|

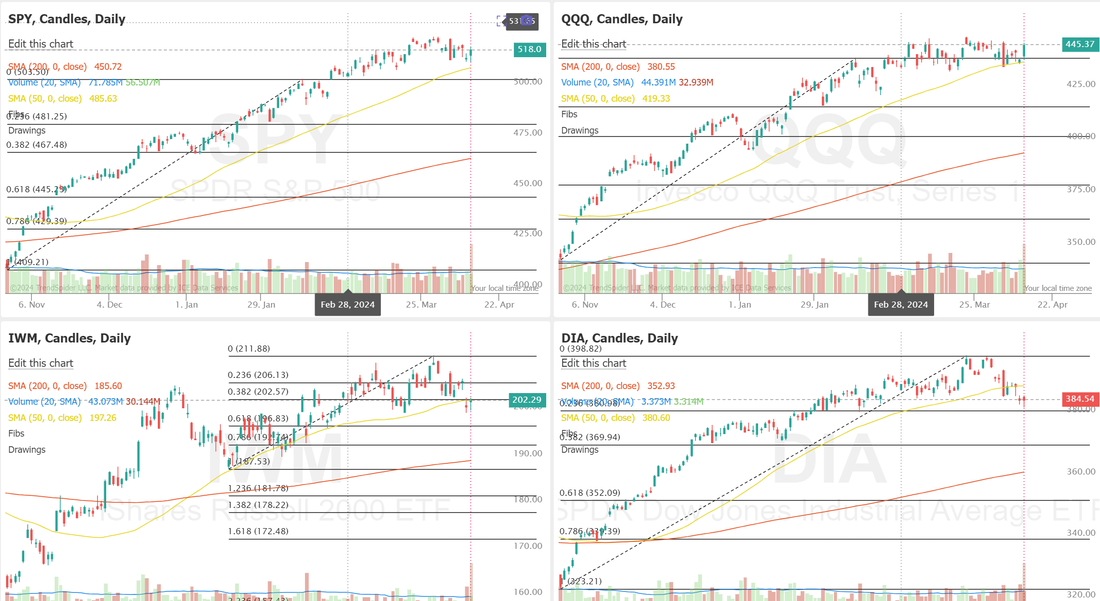

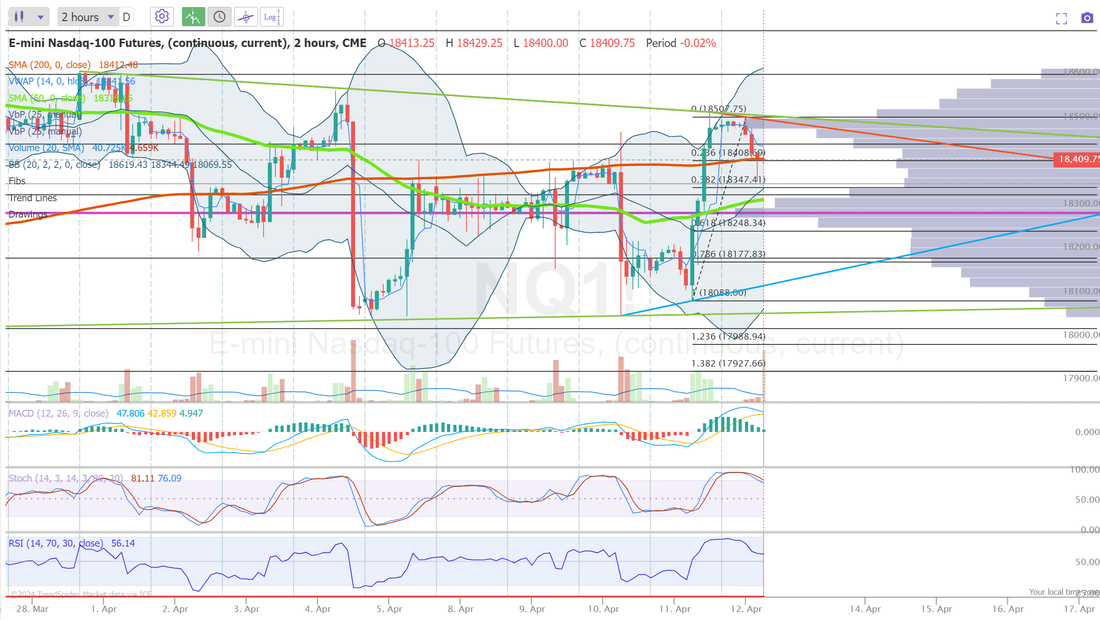

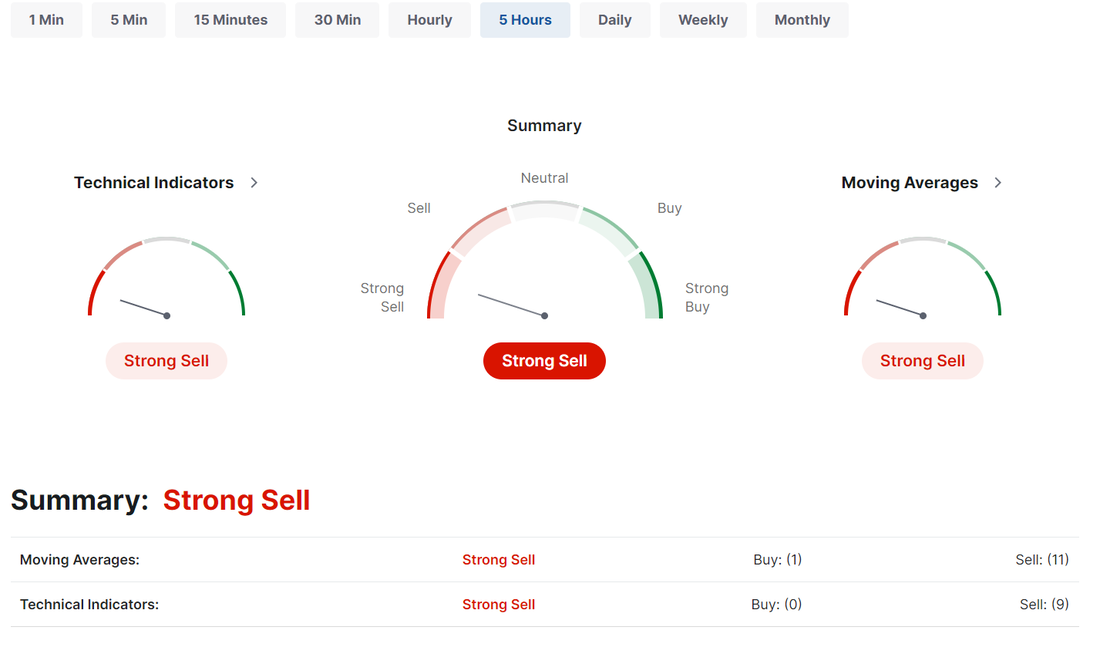

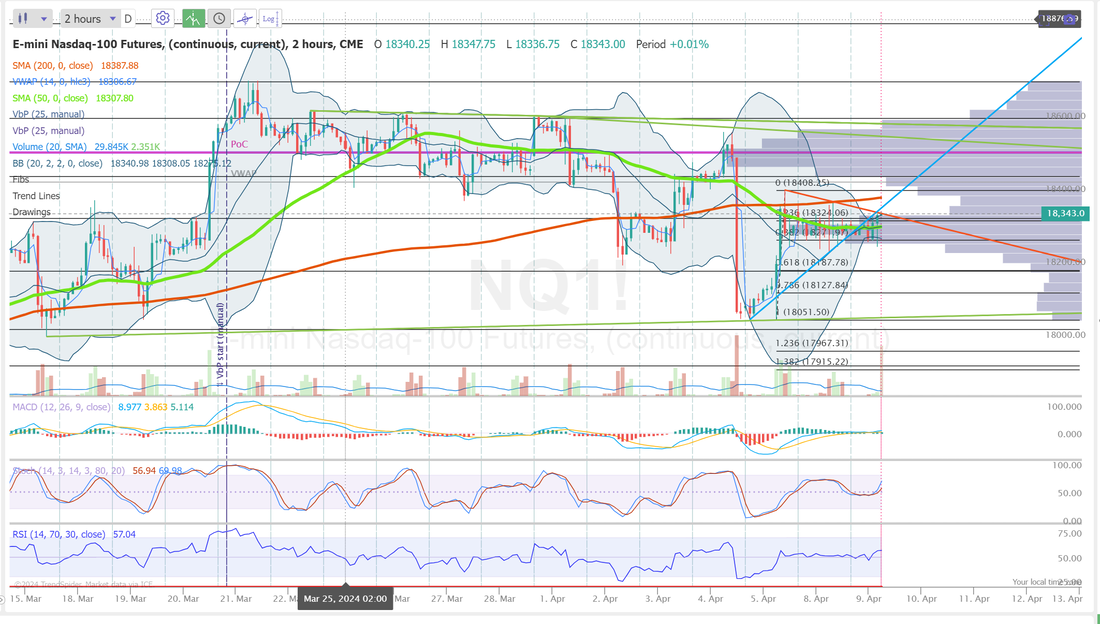

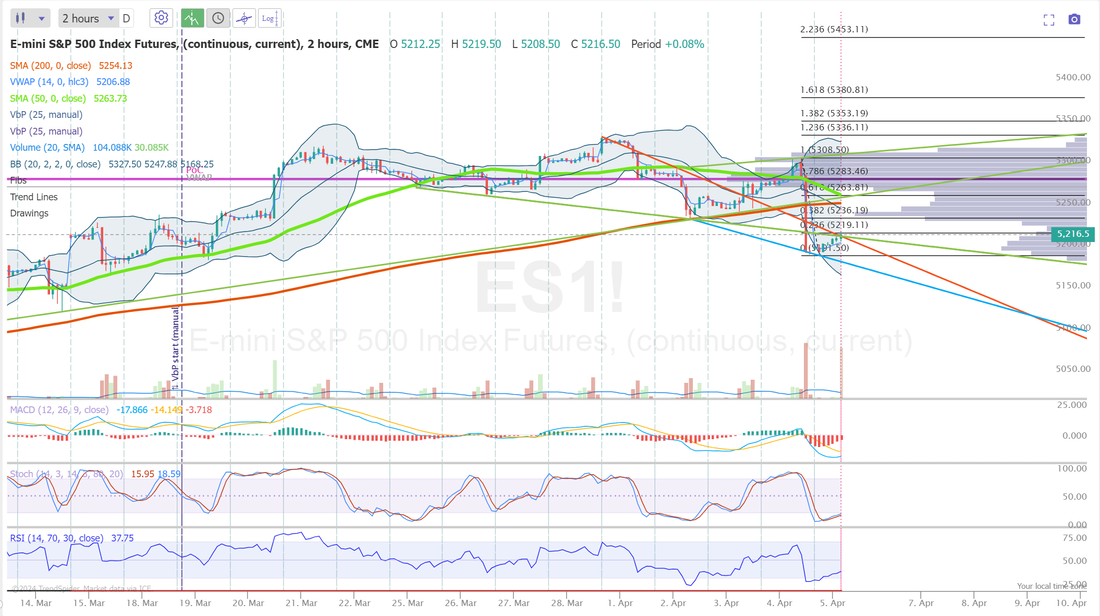

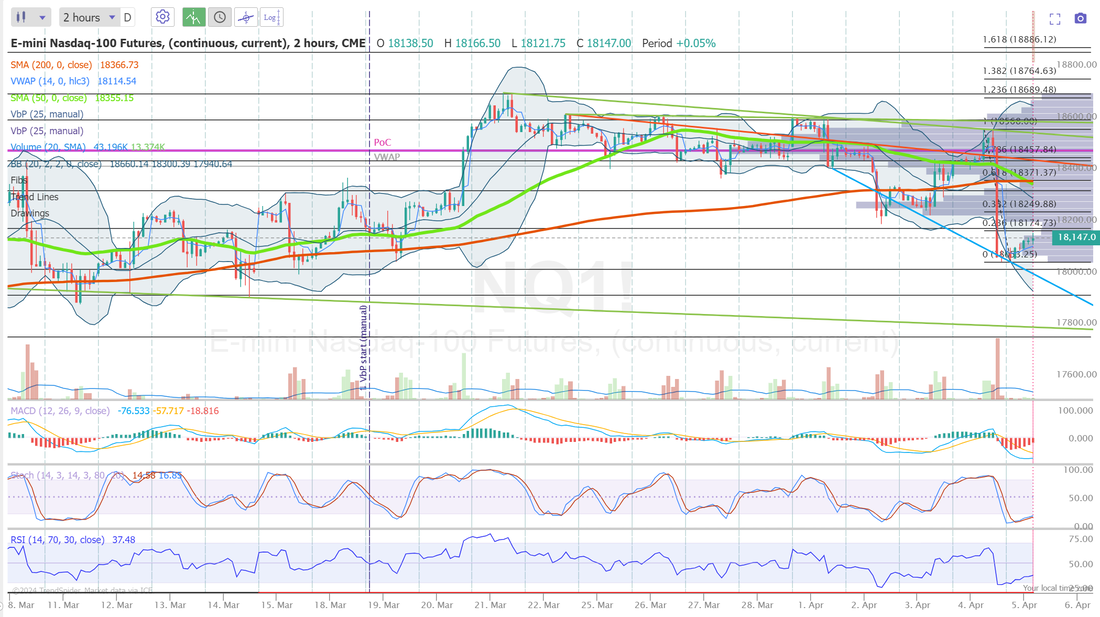

Yesterday started well for me but by the end of the day three of our four 0DTE's lost and most of our model portfolio was down as well. I gave back 12k of the 14k I made last Friday. Our two earnings trades from yesterday look like they should open in the profit zone. Today should be fairly light with our trade docket: CCL, JNJ, LULU, MSTR, SPX/NDX/Event contract NDX/ Bitcoin 0DTE's, PFE, UNH, XBI, UAL, SPY/QQQ. Sell rating in getting more intrenched. All the major indices have now breached their 50DMA's. The Dow and IWM are flirting with losses YTD. The one week heat map doesn't show much strength anywhere in the market. Intra-day levels for me; /ES; 5122/5149/5188/5220 to the upside. 5094/5082/5063/5025 to the downside. /NQ; 17919/17981/18034/19069 to the upside. 17835/17769/17737/17668 to the downside. Bitcoin; 60588 key support. 52685 bottom target. 74549 top target My lean for today is neutral to slightly bearish; Trade well my friends. Have a great day.

0 Comments

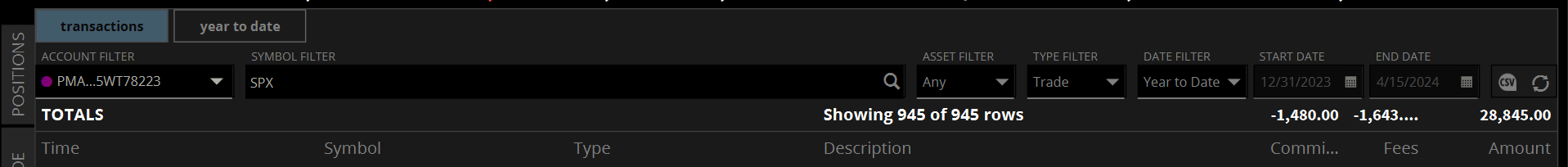

Welcome back traders. What an absolute amazing week we had last week with Friday being the topper. My net liq popped by $14,140 on Friday. Everything clicked for us with the market movement. With 17k of capital in our four 0DTE's we yielded almost 10k in profits. Our 0DTE's have been fabulous for us so far this year. We've hauled in $26,000 of profit, net of fees on the SPX And our NDX has brought us $50,000 in profits. Add in our Bitcoin 0DTE's , which have been insanely good and we are over $80,000 in profits so far this year.  I don't know where you can get four different 0DTE setups each day with this type of result. Unique setups yield unique results. With the Middle East tensions Sunday we were able to get another Thetafairy working. It hit for a profit while we were sleeping. So nice to wake up to money in your pocket before the market even opens. We are looking for a $3,000+ profit today for our new NDX 0DTE with the setup we've been using for two weeks now. Let's take a look at the market. Iran launched a wave of more than 300 drones and cruise and ballistic missiles toward Israel late on Saturday in apparent retaliation for a strike in Syria that resulted in the deaths of top Iranian military officers. A military spokesman, Rear Adm. Daniel Hagari, said that Israel and its allies intercepted most of the attack drones and missiles launched by Iran, calling the outcome “a very significant strategic success.” Meantime, speculation about the conflict remaining contained arose after Iran stated, “the matter can be deemed concluded,” and President Joe Biden reportedly told Israeli Prime Minister Benjamin Netanyahu that the U.S. would not back an Israeli counterattack. Donald Trump, the presumtive Republican nominee has his first criminal trial starting today. While there have been lots of fanfare about his recent trials this is the first one that could include jail time. This effects us directly because we have a big bearish position on in DJT. Chances of rate cuts seems to continue to be diminished. Kansas City Fed President Jeff Schmid stated Friday that he prefers a “patient” approach to rate cuts, emphasizing the importance of waiting for “clear and convincing” evidence indicating that inflation is headed back to the 2% target before reducing interest rates rather than adjusting policy preemptively. Also, San Francisco Fed President Mary Daly said that there’s “absolutely no urgency to adjust the policy rate.” In addition, Boston Fed President Susan Collins expressed her belief that two rate cuts are more probable than three in the current economic environment. Finally, Atlanta Fed President Raphael Bostic reiterated his view for one interest-rate cut this year while maintaining flexibility to make adjustments as necessary. “I think inflation is going to continue to fall, but much slower than I think many would like. If something surprising happens, I’d adjust the outlook based on that,” Bostic said. U.S. rate futures have priced in a 2.6% probability of a 25 basis point rate cut at the next FOMC meeting in May and a 20.4% chance of a 25 basis point rate cut at June’s policy meeting. As far as news catalysts today, we have U.S. retail sales out this morning with Fed member Daily speakiing later in the day. Technicals still point bearish, with last week being the worst week of the year for the markets. I.V. is back! With the SPY having almost as much juice in it as the QQQ. This bodes well for our chances to continue to get Theta Fairy setups on. After several weeks of holding above the year-to-date point of control, the SPY ETF closed this week well below it, at $510.85 (-1.46%). If the price is to continue to fall in the weeks to come, bulls will be keeping a close eye on the late February gap which aligns with the year-to-date anchored VWAP. The QQQ ETF managed to hold it together a bit better than its counterparts this week, closing at $438.27 (-0.50%), just above the year-to-date point of control. If that level is to fail, the late-February gap below could be a target. The small caps struggled the most this week, with the IWM ETF closing below its year-to-date anchored VWAP and ending the week at $198.69 (-2.82%). Now that a new low has been made, it is possible this move could be exhausted, but if the downside move continues next week, the year-to-date point of control could come into play. Our trade docket for today is pretty full, as it is most Mondays: /ES (new potential Theta Fairy), /MCL, /ZN, BA, CCL, DIA, DJT, FSLR, GLD, GOOG, IWM, LULU, MSTR, SPX/NDX/Event contract NDX/ Bitcoin 0DTE's, SPY/QQQ 4DTE, NVDA, PFE, SBUX, TEAM, XBI, ORCL, CRM, PYPL, SHOP. My lean today is bullish: Intra day levels for me: /ES; 5211/5228/5248/5256*(PoC on 2hr. chart) to the upside. 5187/5173/5163/5149 to the downside. /NQ: 18329/18360/18423/18503 to the upside. 18267/18213/18185/18124 to the downside. Bitcoin:

71646 resistance. 64963 support. 63811 downside target. We had an "interesting" day yesterday. I don't think we'll know if it was a successful day until we hear the ringing of the closing bell today. When I was 19 yrs. old I served a church mission in an poor part of South America. Lots of dirt floor shacks with no heating/cooling and outhouses for bathrooms. Our goal was to help improve peoples lives. Sometimes we were successful, sometimes we felt that we just "planted the seeds" of a possible future improvement. That's how I feel right now (before the opening bell) about our day yesterday. We planted some seeds. Today we see if they sprout. Our SPX trade made money but only 3% or $300 dollars on 10k capital. Our NDX brought in $3,000 of credit but wasn't enought to move my net liq into the positive. Our Bitcoin 0DTE worked but we didn't have a lot of capital in that one and our Event Contract NDX was a loss. We did have a second Theta fairy in a row that yielded a nice result. Those are wonderful from a profit perspective but also from a mental aspect. It's just nice to have made some money before the market gets going. Unfortunately we are now back to normal I.V. so it may be some time before we get another one on. The biggest "seed" that we planted yesterday was the positioning of our NDX setup. Depending on price action, we could have an O.K. day or a potentially amazing day. We will most likely continue to work this setup today as we get price action but it certainly looks juicy right now. Our MSTR and NVDA should also yield us some good cash flow today. On to the markets: Not much in the way of news catalysts today. University of Michigan Sentiment April Prelim The University of Michigan Consumer Sentiment Index is an economic indicator that measures the confidence and optimism of US consumers regarding the economy. Published by the University of Michigan, this preliminary index is based on surveys that assess consumer attitudes toward current economic conditions and expectations for the future. It provides an early snapshot of consumer sentiment before the final monthly release. A higher sentiment reading indicates increased confidence, potentially influencing consumer spending—an essential component of economic activity. What to Expect Policymakers, analysts, and businesses monitor this indicator for insights into consumer behavior and economic trends. A higher consumer sentiment could cause an upside risk to inflation, on the other hand, it also indicates that the consumer is doing well in the face of high interest rates, reducing the risks of a recession Markets continue to look weak. We now have both the IWM and DIA under their respective 50DMA. Today will be interesting. Futures are down right now. “The PPI headline number came in a touch lower than estimates, helping markets ease fears of a broad-based inflation assault on supply chain prices in addition to consumer prices,” said Quincy Krosby, Chief Global Strategist at LPL Financial. New York Fed President John Williams stated Thursday that the Fed has made “tremendous progress” toward better balance on its inflation and employment goals, yet emphasized that there’s no urgency to implement rate cuts in the “very near term.” “As we collect more data, we’ll be able to assess have we got that confidence that inflation is moving back to 2%,” Williams said. Also, Richmond Fed President Thomas Barkin said the central bank still has some work to do to contain price pressures and can “take its time” before lowering interest rates. In addition, Boston Fed President Susan Collins said it might require more time than initially anticipated to build the confidence necessary to initiate policy easing, potentially leading to fewer rate reductions this year. “Overall, the recent data have not materially changed my outlook, but they do highlight uncertainties related to timing, and the need for patience - recognizing that disinflation may continue to be uneven,” Collins said. Meanwhile, U.S. rate futures have priced in a 6.6% chance of a 25 basis point rate cut at the next central bank meeting in May and a 22.9% probability of a 25 basis point rate cut at June’s policy meeting. Inflation seems sticky here and the prospect of rate cuts continues to get slashed. There's not a lot for the markets to get excited about right now. My lean for today is neutral: Trading docket for the day: /HE, /ZN, BA, GLD, IWM, META, MSTR?, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, NVDA, SBUX, SHOP, VKTX, VTI, WFC. Intra-day levels for me: /ES; 5227/5253* (PoC on 2 hr. chart)/5265/5282 to the upside. 5220/5201/5189/5174 to the downside. /NQ; 18449/18510/18600/18703 to the upside. 18343/18289* (PoC on 2hr chart)/18246/18180 to the downside. Bitcoin; 69459 is support 70380 is PoC 72278 is resistance. I wish you all the best with your trading today. Have a great weekend.

Welcome back to another day of fighting the inflation data! Yesterday was immensly satisfying for me. It was almost a repeat of Tues., where I started off the day down quite a bit on my net liq and by the end of the day we showed a nice profit. We were able to finally get another Theta Fairy up and working. Its nice financially but also mentally to start each day off with an extra $100 dollars in your pocket. We've got another Theta fairy working for this morning. The DIA drop yesterday hurt us but other than that, most of our positions cooperated by the end of the day. MSTR poured on $3,200 profit and NVDA added $800 profit. We had four 0DTE's. I'll say it again...if you like day trading, no one is going to spoon feed you more daily setups. Our Event contract NDX hit for 18% ROI. Our Bitcoin 0DTE hit for 3% ROI. Our standard NDX hit for 40% ROI! Our standard SPX hit for 17.5% ROI. All told we had 10K at work in the 0DTE's and brought in $4,200 profit. It was a stellar day, to say the least. Our goal, which sounds aggressive to some but is music to our ears is to make at least $1,000 a day. We usually have a pretty good shot at that. Lets get into the market: CPI hit yesterday and the inflation number is hot folks! These numbers are not what the FED is looking for if your goal is to lower rates. We've gone from looking for 7 rate cuts this year to 5 to 3 and now we are talking about maybe only two or even none! Bonds got clobbered. We'e got PPI today. Here's the daily new schedule: 08:30 ET US PPI for March The US Producer Price Index measures the average change over time in the selling prices received by domestic producers for their output. It is an economic indicator that reflects the direction of inflationary pressures at the producer level. PPI is used to assess inflation trends in the early stages of the production process, providing insights into potential changes in consumer prices, making it a leading indicator. What to Expect Higher-than-expected producer prices can point to the potential for these price increases on the supply side to be passed down to the consumer side and become reflected in CPI, which would be a headwind for the Fed’s goal of returning inflation to target. This would be likely to cause weakness in US stocks and strength in the dollar, as traders would likely push back bets on when the Fed would start cutting interest rates this year. US Weekly Initial Jobless Claims The US Initial Jobless Claims report provides data on the number of individuals who filed for unemployment benefits for the first time during the previous week. It serves as an indicator of the labor market’s health, with higher numbers indicating increased layoffs and economic instability, while lower numbers suggest a stronger job market. Continued Jobless Claims, on the other hand, represent the number of individuals who remain on unemployment benefits after their initial claim. What to Expect Employment is one of the Fed’s mandates; yet, FOMC officials have stated that they consider a higher unemployment rate as consistent with their goal of returning to 2% inflation. This means that greater-than-expected jobless claims, implying higher unemployment, are likely to be interpreted by the Fed as good news for inflation’s return to target. This scenario might force US stocks to rise and the currency to fall. As was the case yesterday with CPI, I don't track levels on the PPI release either. It's too much of an algo driven day and we are just along for the ride. Trade docket for today: /ES (Thetafairy),/HE, /HG, /MCL, /ZN, CRM, DIA, DJT, BA, JPM, WFC, BLK, C, SPX/NDX/Event contract NDX, Event contract Bitcoin 0DTE's. Markets continue to look to roll over. IWM and DIA are looking to go negative on the year. And internals are starting to weaken. PPI will obviously be the driver today and I'm sure it will be confirming of yesterdays CPI hotness but, I'm leaning a little bullish today, even with futures tanking. We all paid our ticket to the show and PPI is out shortly so lets see what we can do with it today!

Well, yesterday ended up being a nice little surprise for us. I started off the day with my net liq in the hole and prospects didn't look great however, by the end of the day enough positions came around for us that I finished up solidly in the green. NVDA contributed $1,100 and NDX a whopping $3,000 profit to the day but all our 0DTE's helped. In total, including our 0DTE on Bitcoin, we generated $2,788 of profit on FIVE total 0DTE's and using 12k of capital. All in all, not a bad day. Lets take a look at the markets and what we can expected today: Markets are working back to buy mode. But price action hasn't really changed. The market is coiling here. We have a busy news day: 08:30 ET US CPI for March The US Consumer Price Index gauges the average change in prices paid by consumers for a basket of goods and services over time. Calculated monthly by the US Bureau of Labor Statistics, the CPI reflects fluctuations in the cost of items such as food, housing, healthcare, and transportation. Presented as a percentage change relative to a predetermined base period, the CPI serves as a measure of inflation. What to Expect If inflation comes in hotter (higher) than expected, you will most likely see dollar strength and US stocks weaken, as this signals that the Fed’s fight with inflation is going to require a more hawkish stance, with the potential for a higher for longer US interest rate. 09:45 ET BoC Rate Decision The Bank of Canada Interest Rate Decision is the main monetary policy tool where the Bank of Canada’s Governing Council determines the official interest rate for the Canadian economy. This rate, known as the overnight rate, influences short-term interest rates and serves as a key benchmark for borrowing costs in the country. The Bank of Canada uses this rate to achieve its inflation target and support overall economic goals. Changes in the interest rate can impact consumer spending, business investments, and inflation. What to Expect It is widely expected that the BoC will leave rates unchanged at 5%. If realized, attention will turn to the subsequent BoC rate statement for any clues on the future path of BoC interest rates. Any mention of more rate cuts this year than are already priced in by the markets could prompt strength in Canadian stocks and weakness in the Canadian dollar. However, hawkish remarks implying fewer interest rate cuts than are currently priced this year could result in the opposite. 10:30 ET Weekly EIA Crude Oil Inventories The US Weekly Crude Oil Inventories report provides information on the nation’s stockpile of crude oil, indicating changes in inventory levels over the previous week. Published by the US Energy Information Administration, this report is crucial for understanding supply and demand dynamics in the oil market. Fluctuations in crude oil inventories can influence oil prices and offer insights into market trends. What to Expect An increase in inventories may suggest oversupply or weaker demand, while a decrease may indicate stronger demand or disruptions in supply. 2:00 ET FOMC minutes release All these news catalysts will effect our trading today. We are looking to add to our oil ladder today after inventory numbers are released. We are hedged on both sides of the market going into the open. We have a couple long QQQ puts left over from yesterdays scalping session and our NDX setup would benefit greatly if we pushed up. We also have a juicy Theta Fairy working right now going into the open! We haven't had this type of I.V. or premium in a while. Our trade docket for today: /ES (theta fairy), /MCL, /NG?, AEHR, CGC, DAL, GLD, NDX/SPX/Event contract NDX/Bitcoin 0DTE's, SGH, STZ, KMX. With CPI today I don't post levels. We have been waiting for a catalyst to move this consolidating market for some time. Will today be that catalyst? We'll find out soon enough. Today we trade small. We'll be in the live trading room early to see about some potential scalps on /MNQ as the report is released.

No lean or bias today. Well, yesterday was a barn burner for us. I thought that a $4,000- $5,000 day potentially existed for us but we blew by that with a $10,800 day! MSTR contributed $1,400. NVDA hit for $4,400 and our NDX 0DTE with the adjustment from last Thurs. hit for $3,700 profit. All four of our 0DTE's hit for profits as well. The Event Bitcoin 0DTE setups continue to offer great risk/reward. It looks like we could have another potential $3,000+ day on our NDX today. Let's look at the market: We are still stuck in a neutral rating. These technical setups don't usually last. This generally means the market to coiling for a big move. We continue to be stuck under these heavy resistance levels Price action for the last week has me leaning with a more negative delta on our Oil ladder. My lean today is, once again. Slightly bullish: Trade docket for today: FSLR, GLD, GOOG, SPX/NDX/Event contract NDX/Bitcoin 0DTE's,PFE, TLRY, XBI, 2 new pairs trades, 1 new insider sell trade, SGH and DAL new earnings trades. Tomorrow is when the fun starts with the release of CPI: Wednesday 10th April 08:30 ET US CPI for March The US Consumer Price Index gauges the average change in prices paid by consumers for a basket of goods and services over time. Calculated monthly by the US Bureau of Labor Statistics, the CPI reflects fluctuations in the cost of items such as food, housing, healthcare, and transportation. Presented as a percentage change relative to a predetermined base period, the CPI serves as a measure of inflation. What to Expect If inflation comes in hotter (higher) than expected, you will most likely see dollar strength and US stocks weaken, as this signals that the Fed’s fight with inflation is going to require a more hawkish stance, with the potential for a higher for longer US interest rate. 09:45 ET BoC Rate Decision The Bank of Canada Interest Rate Decision is the main monetary policy tool where the Bank of Canada’s Governing Council determines the official interest rate for the Canadian economy. This rate, known as the overnight rate, influences short-term interest rates and serves as a key benchmark for borrowing costs in the country. The Bank of Canada uses this rate to achieve its inflation target and support overall economic goals. Changes in the interest rate can impact consumer spending, business investments, and inflation. What to Expect It is widely expected that the BoC will leave rates unchanged at 5%. If realized, attention will turn to the subsequent BoC rate statement for any clues on the future path of BoC interest rates. Any mention of more rate cuts this year than are already priced in by the markets could prompt strength in Canadian stocks and weakness in the Canadian dollar. However, hawkish remarks implying fewer interest rate cuts than are currently priced this year could result in the opposite. 10:30 ET Weekly EIA Crude Oil Inventories The US Weekly Crude Oil Inventories report provides information on the nation’s stockpile of crude oil, indicating changes in inventory levels over the previous week. Published by the US Energy Information Administration, this report is crucial for understanding supply and demand dynamics in the oil market. Fluctuations in crude oil inventories can influence oil prices and offer insights into market trends. What to Expect An increase in inventories may suggest oversupply or weaker demand, while a decrease may indicate stronger demand or disruptions in supply. Intra day levels for me: /ES; 5264/5285*(PoC on 4hr. chart)/530/5335 to the upside. 5235/5220/5192/5171 to the downside. /NQ; 18405/18449/18510*(PoC on 2hr. chart)/18604 to the upside. 18271/18182/18126/18061 to the downside. Bitcoin: 74040 resistance. 67692 support. Have a great trading day folks.

Welcome back traders! We had a nice finish to the week last Friday. My net liq was back up 9k after Thursdays 0DTE rolls. NVDA and MSTR continue to do a lot of the heavy lifting. Our MSTR in particular looks set for a monster week with bitcoin soaring againg this morning. We rebounded Friday with successful 0DTE's on NDX, SPX, MSTR and the Event contracts on both Bitcoin and NDX. If you like 0DTE trades and you want the most volume of opportunity out there, we've got em setup for you! Let's take a look at the market: We are bouncing between Neutral and slight Buy rating right now on the futures. The market is looking to retake the bullish price action. Each of the major indices we trade is still sitting above their respective 50DMA albeit the DIA just barely. An interesting change of pace was seen on the SPY daily chart this week, with the price closing below the 21-period EMA for the first time this year. Despite closing only moderately lower than last week at $518.43 (-0.89%), the clear bearish RSI divergence is cause for concern. Much like the SPY, the QQQ also struggled with its 21-period EMA this week, failing to regain it after Thursday’s selloff and closing at $440.47 (-0.80%). The Relative Strength indicator continues to deteriorate, suggesting weakness under the hood. The small caps were the weakest performers of the group this week, closing at $204.45 (-2.78%). Much like its more favored counterparts, the IWM is also showcasing clear bearish RSI divergence while the price struggles below the 21-period EMA. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls advanced by 303K jobs last month, well above the 212K consensus and the biggest increase in 10 months. Also, the U.S. March unemployment rate edged lower to 3.8%, stronger than expectations of no change at 3.9%. In addition, U.S. average hourly earnings came in at +0.3% m/m and +4.1% y/y in March, in line with expectations. Finally, U.S. February consumer credit rose +14.12B, weaker than expectations of +16.20B. “Bang! Employment up, rate cuts need to come out. The Fed will likely need to reconsider its current stance of three rate cuts this year. But, the reason for this likely change in posture is bullish - the economy is doing well,” said George Mateyo at Key Wealth. Dallas Fed President Lorie Logan said on Friday that “it’s much too soon” to contemplate reducing interest rates, pointing to recent high inflation figures and indications that borrowing costs might not be restraining the economy to the extent previously thought. Fed Governor Michelle Bowman also expressed her concern regarding potential upward risks to inflation, emphasizing that it’s “still not yet” time to cut interest rates. U.S. rate futures have priced in a 4.5% chance of a 25 basis point rate cut at the next FOMC meeting in May and a 46.2% probability of a 25 basis point rate cut at June’s policy meeting. The big, pre-planned news catalysts this week will be inflation based, once again. CPI on Weds. and PPI on Thursday. My lean today is ever so slightly bullish: Trade docket for today: LULU, /MCL, /ZN, BA, CCL, DELL, FSLR, GLD, KRUS, MSTR, NVDA, SBUX, IWM, CRM, ORCL, PYPL, PLTR, SHOP, SPY/QQQ, 0DTE's on NDX/SPX/Event contract NDX and Event contract on Bitcoin. TLRY and AEHR earnings plays. Intra-day levels for me: /ES; 5254/5272/5285* (PoC on 2hr. chart) 5242/5225/5212/5194 to the downside. /NQ; 18329/18405/18446/18485*( PoC on 2hr. chart) to the upside. 18272/18188/18132/18051 to the downside. Levels for Bitcoin: 75107 resistance. 67720 is support and also PoC on 4 hr. chart. Have a great week folks. Earnings season ramping back up with Banks later this week! We should also have more pairs trades setups this week.

Well...the streak had to end at some point. Our run of 19 consecutive days and 65 consecutive trades of $1,000+ a day profits is over! I had to roll my SPX/NDX standard 0DTE's yesterday as I got caught in the late day dump. A lot of our members did take profits. We sat at 50-70% capture rates for most of the day. "Don't let green turn to red". I'm down 8k on my NDX and 4k on the SPX position. The adjustment has 16K of capital appreciation potential and approx. $1,400 a day of cash flow potential for the next 24 days so we should be good but it was frustrating to let that green go red. Scalping helped with $1,200 profit and both our event contract 0DTE's worked well. 20% ROI on the NDX version and 12% Profit on the Bitcoin version. Unfortunately I only got filled on $1,400 of my order so it wasn't enough to make a difference. Our Bitcoin 0DTE continues to offer some nice setups. Let's look at the markets: June S&P 500 E-Mini futures (ESM24) are trending up +0.27% this morning as investors looked ahead to the release of crucial U.S. nonfarm payrolls data to gauge the timing of the Federal Reserve’s interest-rate cuts. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose +9K to a 2-month high of 221K, compared to a consensus of 213K. Also, the U.S. trade deficit came in at -$68.90B in February, wider than expectations of -$66.90B and the largest deficit in 10 months. Chicago Fed President Austan Goolsbee said on Thursday that the higher-than-anticipated inflation figures observed at the beginning of the year probably do not alter the overall picture of cooling price growth. “My overall assessment is that these two months should not knock us off the path back to target,” Goolsbee said. Also, Richmond Fed President Thomas Barkin stated that it is “smart” for the central bank to take its time to gain more clarity regarding the trajectory of inflation before reducing interest rates. “Given a strong labor market, we have time for the clouds to clear before beginning the process of toggling rates down,” Barkin said. At the same time, Philadelphia Fed President Patrick Harker said that inflation remains too high. “We’re not where we need to be,” Harker said. In addition, Minneapolis Fed President Neel Kashkari said that interest-rate cuts might not be necessary this year if progress on inflation stalls, particularly if the economy continues to demonstrate strength. U.S. rate futures have priced in a 6.5% chance of a 25 basis point rate cut at the next central bank meeting in May and a 60.1% probability of a 25 basis point rate cut at the June FOMC meeting. Meanwhile, tensions rose in the Middle East after Israel heightened preparations for possible retaliation by Tehran following Monday’s strike on an Iranian diplomatic compound in Syria. Today, all eyes are focused on U.S. Nonfarm Payrolls data in a couple of hours. Economists, on average, forecast that March Nonfarm Payrolls will come in at 212K, compared to the previous value of 275K. “As always, the monthly jobs report will have the final say. Investors will be looking for a ‘Goldilocks’ number that won’t give the Fed any reason to delay rate cuts but also doesn’t suggest the labor market is taking a serious downturn,” said Chris Larkin at E*Trade from Morgan Stanley. We are back to an actual "full" sell signal technically, with yesterdays selloff. On the one hand, yesterdays drawdown did a lot of technical damage to the bull run. On the other, its just simply taken us back to where we were two weeks ago. Another key aspect is the fact that the SPY/QQQ/IWM are all still above the 50DMA. The DIA has dipped below it but its now sitting on some pretty well established support. Every dip we've had this year has been a buy opportunity. At some point that will stop workiing, the question is when? I'll stick my neck out and say it won't stop with this current dip. This was a sell off driven by geo-political rumors. Again, this is just my opinion, which you may not care about but, my opinions form the basis for my trades so it's important for you to know my thoughts. I don't think Iran attacks. At least a full on attack, beyond the attacks their proxies are already executing on a daily basis. I believe we rebound today. Of course we still have the all important NFP to drive us today also. My SPX/NDX adjustment from yesterday benefits with a max profit if the NDX goes up 300 points in 24 days. Futures are up 87 points as I type this so...we are on our way. My lean today is bullish: Our trade docket for today: BA, /ZN?, BYRN, CCL?, CRM?, GOOG, IWM?, LEVI, META?, MSTR?, NDX/Event contract SPX/Bitcoin 0DTE's, NVDA?, PLTR?, PYPL?. Intra-day levels for me: /ES; 5220* (key level to clear)/5238/5264/5283*(PoC) to the upside. 5190/5171/5157/5124 to the downside. /NQ; 18179/18609/18334/18450 to the upside. 18054* (key support level)/17926/17756/17665 to the downside. Bitcoin: 66068 pivot point. 74533 resistance. 60381 support. Have a great weekend folks! We'll see you on Monday.

We had another great day yesterday. I'd actually call it perfect. Not because we killed it with another $20,000 gain. Just the opposite. It was a steady, consistent result of many trades as the day progressed. Big up days can lead to big down days. I'd much prefer to eck out a few thousand dollars profit a day. My net liq ended up $4,100 on the day. It came from all over our model portfolio. NVDA and MSTR continued to provide most of the profits but our 0DTE's, once again were the stars. Eight total entries yesterday, including two 0DTE's on event contracts. One of those was, once again, on Bitcoin. It's not uncommon for us now to have 4-6 0DTE setups a day. I don't know where else you can get this level of volume. We are now on 19 consecutive days of making more than our $1,000 a day income goal from them. We are up $25,000. It also marks 65 consecutive, profitable trades. Bitcoin has added a whole new revenue stream for us. Markets have flip floped back to a slight buy mode at the moment. The reality is that we don't really have a directional bias right now in the market. We continue to just consolidate at these levels just under ATH's. We are going on a couple weeks now of no real action. June S&P 500 E-Mini futures (ESM24) are up +0.30%, and June Nasdaq 100 E-Mini futures (NQM24) are up +0.43% this morning as investor attention turned to crucial U.S. jobs data due Friday after Fed Chair Jerome Powell reiterated that the central bank will likely reduce rates this year. The ADP National Employment report on Wednesday showed private payrolls rose by 184K jobs in March, stronger than expectations of 148K. At the same time, the U.S. March ISM services index unexpectedly fell to 51.4, weaker than expectations of 52.8. In addition, the U.S. ISM services price paid sub-index fell to a 4-year low of 53.4 in March, trailing the 58.4 consensus. Federal Reserve Chair Jerome Powell signaled on Wednesday that policymakers would await clearer indications of lower inflation before considering interest rate cuts. Powell mentioned that recent higher-than-expected inflation figures did not “materially change” the overall picture. He reiterated his anticipation that it will likely be appropriate to start reducing rates “at some point this year.” At the same time, Atlanta Fed President Raphael Bostic stated that it would probably be appropriate to lower interest rates in the fourth quarter, reaffirming his expectation of only one rate cut this year given the economy’s strength and a slower inflation decline. Meanwhile, U.S. rate futures have priced in a 4.8% chance of a 25 basis point rate cut at May’s policy meeting and a 55.8% probability of a 25 basis point rate cut at the June meeting. Today, all eyes are focused on U.S. Initial Jobless Claims data in a couple of hours. Economists, on average, forecast that Initial Jobless Claims will come in at 213K, compared to last week’s value of 210K. 8:30 ET US Trade Balance for February The US Trade Balance for February is an economic indicator that measures the difference between the value of the goods and services exported by the United States and the value of goods and services imported into the country during that month. A positive trade balance indicates that exports exceed imports, which can contribute positively to economic growth and employment. Conversely, a negative trade balance, or trade deficit, means that imports exceed exports, which can put downward pressure on economic growth and employment. The US Trade Balance provides insights into the country’s international trade dynamics and its impact on the overall economy. What to Expect The United States, a significant importer of products, has been in a trade deficit since 1975. While unlikely to influence markets, a smaller-than-anticipated trade deficit would signal faster growth in the United States, which might be interpreted as an upside inflation risk if it is far smaller than expected, or as a relief to recession fears if it is only slightly smaller. US Weekly Initial & Continued Jobless Claims The US Initial Jobless Claims report provides data on the number of individuals who filed for unemployment benefits for the first time during the previous week. It serves as an indicator of the labor market’s health, with higher numbers indicating increased layoffs and economic instability, while lower numbers suggest a stronger job market. Continued Jobless Claims, on the other hand, represent the number of individuals who remain on unemployment benefits after their initial claim. What to Expect Employment is one of the Fed’s mandates; yet, FOMC officials have stated that they consider a higher unemployment rate as consistent with their goal of returning to 2% inflation. This means that greater-than-expected jobless claims, implying higher unemployment, are likely to be interpreted by the Fed as good news for inflation’s return to target. This scenario might force US stocks to rise and the currency to fall. Our trade docket for today: /HG, BB, CCL?, DJT, GLD, /ZN, /MCL, GOOG, IWM, LEVI, M, KRUS, BYRN, MSTR, SPX/NDX/Event contract/Bitcoin 0DTE's. My lean today is neutral to slightly bullish; My intra-day levels: /ES; 5283 is PoC.(purple line)/5293/5300/5311 to the upside. 5275/5268/5260/5252 to the downside. /NQ; 18488 (PoC purple line)/18535/18608/18703 to the upside. 18388/18329/18288/18233 to the downside. Best of luck and good fortune to you all today.

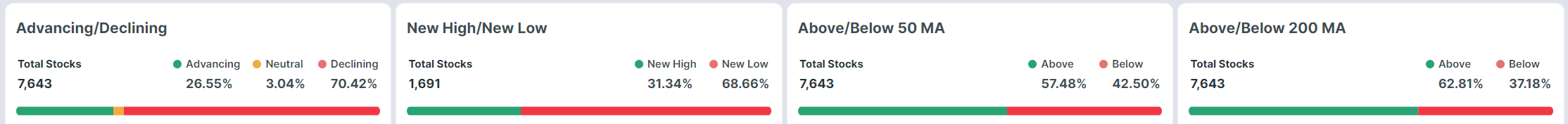

We were able to string another set of winners together yesterday. Scalping added a little. NVDA and MSTR added $4,000 profit by themselves. The big news was one of our successful 0DTE trades. We are on an run of 18 consecutive trading days of $1,000+ day profits and 58 straight winners with over $23,000 of profit. Thats great but one of our 0DTE setups was a new trade for us. We traded the event contract 0DTE on Bitcoin! This new addition now gives us the opportunity to do FOUR 0DTE setups each day! Our three 0DTE's from yesterday yielded $1,118 in profit on $9,300 of capital. On to the markets: Sellers aren't letting go of this latest weakness. Sell rating in getting stronger. All the major indices look tired here. For this months VTI swing trade we had bearish indicators so we went with the short (bearish) position for this months iteration. It's always good to use this trade setup to establish you market bias. We are usually right if we follow the signals it gives us. We continue to see a sector rotation out of tech and into utilities. Every sector got hit yesterday with the exception of Energy. OIl continues to push higher. Healthcare got clobbered yesterday after Medicare reimbursements was not what the sector was hoping form. Bitcoin has dropped over 5% as strength in the U.S. dollar weigh on it. Its bitcoin that we follow to continue to generate impressive cash flow out of MSTR. A quick look at market internals reveals they don't look so healthly lately: Cleveland Fed President Loretta Mester said on Tuesday that she wants to see further evidence indicating a downward trajectory in inflation before considering rate cuts. “If the economy evolves as expected, then in my view, it will be appropriate for the FOMC to begin reducing the fed funds rate later this year,” she said. Speaking with reporters after the speech, Mester affirmed her view that three rate cuts are still likely appropriate for this year but emphasized that “it’s a close call” on whether fewer cuts will be needed. In addition, San Francisco Fed President Mary Daly stated on Tuesday that three interest-rate cuts remain a reasonable expectation for 2024, though she emphasized that “there’s really no urgency to adjust the rate.” U.S. rate futures have priced in a 0.9% chance of a 25 basis point rate cut at the May FOMC meeting and a 62.3% chance of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. Meanwhile, Federal Reserve Chair Jerome Powell is scheduled to deliver a speech at the Stanford Business, Government, and Society Forum later in the day. Also, Fed Governor Michelle Bowman, Chicago Fed President Austan Goolsbee, and Fed Governor Adriana Kugler will speak today. On the economic data front, all eyes are focused on the U.S. ADP Nonfarm Employment Change data in a couple of hours. Economists, on average, forecast that March ADP Nonfarm Employment Change will stand at 148K, compared to the previous value of 140K. Also, investors will likely focus on the U.S. ISM Non-Manufacturing PMI, which arrived at 52.6 in February. Economists foresee the March figure to be 52.8. Pulling back a little to a weekly outlook, Its still just a mixed bad. We aren't universally bearish across the board. One stock that does stand out is TSLA. It slid almost 5% after reporting quarterly sales number that, for the first time in the companies history, were down quarter over quarter. TSLA is no longer a growth company. Its a mature company. BVD, Tesla's biggest competitor and the EV company backed by Warren Buffett slid as well with poor sales numbers. The EV market may have run out of steam. Tesla-focused ETFs dropped after the electric vehicle manufacturing giant said first quarter deliveries plunged 8.5% from the same period a year ago, its first year-over-year decline since 2020, and widely missing Wall Street expectations. Tesla Inc. shares fell about 5% in midday trading. So-called single-stock exchange-traded funds that seek to outpace Tesla fell even more, while those that bet on falling Tesla shares jumped. While Tesla produced more than 433,000 vehicles, it delivered only 387,000, the company said in a press release Tuesday, missing analysts' expectations. A Factset survey forecast 457,000 deliveries for the quarter. Compared with the previous quarter, deliveries sank about 20%. The Direxion Daily TSLA Bull 1.5X Shares (TSLL), which seeks to outpace Tesla shares by one-and-a-half times, dropped more than 10%. The Direxion Daily TSLA Bear 1X Shares (TSLS), which rises when Tesla falls, added 5%. Tesla shares were recently trading at about $165, off over 33% for the year. I don't know that I'd be shorting TSLA here but I certainly don't see a reason to own it. My lean today is neutral: Trade docket for today: /MCL after oil inventory is out. AAPL?, CCL, GLD, IWM, SMCI, XBE, LEVI earnings trade, BB earnings trade. SPX/NDX/EC 0DTE's with the possibility of another Bitcoin 0DTE as well. My intra-day levels;

/ES; 5290 is PoC. This is a key level the market wants to gavitate to. 5265/5277/5285/5290/5296* (big resistance level) To the upside. 5247/5235* (key support level)/5210/5190 to the downside. /NQ; 18265* (PoC on 2 hr. chart)/18303/18356/18456 to the upside. 18202/18107/18056/18028 to the downside. |

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |