|

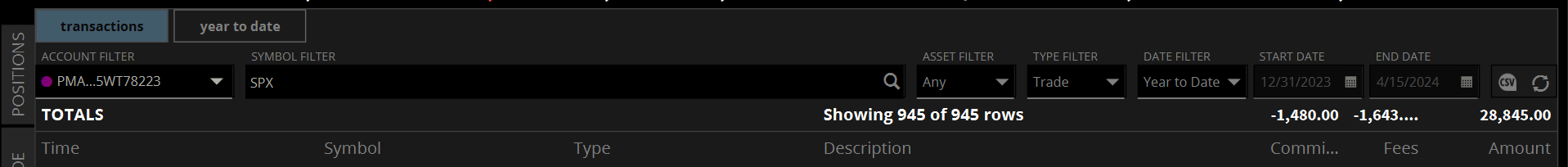

Welcome back traders. What an absolute amazing week we had last week with Friday being the topper. My net liq popped by $14,140 on Friday. Everything clicked for us with the market movement. With 17k of capital in our four 0DTE's we yielded almost 10k in profits. Our 0DTE's have been fabulous for us so far this year. We've hauled in $26,000 of profit, net of fees on the SPX And our NDX has brought us $50,000 in profits. Add in our Bitcoin 0DTE's , which have been insanely good and we are over $80,000 in profits so far this year.  I don't know where you can get four different 0DTE setups each day with this type of result. Unique setups yield unique results. With the Middle East tensions Sunday we were able to get another Thetafairy working. It hit for a profit while we were sleeping. So nice to wake up to money in your pocket before the market even opens. We are looking for a $3,000+ profit today for our new NDX 0DTE with the setup we've been using for two weeks now. Let's take a look at the market. Iran launched a wave of more than 300 drones and cruise and ballistic missiles toward Israel late on Saturday in apparent retaliation for a strike in Syria that resulted in the deaths of top Iranian military officers. A military spokesman, Rear Adm. Daniel Hagari, said that Israel and its allies intercepted most of the attack drones and missiles launched by Iran, calling the outcome “a very significant strategic success.” Meantime, speculation about the conflict remaining contained arose after Iran stated, “the matter can be deemed concluded,” and President Joe Biden reportedly told Israeli Prime Minister Benjamin Netanyahu that the U.S. would not back an Israeli counterattack. Donald Trump, the presumtive Republican nominee has his first criminal trial starting today. While there have been lots of fanfare about his recent trials this is the first one that could include jail time. This effects us directly because we have a big bearish position on in DJT. Chances of rate cuts seems to continue to be diminished. Kansas City Fed President Jeff Schmid stated Friday that he prefers a “patient” approach to rate cuts, emphasizing the importance of waiting for “clear and convincing” evidence indicating that inflation is headed back to the 2% target before reducing interest rates rather than adjusting policy preemptively. Also, San Francisco Fed President Mary Daly said that there’s “absolutely no urgency to adjust the policy rate.” In addition, Boston Fed President Susan Collins expressed her belief that two rate cuts are more probable than three in the current economic environment. Finally, Atlanta Fed President Raphael Bostic reiterated his view for one interest-rate cut this year while maintaining flexibility to make adjustments as necessary. “I think inflation is going to continue to fall, but much slower than I think many would like. If something surprising happens, I’d adjust the outlook based on that,” Bostic said. U.S. rate futures have priced in a 2.6% probability of a 25 basis point rate cut at the next FOMC meeting in May and a 20.4% chance of a 25 basis point rate cut at June’s policy meeting. As far as news catalysts today, we have U.S. retail sales out this morning with Fed member Daily speakiing later in the day. Technicals still point bearish, with last week being the worst week of the year for the markets. I.V. is back! With the SPY having almost as much juice in it as the QQQ. This bodes well for our chances to continue to get Theta Fairy setups on. After several weeks of holding above the year-to-date point of control, the SPY ETF closed this week well below it, at $510.85 (-1.46%). If the price is to continue to fall in the weeks to come, bulls will be keeping a close eye on the late February gap which aligns with the year-to-date anchored VWAP. The QQQ ETF managed to hold it together a bit better than its counterparts this week, closing at $438.27 (-0.50%), just above the year-to-date point of control. If that level is to fail, the late-February gap below could be a target. The small caps struggled the most this week, with the IWM ETF closing below its year-to-date anchored VWAP and ending the week at $198.69 (-2.82%). Now that a new low has been made, it is possible this move could be exhausted, but if the downside move continues next week, the year-to-date point of control could come into play. Our trade docket for today is pretty full, as it is most Mondays: /ES (new potential Theta Fairy), /MCL, /ZN, BA, CCL, DIA, DJT, FSLR, GLD, GOOG, IWM, LULU, MSTR, SPX/NDX/Event contract NDX/ Bitcoin 0DTE's, SPY/QQQ 4DTE, NVDA, PFE, SBUX, TEAM, XBI, ORCL, CRM, PYPL, SHOP. My lean today is bullish: Intra day levels for me: /ES; 5211/5228/5248/5256*(PoC on 2hr. chart) to the upside. 5187/5173/5163/5149 to the downside. /NQ: 18329/18360/18423/18503 to the upside. 18267/18213/18185/18124 to the downside. Bitcoin:

71646 resistance. 64963 support. 63811 downside target.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |