|

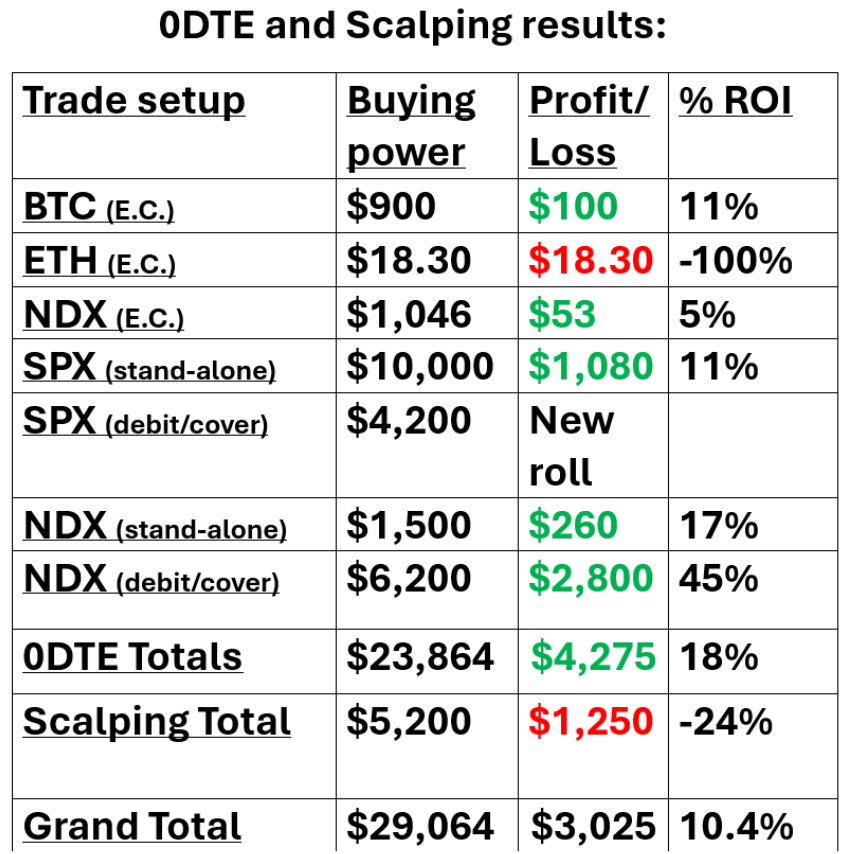

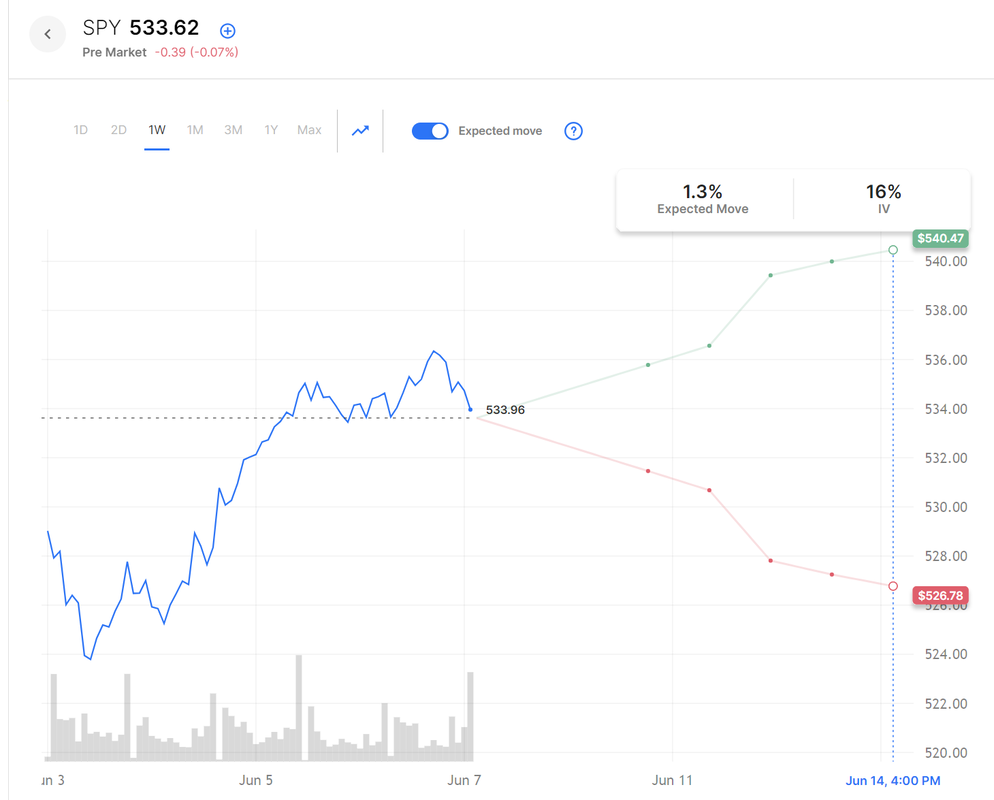

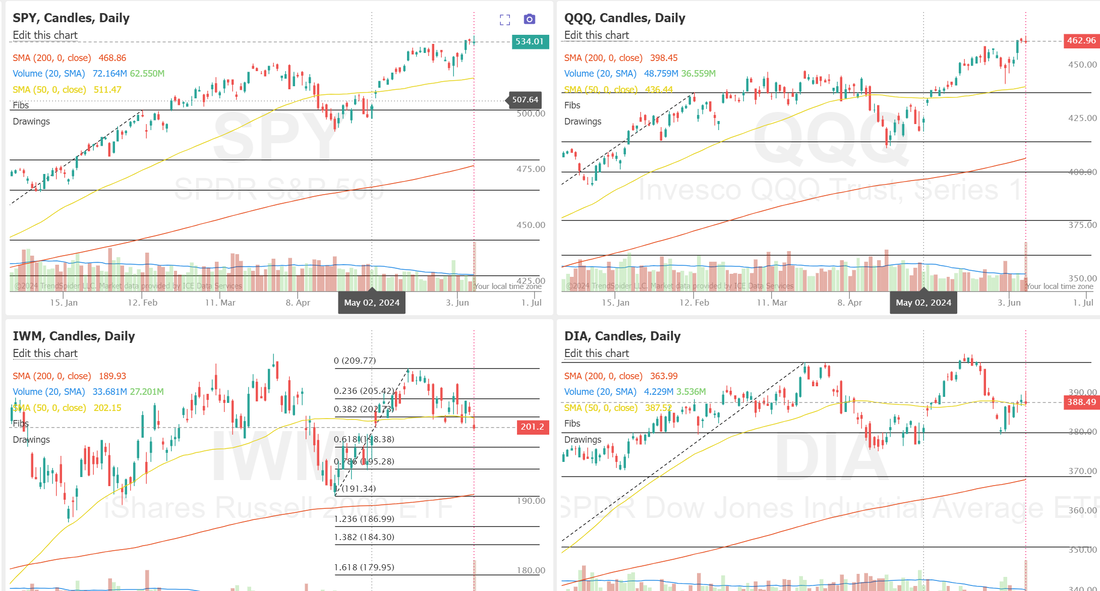

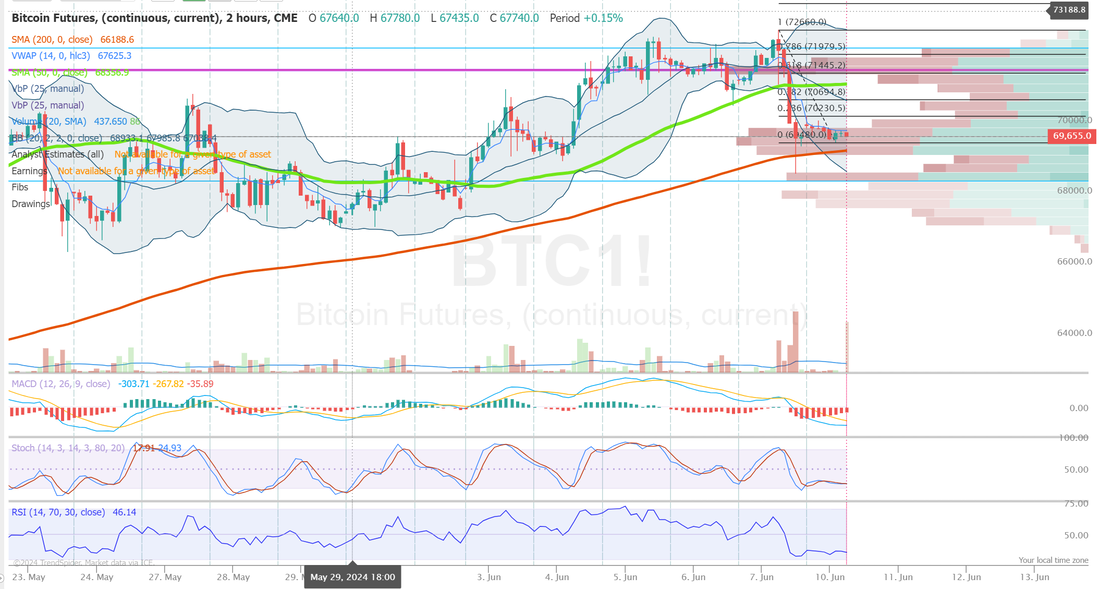

Welcome back traders. I hope you all had a great weekend. We had a nice finish to our week with Fridays results. It seems like a stretch, and everything would need to stay on track with no big drawdowns but... we are on track for almost $400,000 of income this year annualized out on our scalping/0DTE's. To say I'm thrilled with our results is an understatement. We've got a potential big payoff awaiting us today in our SPX rolled cover. It could be a nice start to the week. Lets take a look at the markets and price action; Firstly, some key items to watch. Roaring Kitty, the GME trader is back! If you haven't been following this saga and GME's price swings you owe it to yourself. This is better than an action flick and you don't have to pay to watch. I'm sitting on the sidelines for now but we've had great success shorting GME and AMC for that matter on these big pops to the upside. NVDA's 10 for 1 split is active today. While a split has no actual effect on a stocks fundamentals it should help us tremendously to continue our slow march to the exits on this trade. It will be much easier to reduce buying power now. Our trade continues to look good but it also continues to get pushed out in time....someday. Thursday we get the big vote result on Elon's pay package at TESLA. This could be a market mover for the stock. Of Course, we also have a potential monster of a day coming Weds. with BOTH CPI and FOMC in the same day! We may have a shot at some more Theta fairy setups this week. After several days retesting the March highs, the SPY managed to find its footing and push higher, closing the week at $534.01 (+1.26%). Additionally, MACD is back in positive territory, turning up and showing the beginnings of a bullish cross. Much like the SPY, the QQQ found clear support at the March highs and rallied to make new all-time highs on Friday and close the week at $462.96 (+2.72%). Additionally, a clear bullish cross up is visualized on MACD, a sign that this move could just be getting started. The doldrums returned for the small caps, which closed at $201.20 (-2.47%) this week after failing to push out of the handle. Despite last week’s relative strength, IWM has struggled since the bearish MACD cross in late May. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls climbed by 272K jobs last month, well above the 182K consensus. At the same time, the U.S. May unemployment rate unexpectedly rose to 4.0%, weaker than expectations of no change at 3.9%. Also, U.S. average hourly earnings came in at +0.4% m/m and +4.1% y/y in May, stronger than expectations of +0.3% m/m and +3.9% y/y. Finally, U.S. April consumer credit rose +$6.40B, weaker than expectations of +$9.30B. “[Friday’s] jobs report may lower rate-cut expectations,” said Bret Kenwell at eToro. “But at the end of the day, a strong labor market is hardly a bad thing - especially for an economy that’s so dependent on consumer spending.” The U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference will take center stage in the coming week. The Federal Reserve is anticipated to hold interest rates steady for the seventh straight meeting on Wednesday, shifting investor focus to the central bank’s quarterly “dot plot” in its Summary of Economic Projections, which displays Federal Open Market Committee member projections regarding the trajectory of interest rates. The updated “dot plot” is likely to indicate two 25-basis point cuts this year, down from three cuts projected in March. Meanwhile, U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at the July FOMC meeting and a 43.4% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. On the economic data front, the U.S. consumer inflation report for May will be the main highlight. Also, market participants will be monitoring other economic data releases this week, including the U.S. Core CPI, PPI, Core PPI, Crude Oil Inventories, Initial Jobless Claims, Export Price Index, Import Price Index, and Michigan Consumer Sentiment Index (preliminary). On the earnings front, major companies like Adobe (ADBE), Oracle (ORCL), and Broadcom (AVGO) are set to report their quarterly figures this week. In addition, several Fed officials will be making appearances this week, including Williams, Goolsbee, and Cook. The U.S. economic data slate is mainly empty on Monday. I.V. for this week is MUCH better than last week, thanks to CPI and FOMC. I'll go over out trade docket today in our live zoom feed. It's hard to say what we can do today until we get a market open because our buying power is artifically inflated right now with the NVDA split. Once that balances out we'll know how much BP we have to work with. My bias to start off the week is bearish. I think the current FED trend of continuing to push of rate cuts continues this week. The divergence in the major indices we trade continues with the SPY and QQQ holding near highs and the IWM and DOW still stuck under their 50DMA. Intra-day levels for me: /ES; 5366/5375/5386/5396 to the upside. 5349/5338/5318/5303 to the downside. /NQ; 19043/19086/19115/19155 to the upside. 18973/18939/18863/18843 to the downside. Bitcoin: We continue to trade in a very tight range. Look for a break out soon. Resistance is 72,660. Support is 68,406. Have a great day folks. See you in the trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |