|

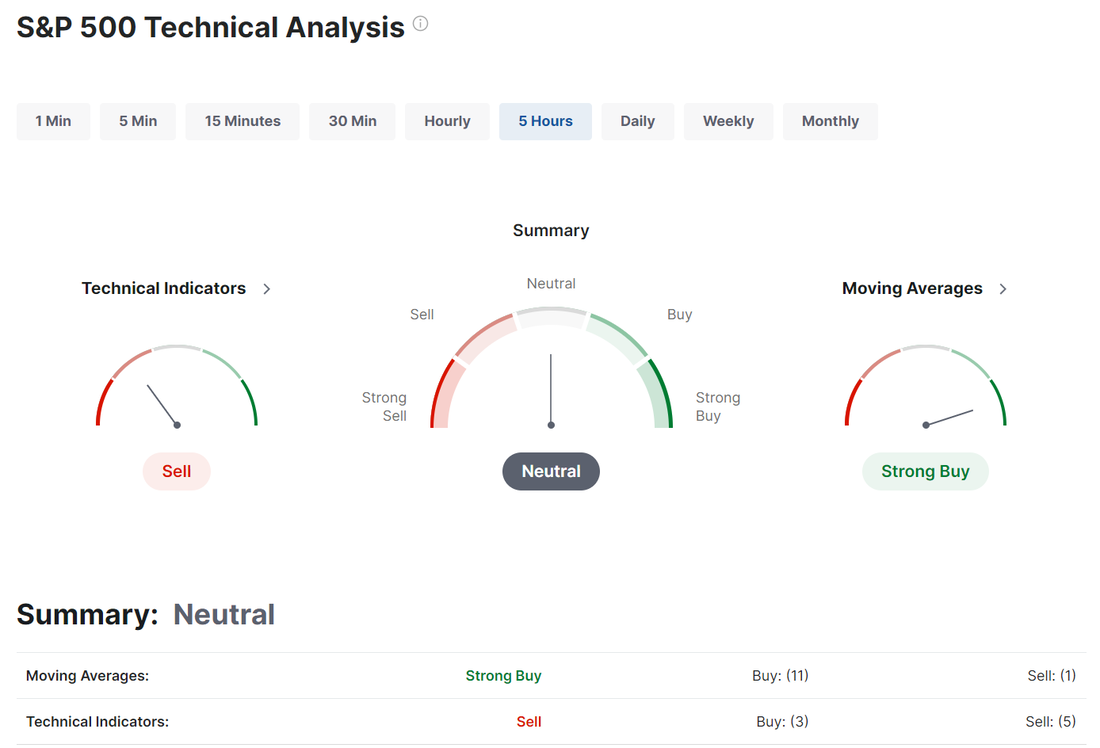

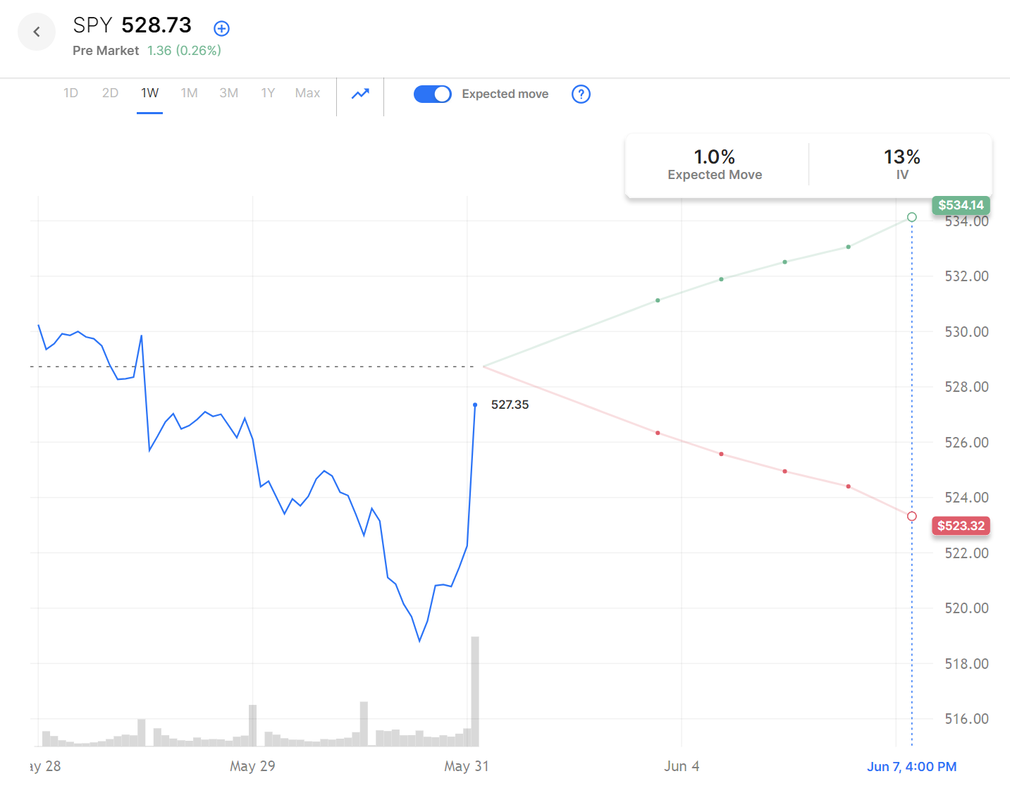

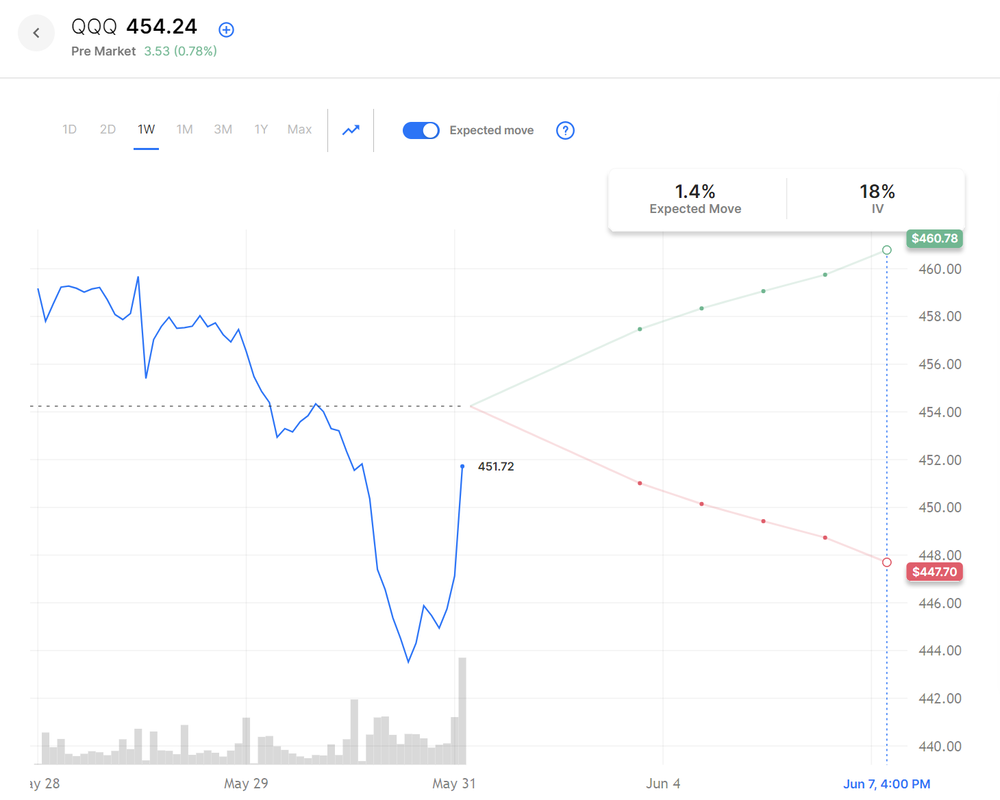

Welcome back to a new week and a new month of trading! I just got back from three days of my latest mastermind. I'm excited to share some of the ideas I got from it with you all in our live zoom session today! Fridays price action in the market was crazy, to say the least. It was also one of our biggest days ever for our NDX 0DTE with a massive win. This now puts our results for the year with just the NDX 0DTE alone well over $100,000 of profit. I'm absolutely thrilled with our results YTD. Let's look at the price action. Last week, as the indexes began to show weakness, all eyes were on the March highs. Bullish traders hoped those levels would provide strong support, and while things were initially looking dicey from the one-two punch of lower-than-expected GDP numbers on Thursday and PCE numbers on Friday, the week ended with a face-ripper rally and key levels being held. After failing below the March highs, the SPY looked to be weakening into the month’s end but a late-day rally on Friday allowed this index to find support at the 21-day EMA and close at $527.37 (–0.40%). Additionally, the new 14-day lows list recently flashed a hot reading above 50%, which has led to sharp bounces higher over the past year. Much like the SPY, QQQ struggled throughout the week, briefly trading below the March highs and the 21-day EMA. Despite that, the rally on Friday pushed this index to close the month at $450.71 (-1.58%), above both of those key levels. As has been the case throughout the last year, the percentage of names making new 14-day lows increases sharply, it has acted as a precursor to important bottoms. After multiple weeks of underperformance, IWM faired the best this week, going inside on the month and closing at $205.77 (+0.16%). Much like its peers, the price managed to find support at the 21 EMA despite 42% of names making new 14-day lows this week. We start the day off technically with a "reset" neutral rating. There's a good chance todays price action could swing us definatively one way or the other for our next trend bias. Expected moves in the market this week are about inline with what we've been getting. My bias, expecially after the strong rebound on Friday is slightly bullish, even with the neutral technical rating we start the day with. Potential market moving news today: 09:45 ET US S&P Manufacturing PMI Final for May Median Forecast 50.9 | Prior 50.9 | Range 50.9 / 50.8 10:00 ET US ISM Manufacturing PMI for May Median Forecast 49.7 | Prior 49.2 | Range 50.1 / 49 Trade docket for today: BA, CCL, CVS, DELL?, DIS, DJT, FSLR, SPX/NDX/E.C. NDX/ BTC/ETH 0DTE's, NVDA?, SMCI, SPY. Intra-day levels for me: /ES; 5314/5325 (PoC)/5334/5361 to the upside. 5303/5287/5272/5262 to the downside. /NQ: 18725(PoC)/18771/18827/18861 to the upside. 18668/18608/18575/18507 to the downside. Bitcoin: 73,232 resistance. 66,119 support. Let's shoot for another great day folks. Not to jinx us but our NDX setup from Friday is lookiing like a potential $6,000 profit day today if the bullish bias holds.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |