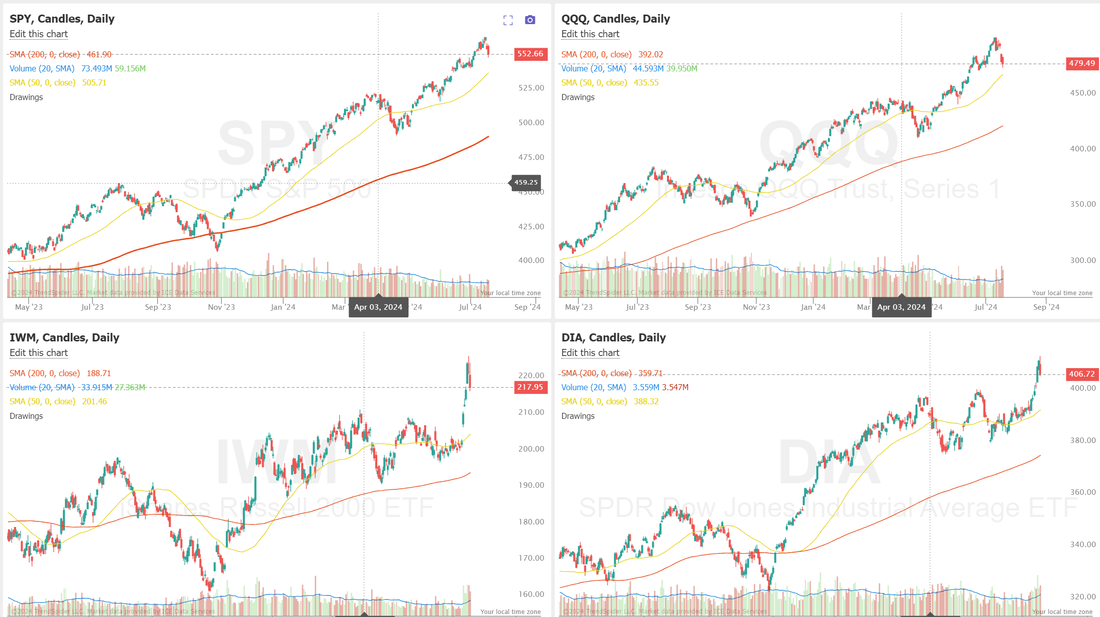

Welcome to Friday traders! The gateway to the weekend! We had a pretty good day yesterday and our Event Contract 0DTE's contributed a bunch. Here's our results. A couple on notes on our trades: We had a very quick, post-earnings take profit on TSM. We also have NFLX and ISRG earnings trades that we should get a profitable exit this morning at the open. We restarted our /MNQ ratio setup last night. I anticipate this to be a near daily setup now with the goal of bringing in $100 a day per contract traded. We'll go into more detail on that setup in todays zoom. We also got a Theta Fairy working and I want to discuss how we can get that back to a more full time trade today. We had two 0DTE's on BTC and two on ETH yesterday. As you know, we strive to make at least $1,000 a day on our 0DTE's and with just $3,200 of buying power the crypto 0DTE's brought in almost $400 of that goal. If you're not trading event contracts you're missing out on some opportunites to create edge and its the best way I know of to day trade crypto. You can get the platfrom setup for free and trade with as little as $20 dollars. Check it out. Let's take a look at the markets. With yesterdays sell off we flip back to a more decisive sell rating on the technicals. A couple of interesting notes; S&P 500 was down more than 1%. What was telling was the breadth. Is this the strongest market ever? The S&P 500 has hit 37 all-time highs this year, the most since 2021. The index has already seen more new records than in every year since 2016, except for 2017 and 2021. It is on pace to hit the 3rd most all-time highs in history, only behind 2021 and 1995 which saw 70 and 77 records. Overall, the S&P 500 is up ~17% year-to-date which marks the 12th best start to a year in the entire stock market history. Will the market hit over 70 new highs this year? $VIX overbought on daily RSI. VIX rarely stays overbought long... The past four times this has happened, it's marked multi-month tops for the VIX. Here's a snapshot of the major indices we trade. Of note yesterday was the fact that the parabolicly bullish IWM and DIA also joined in on the sell off. Futures are slightly up to mixed as I type. I've got a long QQQ scalp on that I carried over from yesterday that could use some more bullishness. Computer systems failed worldwide on Friday, disrupting services at airlines, banks, and the London Stock Exchange after a widely used cybersecurity program crashed and Microsoft separately reported issues with its cloud services. CrowdStrike Holdings alerted customers on Friday that its Falcon Sensor threat-monitoring product was causing crashes in Microsoft’s Windows operating system. At the same time, it was unclear what caused the issues, which coincided with disruptions in Microsoft’s Azure cloud and 365 services. In yesterday’s trading session, Wall Street’s major indexes ended lower. Domino’s Pizza (DPZ) tumbled over -13% and was the top percentage loser on the S&P 500 after the world’s largest pizza company reported weaker-than-expected Q2 total domestic comparable sales growth and suspended its target of opening more than 1,100 global net stores. Also, mega-cap technology stocks lost ground, with Amazon.com (AMZN) and Apple (AAPL) falling more than -2%. In addition, Elevance Health (ELV) slid over -3% after Bank of America Global Research downgraded the stock to Neutral from Buy. On the bullish side, D.R. Horton (DHI) surged more than +10% and was the top percentage gainer on the S&P 500 after the homebuilder reported upbeat Q3 results and announced a new $4.0 billion stock buyback program. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose +20K to 243K, compared with the 229K expected. Also, the U.S. July Philadelphia Fed manufacturing index rose to 13.9, stronger than expectations of 2.7. In addition, the Conference Board’s leading economic index for the U.S. fell -0.2% m/m in June, better than expectations of -0.3% m/m. “The Fed asked to see more evidence of a cooling economy, and for the most part, they’ve gotten it,” said Chris Larkin at E*Trade from Morgan Stanley. “Add [Thursday’s] weekly jobless claims to the list of rate-cut-friendly data points. The path to September remains open.” Chicago Fed President Austan Goolsbee said on Thursday that the Fed may need to cut interest rates soon to prevent a sharper deterioration in the labor market, which has cooled in recent months. While the Fed’s battle against inflation continues, several months of improving data have reassured him that officials are on course to reduce inflation to their 2% target, Goolsbee said. Also, San Francisco Fed President Mary Daly stated that some recent inflation data has been “really good,” but the Fed has not yet attained price stability. “We’re not there yet,” Daly said. “We don’t have price stability right now and we need to be very confident that we’re on a sustainable path to achieve it.” Meanwhile, U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at the July FOMC meeting and a 95.3% chance of a 25 basis point rate cut at September’s policy meeting. On the earnings front, notable companies like American Express (AXP), Schlumberger (SLB), Travelers (TRV), Halliburton (HAL), and Regions Financial (RF) are set to report their quarterly figures today. The U.S. economic data slate is empty on Friday. However, investors will likely focus on speeches from New York Fed President John Williams and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.192%, up +0.12%. My bias today is slightly bullish IF, and it's a big if, the markets can shake off the big computer snafu from overnight. One of the trades we are looking at today is CRWD. Our trade docket today: DELL, DJT, FSLR, ISRG, Theta fairy, /MNQ, IWM, LEVI, NFLX, NVDA, CRWD, 0DTE's. Intra-day levels for me: /ES; 5605/5613*(200 period M.A.)/5628/5642*(PoC) to the upside. 5592/5579/5570 to the downside. Below 5570 we could get some heavy bearish action. /NQ; 19968/20000*(PoC)/20082/20173 to the upside. 19888/19846/19805/19754 to the downside. Below 19754 could be very bearish. Bitcoin; 65,373 resistance. 63,623 support. Unless we get some movement today it may be tough to get a setup on the cryptos. Let's have another profitable day and I hope you all have a safe and enjoyable weekend!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |