|

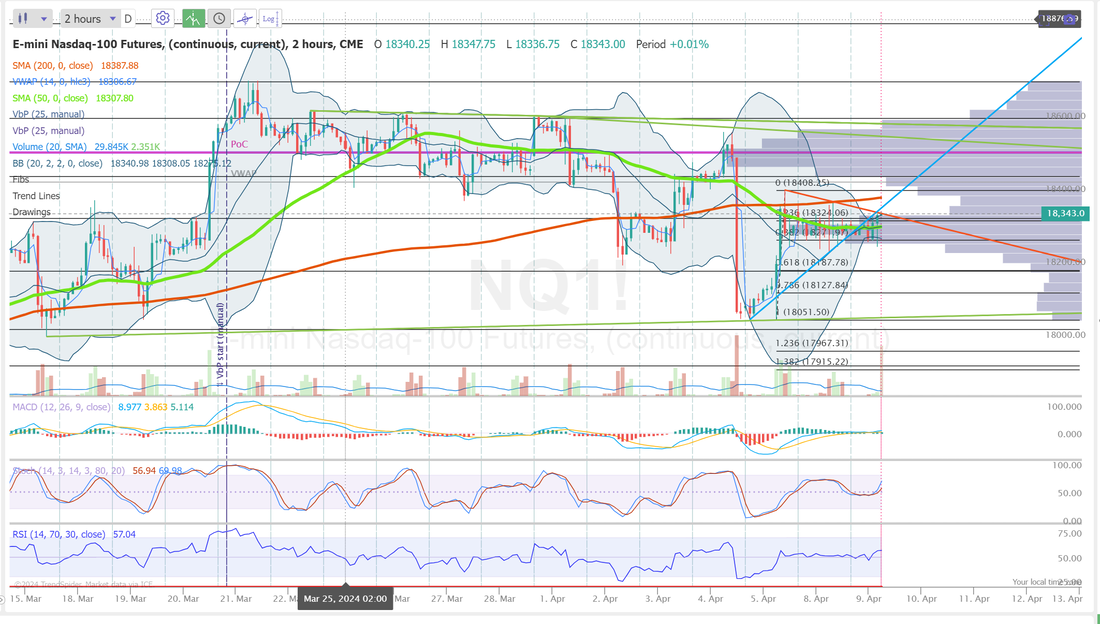

Well, yesterday was a barn burner for us. I thought that a $4,000- $5,000 day potentially existed for us but we blew by that with a $10,800 day! MSTR contributed $1,400. NVDA hit for $4,400 and our NDX 0DTE with the adjustment from last Thurs. hit for $3,700 profit. All four of our 0DTE's hit for profits as well. The Event Bitcoin 0DTE setups continue to offer great risk/reward. It looks like we could have another potential $3,000+ day on our NDX today. Let's look at the market: We are still stuck in a neutral rating. These technical setups don't usually last. This generally means the market to coiling for a big move. We continue to be stuck under these heavy resistance levels Price action for the last week has me leaning with a more negative delta on our Oil ladder. My lean today is, once again. Slightly bullish: Trade docket for today: FSLR, GLD, GOOG, SPX/NDX/Event contract NDX/Bitcoin 0DTE's,PFE, TLRY, XBI, 2 new pairs trades, 1 new insider sell trade, SGH and DAL new earnings trades. Tomorrow is when the fun starts with the release of CPI: Wednesday 10th April 08:30 ET US CPI for March The US Consumer Price Index gauges the average change in prices paid by consumers for a basket of goods and services over time. Calculated monthly by the US Bureau of Labor Statistics, the CPI reflects fluctuations in the cost of items such as food, housing, healthcare, and transportation. Presented as a percentage change relative to a predetermined base period, the CPI serves as a measure of inflation. What to Expect If inflation comes in hotter (higher) than expected, you will most likely see dollar strength and US stocks weaken, as this signals that the Fed’s fight with inflation is going to require a more hawkish stance, with the potential for a higher for longer US interest rate. 09:45 ET BoC Rate Decision The Bank of Canada Interest Rate Decision is the main monetary policy tool where the Bank of Canada’s Governing Council determines the official interest rate for the Canadian economy. This rate, known as the overnight rate, influences short-term interest rates and serves as a key benchmark for borrowing costs in the country. The Bank of Canada uses this rate to achieve its inflation target and support overall economic goals. Changes in the interest rate can impact consumer spending, business investments, and inflation. What to Expect It is widely expected that the BoC will leave rates unchanged at 5%. If realized, attention will turn to the subsequent BoC rate statement for any clues on the future path of BoC interest rates. Any mention of more rate cuts this year than are already priced in by the markets could prompt strength in Canadian stocks and weakness in the Canadian dollar. However, hawkish remarks implying fewer interest rate cuts than are currently priced this year could result in the opposite. 10:30 ET Weekly EIA Crude Oil Inventories The US Weekly Crude Oil Inventories report provides information on the nation’s stockpile of crude oil, indicating changes in inventory levels over the previous week. Published by the US Energy Information Administration, this report is crucial for understanding supply and demand dynamics in the oil market. Fluctuations in crude oil inventories can influence oil prices and offer insights into market trends. What to Expect An increase in inventories may suggest oversupply or weaker demand, while a decrease may indicate stronger demand or disruptions in supply. Intra day levels for me: /ES; 5264/5285*(PoC on 4hr. chart)/530/5335 to the upside. 5235/5220/5192/5171 to the downside. /NQ; 18405/18449/18510*(PoC on 2hr. chart)/18604 to the upside. 18271/18182/18126/18061 to the downside. Bitcoin: 74040 resistance. 67692 support. Have a great trading day folks.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |