|

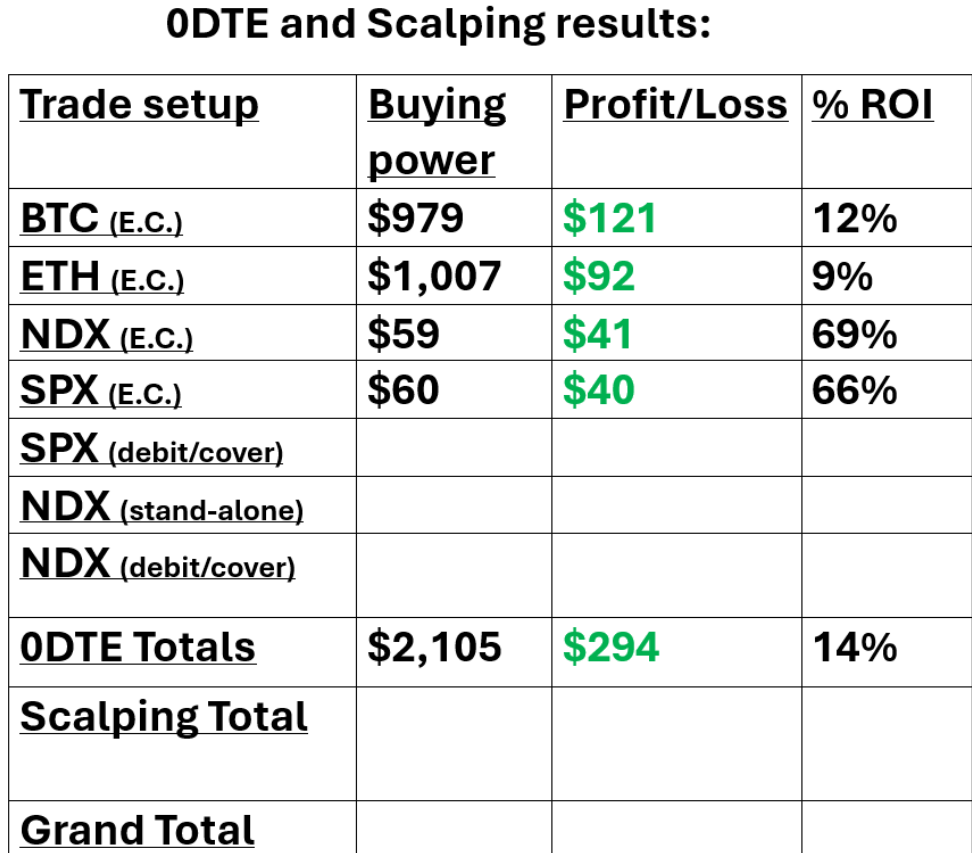

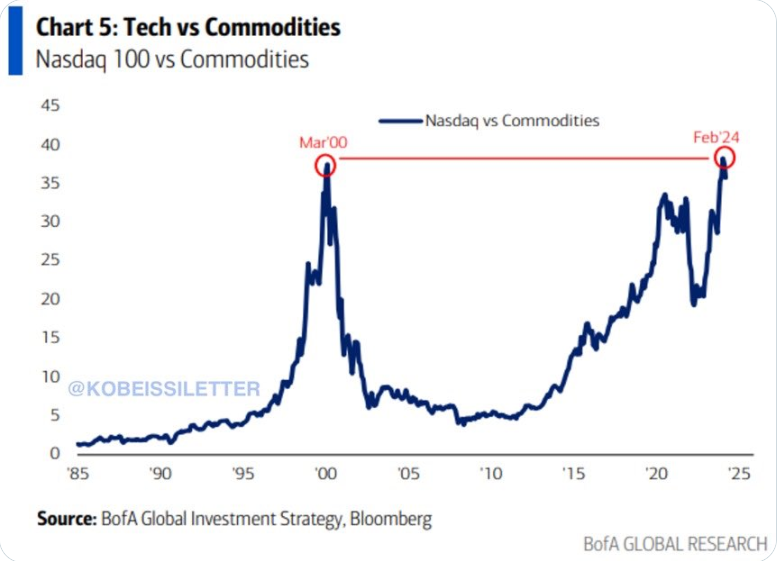

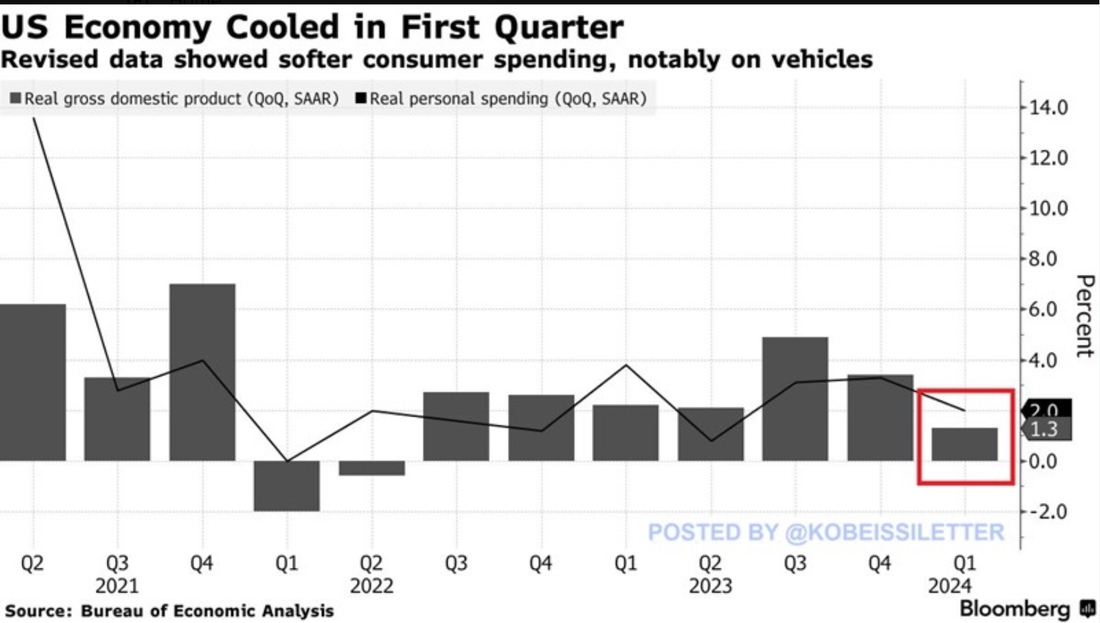

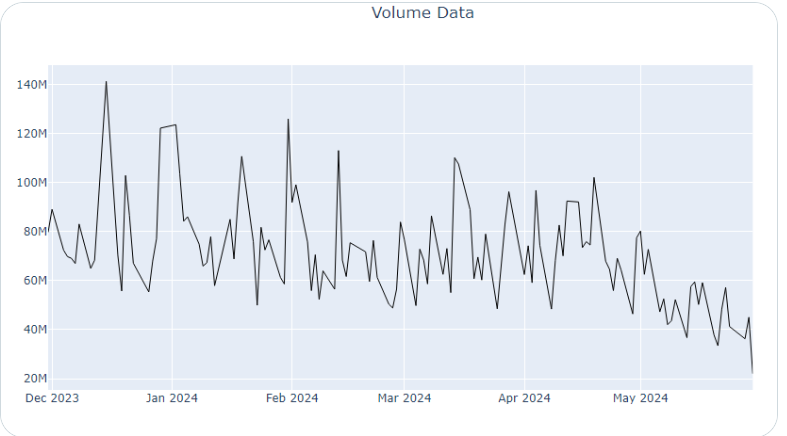

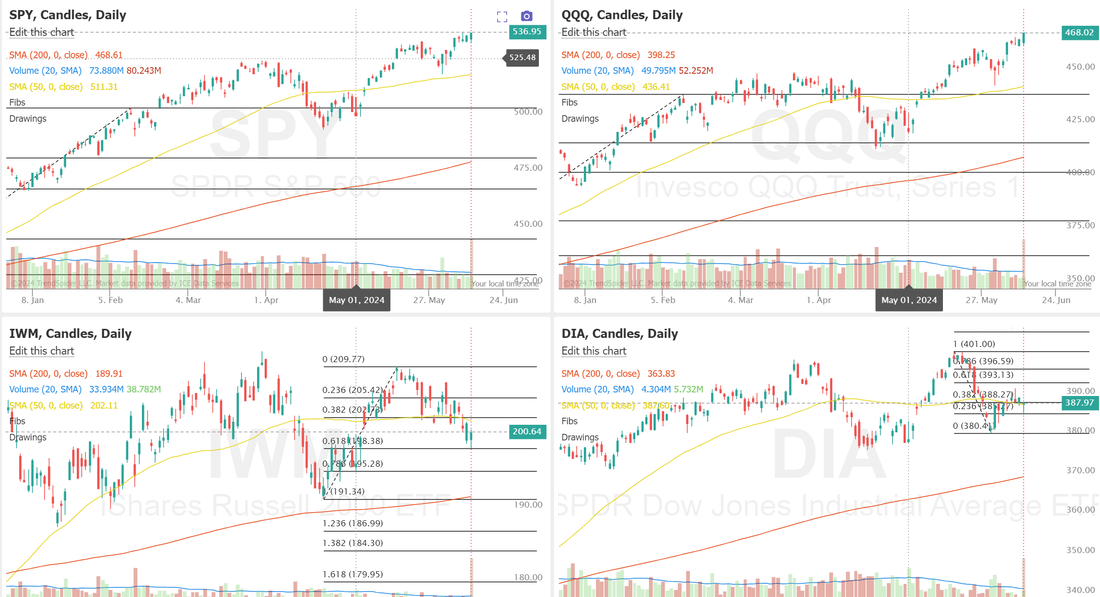

Good CPI/FOMC day my friends! Well, yesterday was either amazing for us, considering our platforms were down most of the day or, it was basically a day off. Just depends on how you look at it. TOS/Schwab was down most of the day and I was having execution issues on Tasty for scalping so this is the sum total of what we did yesterday: We were able to get four 0DTE's working with our Kalshi event contract broker. A 14% ROI and almost $300 profit is better than a poke in the eye with a sharp stick...all things considered. Today however? Well, this should be a different day. No charts. No levels. No lean bias for me today. We have a unique, dual-fold catalyst today with CPI inflation numbers our pre-market and then FOMC and Powell to finish off the day. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. With the Fed widely anticipated to hold borrowing costs at a two-decade high for a seventh straight meeting, the focus will shift to policymakers’ quarterly rate projections, known as the “dot plot,” and Chair Jerome Powell’s post-decision press conference. According to the median estimate in a Bloomberg survey, a 41% plurality of economists anticipate the Fed signaling two cuts in the closely watched “dot plot,” while an equal number expect the forecasts to indicate just one or no cuts at all. “We expect Fed Chair Powell and company to maintain a position that stresses potential rate cuts remain contingent on the committee seeing further progress made on bringing down price pressures,” said Anthony Saglimbene at Ameriprise. U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting and a 48.3% chance of a 25 basis point rate cut at September’s policy meeting. On the earnings front, California-based semiconductor giant Broadcom (AVGO) is slated to report its Q2 earnings results today. On the economic data front, investors will direct their attention to the U.S. consumer inflation report. Economists, on average, forecast that the U.S. May CPI will come in at +0.1% m/m and +3.4% y/y, compared to the previous numbers of +0.3% m/m and +3.4% y/y. The U.S. Core CPI data will also be closely watched today. Economists anticipate the Core CPI to be +0.3% m/m and +3.5% y/y in May, compared to the previous figures of +0.3% m/m and +3.6% y/y. What will the market do today? It's interesting that while the SPY is hitting new ATH's the internals are weakening. Maybe the ultimate pairs trade is short tech and long commodities? Has stagflation been confirmed? Second reading of US Q1 2024 GDP just fell to 1.3%, below the initially reported growth of 1.6% last month. This is ~60% less than the 3.4% growth seen in Q4 2023. This downward GDP revision primarily reflected slower consumer spending of -2.0%, down from previously reported +2.5% expansion. Meanwhile, the Core PCE Price Index hit 3.6%, up sharply from its 2.0% reading in Q4 2023. A weakening economy with rising inflation is the worst outcome for the Fed. Is the Fed trapped? One thing is for sure. Volume data on SPY has been absolutely horrible! The SPY and QQQ look priced for perfection and the IWM and DIA look like they could roll over and die. Somethings got to give here and today may very well do that day. With no levels or bias today, here's our trade plan and docket: We've cleared out a lot of "closet space" yesterday and have plenty of dry powder to work today. Our approach won't be much different today than it is every FOMC/Powell day. We have the SPX debit 0DTE still working. I'll cover that this morning with a smaller position. We'll also put a very small, very asymmetrical 0DTE on the SPX as a stand alone with the goal of getting an early exit before FOMC. We are also looking to get a Theta fairy on before CPI comes out. Then...we just sit on our hands for most of the day. 20 minutes into Powells testimony we'll start hitting our trades and we have a bunch! All our ladder trades. Bonds/Oil/DIA/GLD. All our credit strangles FSLR, WYNN, ORCL, CRM, PLTR, PYPL, SHOP. Earnings plays on AVGO and PLAY. All seven 0DTE's. Our SPY/QQQ 4DTE's. Its going to be a hectic end of the day. Trade to trade well today my friends. See you all in the live zoom!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |