|

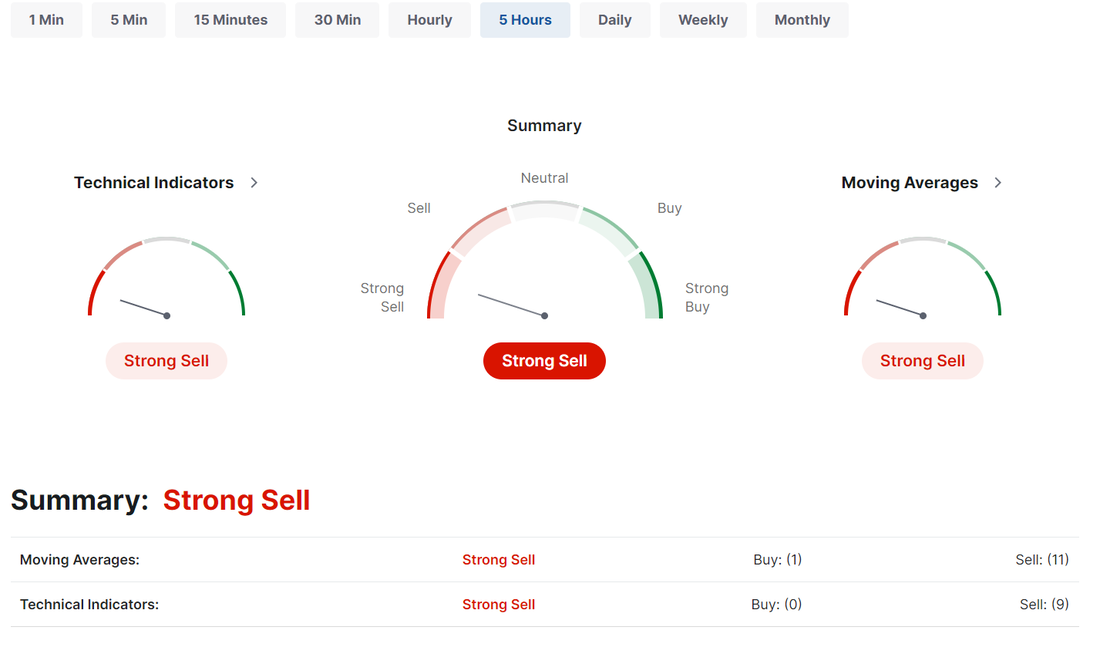

Welcome back to another day of fighting the inflation data! Yesterday was immensly satisfying for me. It was almost a repeat of Tues., where I started off the day down quite a bit on my net liq and by the end of the day we showed a nice profit. We were able to finally get another Theta Fairy up and working. Its nice financially but also mentally to start each day off with an extra $100 dollars in your pocket. We've got another Theta fairy working for this morning. The DIA drop yesterday hurt us but other than that, most of our positions cooperated by the end of the day. MSTR poured on $3,200 profit and NVDA added $800 profit. We had four 0DTE's. I'll say it again...if you like day trading, no one is going to spoon feed you more daily setups. Our Event contract NDX hit for 18% ROI. Our Bitcoin 0DTE hit for 3% ROI. Our standard NDX hit for 40% ROI! Our standard SPX hit for 17.5% ROI. All told we had 10K at work in the 0DTE's and brought in $4,200 profit. It was a stellar day, to say the least. Our goal, which sounds aggressive to some but is music to our ears is to make at least $1,000 a day. We usually have a pretty good shot at that. Lets get into the market: CPI hit yesterday and the inflation number is hot folks! These numbers are not what the FED is looking for if your goal is to lower rates. We've gone from looking for 7 rate cuts this year to 5 to 3 and now we are talking about maybe only two or even none! Bonds got clobbered. We'e got PPI today. Here's the daily new schedule: 08:30 ET US PPI for March The US Producer Price Index measures the average change over time in the selling prices received by domestic producers for their output. It is an economic indicator that reflects the direction of inflationary pressures at the producer level. PPI is used to assess inflation trends in the early stages of the production process, providing insights into potential changes in consumer prices, making it a leading indicator. What to Expect Higher-than-expected producer prices can point to the potential for these price increases on the supply side to be passed down to the consumer side and become reflected in CPI, which would be a headwind for the Fed’s goal of returning inflation to target. This would be likely to cause weakness in US stocks and strength in the dollar, as traders would likely push back bets on when the Fed would start cutting interest rates this year. US Weekly Initial Jobless Claims The US Initial Jobless Claims report provides data on the number of individuals who filed for unemployment benefits for the first time during the previous week. It serves as an indicator of the labor market’s health, with higher numbers indicating increased layoffs and economic instability, while lower numbers suggest a stronger job market. Continued Jobless Claims, on the other hand, represent the number of individuals who remain on unemployment benefits after their initial claim. What to Expect Employment is one of the Fed’s mandates; yet, FOMC officials have stated that they consider a higher unemployment rate as consistent with their goal of returning to 2% inflation. This means that greater-than-expected jobless claims, implying higher unemployment, are likely to be interpreted by the Fed as good news for inflation’s return to target. This scenario might force US stocks to rise and the currency to fall. As was the case yesterday with CPI, I don't track levels on the PPI release either. It's too much of an algo driven day and we are just along for the ride. Trade docket for today: /ES (Thetafairy),/HE, /HG, /MCL, /ZN, CRM, DIA, DJT, BA, JPM, WFC, BLK, C, SPX/NDX/Event contract NDX, Event contract Bitcoin 0DTE's. Markets continue to look to roll over. IWM and DIA are looking to go negative on the year. And internals are starting to weaken. PPI will obviously be the driver today and I'm sure it will be confirming of yesterdays CPI hotness but, I'm leaning a little bullish today, even with futures tanking. We all paid our ticket to the show and PPI is out shortly so lets see what we can do with it today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |