|

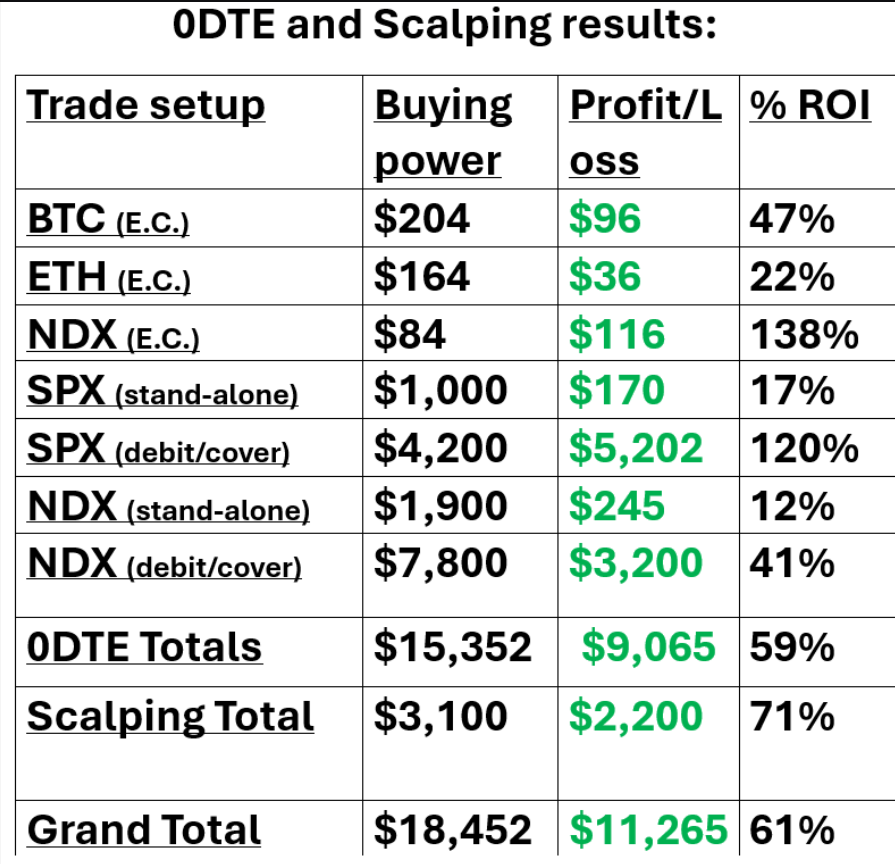

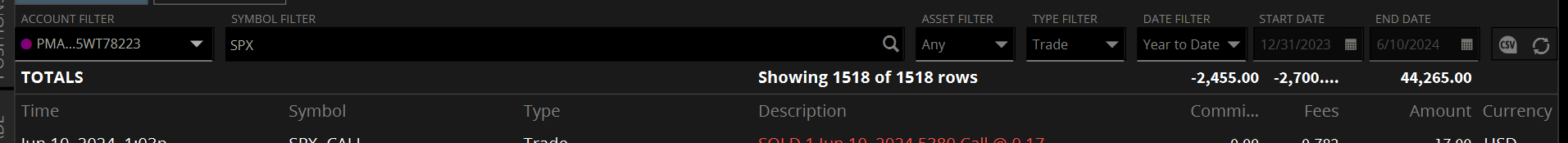

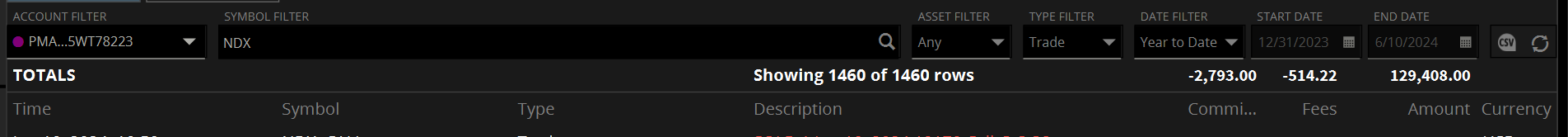

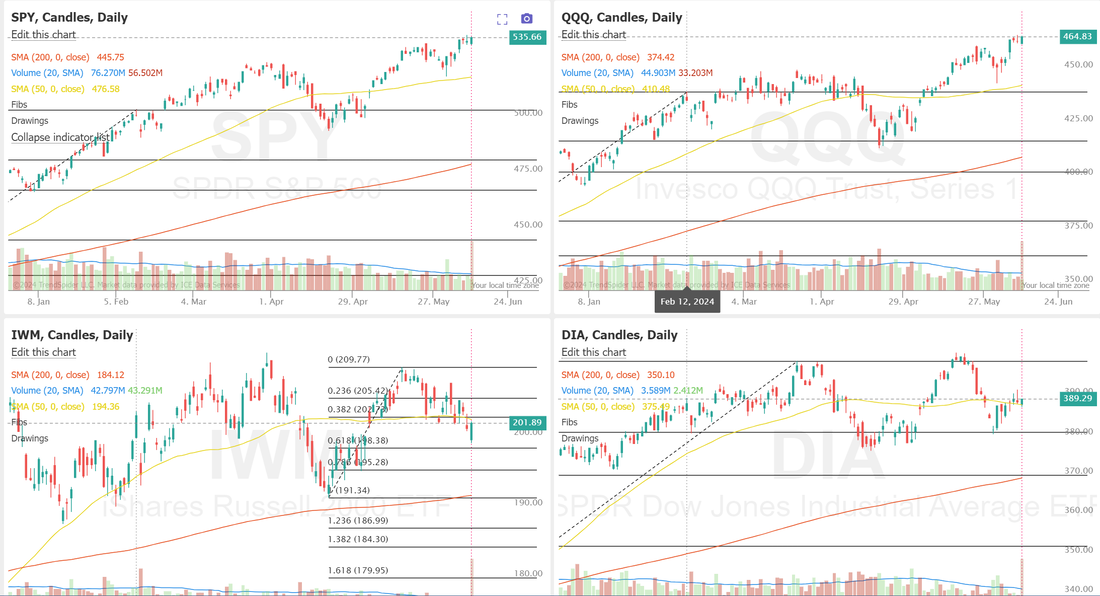

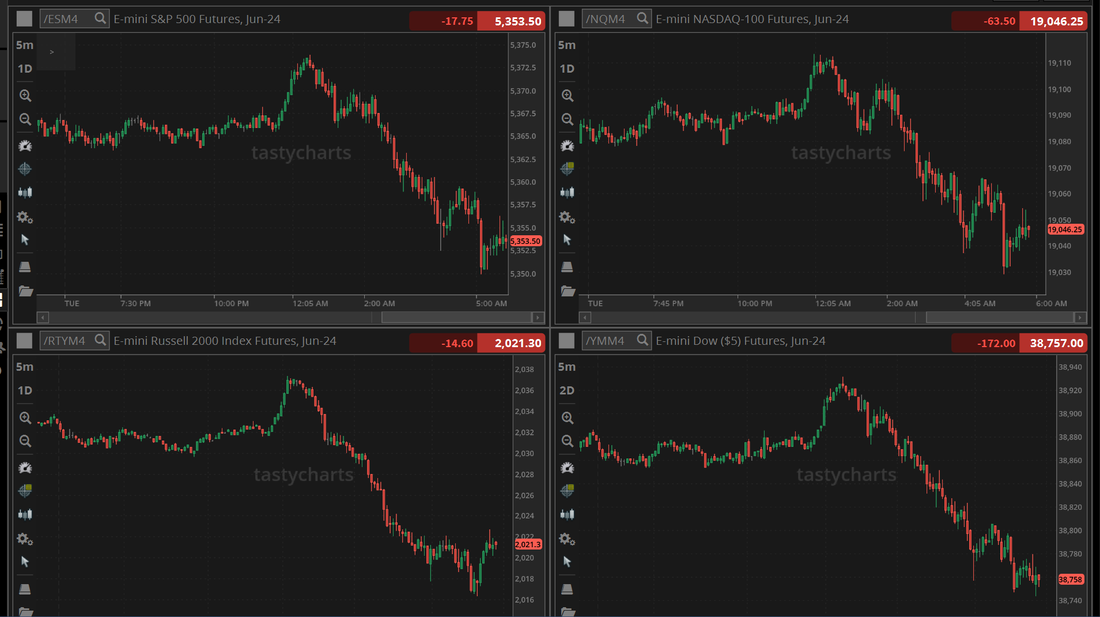

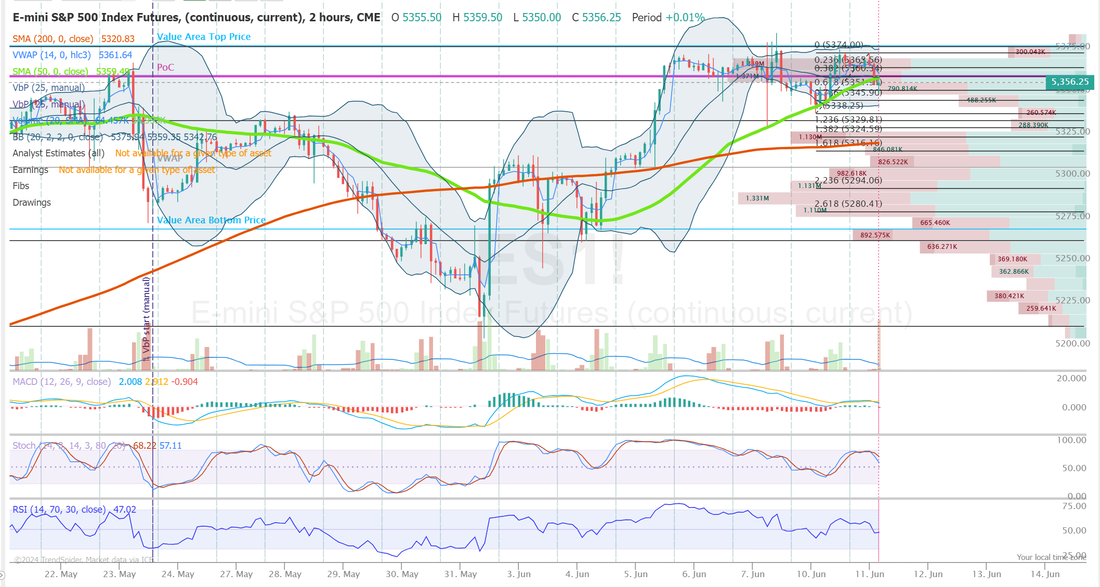

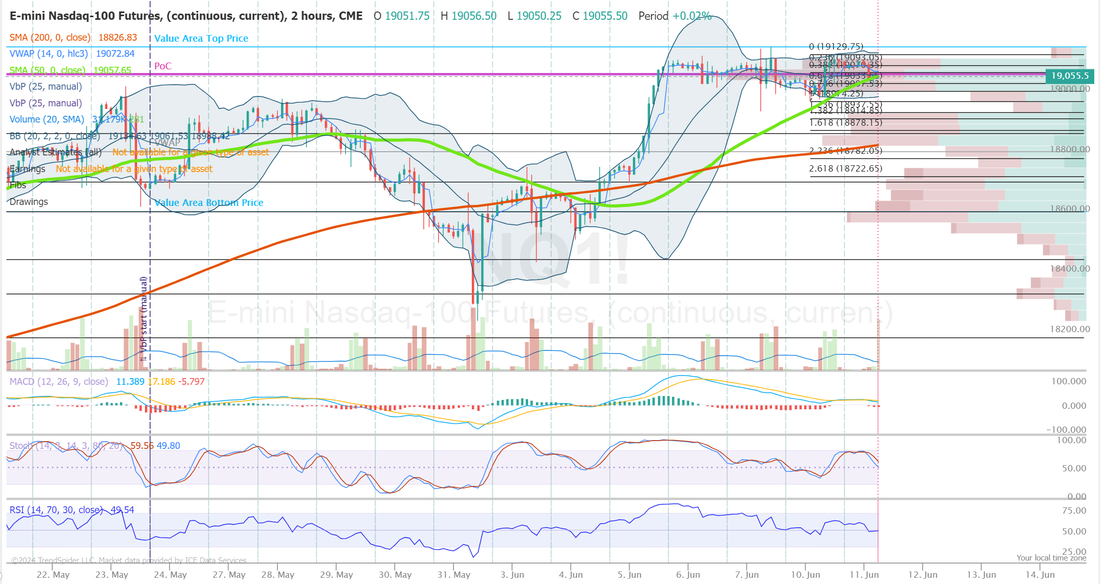

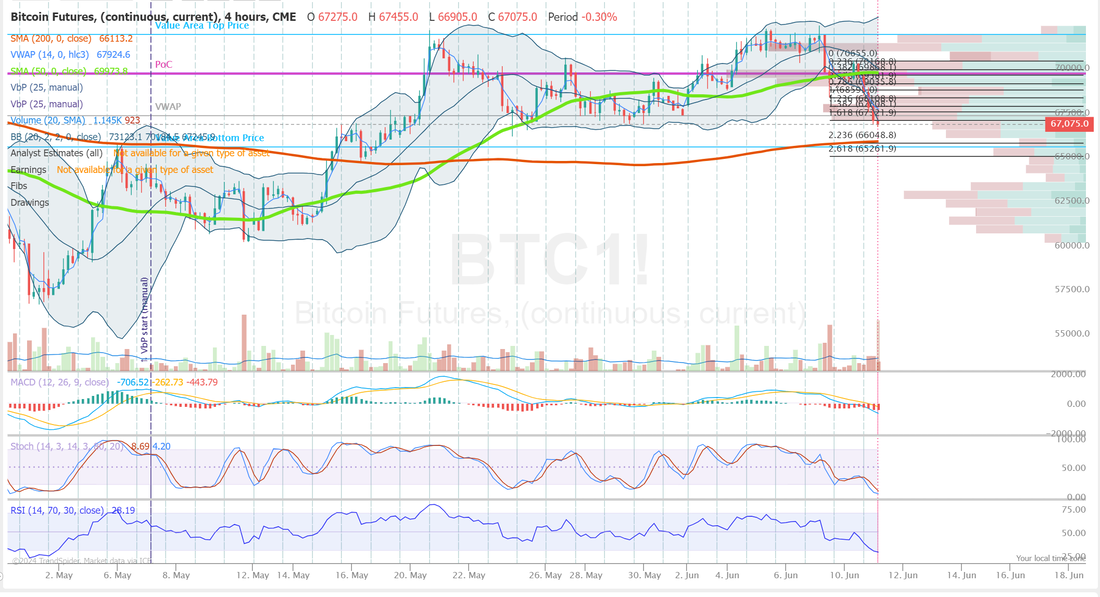

Welcome back folks. What an absolute fantastic, picture perfect day for us yesterday. I can't even express how far ahead of our pro-forma goals we are. This is just fantastic. Here's a quick snap shot of our seven 0DTE's and scalping from yesterday: That outsized gain on our SPX debit setup has been building since last Thursday , with two rolls but finally realized and booked the proift yesterday. We've talked about the potential for us to make as much as $500,000 dollars profit this year from all seven of our daily possible 0DTE setups and our now daily effort with scalping. It seems almost fantastical and well, a pipe dream, to be honest, but guess what? That pretty close to what we are on pace for. If our numbers hold through the first six months of this year we will be very close to $200,000 documeted profits on our 0DTE's. Our four standard SPX/NDX setups are close to $170,000 pure profit now and our three Event contract 0DTE's have added another approx. $6,000 of profit. With some good fortune, we could finish the month off very close that that $200,000 goal. Our scalping is continuing to produce results above expectations. Moving to five days a week we've reset our income target to $100,000 for a 12 month period vs. the $50,000 target we had with just two days a week effort. I know there are some amazing traders out there but I have to believe that these results put us up against the very best of the best. I'm extremely proud of what we've accomplished and I'm always thrilled when our members express how grateful they are to have found us. This is a special community of solid people. I appreciate all of you who contribute to the programs success. If you would like a free peek at how we are achieving this come hang out for a week at no -charge and see what we do. If you're just interested in scalping and don't want to trade full time and are happy with the potential for an extra $100,000 a year in income go here: Lets take a look at the markets: Markets continue to stall here. Most likely awaiting the dual catalyst of CPI/FOMC Weds. Futures are down as we speak The Federal Reserve kicks off its two-day meeting later in the day, with investors widely anticipating the U.S. central bank to hold borrowing costs steady on Wednesday for the seventh consecutive gathering. Investor attention will center on the Fed’s new “dot plot” in its Summary of Economic Projections, which displays Federal Open Market Committee member projections regarding the trajectory of interest rates. Market participants will also pay close attention to Fed Chair Jerome Powell’s post-decision press conference for hints about when the Fed might cut interest rates. Meanwhile, a 41% plurality of economists anticipate the Fed signaling two cuts in the closely watched “dot plot,” while an equal number expect the forecasts to indicate just one or no cuts at all, according to the median estimate in a Bloomberg survey. Investor focus also rests on the May reading of the U.S. Consumer Price Index, set for release on Wednesday, which is expected to show that headline inflation remained steady from April at +3.4% y/y. At the same time, U.S. May underlying inflation is expected to ease slightly to +3.5% y/y from +3.6% y/y in April. “The interest-rate guessing game goes on,” said Chris Larkin at E*Trade from Morgan Stanley. “Even the friendliest inflation numbers probably won’t push the Fed to act any sooner than September.” U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 50.0% chance of a 25 basis point rate cut at the September meeting. On the earnings front, Texas-based software giant Oracle (ORCL) is scheduled to report its Q4 earnings results today. The U.S. economic data slate is mainly empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.433%, down -0.85%. Our trade docket for today is stlll light until we get past Powells testimony. /HG, DELL, DIS, DJT, FSLR, all 7 0DTE's, SMCI, ORCL, GME. My bias today is bearish, once again. Until we get past Powells testimony on Weds. there isn't much insentive for bulls to stick there necks out. Intra-day levels for me: /ES; 5365/5373/5383/5398 to the upside. 5352/5344/5332/5325 to the downside. /NQ; 19090/19132/19155/19226 to the upside. 19033/18975/18934/18876 to the downside. Bitcoin; Bitcoin got hammered overnight. 69768 is resistance and 66073 is now new support. Be safe out there today folks and save up some buying power for Weds. It should be a doozy.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |