|

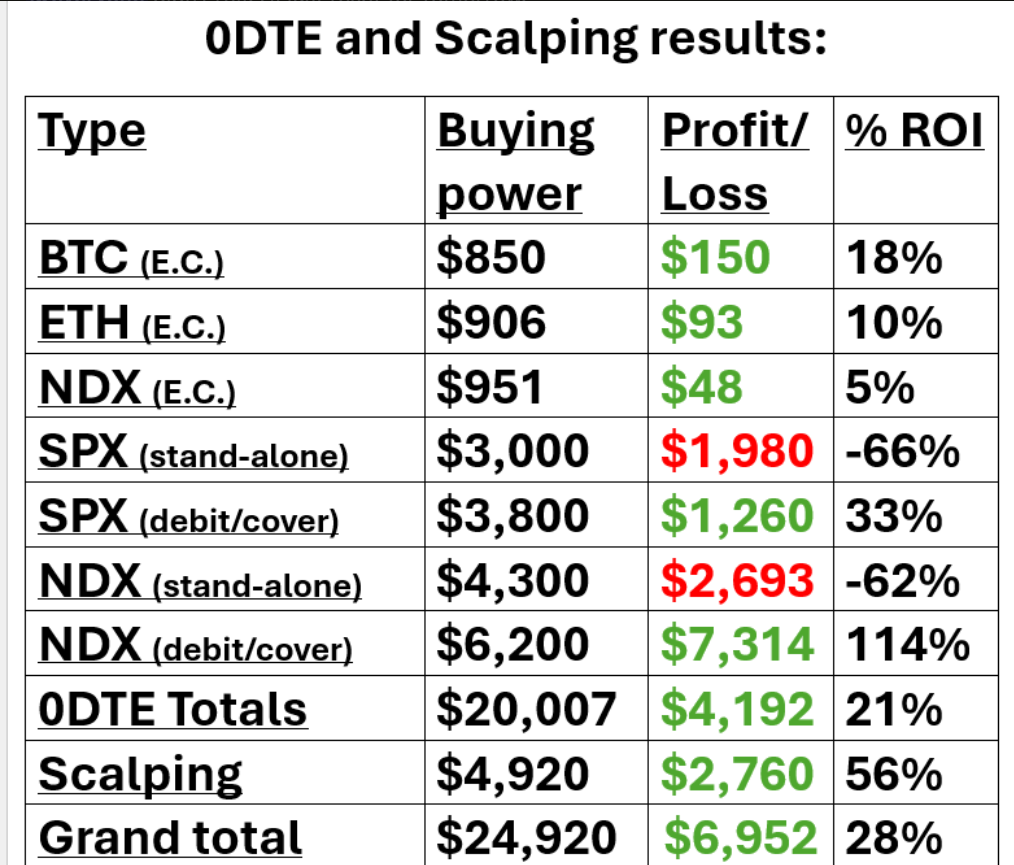

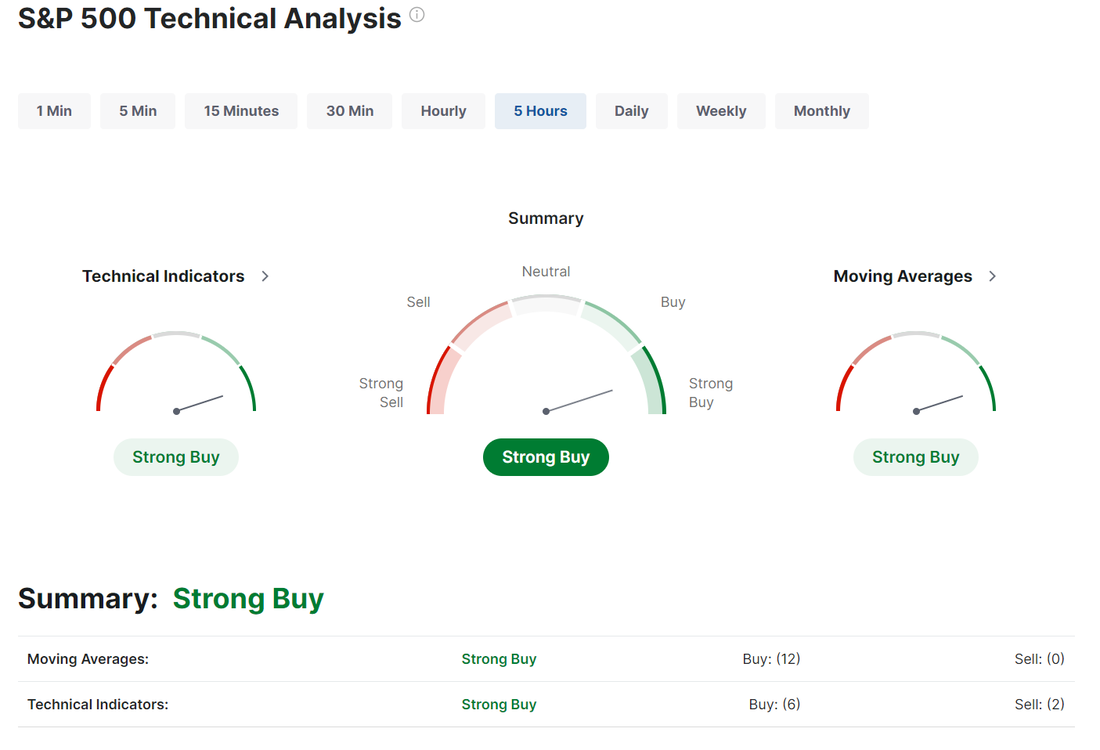

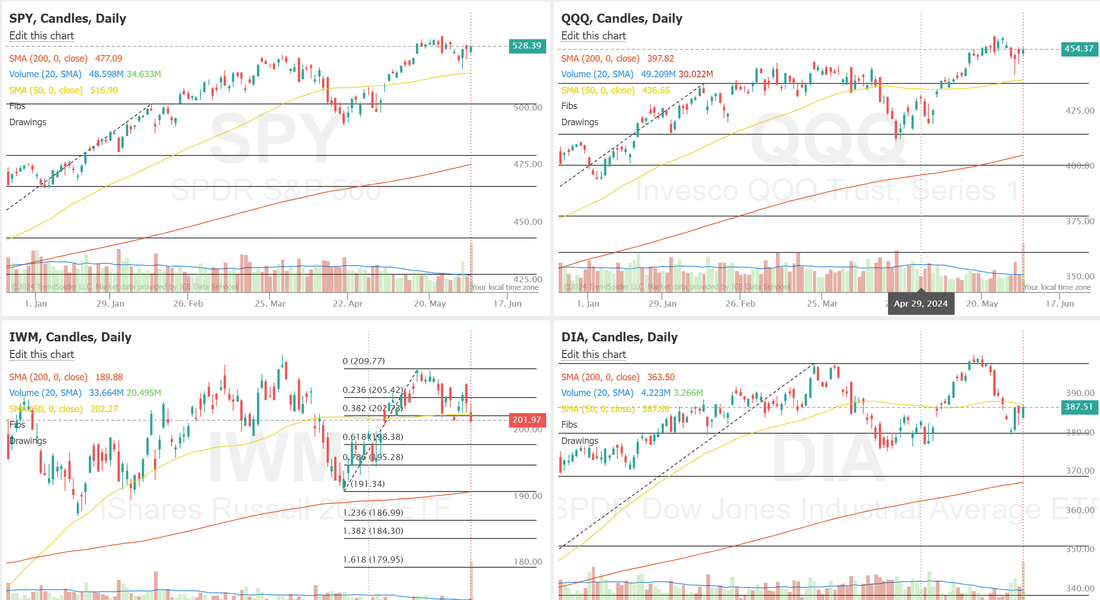

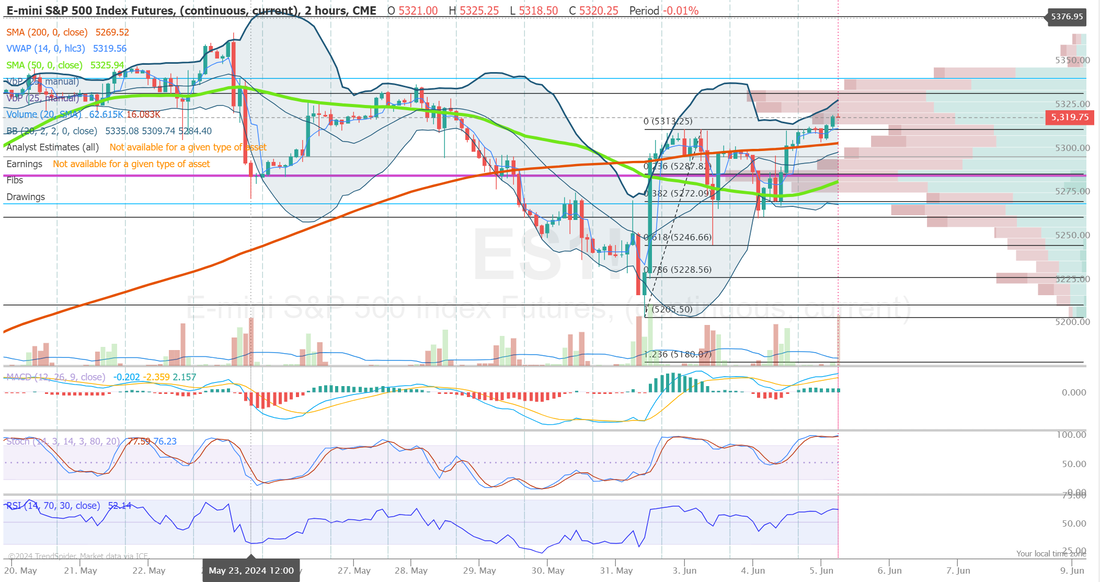

Welcome back traders. We are already approaching mid-week. Yesterday was a solid one for us. As you know, if you are in our live trading room, we've upped the ante with our 0DTE setups to a possible seven different opportunites each day. That combined with going to scalping five days a week means there is a greater focus and importance on them. I've put a matrix together to track our daily results and will start posting that here each day. I'm super proud of our 0DTE approach. I don't know if there is another program out there that offers as many opportunities on a daily basis and where they do more (return wise) with less (capital commitment). Let's take a look at the markets: une S&P 500 E-Mini futures (ESM24) are trending up +0.25% this morning following a positive session on Tuesday as a decline in U.S. job openings firmed up Federal Reserve rate-cut bets, with investors’ focus now turning to the ADP National Employment numbers due later in the day. A Labor Department report on Tuesday showed that U.S. JOLTs job openings fell to a 3-year low of 8.059M in April, weaker than expectations of 8.370M. At the same time, U.S. April factory orders rose +0.7% m/m, in line with expectations. “The evidence is accumulating that the Fed should begin easing,” said Ronald Temple, chief market strategist at Lazard. Meanwhile, U.S. rate futures have priced in a 0% chance of a 25 basis point rate cut at June’s policy meeting and a 16.5% probability of a 25 basis point rate cut at the July meeting. Also, U.S. rate futures have priced in a 55.3% chance of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. On the earnings front, notable companies like Lululemon Athletica (LULU), Dollar Tree (DLTR), Campbell Soup (CPB), and Five Below (FIVE) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. ADP Nonfarm Employment Change data in a couple of hours. Economists, on average, forecast that the May ADP Nonfarm Employment Change will stand at 173K, compared to the previous number of 192K. Also, investors will focus on the U.S. ISM Non-Manufacturing PMI, which arrived at 49.4 in April. Economists foresee the May figure to be 51.0. The U.S. S&P Global Composite PMI will come in today. Economists expect the May figure to be 54.4, compared to April’s value of 51.3. The U.S. S&P Global Services PMI will also be closely watched today. Economists foresee this figure to arrive at 54.8 in May, compared to 51.3 in April. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -2.100M, compared to last week’s value of -4.156M. Markets continue to entrench with a bullish bias. But I wouldn't say they bulls are safe. Both the IWM and DIA are still pinned underneath their repective 50DMA. SPY and QQQ are fairing better but still find themselves trapped under a pretty heavy resistance area. My bias today is bullish. When all the technicals point in the same direction you go with it. Trade docket today is light. Scalping, LULU?, /HG, BA, CRWD, DLTR, HPE, All seven 0DTE setups, WOOF. Intra-day levels: /ES; 5334/5342/5359/5367 to the upside. 5312* (key support level)/5305* (200 period MA)/5287*(PoC)/5272 to the downside. /NQ; 18867/18901/18957/19000 to the upside. 18755*(PoC)/18705/18638/18604 to the downside. Bitcoin; 73384 resistance. 67220 support. Good luck today traders. Trade safe.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |