|

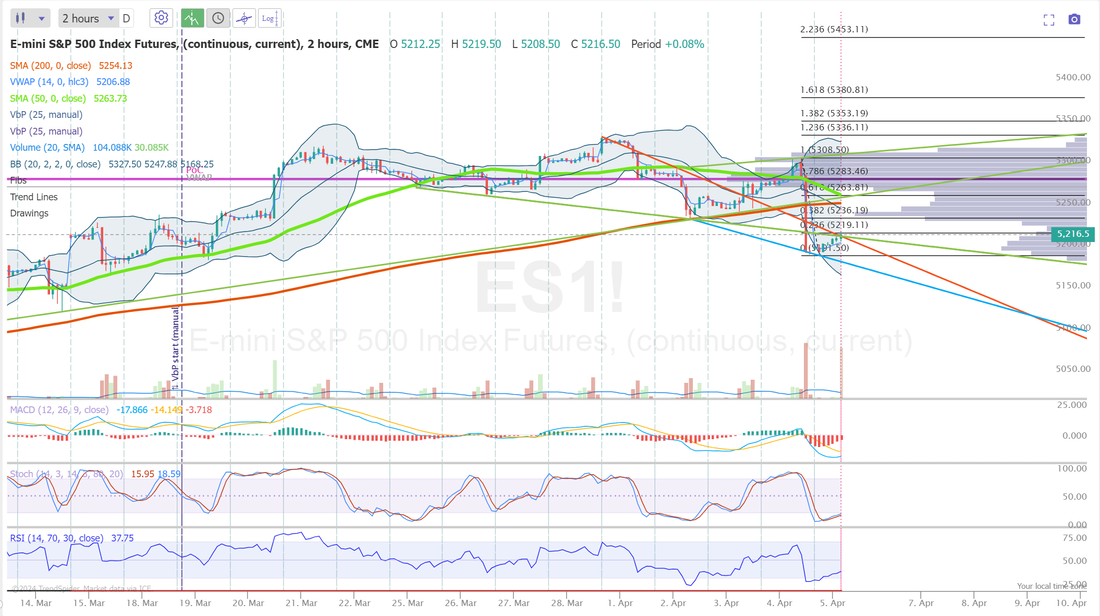

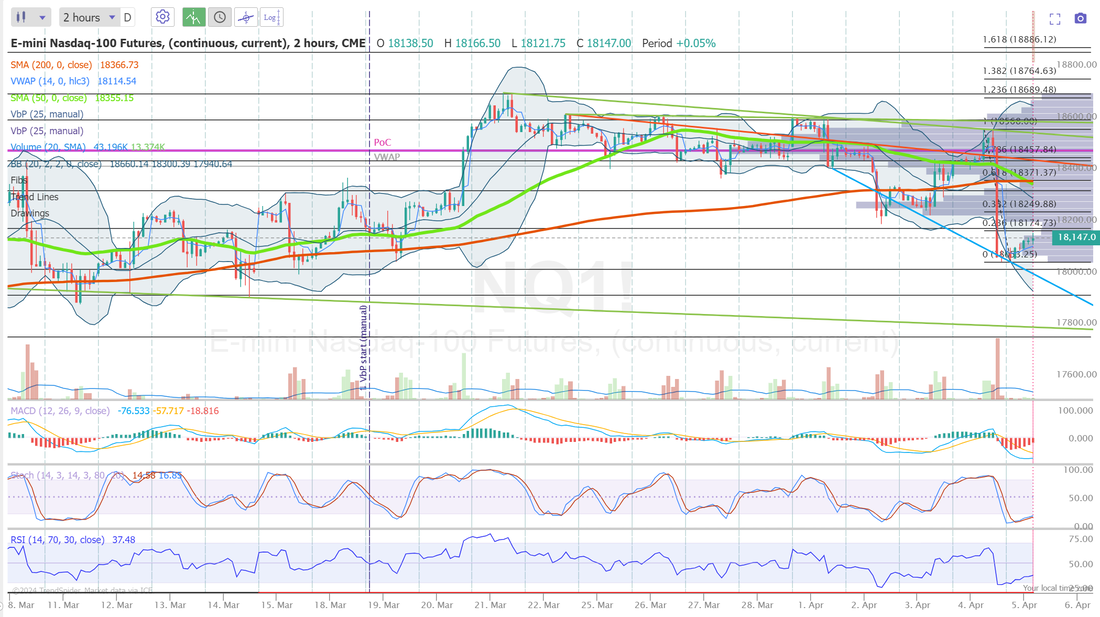

Well...the streak had to end at some point. Our run of 19 consecutive days and 65 consecutive trades of $1,000+ a day profits is over! I had to roll my SPX/NDX standard 0DTE's yesterday as I got caught in the late day dump. A lot of our members did take profits. We sat at 50-70% capture rates for most of the day. "Don't let green turn to red". I'm down 8k on my NDX and 4k on the SPX position. The adjustment has 16K of capital appreciation potential and approx. $1,400 a day of cash flow potential for the next 24 days so we should be good but it was frustrating to let that green go red. Scalping helped with $1,200 profit and both our event contract 0DTE's worked well. 20% ROI on the NDX version and 12% Profit on the Bitcoin version. Unfortunately I only got filled on $1,400 of my order so it wasn't enough to make a difference. Our Bitcoin 0DTE continues to offer some nice setups. Let's look at the markets: June S&P 500 E-Mini futures (ESM24) are trending up +0.27% this morning as investors looked ahead to the release of crucial U.S. nonfarm payrolls data to gauge the timing of the Federal Reserve’s interest-rate cuts. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose +9K to a 2-month high of 221K, compared to a consensus of 213K. Also, the U.S. trade deficit came in at -$68.90B in February, wider than expectations of -$66.90B and the largest deficit in 10 months. Chicago Fed President Austan Goolsbee said on Thursday that the higher-than-anticipated inflation figures observed at the beginning of the year probably do not alter the overall picture of cooling price growth. “My overall assessment is that these two months should not knock us off the path back to target,” Goolsbee said. Also, Richmond Fed President Thomas Barkin stated that it is “smart” for the central bank to take its time to gain more clarity regarding the trajectory of inflation before reducing interest rates. “Given a strong labor market, we have time for the clouds to clear before beginning the process of toggling rates down,” Barkin said. At the same time, Philadelphia Fed President Patrick Harker said that inflation remains too high. “We’re not where we need to be,” Harker said. In addition, Minneapolis Fed President Neel Kashkari said that interest-rate cuts might not be necessary this year if progress on inflation stalls, particularly if the economy continues to demonstrate strength. U.S. rate futures have priced in a 6.5% chance of a 25 basis point rate cut at the next central bank meeting in May and a 60.1% probability of a 25 basis point rate cut at the June FOMC meeting. Meanwhile, tensions rose in the Middle East after Israel heightened preparations for possible retaliation by Tehran following Monday’s strike on an Iranian diplomatic compound in Syria. Today, all eyes are focused on U.S. Nonfarm Payrolls data in a couple of hours. Economists, on average, forecast that March Nonfarm Payrolls will come in at 212K, compared to the previous value of 275K. “As always, the monthly jobs report will have the final say. Investors will be looking for a ‘Goldilocks’ number that won’t give the Fed any reason to delay rate cuts but also doesn’t suggest the labor market is taking a serious downturn,” said Chris Larkin at E*Trade from Morgan Stanley. We are back to an actual "full" sell signal technically, with yesterdays selloff. On the one hand, yesterdays drawdown did a lot of technical damage to the bull run. On the other, its just simply taken us back to where we were two weeks ago. Another key aspect is the fact that the SPY/QQQ/IWM are all still above the 50DMA. The DIA has dipped below it but its now sitting on some pretty well established support. Every dip we've had this year has been a buy opportunity. At some point that will stop workiing, the question is when? I'll stick my neck out and say it won't stop with this current dip. This was a sell off driven by geo-political rumors. Again, this is just my opinion, which you may not care about but, my opinions form the basis for my trades so it's important for you to know my thoughts. I don't think Iran attacks. At least a full on attack, beyond the attacks their proxies are already executing on a daily basis. I believe we rebound today. Of course we still have the all important NFP to drive us today also. My SPX/NDX adjustment from yesterday benefits with a max profit if the NDX goes up 300 points in 24 days. Futures are up 87 points as I type this so...we are on our way. My lean today is bullish: Our trade docket for today: BA, /ZN?, BYRN, CCL?, CRM?, GOOG, IWM?, LEVI, META?, MSTR?, NDX/Event contract SPX/Bitcoin 0DTE's, NVDA?, PLTR?, PYPL?. Intra-day levels for me: /ES; 5220* (key level to clear)/5238/5264/5283*(PoC) to the upside. 5190/5171/5157/5124 to the downside. /NQ; 18179/18609/18334/18450 to the upside. 18054* (key support level)/17926/17756/17665 to the downside. Bitcoin: 66068 pivot point. 74533 resistance. 60381 support. Have a great weekend folks! We'll see you on Monday.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |