|

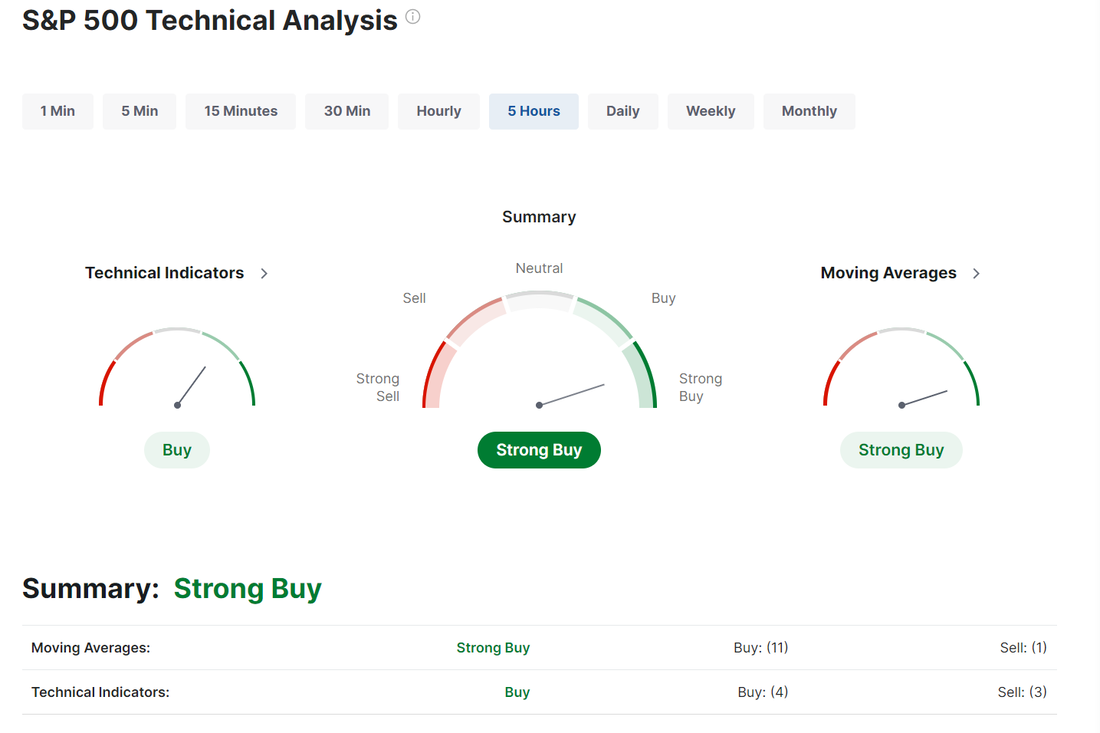

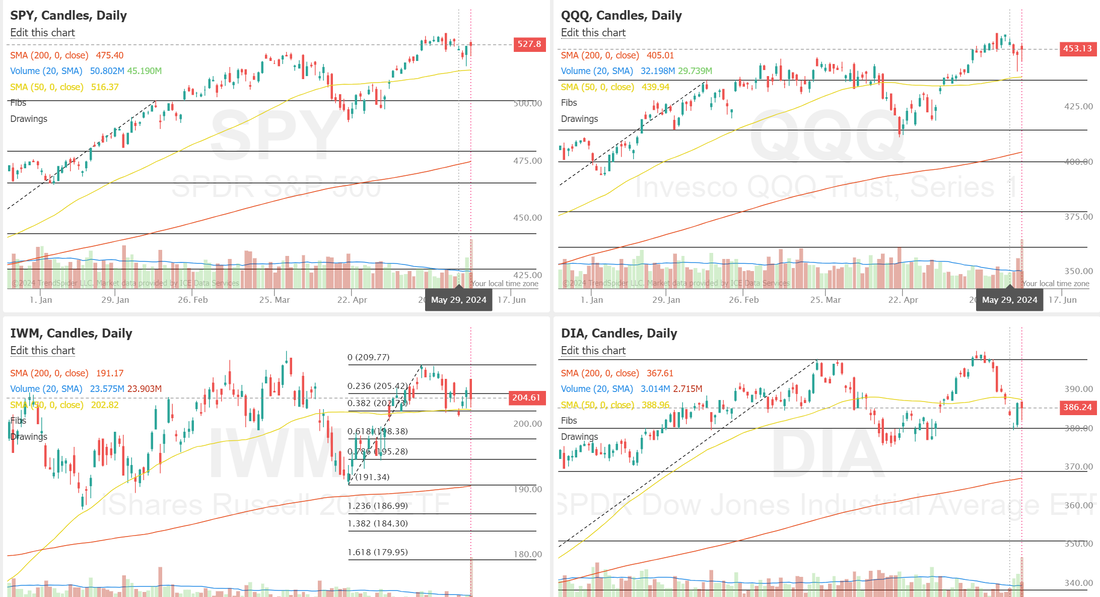

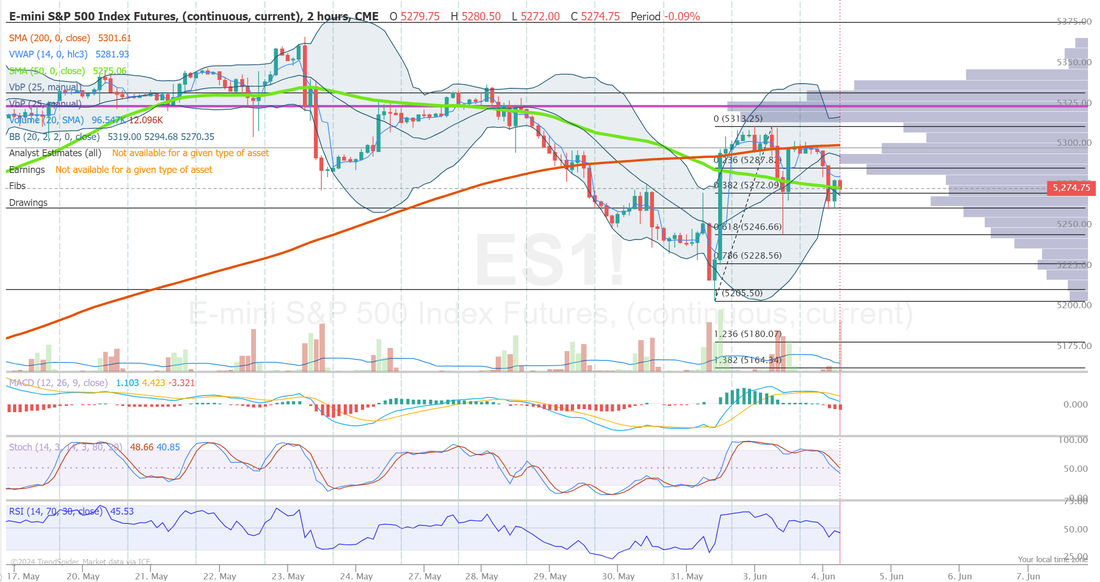

Welcome back traders! Yesterday was a little bit of a continuation of Fridays price action. Erratic and tough to follow. We had a successful day with scalping. Two trades, 28 mins., $1,500 dollars profit. While we weren't able to get all our 0DTE's working, the ones we did yielded great results 17% on Event contract NDX, 4.3% on SPX and 25% on NDX. The race is on to see if we can get to the $200,000 profit mark by the end of July. Our 0DTE's continue to be just stellar and with our new additon using the SPX we have the opportunity to put on SEVEN, unique and different 0DTE's every day. I don't know of another trader, place or system that is doing this. Let's take a look at the markets. The markets swung back to buy mode. Can they mount an attack to get back to those March highs? It certainly seems like they are trying. Economic data on Monday showed that the U.S. ISM manufacturing index unexpectedly fell to 48.7 in May, weaker than expectations of 49.8. Also, the U.S. May ISM prices paid sub-index slipped to 57.0, weaker than expectations of 60.0. In addition, U.S. construction spending unexpectedly fell -0.1% m/m in April, weaker than expectations of +0.2% m/m. At the same time, the U.S. May S&P Global manufacturing PMI came in at 51.3 compared to the estimated 50.9 and 50.0 prior levels. “Bad news may no longer be good news. In recent months, investors have cheered weaker-than-estimated data based on expectations that it could accelerate the start of the Fed’s policy loosening. Investors are now reacting to soft data with fear,” said Jose Torres at Interactive Brokers. Meanwhile, U.S. rate futures have priced in a 0% chance of a 25 basis point rate cut at June’s monetary policy meeting and a 16.5% chance of a 25 basis point rate cut at the July FOMC meeting. On the earnings front, notable companies like Crowdstrike Holdings (CRWD), Ferguson (FERG), PVH (PVH), Hewlett Packard Enterprise (HPE), and Bath & Body Works (BBWI) are slated to release their quarterly results today. Today, all eyes are focused on the U.S. JOLTs Job Openings data in a couple of hours. Economists, on average, forecast that the April JOLTs Job Openings will come in at 8.370M, compared to the previous figure of 8.488M. U.S. Factory Orders data will be reported today as well. Economists foresee this figure to stand at +0.7% m/m in April, compared to the previous number of +1.6% m/m. My bias for today is Neutral. I don't see any levels being cleared, either on the support or resistance side yet that would imply we have a clear trend. Trade docket for today: /HE, BA?, IWM, XBI, DELL, DJT, GOOG, SPX/NDX/E.C. NDX/BTC/ETH 0DTE's, NVDA, SPY, WOOF. CRWD. Intra-day levels for me: /ES; 5288/5299/5312/5326 to the upside. 5271/5263/5247/5228 to the downside. /NQ; 18607/18636/18706/18759 to the upside. 18556/18443/18340/18293 to the downside. Bitcoin; 72,312 resistance. 66,124 support. Have a great day folks. Let's see if we can do it again with our 0DTE's.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |