|

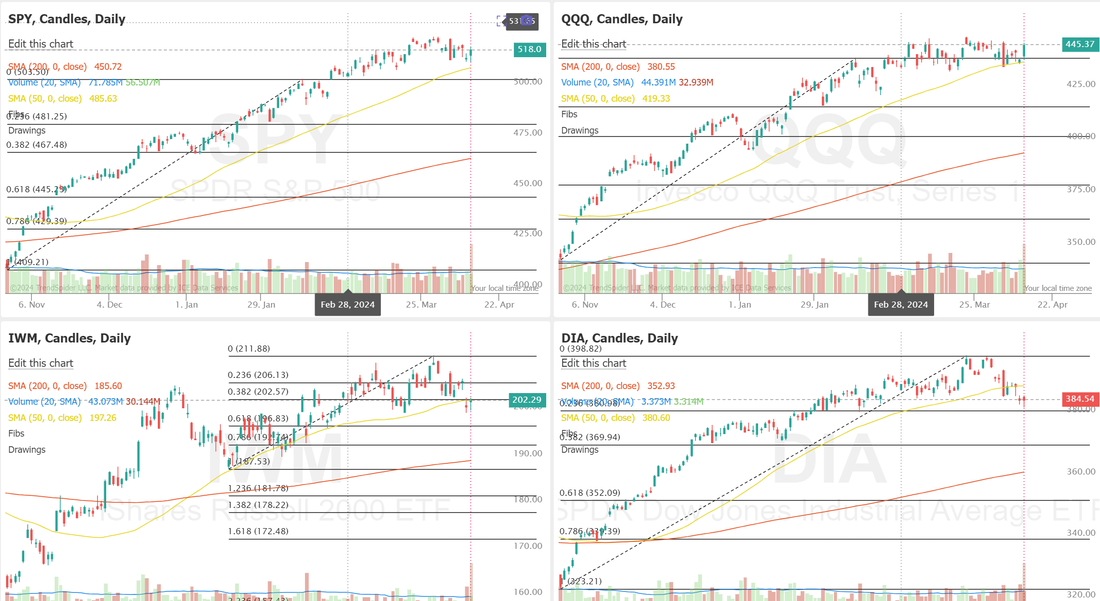

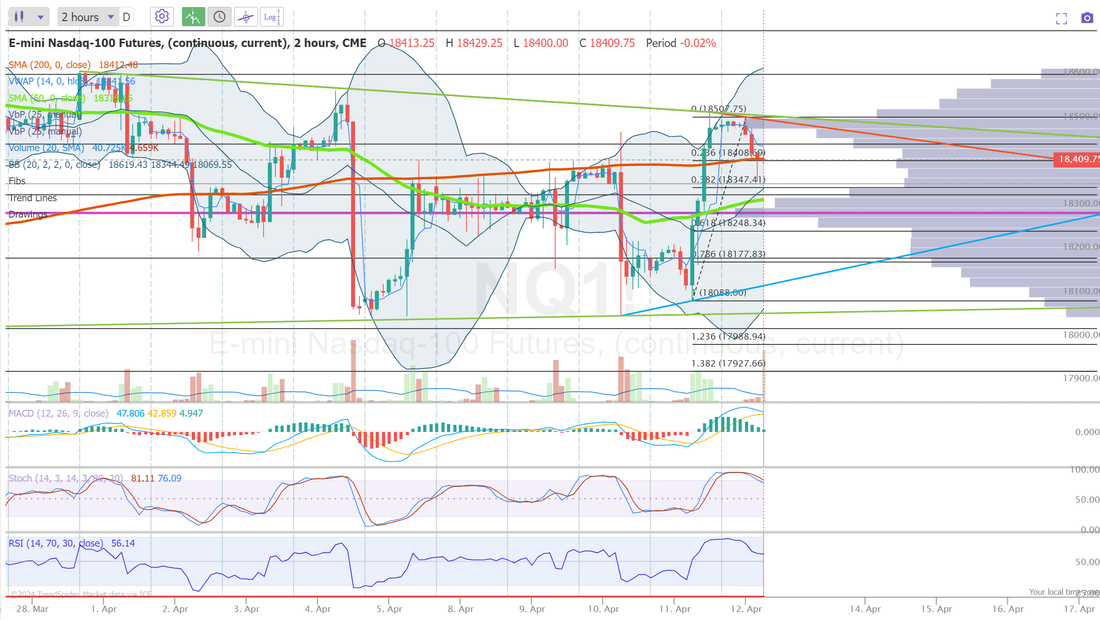

We had an "interesting" day yesterday. I don't think we'll know if it was a successful day until we hear the ringing of the closing bell today. When I was 19 yrs. old I served a church mission in an poor part of South America. Lots of dirt floor shacks with no heating/cooling and outhouses for bathrooms. Our goal was to help improve peoples lives. Sometimes we were successful, sometimes we felt that we just "planted the seeds" of a possible future improvement. That's how I feel right now (before the opening bell) about our day yesterday. We planted some seeds. Today we see if they sprout. Our SPX trade made money but only 3% or $300 dollars on 10k capital. Our NDX brought in $3,000 of credit but wasn't enought to move my net liq into the positive. Our Bitcoin 0DTE worked but we didn't have a lot of capital in that one and our Event Contract NDX was a loss. We did have a second Theta fairy in a row that yielded a nice result. Those are wonderful from a profit perspective but also from a mental aspect. It's just nice to have made some money before the market gets going. Unfortunately we are now back to normal I.V. so it may be some time before we get another one on. The biggest "seed" that we planted yesterday was the positioning of our NDX setup. Depending on price action, we could have an O.K. day or a potentially amazing day. We will most likely continue to work this setup today as we get price action but it certainly looks juicy right now. Our MSTR and NVDA should also yield us some good cash flow today. On to the markets: Not much in the way of news catalysts today. University of Michigan Sentiment April Prelim The University of Michigan Consumer Sentiment Index is an economic indicator that measures the confidence and optimism of US consumers regarding the economy. Published by the University of Michigan, this preliminary index is based on surveys that assess consumer attitudes toward current economic conditions and expectations for the future. It provides an early snapshot of consumer sentiment before the final monthly release. A higher sentiment reading indicates increased confidence, potentially influencing consumer spending—an essential component of economic activity. What to Expect Policymakers, analysts, and businesses monitor this indicator for insights into consumer behavior and economic trends. A higher consumer sentiment could cause an upside risk to inflation, on the other hand, it also indicates that the consumer is doing well in the face of high interest rates, reducing the risks of a recession Markets continue to look weak. We now have both the IWM and DIA under their respective 50DMA. Today will be interesting. Futures are down right now. “The PPI headline number came in a touch lower than estimates, helping markets ease fears of a broad-based inflation assault on supply chain prices in addition to consumer prices,” said Quincy Krosby, Chief Global Strategist at LPL Financial. New York Fed President John Williams stated Thursday that the Fed has made “tremendous progress” toward better balance on its inflation and employment goals, yet emphasized that there’s no urgency to implement rate cuts in the “very near term.” “As we collect more data, we’ll be able to assess have we got that confidence that inflation is moving back to 2%,” Williams said. Also, Richmond Fed President Thomas Barkin said the central bank still has some work to do to contain price pressures and can “take its time” before lowering interest rates. In addition, Boston Fed President Susan Collins said it might require more time than initially anticipated to build the confidence necessary to initiate policy easing, potentially leading to fewer rate reductions this year. “Overall, the recent data have not materially changed my outlook, but they do highlight uncertainties related to timing, and the need for patience - recognizing that disinflation may continue to be uneven,” Collins said. Meanwhile, U.S. rate futures have priced in a 6.6% chance of a 25 basis point rate cut at the next central bank meeting in May and a 22.9% probability of a 25 basis point rate cut at June’s policy meeting. Inflation seems sticky here and the prospect of rate cuts continues to get slashed. There's not a lot for the markets to get excited about right now. My lean for today is neutral: Trading docket for the day: /HE, /ZN, BA, GLD, IWM, META, MSTR?, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, NVDA, SBUX, SHOP, VKTX, VTI, WFC. Intra-day levels for me: /ES; 5227/5253* (PoC on 2 hr. chart)/5265/5282 to the upside. 5220/5201/5189/5174 to the downside. /NQ; 18449/18510/18600/18703 to the upside. 18343/18289* (PoC on 2hr chart)/18246/18180 to the downside. Bitcoin; 69459 is support 70380 is PoC 72278 is resistance. I wish you all the best with your trading today. Have a great weekend.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |