|

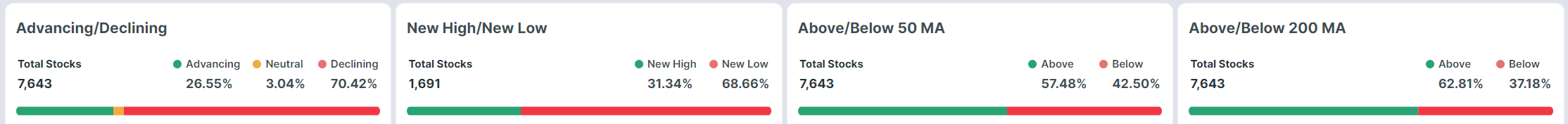

We were able to string another set of winners together yesterday. Scalping added a little. NVDA and MSTR added $4,000 profit by themselves. The big news was one of our successful 0DTE trades. We are on an run of 18 consecutive trading days of $1,000+ day profits and 58 straight winners with over $23,000 of profit. Thats great but one of our 0DTE setups was a new trade for us. We traded the event contract 0DTE on Bitcoin! This new addition now gives us the opportunity to do FOUR 0DTE setups each day! Our three 0DTE's from yesterday yielded $1,118 in profit on $9,300 of capital. On to the markets: Sellers aren't letting go of this latest weakness. Sell rating in getting stronger. All the major indices look tired here. For this months VTI swing trade we had bearish indicators so we went with the short (bearish) position for this months iteration. It's always good to use this trade setup to establish you market bias. We are usually right if we follow the signals it gives us. We continue to see a sector rotation out of tech and into utilities. Every sector got hit yesterday with the exception of Energy. OIl continues to push higher. Healthcare got clobbered yesterday after Medicare reimbursements was not what the sector was hoping form. Bitcoin has dropped over 5% as strength in the U.S. dollar weigh on it. Its bitcoin that we follow to continue to generate impressive cash flow out of MSTR. A quick look at market internals reveals they don't look so healthly lately: Cleveland Fed President Loretta Mester said on Tuesday that she wants to see further evidence indicating a downward trajectory in inflation before considering rate cuts. “If the economy evolves as expected, then in my view, it will be appropriate for the FOMC to begin reducing the fed funds rate later this year,” she said. Speaking with reporters after the speech, Mester affirmed her view that three rate cuts are still likely appropriate for this year but emphasized that “it’s a close call” on whether fewer cuts will be needed. In addition, San Francisco Fed President Mary Daly stated on Tuesday that three interest-rate cuts remain a reasonable expectation for 2024, though she emphasized that “there’s really no urgency to adjust the rate.” U.S. rate futures have priced in a 0.9% chance of a 25 basis point rate cut at the May FOMC meeting and a 62.3% chance of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. Meanwhile, Federal Reserve Chair Jerome Powell is scheduled to deliver a speech at the Stanford Business, Government, and Society Forum later in the day. Also, Fed Governor Michelle Bowman, Chicago Fed President Austan Goolsbee, and Fed Governor Adriana Kugler will speak today. On the economic data front, all eyes are focused on the U.S. ADP Nonfarm Employment Change data in a couple of hours. Economists, on average, forecast that March ADP Nonfarm Employment Change will stand at 148K, compared to the previous value of 140K. Also, investors will likely focus on the U.S. ISM Non-Manufacturing PMI, which arrived at 52.6 in February. Economists foresee the March figure to be 52.8. Pulling back a little to a weekly outlook, Its still just a mixed bad. We aren't universally bearish across the board. One stock that does stand out is TSLA. It slid almost 5% after reporting quarterly sales number that, for the first time in the companies history, were down quarter over quarter. TSLA is no longer a growth company. Its a mature company. BVD, Tesla's biggest competitor and the EV company backed by Warren Buffett slid as well with poor sales numbers. The EV market may have run out of steam. Tesla-focused ETFs dropped after the electric vehicle manufacturing giant said first quarter deliveries plunged 8.5% from the same period a year ago, its first year-over-year decline since 2020, and widely missing Wall Street expectations. Tesla Inc. shares fell about 5% in midday trading. So-called single-stock exchange-traded funds that seek to outpace Tesla fell even more, while those that bet on falling Tesla shares jumped. While Tesla produced more than 433,000 vehicles, it delivered only 387,000, the company said in a press release Tuesday, missing analysts' expectations. A Factset survey forecast 457,000 deliveries for the quarter. Compared with the previous quarter, deliveries sank about 20%. The Direxion Daily TSLA Bull 1.5X Shares (TSLL), which seeks to outpace Tesla shares by one-and-a-half times, dropped more than 10%. The Direxion Daily TSLA Bear 1X Shares (TSLS), which rises when Tesla falls, added 5%. Tesla shares were recently trading at about $165, off over 33% for the year. I don't know that I'd be shorting TSLA here but I certainly don't see a reason to own it. My lean today is neutral: Trade docket for today: /MCL after oil inventory is out. AAPL?, CCL, GLD, IWM, SMCI, XBE, LEVI earnings trade, BB earnings trade. SPX/NDX/EC 0DTE's with the possibility of another Bitcoin 0DTE as well. My intra-day levels;

/ES; 5290 is PoC. This is a key level the market wants to gavitate to. 5265/5277/5285/5290/5296* (big resistance level) To the upside. 5247/5235* (key support level)/5210/5190 to the downside. /NQ; 18265* (PoC on 2 hr. chart)/18303/18356/18456 to the upside. 18202/18107/18056/18028 to the downside.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |