|

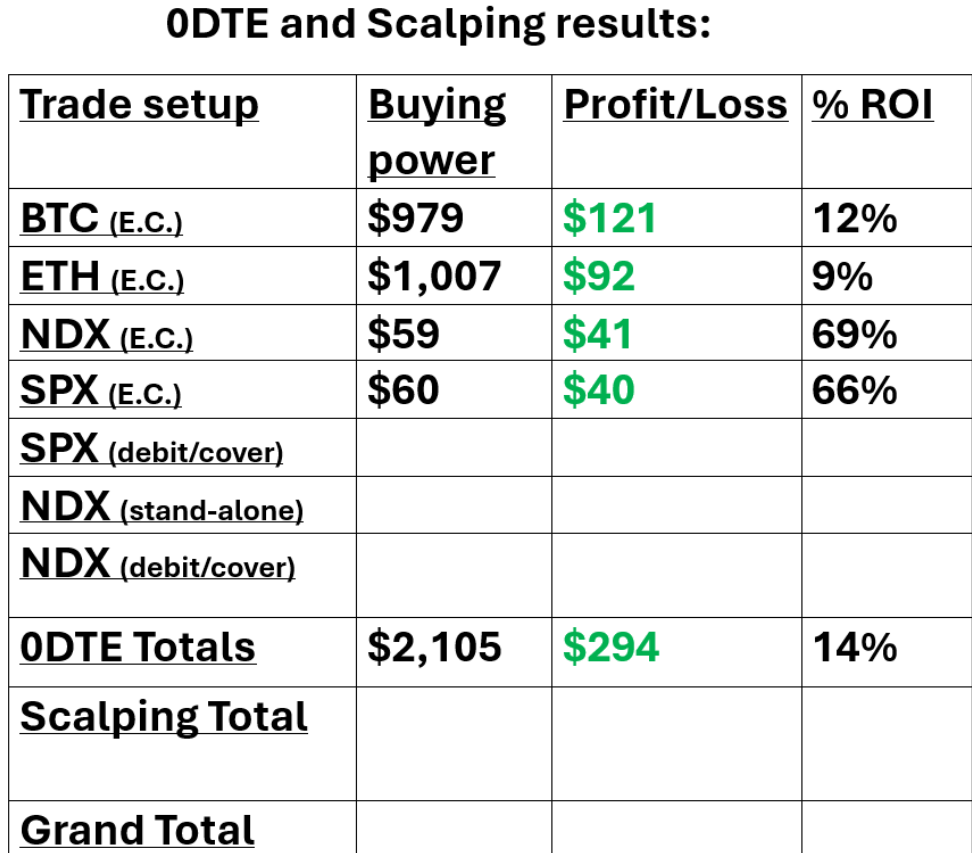

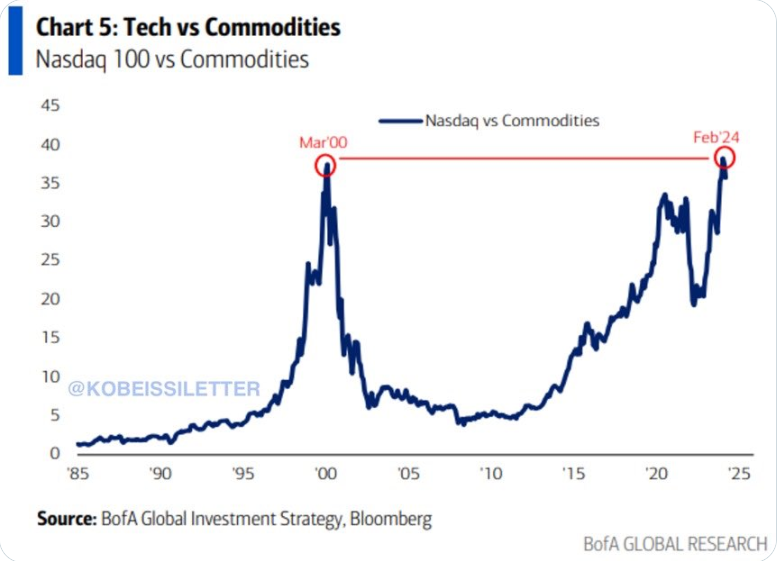

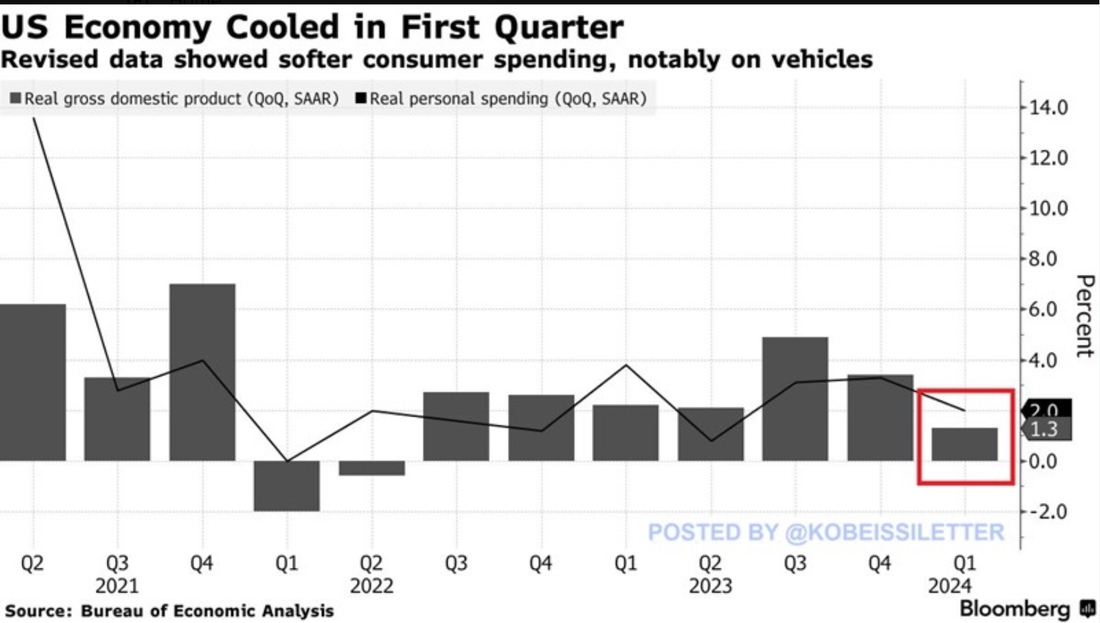

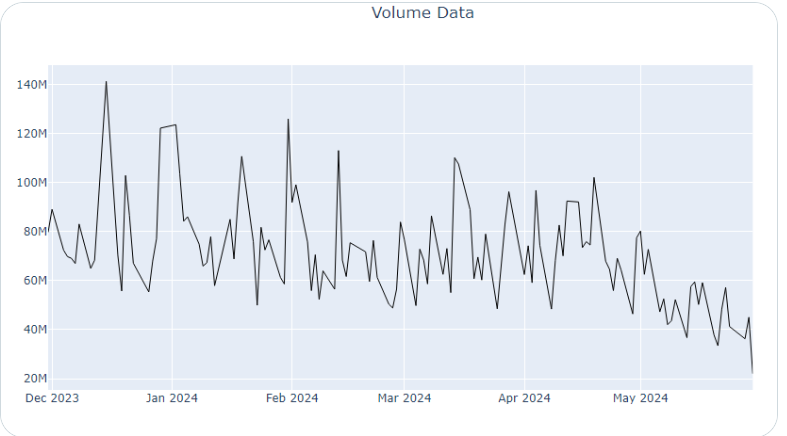

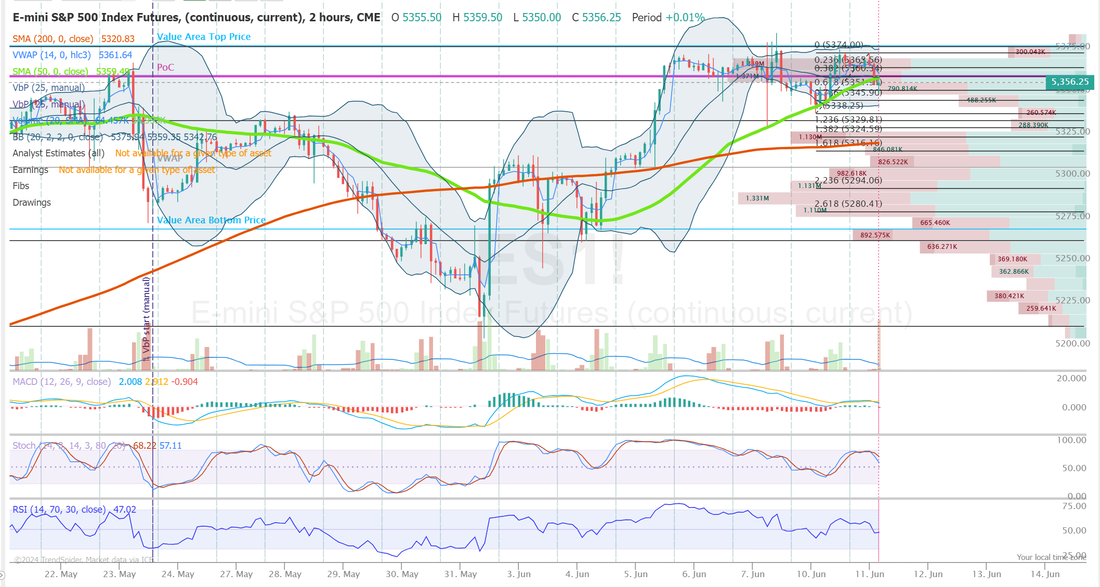

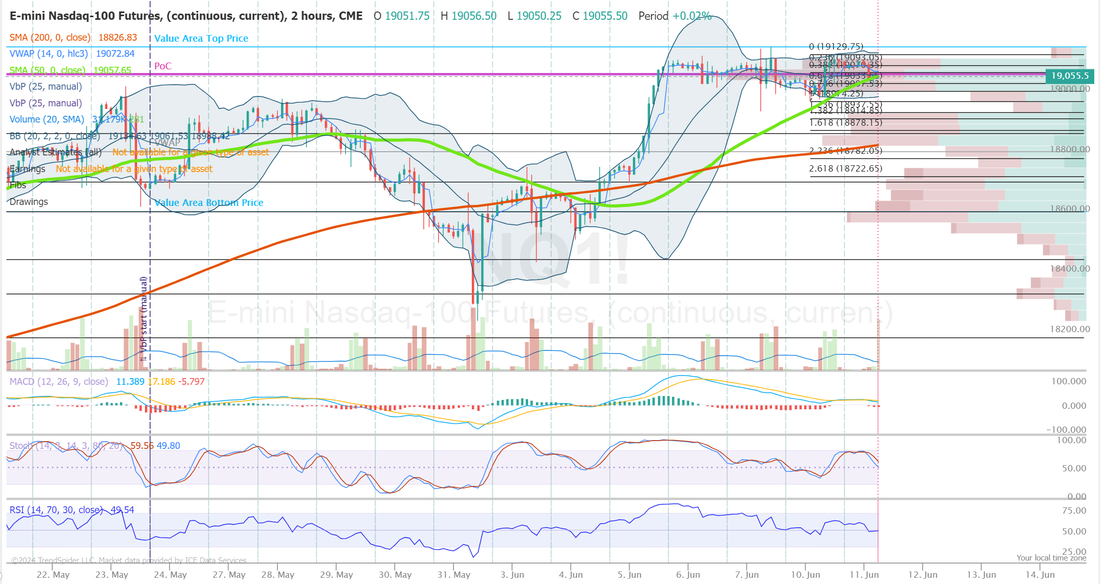

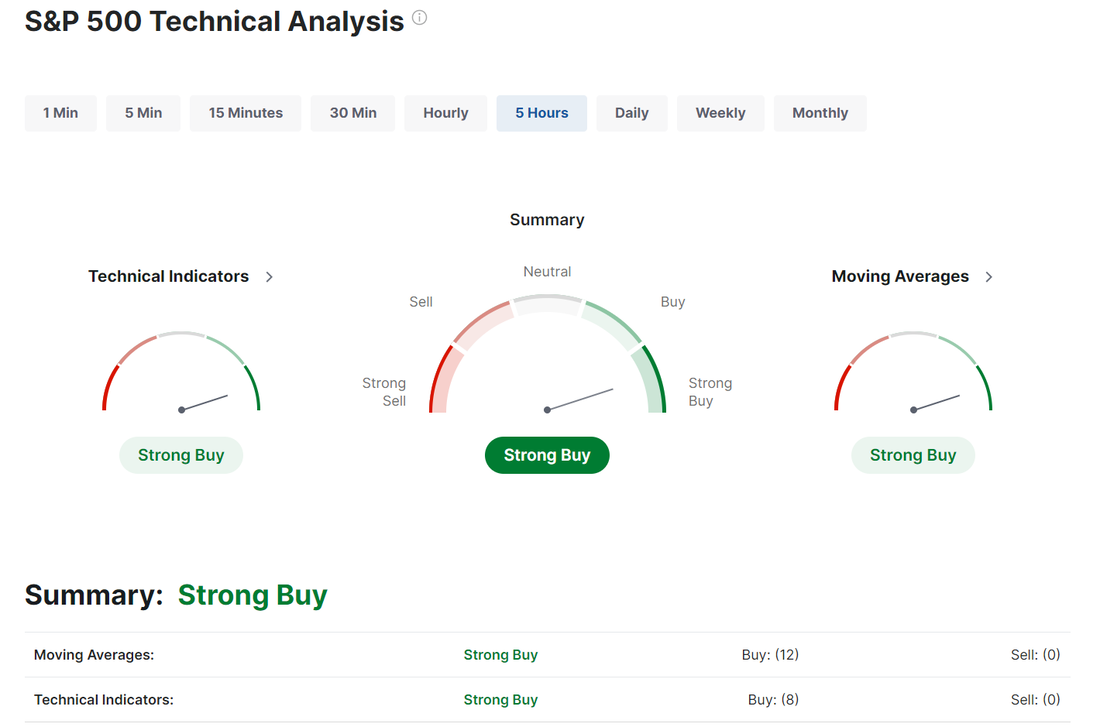

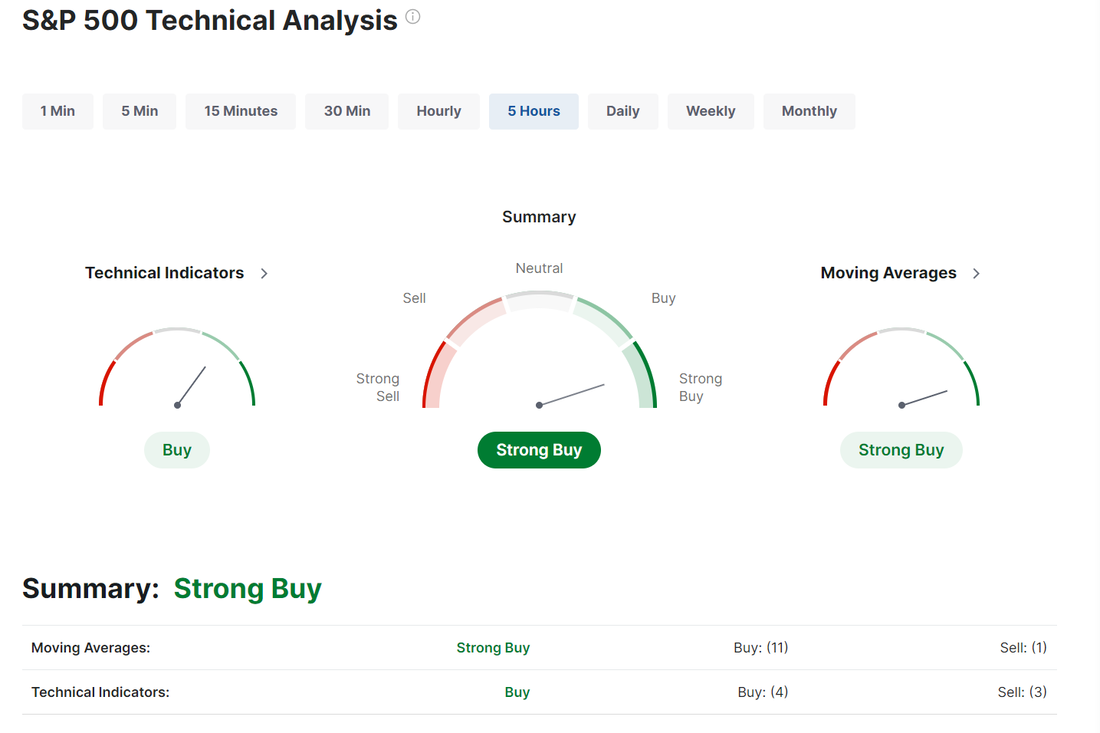

Good CPI/FOMC day my friends! Well, yesterday was either amazing for us, considering our platforms were down most of the day or, it was basically a day off. Just depends on how you look at it. TOS/Schwab was down most of the day and I was having execution issues on Tasty for scalping so this is the sum total of what we did yesterday: We were able to get four 0DTE's working with our Kalshi event contract broker. A 14% ROI and almost $300 profit is better than a poke in the eye with a sharp stick...all things considered. Today however? Well, this should be a different day. No charts. No levels. No lean bias for me today. We have a unique, dual-fold catalyst today with CPI inflation numbers our pre-market and then FOMC and Powell to finish off the day. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. With the Fed widely anticipated to hold borrowing costs at a two-decade high for a seventh straight meeting, the focus will shift to policymakers’ quarterly rate projections, known as the “dot plot,” and Chair Jerome Powell’s post-decision press conference. According to the median estimate in a Bloomberg survey, a 41% plurality of economists anticipate the Fed signaling two cuts in the closely watched “dot plot,” while an equal number expect the forecasts to indicate just one or no cuts at all. “We expect Fed Chair Powell and company to maintain a position that stresses potential rate cuts remain contingent on the committee seeing further progress made on bringing down price pressures,” said Anthony Saglimbene at Ameriprise. U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting and a 48.3% chance of a 25 basis point rate cut at September’s policy meeting. On the earnings front, California-based semiconductor giant Broadcom (AVGO) is slated to report its Q2 earnings results today. On the economic data front, investors will direct their attention to the U.S. consumer inflation report. Economists, on average, forecast that the U.S. May CPI will come in at +0.1% m/m and +3.4% y/y, compared to the previous numbers of +0.3% m/m and +3.4% y/y. The U.S. Core CPI data will also be closely watched today. Economists anticipate the Core CPI to be +0.3% m/m and +3.5% y/y in May, compared to the previous figures of +0.3% m/m and +3.6% y/y. What will the market do today? It's interesting that while the SPY is hitting new ATH's the internals are weakening. Maybe the ultimate pairs trade is short tech and long commodities? Has stagflation been confirmed? Second reading of US Q1 2024 GDP just fell to 1.3%, below the initially reported growth of 1.6% last month. This is ~60% less than the 3.4% growth seen in Q4 2023. This downward GDP revision primarily reflected slower consumer spending of -2.0%, down from previously reported +2.5% expansion. Meanwhile, the Core PCE Price Index hit 3.6%, up sharply from its 2.0% reading in Q4 2023. A weakening economy with rising inflation is the worst outcome for the Fed. Is the Fed trapped? One thing is for sure. Volume data on SPY has been absolutely horrible! The SPY and QQQ look priced for perfection and the IWM and DIA look like they could roll over and die. Somethings got to give here and today may very well do that day. With no levels or bias today, here's our trade plan and docket: We've cleared out a lot of "closet space" yesterday and have plenty of dry powder to work today. Our approach won't be much different today than it is every FOMC/Powell day. We have the SPX debit 0DTE still working. I'll cover that this morning with a smaller position. We'll also put a very small, very asymmetrical 0DTE on the SPX as a stand alone with the goal of getting an early exit before FOMC. We are also looking to get a Theta fairy on before CPI comes out. Then...we just sit on our hands for most of the day. 20 minutes into Powells testimony we'll start hitting our trades and we have a bunch! All our ladder trades. Bonds/Oil/DIA/GLD. All our credit strangles FSLR, WYNN, ORCL, CRM, PLTR, PYPL, SHOP. Earnings plays on AVGO and PLAY. All seven 0DTE's. Our SPY/QQQ 4DTE's. Its going to be a hectic end of the day. Trade to trade well today my friends. See you all in the live zoom!

0 Comments

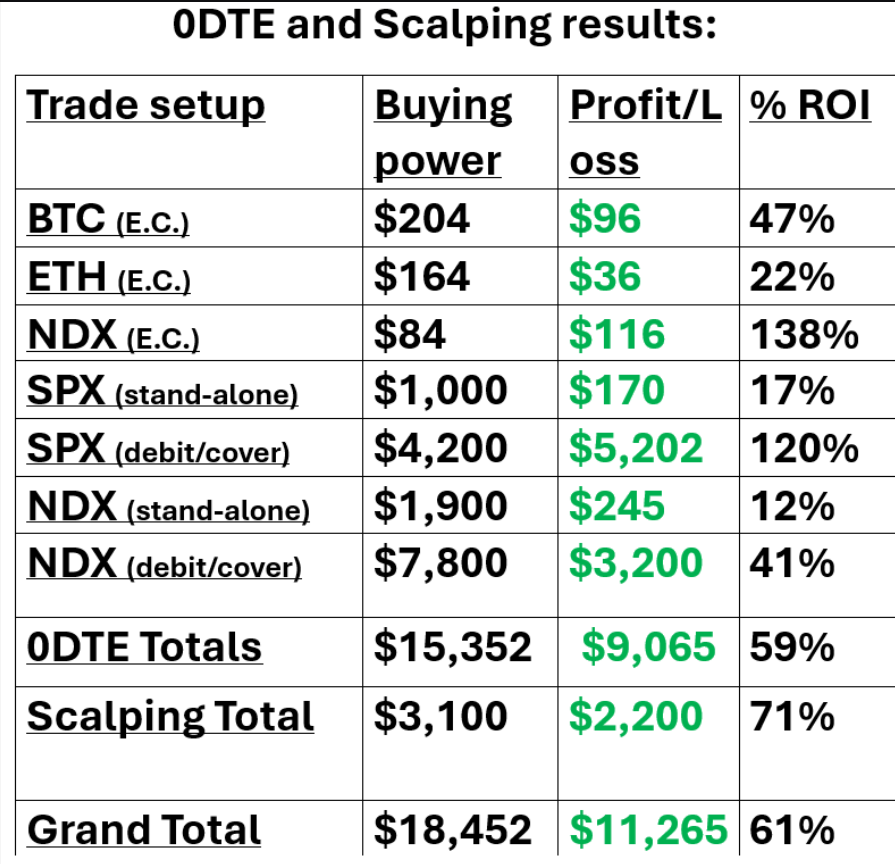

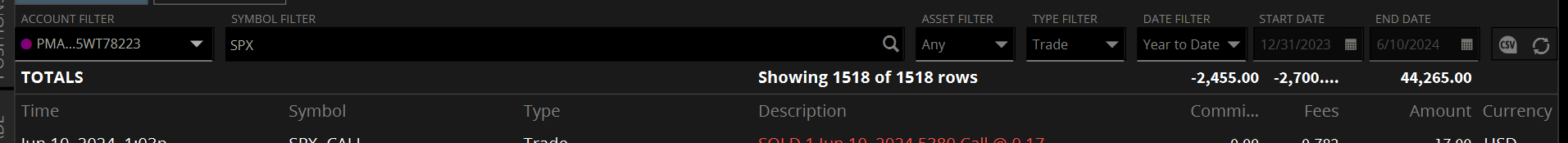

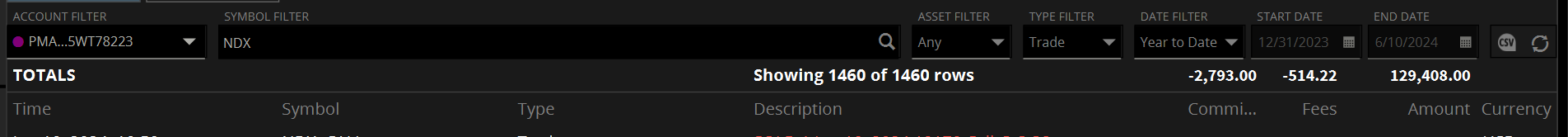

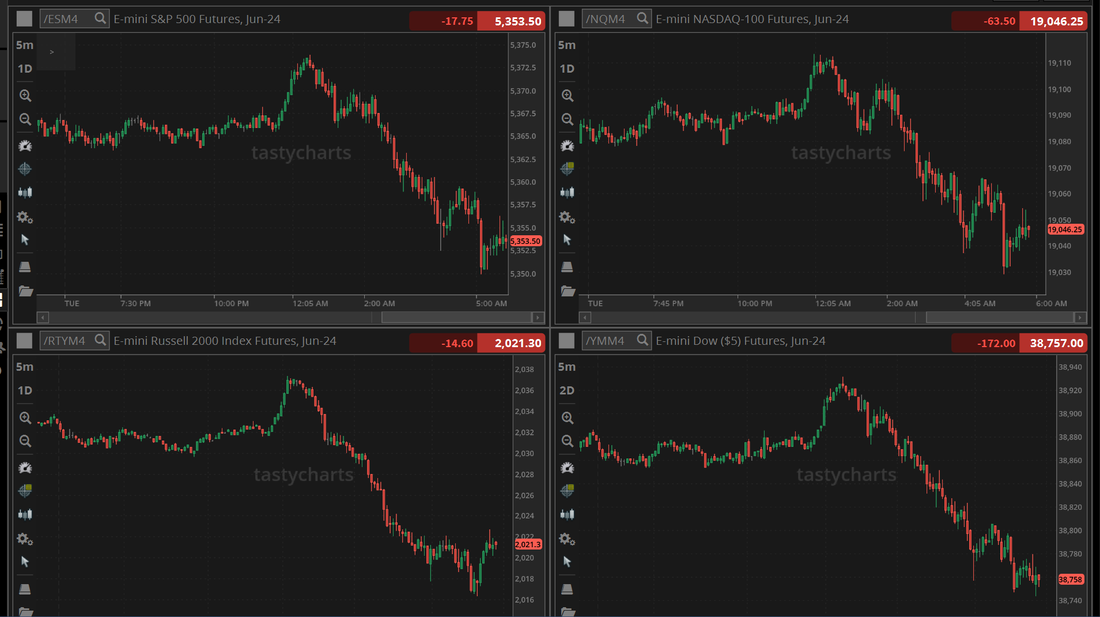

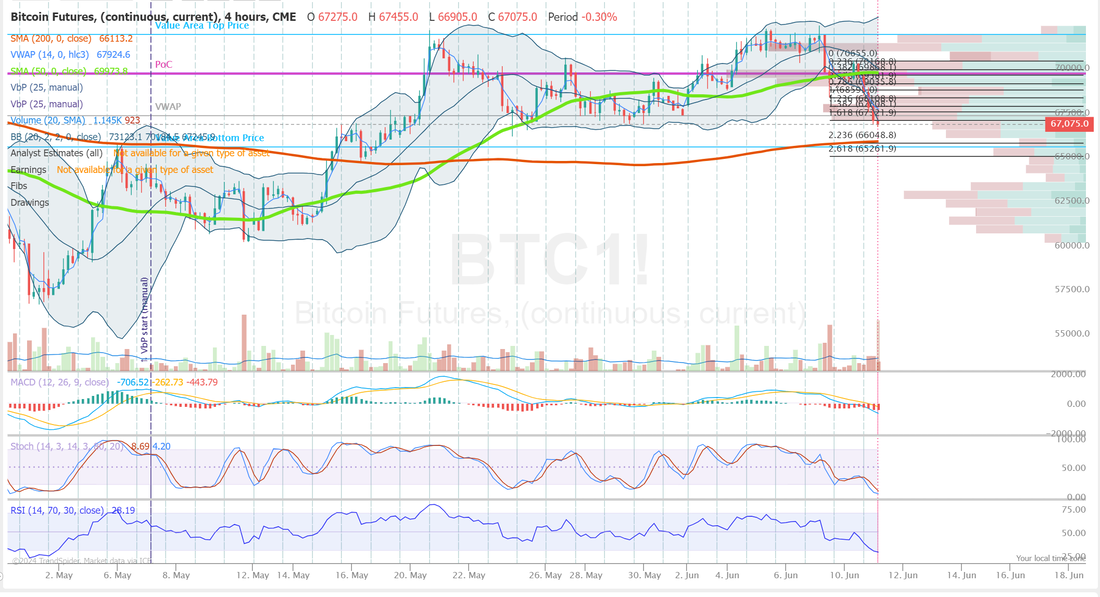

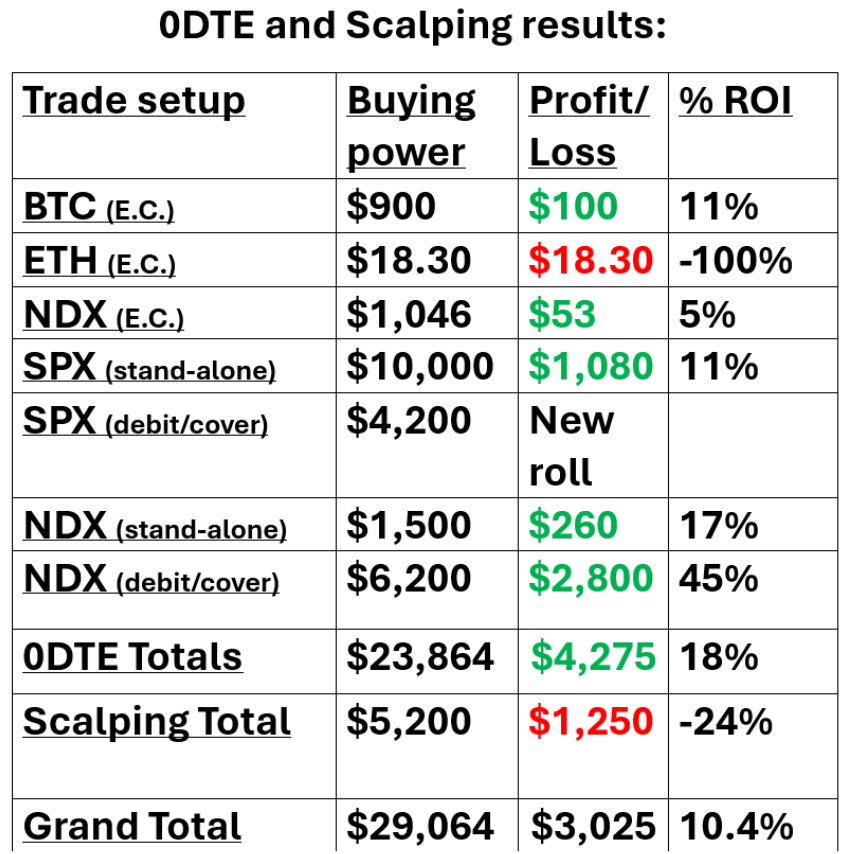

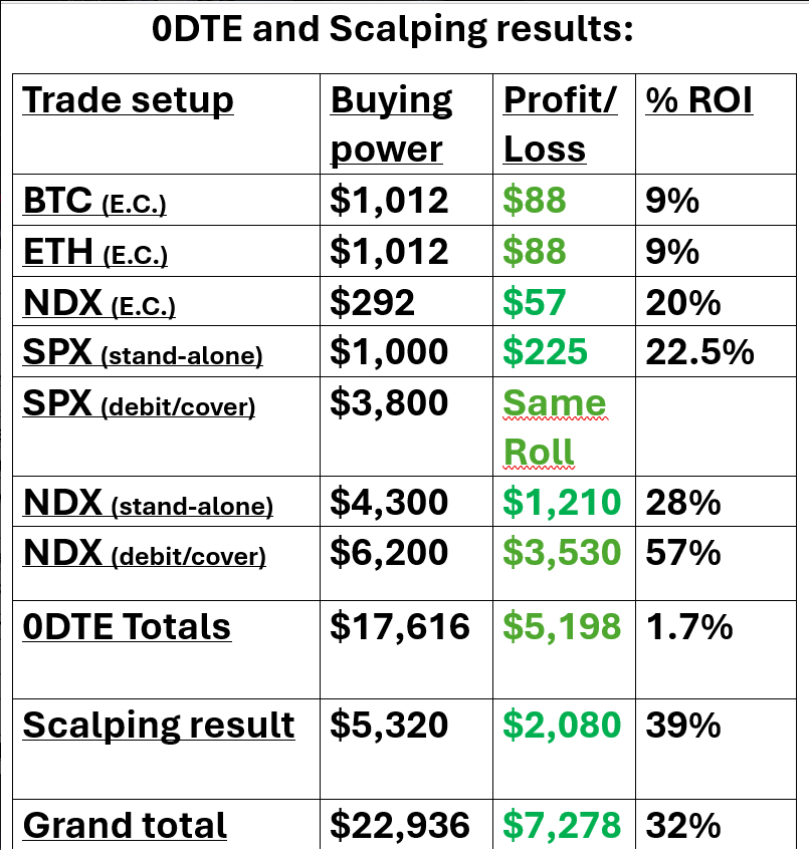

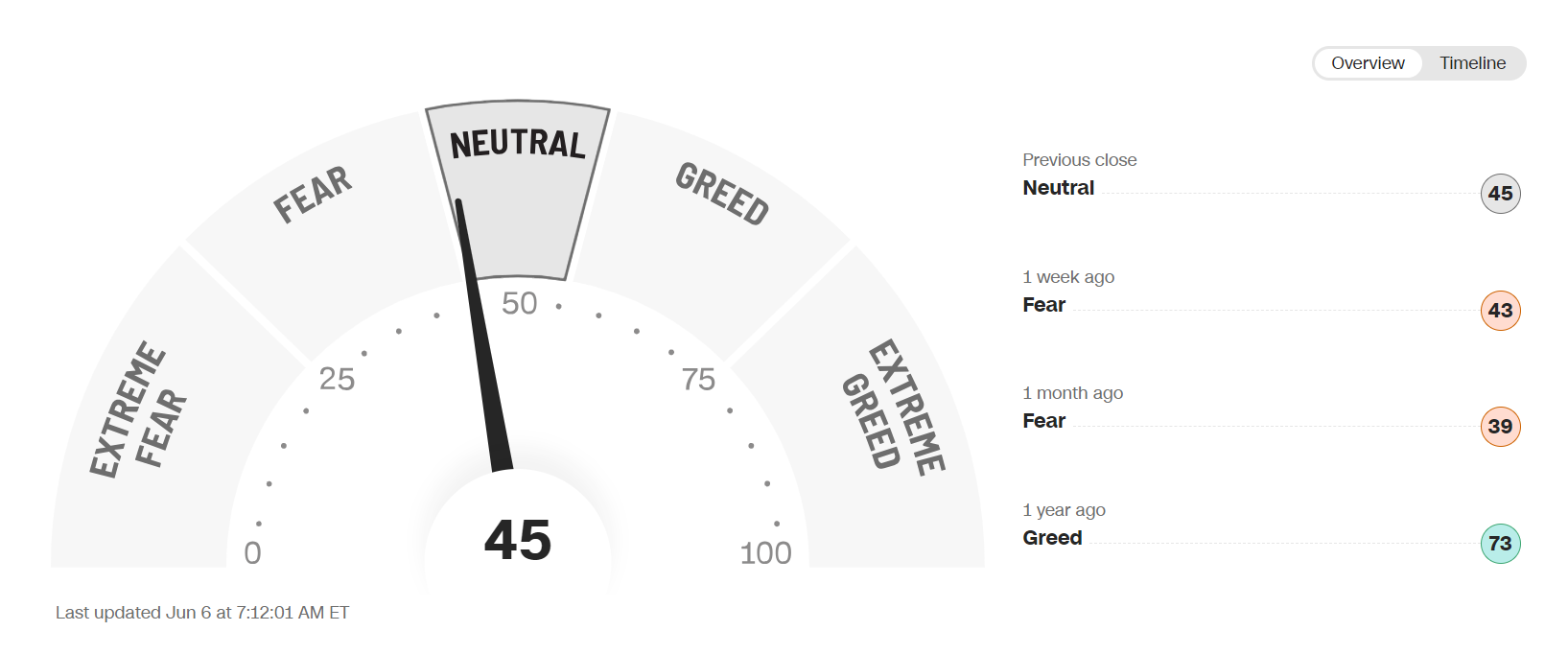

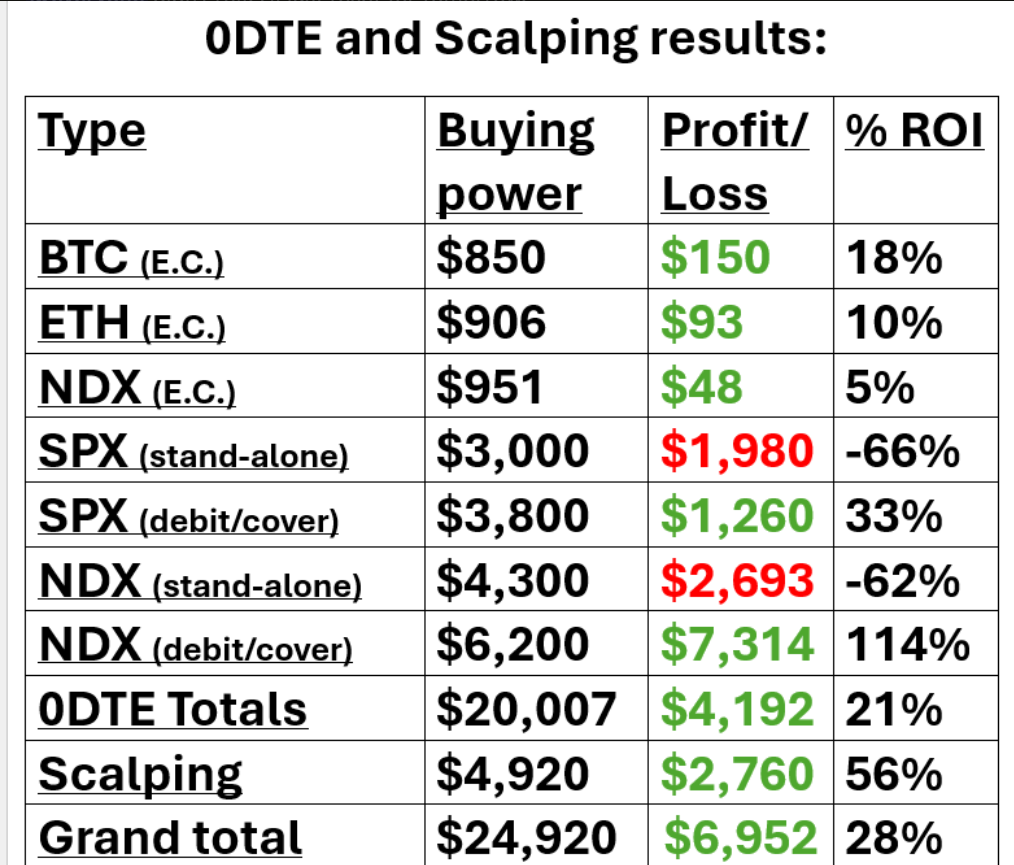

Welcome back folks. What an absolute fantastic, picture perfect day for us yesterday. I can't even express how far ahead of our pro-forma goals we are. This is just fantastic. Here's a quick snap shot of our seven 0DTE's and scalping from yesterday: That outsized gain on our SPX debit setup has been building since last Thursday , with two rolls but finally realized and booked the proift yesterday. We've talked about the potential for us to make as much as $500,000 dollars profit this year from all seven of our daily possible 0DTE setups and our now daily effort with scalping. It seems almost fantastical and well, a pipe dream, to be honest, but guess what? That pretty close to what we are on pace for. If our numbers hold through the first six months of this year we will be very close to $200,000 documeted profits on our 0DTE's. Our four standard SPX/NDX setups are close to $170,000 pure profit now and our three Event contract 0DTE's have added another approx. $6,000 of profit. With some good fortune, we could finish the month off very close that that $200,000 goal. Our scalping is continuing to produce results above expectations. Moving to five days a week we've reset our income target to $100,000 for a 12 month period vs. the $50,000 target we had with just two days a week effort. I know there are some amazing traders out there but I have to believe that these results put us up against the very best of the best. I'm extremely proud of what we've accomplished and I'm always thrilled when our members express how grateful they are to have found us. This is a special community of solid people. I appreciate all of you who contribute to the programs success. If you would like a free peek at how we are achieving this come hang out for a week at no -charge and see what we do. If you're just interested in scalping and don't want to trade full time and are happy with the potential for an extra $100,000 a year in income go here: Lets take a look at the markets: Markets continue to stall here. Most likely awaiting the dual catalyst of CPI/FOMC Weds. Futures are down as we speak The Federal Reserve kicks off its two-day meeting later in the day, with investors widely anticipating the U.S. central bank to hold borrowing costs steady on Wednesday for the seventh consecutive gathering. Investor attention will center on the Fed’s new “dot plot” in its Summary of Economic Projections, which displays Federal Open Market Committee member projections regarding the trajectory of interest rates. Market participants will also pay close attention to Fed Chair Jerome Powell’s post-decision press conference for hints about when the Fed might cut interest rates. Meanwhile, a 41% plurality of economists anticipate the Fed signaling two cuts in the closely watched “dot plot,” while an equal number expect the forecasts to indicate just one or no cuts at all, according to the median estimate in a Bloomberg survey. Investor focus also rests on the May reading of the U.S. Consumer Price Index, set for release on Wednesday, which is expected to show that headline inflation remained steady from April at +3.4% y/y. At the same time, U.S. May underlying inflation is expected to ease slightly to +3.5% y/y from +3.6% y/y in April. “The interest-rate guessing game goes on,” said Chris Larkin at E*Trade from Morgan Stanley. “Even the friendliest inflation numbers probably won’t push the Fed to act any sooner than September.” U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 50.0% chance of a 25 basis point rate cut at the September meeting. On the earnings front, Texas-based software giant Oracle (ORCL) is scheduled to report its Q4 earnings results today. The U.S. economic data slate is mainly empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.433%, down -0.85%. Our trade docket for today is stlll light until we get past Powells testimony. /HG, DELL, DIS, DJT, FSLR, all 7 0DTE's, SMCI, ORCL, GME. My bias today is bearish, once again. Until we get past Powells testimony on Weds. there isn't much insentive for bulls to stick there necks out. Intra-day levels for me: /ES; 5365/5373/5383/5398 to the upside. 5352/5344/5332/5325 to the downside. /NQ; 19090/19132/19155/19226 to the upside. 19033/18975/18934/18876 to the downside. Bitcoin; Bitcoin got hammered overnight. 69768 is resistance and 66073 is now new support. Be safe out there today folks and save up some buying power for Weds. It should be a doozy.

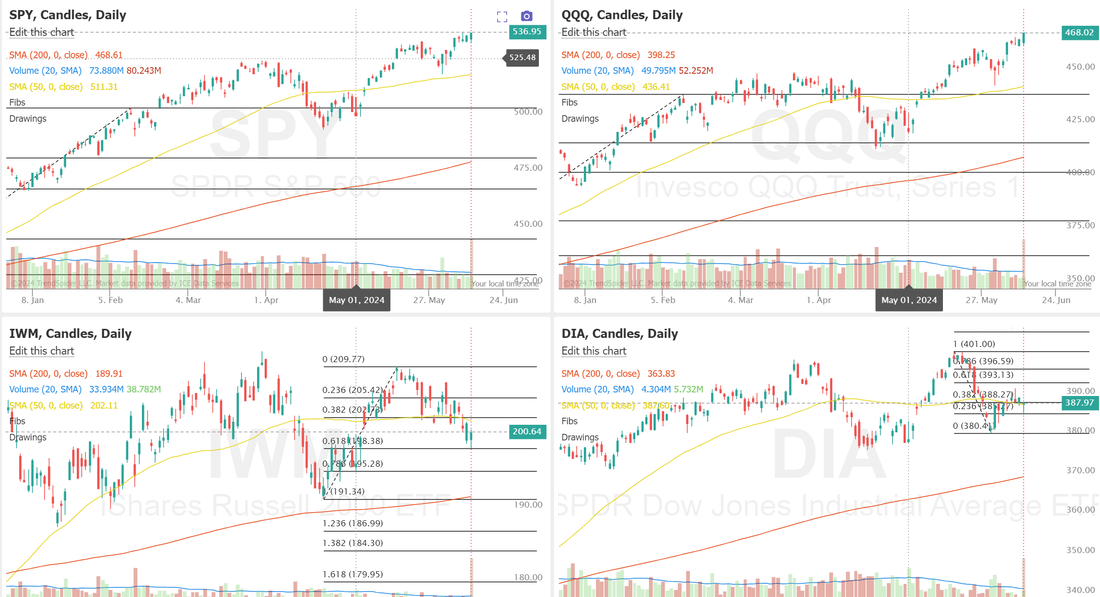

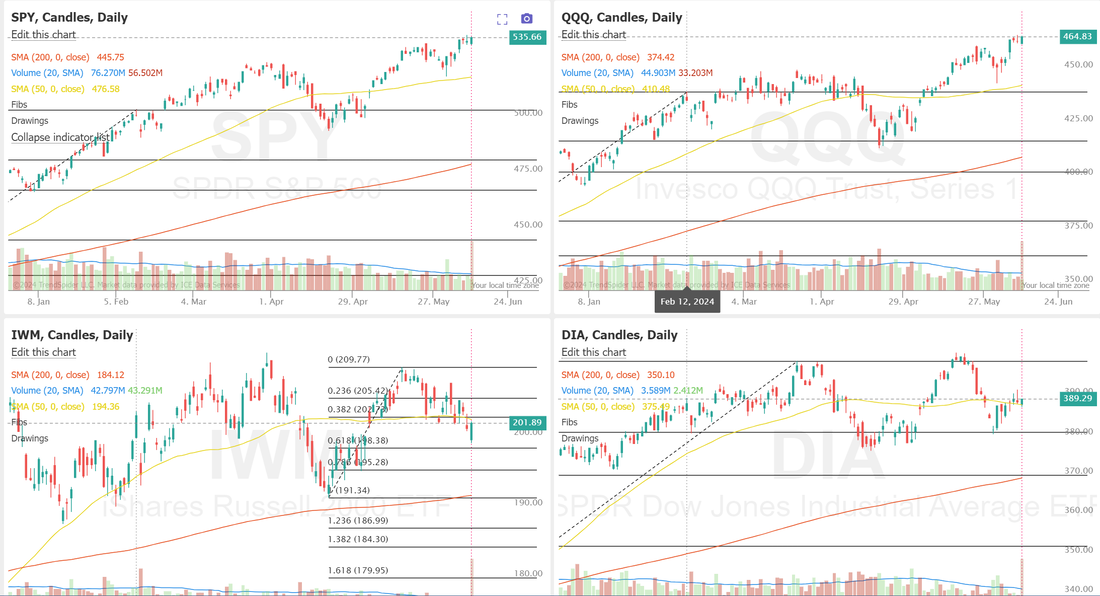

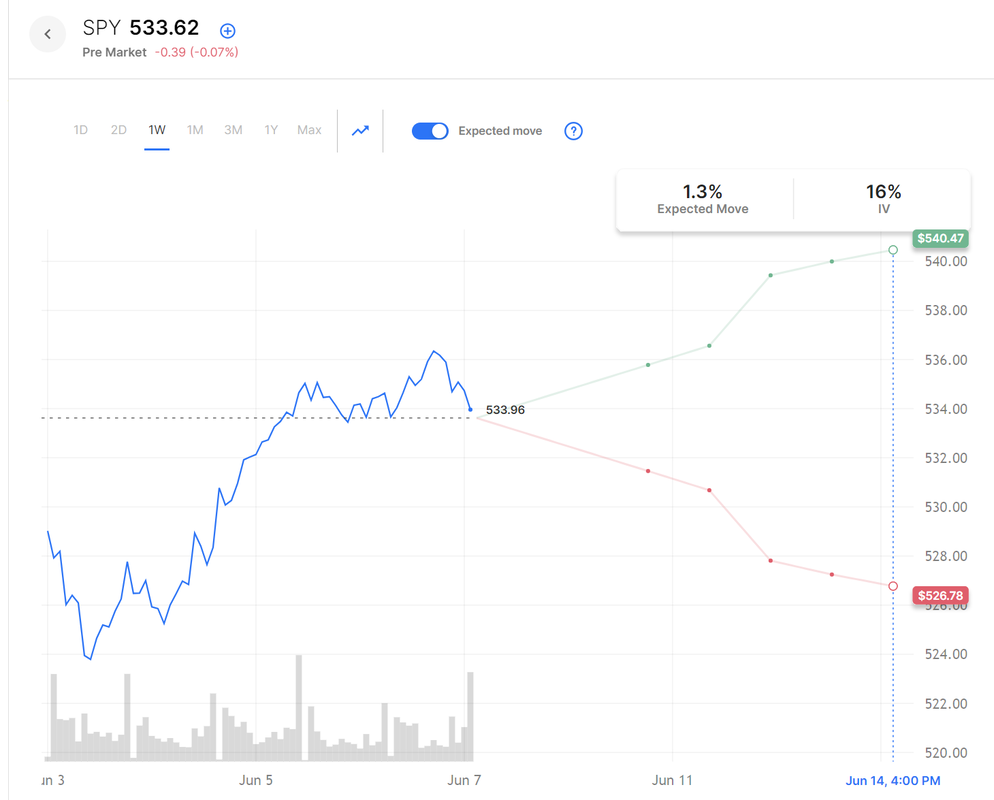

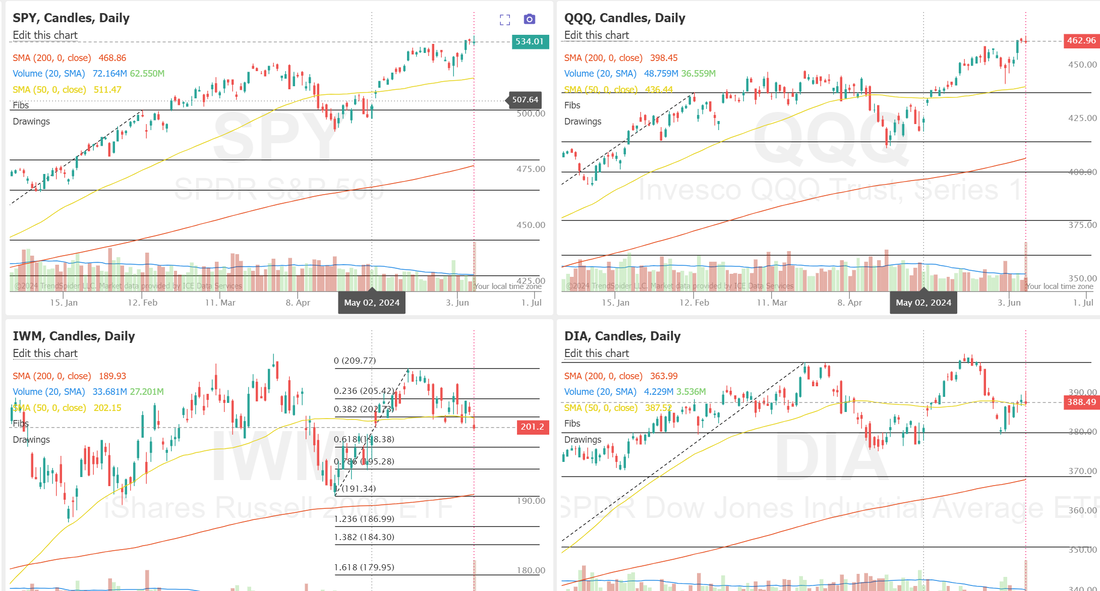

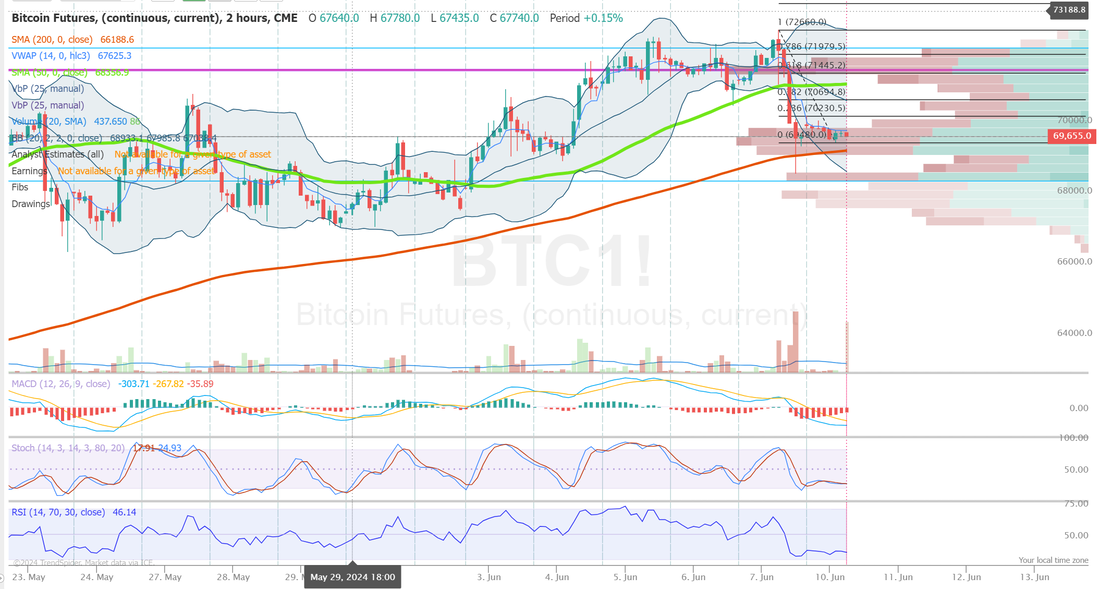

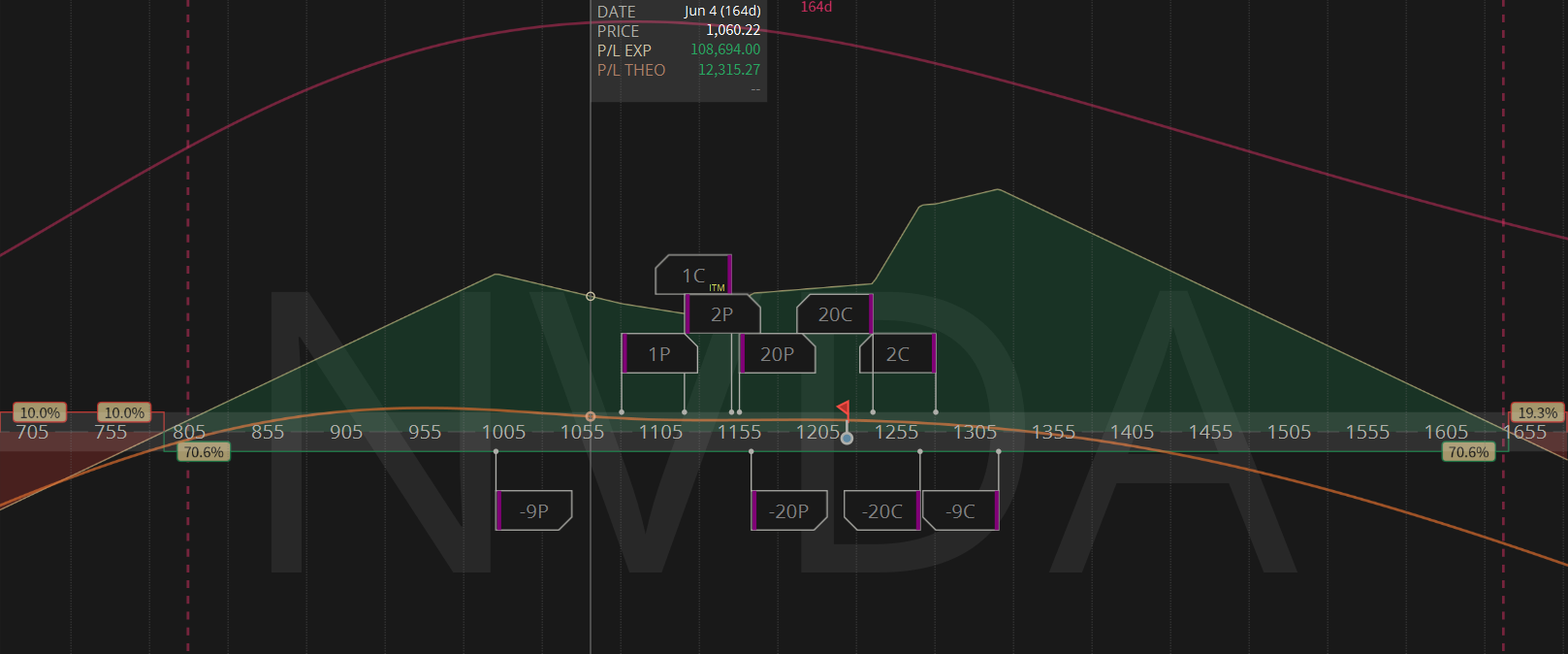

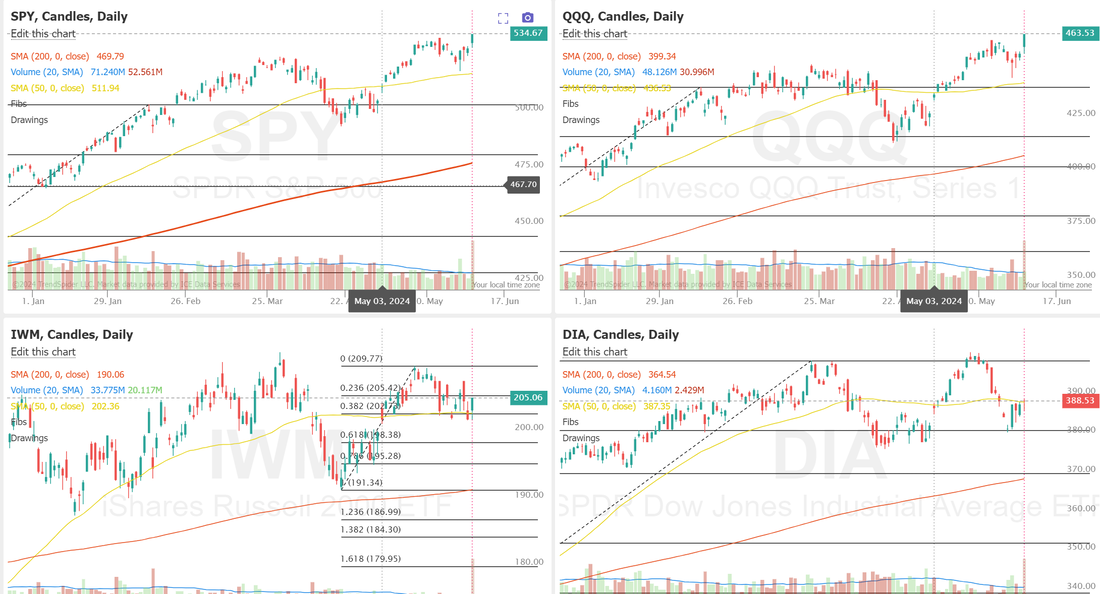

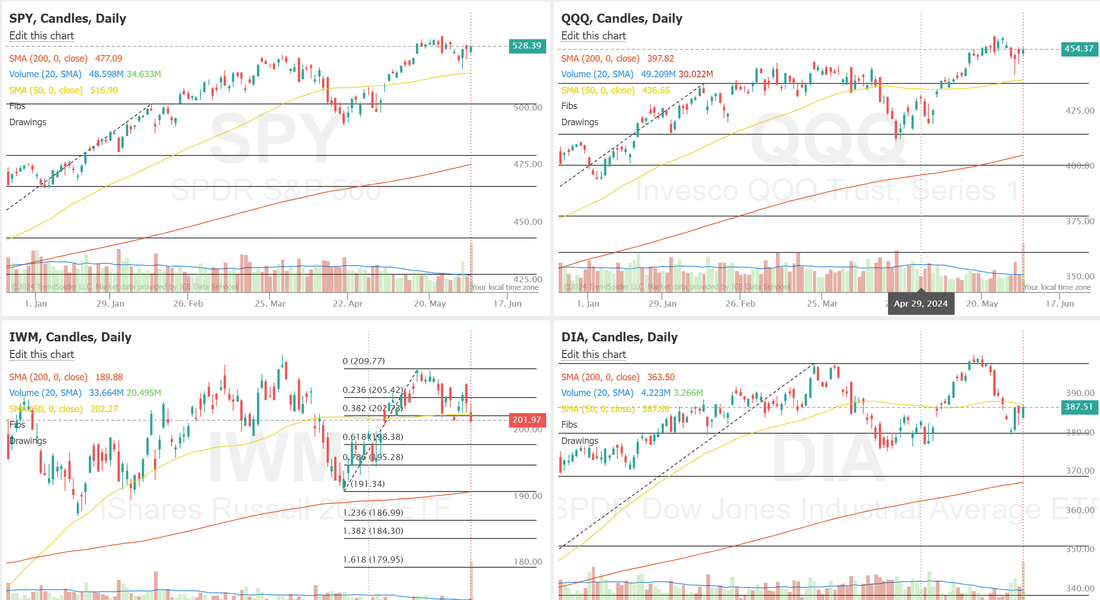

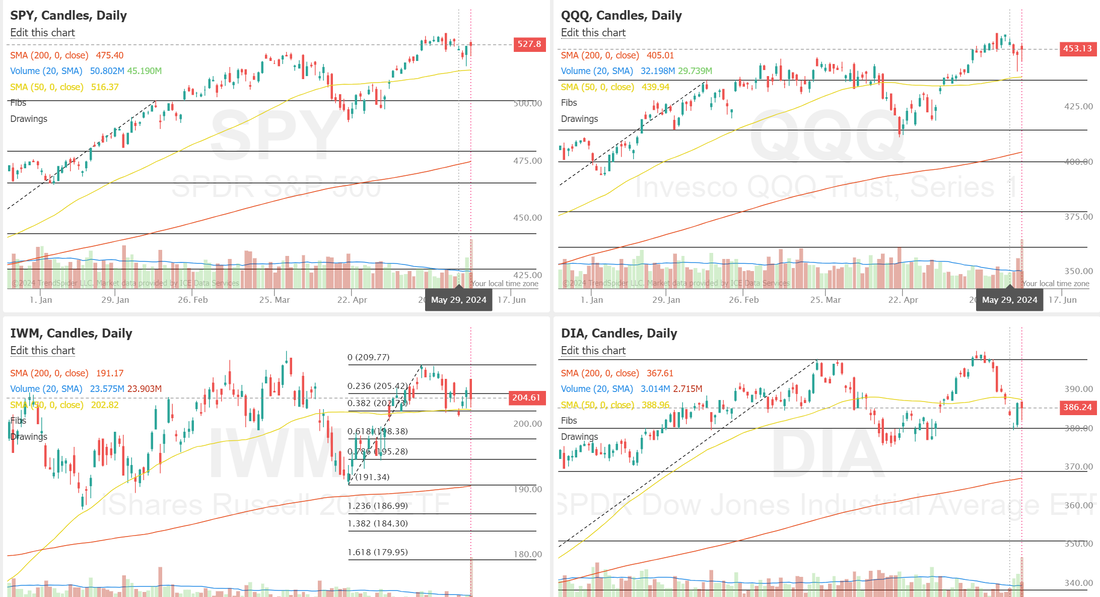

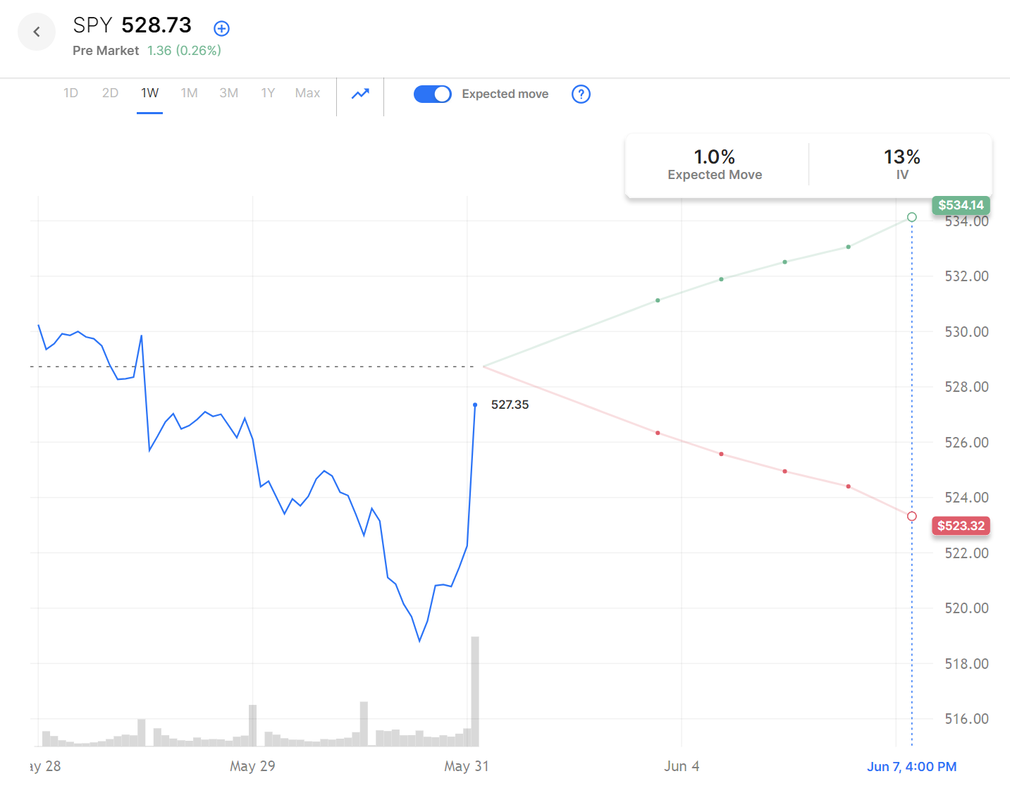

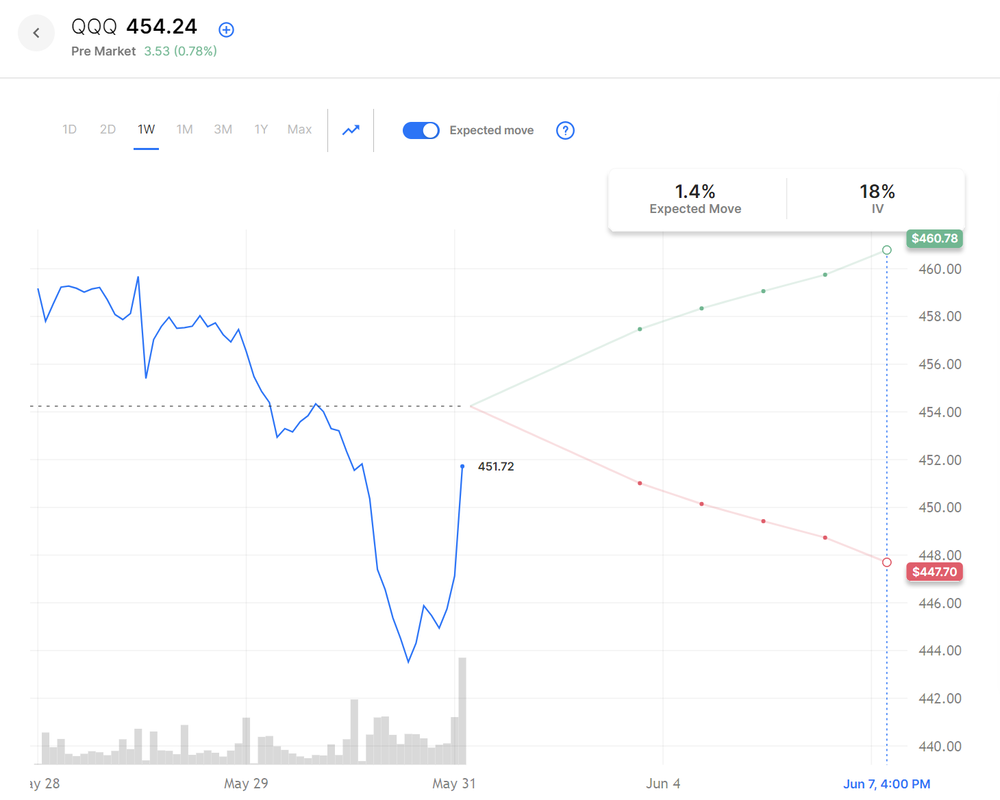

Welcome back traders. I hope you all had a great weekend. We had a nice finish to our week with Fridays results. It seems like a stretch, and everything would need to stay on track with no big drawdowns but... we are on track for almost $400,000 of income this year annualized out on our scalping/0DTE's. To say I'm thrilled with our results is an understatement. We've got a potential big payoff awaiting us today in our SPX rolled cover. It could be a nice start to the week. Lets take a look at the markets and price action; Firstly, some key items to watch. Roaring Kitty, the GME trader is back! If you haven't been following this saga and GME's price swings you owe it to yourself. This is better than an action flick and you don't have to pay to watch. I'm sitting on the sidelines for now but we've had great success shorting GME and AMC for that matter on these big pops to the upside. NVDA's 10 for 1 split is active today. While a split has no actual effect on a stocks fundamentals it should help us tremendously to continue our slow march to the exits on this trade. It will be much easier to reduce buying power now. Our trade continues to look good but it also continues to get pushed out in time....someday. Thursday we get the big vote result on Elon's pay package at TESLA. This could be a market mover for the stock. Of Course, we also have a potential monster of a day coming Weds. with BOTH CPI and FOMC in the same day! We may have a shot at some more Theta fairy setups this week. After several days retesting the March highs, the SPY managed to find its footing and push higher, closing the week at $534.01 (+1.26%). Additionally, MACD is back in positive territory, turning up and showing the beginnings of a bullish cross. Much like the SPY, the QQQ found clear support at the March highs and rallied to make new all-time highs on Friday and close the week at $462.96 (+2.72%). Additionally, a clear bullish cross up is visualized on MACD, a sign that this move could just be getting started. The doldrums returned for the small caps, which closed at $201.20 (-2.47%) this week after failing to push out of the handle. Despite last week’s relative strength, IWM has struggled since the bearish MACD cross in late May. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls climbed by 272K jobs last month, well above the 182K consensus. At the same time, the U.S. May unemployment rate unexpectedly rose to 4.0%, weaker than expectations of no change at 3.9%. Also, U.S. average hourly earnings came in at +0.4% m/m and +4.1% y/y in May, stronger than expectations of +0.3% m/m and +3.9% y/y. Finally, U.S. April consumer credit rose +$6.40B, weaker than expectations of +$9.30B. “[Friday’s] jobs report may lower rate-cut expectations,” said Bret Kenwell at eToro. “But at the end of the day, a strong labor market is hardly a bad thing - especially for an economy that’s so dependent on consumer spending.” The U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference will take center stage in the coming week. The Federal Reserve is anticipated to hold interest rates steady for the seventh straight meeting on Wednesday, shifting investor focus to the central bank’s quarterly “dot plot” in its Summary of Economic Projections, which displays Federal Open Market Committee member projections regarding the trajectory of interest rates. The updated “dot plot” is likely to indicate two 25-basis point cuts this year, down from three cuts projected in March. Meanwhile, U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at the July FOMC meeting and a 43.4% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. On the economic data front, the U.S. consumer inflation report for May will be the main highlight. Also, market participants will be monitoring other economic data releases this week, including the U.S. Core CPI, PPI, Core PPI, Crude Oil Inventories, Initial Jobless Claims, Export Price Index, Import Price Index, and Michigan Consumer Sentiment Index (preliminary). On the earnings front, major companies like Adobe (ADBE), Oracle (ORCL), and Broadcom (AVGO) are set to report their quarterly figures this week. In addition, several Fed officials will be making appearances this week, including Williams, Goolsbee, and Cook. The U.S. economic data slate is mainly empty on Monday. I.V. for this week is MUCH better than last week, thanks to CPI and FOMC. I'll go over out trade docket today in our live zoom feed. It's hard to say what we can do today until we get a market open because our buying power is artifically inflated right now with the NVDA split. Once that balances out we'll know how much BP we have to work with. My bias to start off the week is bearish. I think the current FED trend of continuing to push of rate cuts continues this week. The divergence in the major indices we trade continues with the SPY and QQQ holding near highs and the IWM and DOW still stuck under their 50DMA. Intra-day levels for me: /ES; 5366/5375/5386/5396 to the upside. 5349/5338/5318/5303 to the downside. /NQ; 19043/19086/19115/19155 to the upside. 18973/18939/18863/18843 to the downside. Bitcoin: We continue to trade in a very tight range. Look for a break out soon. Resistance is 72,660. Support is 68,406. Have a great day folks. See you in the trading room shortly.

Welcome back to Friday! We had a picture perfect day yesterday. It's rare but everyone once in a while everything clicks at the same time. A: We got all seven of our possible 0DTE's working. B: They all hit for a profit. C: They all went out at max. gains. In addition to our 0DTE's we had an above avg. result with our scalping. Sentiment A global equity rally faltered ahead of key US jobs data, which could cement bets on when the Federal Reserve will begin to ease monetary policy. While traders were wary of placing large bets this morning, global stocks are poised to end a two-week losing streak. Rate-cut expectations have risen in the last week, boosted by a slew of weaker-than-expected US data, as well as easing by the Bank of Canada and the European Central Bank. Docket 08:30 ET US Employment Situation for May Nonfarm Payrolls – Median Forecast: 185k | Prior: 175k | Range: 258k / 120k Unemployment Rate – Median Forecast: 3.9% | Prior: 3.9% | Range: 4% / 3.8% Average Earning YoY – Median Forecast: 3.9% | Prior: 3.9% | Range: 4% / 3.8% Trade docket for today: 0DTE's, Scalping, , DOCU. My software is down this morning so no chart action to share. This will be short and sweet. Our goal today is to de-risk and get capital back for next Monday.

I hope you all have a good weekend. Welcome back traders! Yesterday was a mixed result day for me. Scalping was a bust and while we made money overall on our seven 0DTE's we rolled two of them. NVDA also hurt my net liq. We've rebalanced our setup. At this point, I'll probably be in this trade until I die! Some interesting stats on Nivdia, with yesterdays surge they have overtaken Apple as the most valuable company in the world. Three trillion dollar valuation! It's due for its 10-1 split tomorrow after the close. What will that do to the share price? Generally it's not been positive. Lets take a look at the markets: Buy mode is really kicking in now. Only the DOW is lagging. Although, it doesn't look like its full "risk on" mode. Overall market internals aren't the best either if you are bullish The gains over the last week have been concentrated on some big cap names. My lean today is neutral after yesterdays pop. Trade docket for today doesn't look too busy. We should have a nice take profit opening trade on our LULU earnings setup and then mostly focusing back on scalping and the seven potential 0DTE's. The remainder of our model portfolio doesn't look like it should need too much attention today. On the economic data front, investors will focus on U.S. Initial Jobless Claims data due later in the day. Economists estimate this figure to come in at 220K, compared to last week’s number of 219K. U.S. Unit Labor Costs and Nonfarm Productivity data will also be closely watched today. Economists forecast Q1 Unit Labor Costs to be at +4.7% q/q and Q1 Nonfarm Productivity to stand at +0.3% q/q, compared to the fourth-quarter numbers of +0.4% q/q and +3.2% q/q, respectively. U.S. Trade Balance data will be reported today as well. Economists foresee this figure to stand at -$76.20B in April, compared to the previous figure of -$69.40B. Intra-day levels for me: /ES; 5369/5373/5378/5411 to the upside. 5353/5346/5338/5323 to the downside. /NQ; 19111/19172/19230/19257 to the upside. 19071/19029/18976/18886 to the downside. Bitcoin; 74,580 is resistance. 67138 is support. Good luck today traders. Let's have a great day.

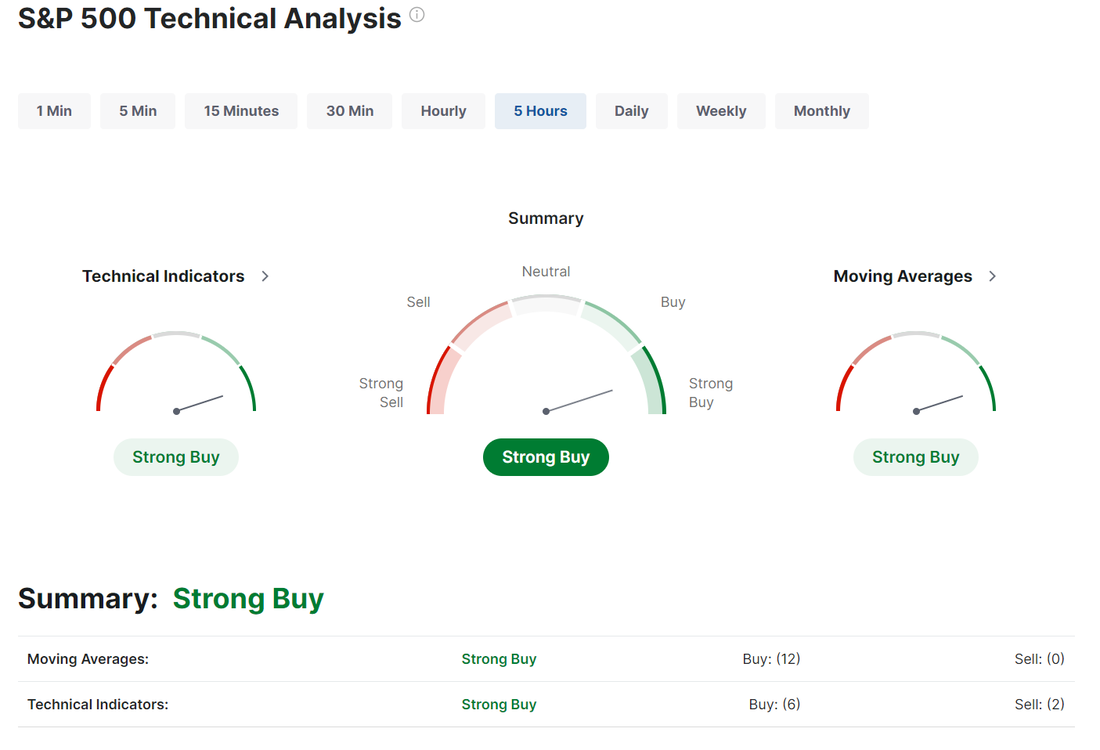

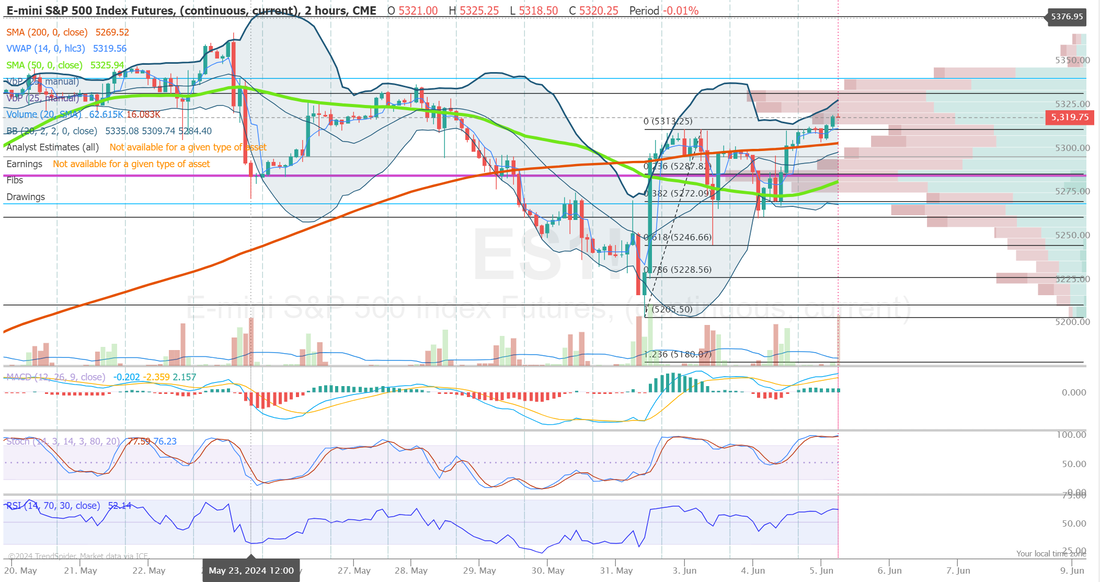

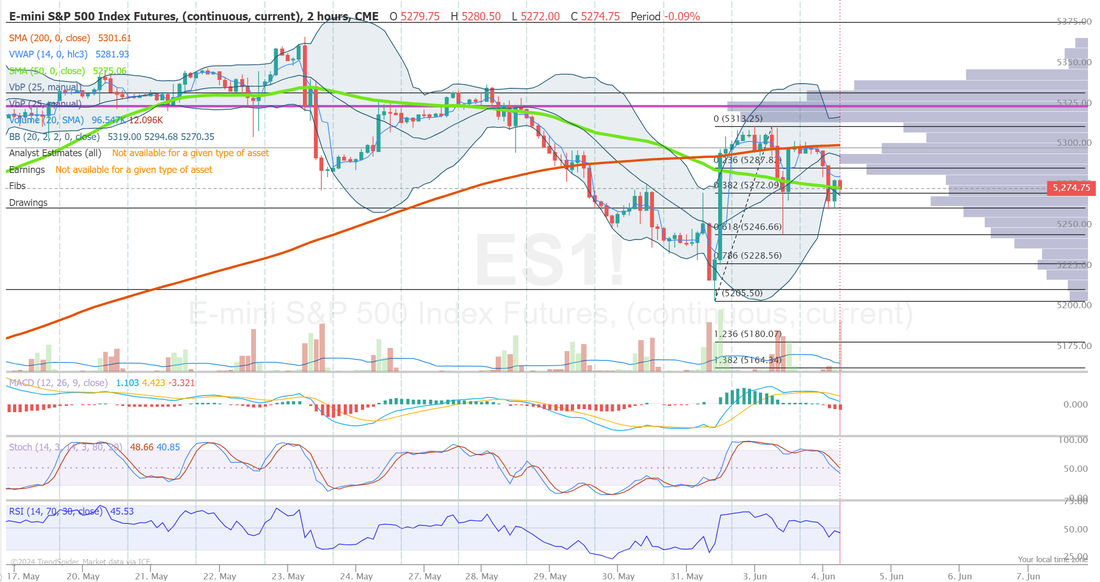

Welcome back traders. We are already approaching mid-week. Yesterday was a solid one for us. As you know, if you are in our live trading room, we've upped the ante with our 0DTE setups to a possible seven different opportunites each day. That combined with going to scalping five days a week means there is a greater focus and importance on them. I've put a matrix together to track our daily results and will start posting that here each day. I'm super proud of our 0DTE approach. I don't know if there is another program out there that offers as many opportunities on a daily basis and where they do more (return wise) with less (capital commitment). Let's take a look at the markets: une S&P 500 E-Mini futures (ESM24) are trending up +0.25% this morning following a positive session on Tuesday as a decline in U.S. job openings firmed up Federal Reserve rate-cut bets, with investors’ focus now turning to the ADP National Employment numbers due later in the day. A Labor Department report on Tuesday showed that U.S. JOLTs job openings fell to a 3-year low of 8.059M in April, weaker than expectations of 8.370M. At the same time, U.S. April factory orders rose +0.7% m/m, in line with expectations. “The evidence is accumulating that the Fed should begin easing,” said Ronald Temple, chief market strategist at Lazard. Meanwhile, U.S. rate futures have priced in a 0% chance of a 25 basis point rate cut at June’s policy meeting and a 16.5% probability of a 25 basis point rate cut at the July meeting. Also, U.S. rate futures have priced in a 55.3% chance of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. On the earnings front, notable companies like Lululemon Athletica (LULU), Dollar Tree (DLTR), Campbell Soup (CPB), and Five Below (FIVE) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. ADP Nonfarm Employment Change data in a couple of hours. Economists, on average, forecast that the May ADP Nonfarm Employment Change will stand at 173K, compared to the previous number of 192K. Also, investors will focus on the U.S. ISM Non-Manufacturing PMI, which arrived at 49.4 in April. Economists foresee the May figure to be 51.0. The U.S. S&P Global Composite PMI will come in today. Economists expect the May figure to be 54.4, compared to April’s value of 51.3. The U.S. S&P Global Services PMI will also be closely watched today. Economists foresee this figure to arrive at 54.8 in May, compared to 51.3 in April. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -2.100M, compared to last week’s value of -4.156M. Markets continue to entrench with a bullish bias. But I wouldn't say they bulls are safe. Both the IWM and DIA are still pinned underneath their repective 50DMA. SPY and QQQ are fairing better but still find themselves trapped under a pretty heavy resistance area. My bias today is bullish. When all the technicals point in the same direction you go with it. Trade docket today is light. Scalping, LULU?, /HG, BA, CRWD, DLTR, HPE, All seven 0DTE setups, WOOF. Intra-day levels: /ES; 5334/5342/5359/5367 to the upside. 5312* (key support level)/5305* (200 period MA)/5287*(PoC)/5272 to the downside. /NQ; 18867/18901/18957/19000 to the upside. 18755*(PoC)/18705/18638/18604 to the downside. Bitcoin; 73384 resistance. 67220 support. Good luck today traders. Trade safe.

Welcome back traders! Yesterday was a little bit of a continuation of Fridays price action. Erratic and tough to follow. We had a successful day with scalping. Two trades, 28 mins., $1,500 dollars profit. While we weren't able to get all our 0DTE's working, the ones we did yielded great results 17% on Event contract NDX, 4.3% on SPX and 25% on NDX. The race is on to see if we can get to the $200,000 profit mark by the end of July. Our 0DTE's continue to be just stellar and with our new additon using the SPX we have the opportunity to put on SEVEN, unique and different 0DTE's every day. I don't know of another trader, place or system that is doing this. Let's take a look at the markets. The markets swung back to buy mode. Can they mount an attack to get back to those March highs? It certainly seems like they are trying. Economic data on Monday showed that the U.S. ISM manufacturing index unexpectedly fell to 48.7 in May, weaker than expectations of 49.8. Also, the U.S. May ISM prices paid sub-index slipped to 57.0, weaker than expectations of 60.0. In addition, U.S. construction spending unexpectedly fell -0.1% m/m in April, weaker than expectations of +0.2% m/m. At the same time, the U.S. May S&P Global manufacturing PMI came in at 51.3 compared to the estimated 50.9 and 50.0 prior levels. “Bad news may no longer be good news. In recent months, investors have cheered weaker-than-estimated data based on expectations that it could accelerate the start of the Fed’s policy loosening. Investors are now reacting to soft data with fear,” said Jose Torres at Interactive Brokers. Meanwhile, U.S. rate futures have priced in a 0% chance of a 25 basis point rate cut at June’s monetary policy meeting and a 16.5% chance of a 25 basis point rate cut at the July FOMC meeting. On the earnings front, notable companies like Crowdstrike Holdings (CRWD), Ferguson (FERG), PVH (PVH), Hewlett Packard Enterprise (HPE), and Bath & Body Works (BBWI) are slated to release their quarterly results today. Today, all eyes are focused on the U.S. JOLTs Job Openings data in a couple of hours. Economists, on average, forecast that the April JOLTs Job Openings will come in at 8.370M, compared to the previous figure of 8.488M. U.S. Factory Orders data will be reported today as well. Economists foresee this figure to stand at +0.7% m/m in April, compared to the previous number of +1.6% m/m. My bias for today is Neutral. I don't see any levels being cleared, either on the support or resistance side yet that would imply we have a clear trend. Trade docket for today: /HE, BA?, IWM, XBI, DELL, DJT, GOOG, SPX/NDX/E.C. NDX/BTC/ETH 0DTE's, NVDA, SPY, WOOF. CRWD. Intra-day levels for me: /ES; 5288/5299/5312/5326 to the upside. 5271/5263/5247/5228 to the downside. /NQ; 18607/18636/18706/18759 to the upside. 18556/18443/18340/18293 to the downside. Bitcoin; 72,312 resistance. 66,124 support. Have a great day folks. Let's see if we can do it again with our 0DTE's.

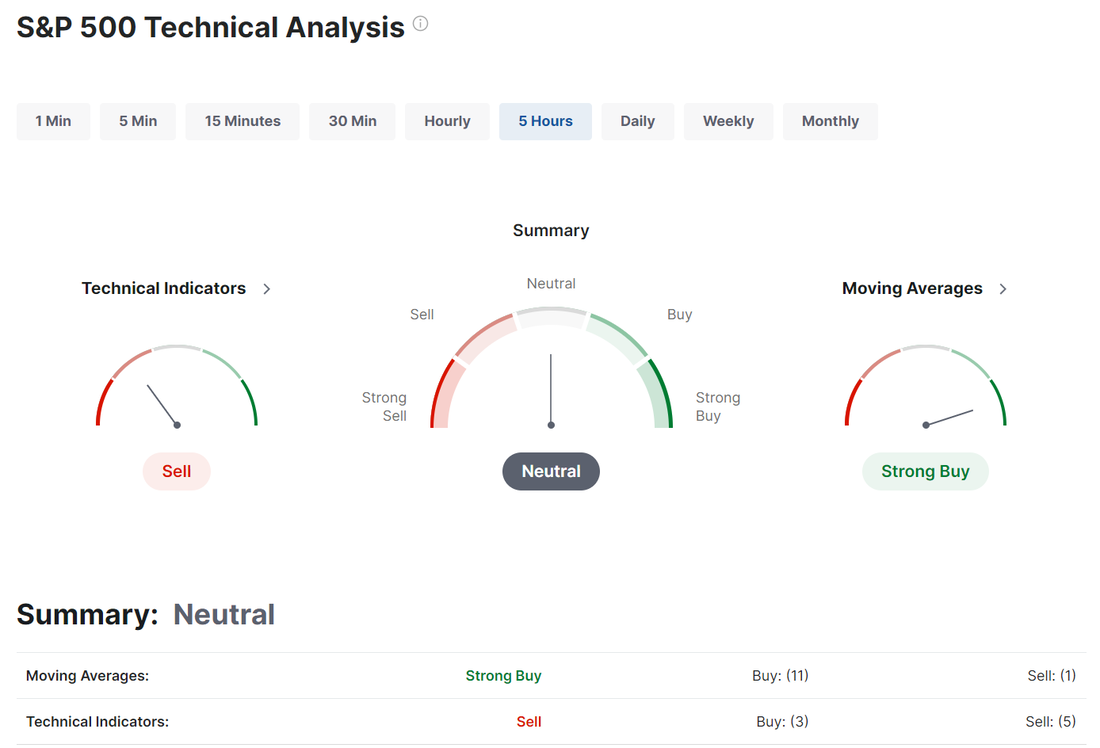

Welcome back to a new week and a new month of trading! I just got back from three days of my latest mastermind. I'm excited to share some of the ideas I got from it with you all in our live zoom session today! Fridays price action in the market was crazy, to say the least. It was also one of our biggest days ever for our NDX 0DTE with a massive win. This now puts our results for the year with just the NDX 0DTE alone well over $100,000 of profit. I'm absolutely thrilled with our results YTD. Let's look at the price action. Last week, as the indexes began to show weakness, all eyes were on the March highs. Bullish traders hoped those levels would provide strong support, and while things were initially looking dicey from the one-two punch of lower-than-expected GDP numbers on Thursday and PCE numbers on Friday, the week ended with a face-ripper rally and key levels being held. After failing below the March highs, the SPY looked to be weakening into the month’s end but a late-day rally on Friday allowed this index to find support at the 21-day EMA and close at $527.37 (–0.40%). Additionally, the new 14-day lows list recently flashed a hot reading above 50%, which has led to sharp bounces higher over the past year. Much like the SPY, QQQ struggled throughout the week, briefly trading below the March highs and the 21-day EMA. Despite that, the rally on Friday pushed this index to close the month at $450.71 (-1.58%), above both of those key levels. As has been the case throughout the last year, the percentage of names making new 14-day lows increases sharply, it has acted as a precursor to important bottoms. After multiple weeks of underperformance, IWM faired the best this week, going inside on the month and closing at $205.77 (+0.16%). Much like its peers, the price managed to find support at the 21 EMA despite 42% of names making new 14-day lows this week. We start the day off technically with a "reset" neutral rating. There's a good chance todays price action could swing us definatively one way or the other for our next trend bias. Expected moves in the market this week are about inline with what we've been getting. My bias, expecially after the strong rebound on Friday is slightly bullish, even with the neutral technical rating we start the day with. Potential market moving news today: 09:45 ET US S&P Manufacturing PMI Final for May Median Forecast 50.9 | Prior 50.9 | Range 50.9 / 50.8 10:00 ET US ISM Manufacturing PMI for May Median Forecast 49.7 | Prior 49.2 | Range 50.1 / 49 Trade docket for today: BA, CCL, CVS, DELL?, DIS, DJT, FSLR, SPX/NDX/E.C. NDX/ BTC/ETH 0DTE's, NVDA?, SMCI, SPY. Intra-day levels for me: /ES; 5314/5325 (PoC)/5334/5361 to the upside. 5303/5287/5272/5262 to the downside. /NQ: 18725(PoC)/18771/18827/18861 to the upside. 18668/18608/18575/18507 to the downside. Bitcoin: 73,232 resistance. 66,119 support. Let's shoot for another great day folks. Not to jinx us but our NDX setup from Friday is lookiing like a potential $6,000 profit day today if the bullish bias holds.

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |