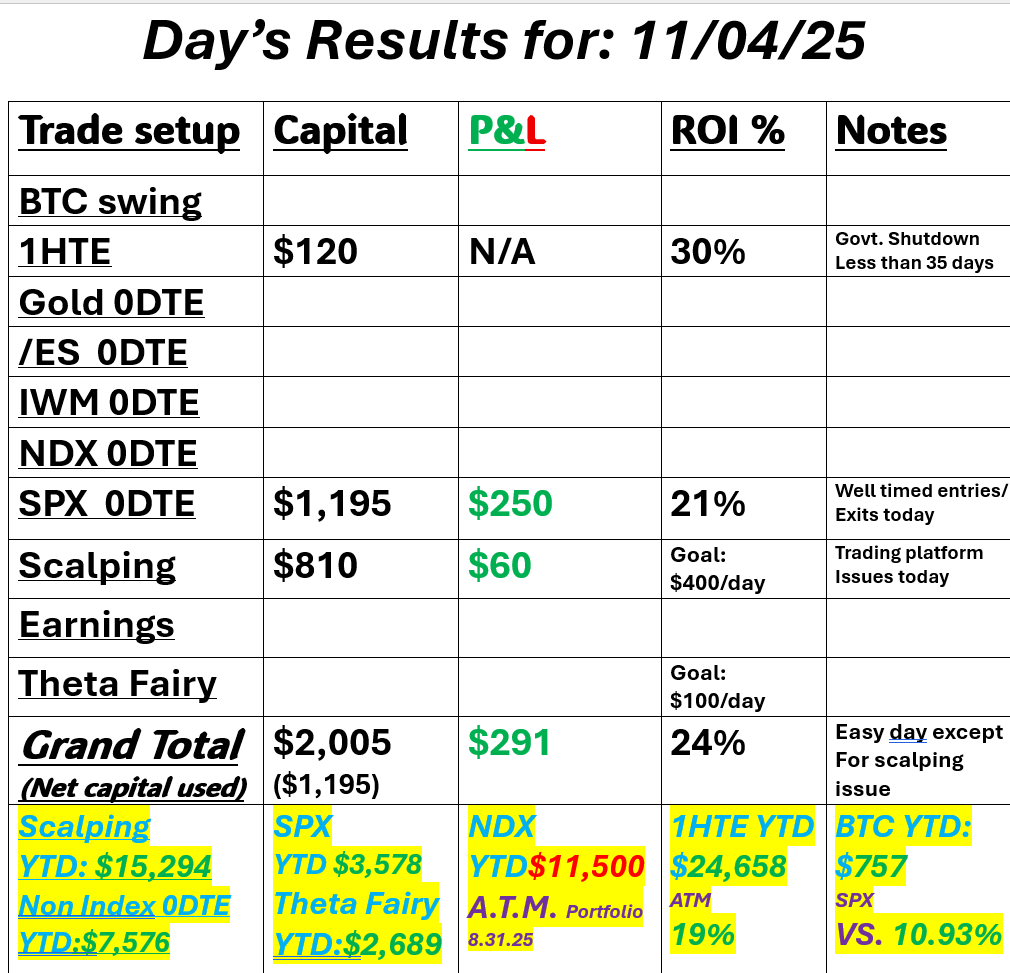

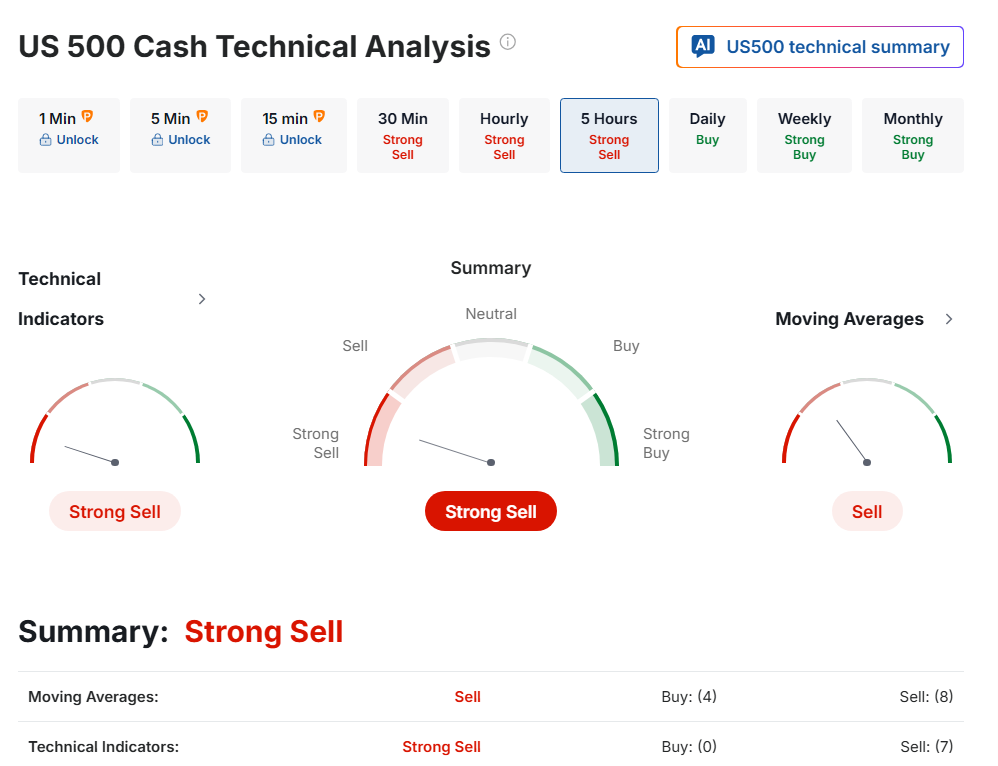

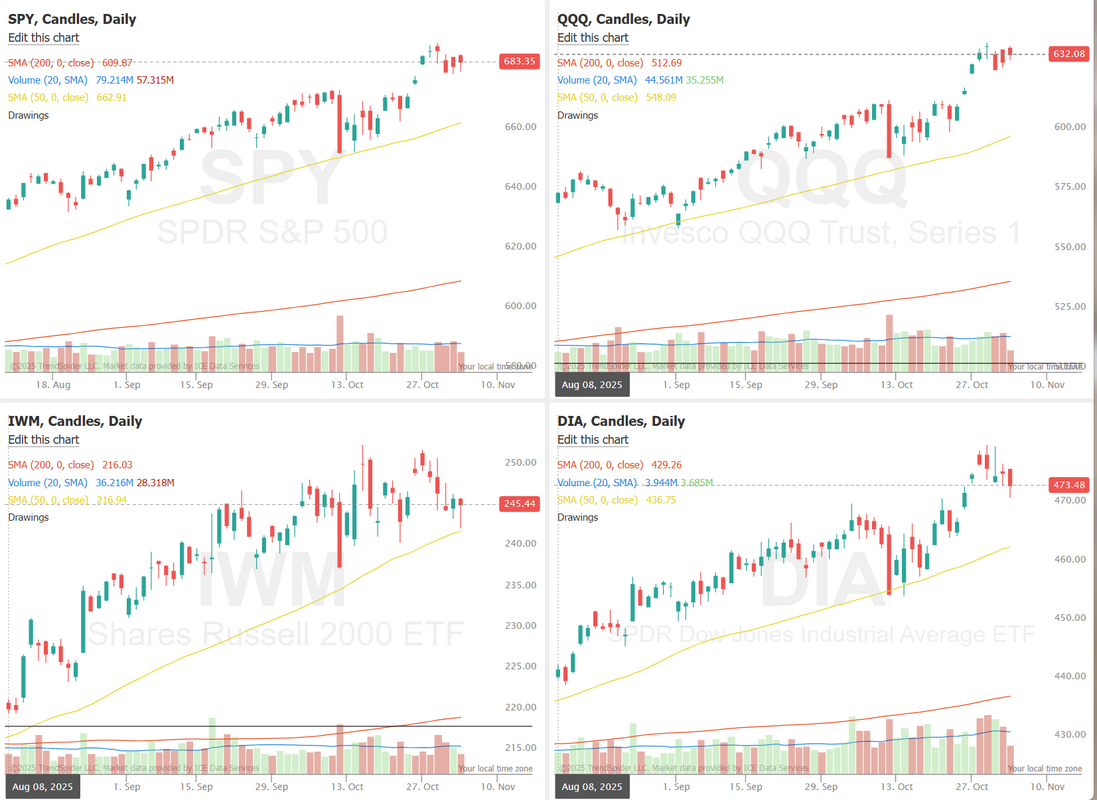

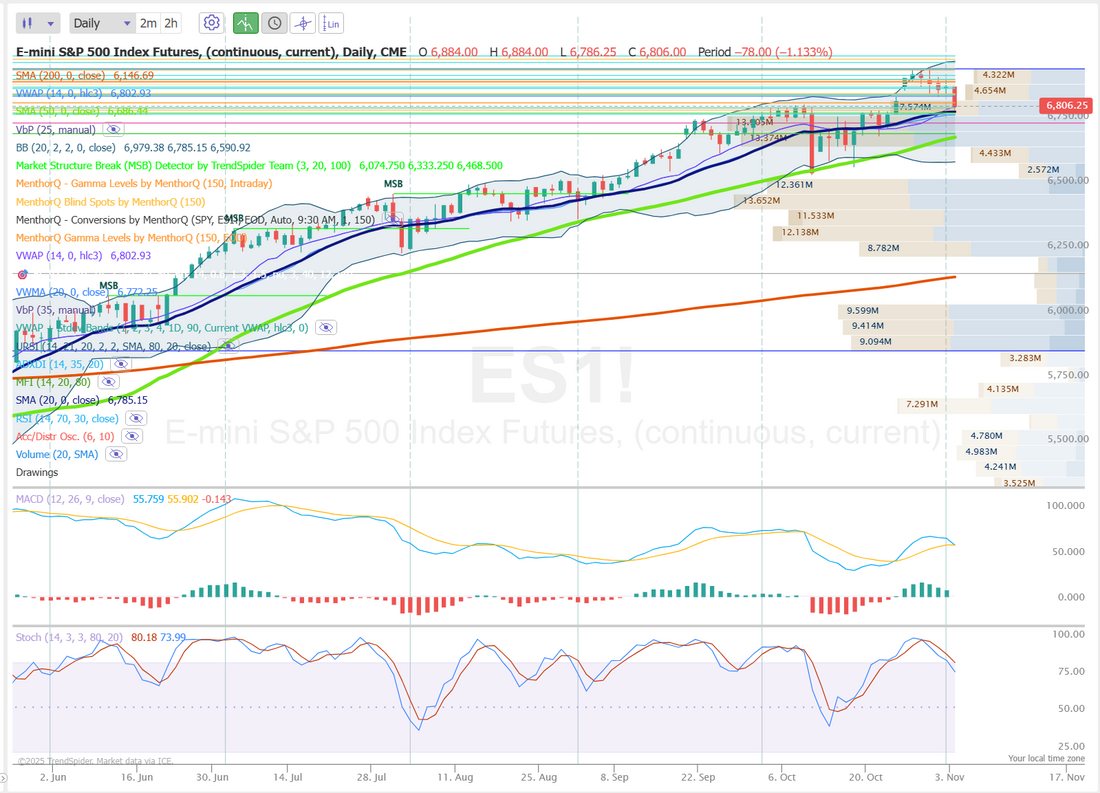

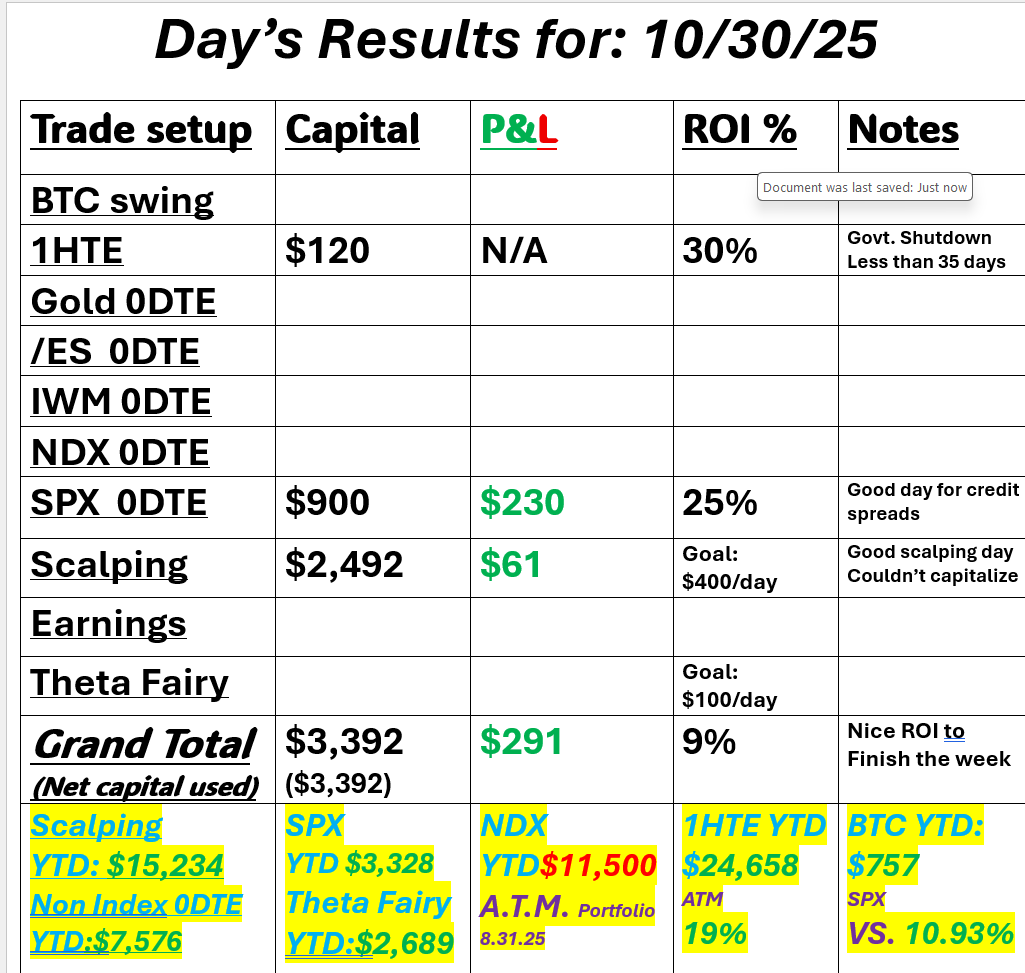

Buy the dip today?We've got a nice selloff in the the futures this morning. You know me. I love down days. Better movement and better premium to work with. The question is, are you going to buy the dip? That's been what's worked all year. I'm still cautiously optimistic we can get a "real" rollover and change of direction going. Call me a bearish optimist! We had a solid day yesterday even though my scalping interface was messed up in the morning. Tastys active V2 platform seems to not work as often as it does function properly. Here's a look at our day. Let's take a look at the markets. We start the day with a sell signal. Futures are down as I type. We've had a lot of these weak days followed by small retraces to the downside, only to be bought up and take us even higher. We all know at some point the "buy the dip" will stop working and the "sell the rip" will take over. We just don't know when. Today maybe? We've got some nice sell side action going right now in the futures. We'll see. That's why we show up every day. The S&P 500 momentum score remains elevated near its upper range, signaling sustained strength in short-term price action after weeks of consistent upside. Despite a few pauses, the index continues to hold above key recent support levels, with momentum readings steady at the maximum score of 5, a sign that trend-following strategies may still find underlying resilience in the current structure. However, the tight clustering near recent highs suggests some consolidation could unfold as markets digest prior gains. In the short term, traders may watch for whether the index can maintain this elevated momentum or begin to cool if profit-taking increases, particularly ahead of key macro events and earnings updates. December S&P 500 E-Mini futures (ESZ25) are down -1.01%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -1.31% this morning as quarterly results from AI bellwether Palantir failed to impress investors and Wall Street executives cautioned about a potential correction due to sky-high valuations. Palantir Technologies (PLTR) slumped over -7% in pre-market trading amid valuation concerns, despite the company reporting upbeat Q3 results and raising its full-year revenue guidance. Morgan Stanley’s Ted Pick and Goldman Sachs’ David Solomon were among Wall Street executives at a Hong Kong summit who cautioned that markets might be facing a significant pullback, while noting that pullbacks are a normal part of market cycles. Also, Mike Gitlin, president and chief executive officer of Capital Group, which manages about $3 trillion in assets, said that corporate earnings remain strong but “what’s challenging are valuations.” Also weighing on sentiment were mixed remarks from Federal Reserve officials. Chicago Fed President Austan Goolsbee said on Monday, “I’m not decided going into the December meeting. I am nervous about the inflation side of the ledger, where you’ve seen inflation above the target for four and a half years, and it’s trending the wrong way.” Also, Fed Governor Lisa Cook said she views the risk of further labor market weakness as outweighing the risk of rising inflation, though she refrained from explicitly supporting another rate cut next month. In addition, San Francisco Fed President Mary Daly said policymakers should “keep an open mind” about the possibility of a rate cut in December. By contrast, Fed Governor Stephen Miran said monetary policy remains restrictive and that he will continue to push for larger interest rate cuts. “The Fed is too restrictive, neutral is quite a ways below where current policy is,” Miran said. Investors now await a fresh batch of corporate earnings reports. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. IDEXX Laboratories (IDXX) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the veterinary medicine company posted upbeat Q3 results and raised its full-year guidance. Also, Amazon.com (AMZN) climbed +4% and was the top percentage gainer on the Dow after the tech giant’s cloud unit signed a $38 billion agreement to provide OpenAI with Nvidia GPUs. In addition, Kenvue (KVUE) jumped over +12% after Kimberly-Clark agreed to acquire the Tylenol maker for about $40 billion. On the bearish side, Charter Communications (CHTR) slid more than -4% and was the top percentage loser on the Nasdaq 100 after KeyBanc and Bernstein downgraded the stock. Economic data released on Monday showed that the U.S. ISM manufacturing index unexpectedly fell to 48.7 in October, weaker than expectations of 49.4. At the same time, the U.S. October S&P Global manufacturing PMI was revised higher to 52.5, stronger than expectations of 52.2. “With U.S. data softening and Fed officials keeping policy optionality alive, investors are reassessing positioning rather than chasing risk,” said Billy Leung, an investment strategist at Global X Management. U.S. rate futures have priced in a 72.1% chance of a 25 basis point rate cut and a 27.9% chance of no rate change at the next FOMC meeting in December. Third-quarter corporate earnings season rolls on, with investors awaiting fresh reports from high-profile companies today, including Advanced Micro Devices (AMD), Shopify (SHOP), Uber Technologies (UBER), Arista Networks (ANET), Amgen (AMGN), Pfizer (PFE), and Spotify (SPOT). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Investors will also focus on a speech from Fed Vice Chair for Supervision Michelle Bowman. Meanwhile, the U.S. government shutdown has entered its 35th day, with bipartisan negotiations reportedly gaining momentum and making progress. The government shutdown is set to become the longest in history, surpassing the 35-day shutdown that occurred during President Trump’s first term in 2018-2019. In light of the shutdown, the publication of September JOLTs job openings, factory orders, and trade data, originally set for today, will be delayed. Goldman Sachs analysts said in a note that the current U.S. government shutdown appears poised to have the most significant economic impact of any shutdown on record. “Not only is it likely to run longer than the 35-day partial shutdown in 2018-2019, it is much broader than prior lengthy shutdowns, which affected only a few agencies,” the analysts said. They noted that a prolonged shutdown could more heavily impact federal spending and investment and might also spill over into private-sector activity. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.091%, down -0.39%. We had a really solid training session yesterday on the R-multiple. Tomorrow we'll discuss attribution analysis. Come join us on our live zoom feed. My lean or bias today is bearish. I'm "optimistic" we can finally get something working to the downside. Let's look at our intraday levels. This morning's futures have created some new levels. On the daily chart, we are close to a full-on sell signal. The 20-day moving average at 6782 could come into play. If we lose the 50DMA at 6686, the next target would be the 50DMA. 6820, 6845, 6851, 6864 are resistance levels. 6799, 6794 (200 PMA on 2hr. chart), 6776, 6767 are support levels. I look forward to seeing you all in the live trading room shortly. We've got exactly what we want to start the day; #1. Movement. #2. Movement to the downside. So let's see what we can do with it!

0 Comments

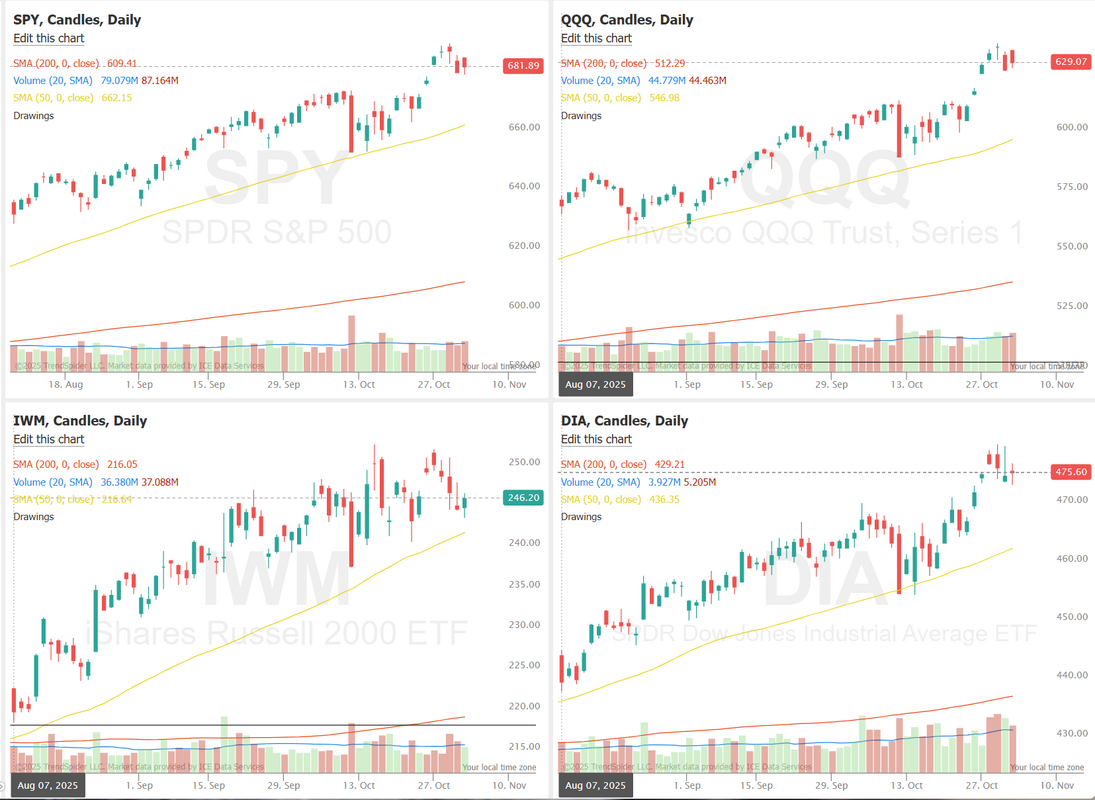

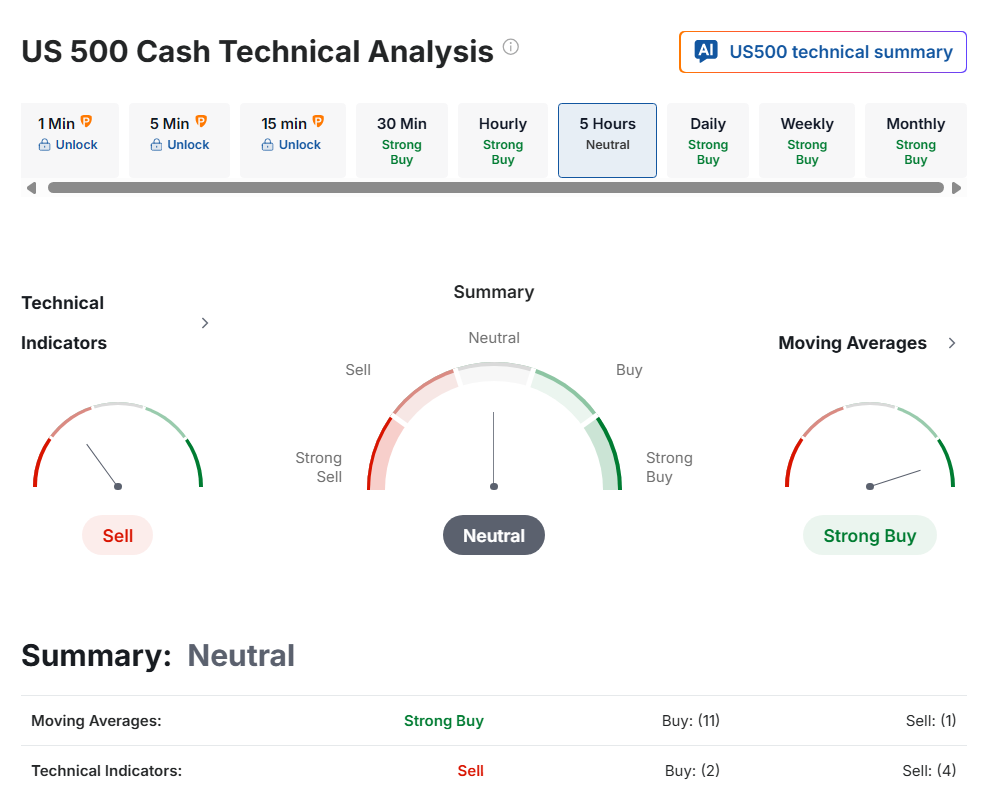

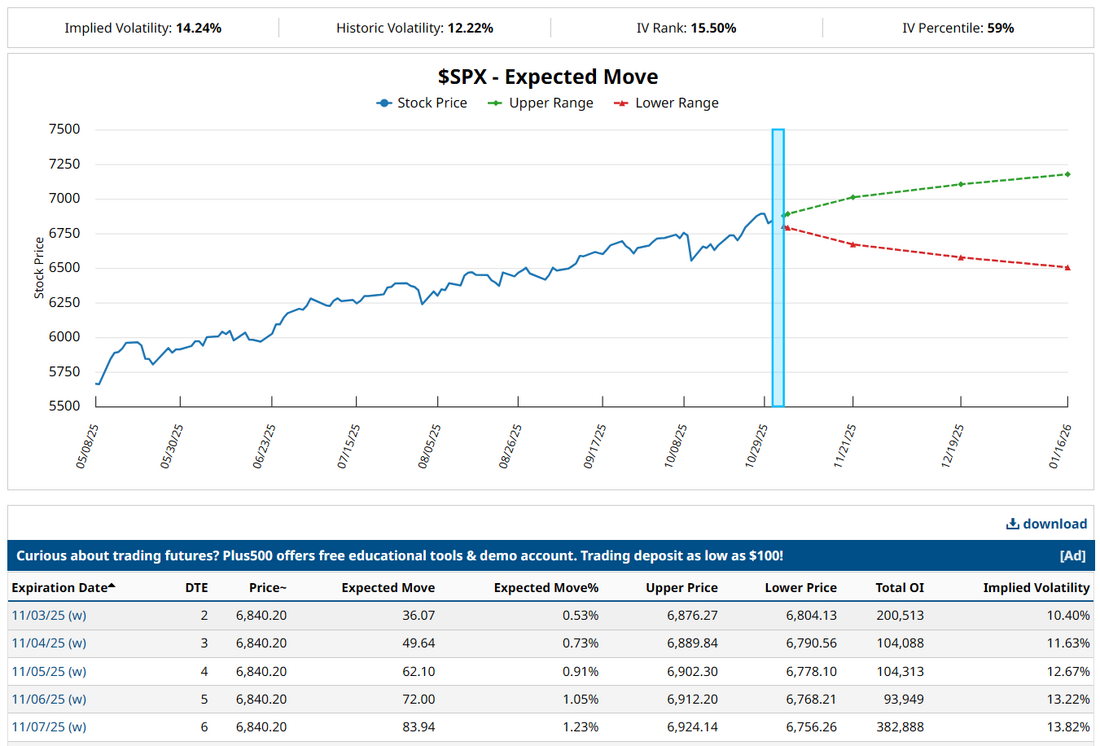

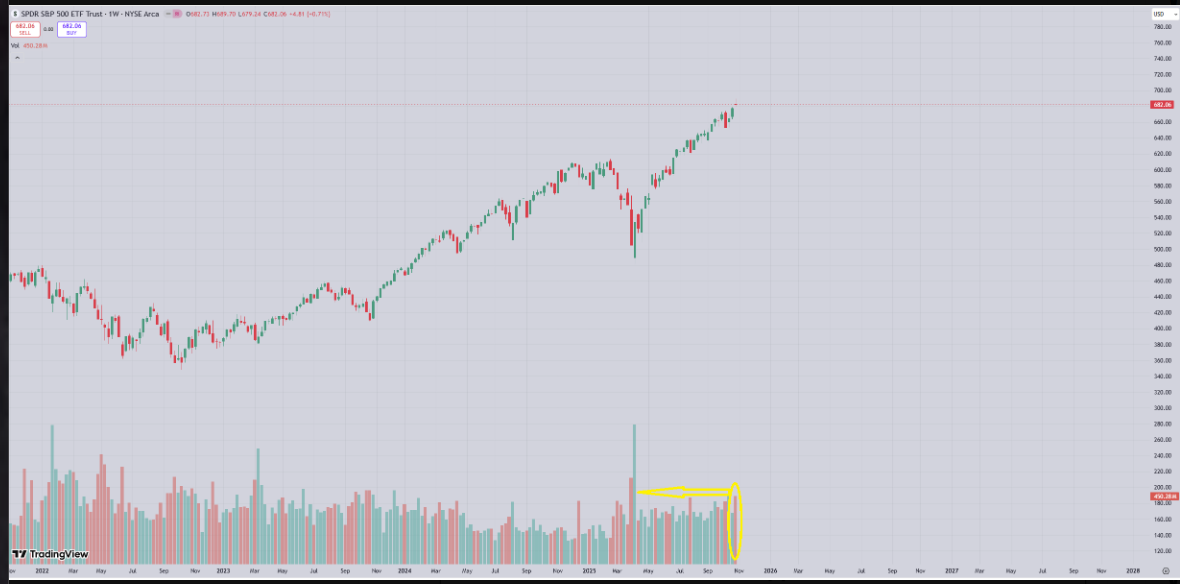

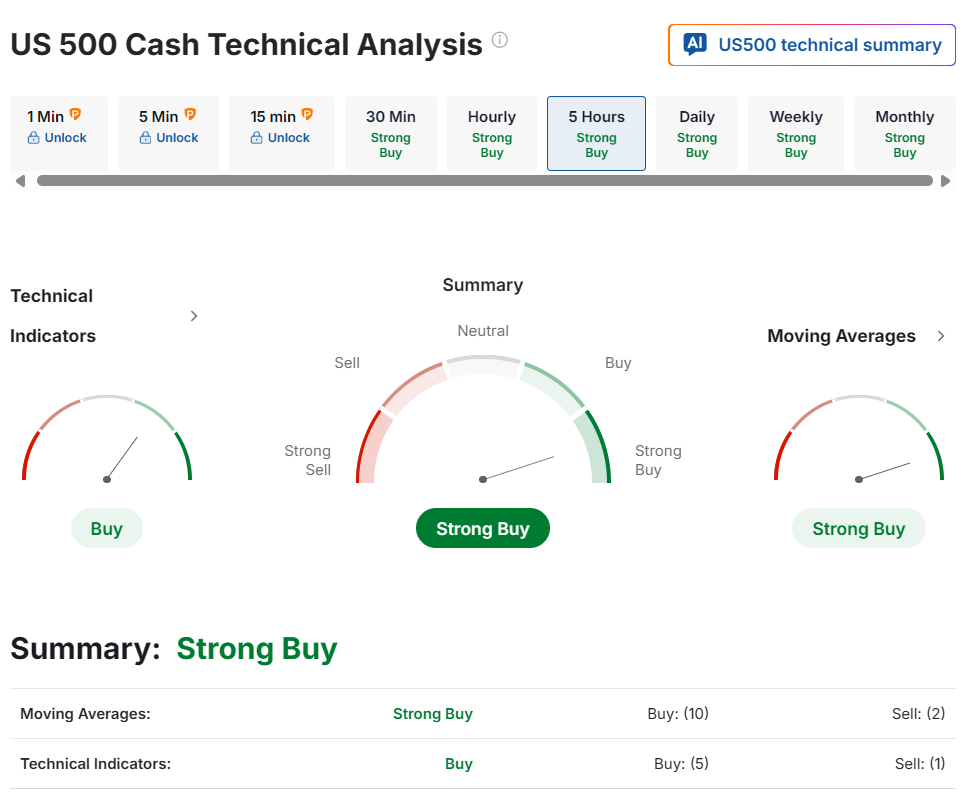

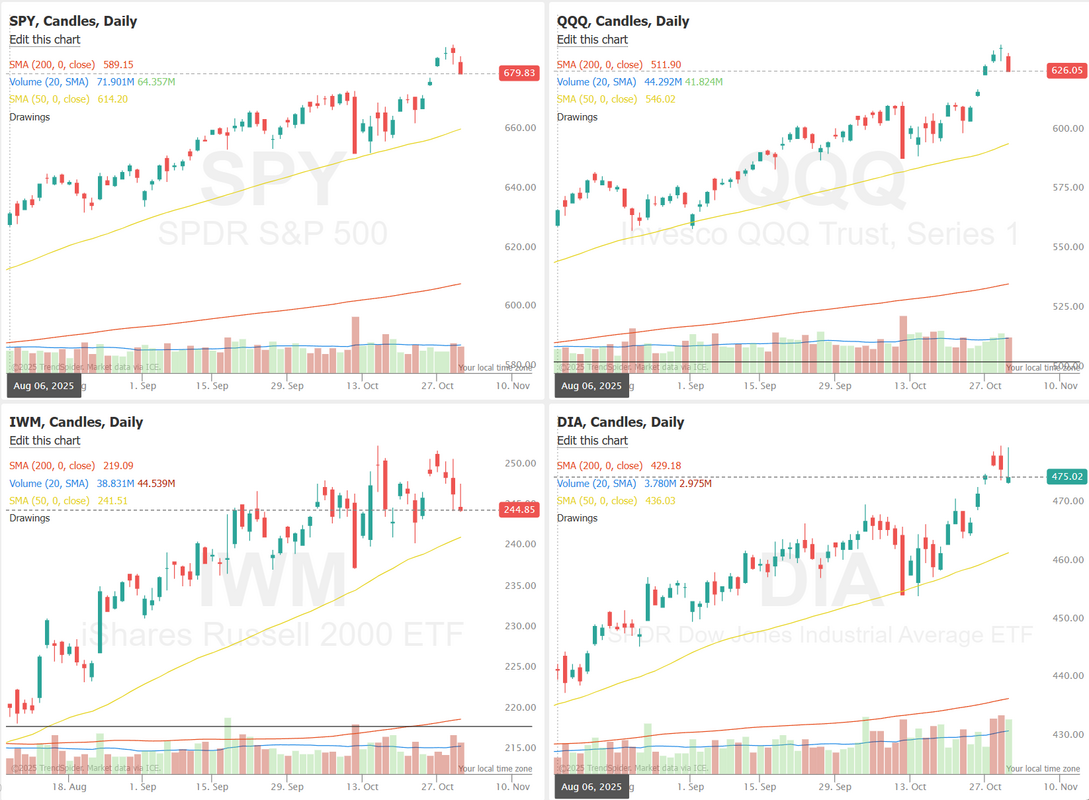

It's November folks!I can't even believe it! So crazy. Where did the summer go? I have to confess, I didn't get out and do all I wanted this year. Time is precious. We've got to make the most of it. I hope your weekend was grand. The wife is out of town so it was a lot of dog walks for me. Nice to get out of the house and away from the screens for a bit. We're back at it today with the start of a fresh month. Friday was strong (and easy) for us. Credits were juicy to start the day and we never needed to make any adjustments. Here's a look at our day. Let's look at the market. The daily chart doesn't really show the movement we got Friday. It was truly an up and down day. It should have been a perfect day for scalping but I couldn't get much working. Technicals are neutral to start the day. Futures are up across the board. I think this morning may be a "wait and see" day. My lean or bias, as I said is more wait and see. Futures are all green this morning but there's some decent resistance above current levels. I think it's best this morning to let the initial trend develop. December S&P 500 E-Mini futures (ESZ25) are up +0.42%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.57% this morning, pointing to further gains on Wall Street as strong tech earnings and easing U.S.-China trade tensions continued to buoy sentiment. Investor attention this week is on a new wave of corporate earnings reports, with key releases from data analytics software developer Palantir and chipmaker Advanced Micro Devices, alongside remarks from Federal Reserve officials and U.S. private-sector economic data. In Friday’s trading session, Wall Street’s major equity averages closed higher. Amazon.com (AMZN) surged over +9% and was the top percentage gainer on the Dow and Nasdaq 100 after the tech and online retailing giant posted upbeat Q3 results and issued solid Q4 revenue guidance. Also, Twilio (TWLO) soared more than +19% after the communications software provider reported better-than-expected Q3 results and gave above-consensus Q4 guidance. In addition, Brighthouse Financial (BHF) jumped over +24% after the Financial Times reported that Aquarian Holdings was in advanced talks to take the company private. On the bearish side, DexCom (DXCM) plunged more than -14% and was the top percentage loser on the S&P 500 and Nasdaq 100 after interim CEO Jake Leach said during the company’s Q3 earnings call that 2026 revenue growth could fall short of analysts’ expectations. Economic data released on Friday showed that the U.S. Chicago PMI rose to 43.8 in October, stronger than expectations of 42.3. Kansas City Fed President Jeff Schmid said on Friday that he voted against last Wednesday’s 25 basis point rate cut because he’s concerned that economic growth and investment could fuel upward pressure on inflation. “By my assessment, the labor market is largely in balance, the economy shows continued momentum, and inflation remains too high,” Schmid said in a statement. Also, Dallas Fed President Lorie Logan and Cleveland Fed President Beth Hammack said they would have preferred to keep interest rates unchanged. At the same time, Atlanta Fed President Raphael Bostic said he “eventually got behind” the decision to lower rates, noting that monetary policy remains “in restrictive territory” even after the cut. U.S. rate futures have priced in a 69.3% probability of a 25 basis point rate cut and a 30.7% chance of no rate change at the conclusion of the Fed’s December meeting. Third-quarter corporate earnings season continues in full flow, and investors await new reports from notable companies this week, including Advanced Micro Devices (AMD), Qualcomm (QCOM), Arm (ARM), Palantir (PLTR), Shopify (SHOP), Uber Technologies (UBER), Applovin (APP), McDonald’s (MCD), and Robinhood Markets (HOOD). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Market participants will also parse comments from a slew of Fed officials, following Chair Jerome Powell’s warning last Wednesday against assuming another rate cut in December. Fed Vice Chair Philip Jefferson, Fed Governor Lisa Cook, San Francisco Fed President Mary Daly, Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Michael Barr, New York Fed President John Williams, Cleveland Fed President Beth Hammack, Fed Governor Christopher Waller, Philadelphia Fed President Anna Paulson, St. Louis Fed President Alberto Musalem, and Fed Governor Stephen Miran are scheduled to speak this week. Their views of the economy and labor market will be scrutinized closely, as official data releases remain delayed due to the month-long government shutdown. The U.S. government shutdown has entered its 34th day. Democratic senators once again called on President Trump to personally step in to help end the government shutdown as the standoff entered a critical week, with the lapse on track to become the longest in history. If the shutdown continues, the publication of official U.S. economic data scheduled for this week, including the key U.S. jobs report for October, will be delayed. It would mark the second consecutive nonfarm payrolls report delayed due to the shutdown. This leaves investors focusing on private-sector data, with the ADP employment report being the highlight. The report will provide fresh insights into the health of the labor market. Other noteworthy private-sector data releases include the ISM survey on U.S. services sector activity and the University of Michigan’s preliminary Consumer Sentiment Index. Today, investors will focus on the U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI data, set to be released in a couple of hours. Economists expect the October ISM manufacturing index to be 49.4 and the S&P Global manufacturing PMI to be 52.2, compared to the previous values of 49.1 and 52.0, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.088%, down -0.34%. Looking at the expected move for the week. 1.23% for the week on SPX. Not high. Not low. Looks like a typical week of premium potential. S&P500. Ended last week with a gravestone doji on the highest volume since we bottomed out in April. This is typically a sign of a reversal coming, need to see follow through this week for confirmation. If you aren't familiar with the gravestone doji: A gravestone doji has a distinctive "inverted T" shape that shows a battle between buyers (bulls) and sellers (bears).

When a gravestone doji appears, it suggests a shift in market sentiment.

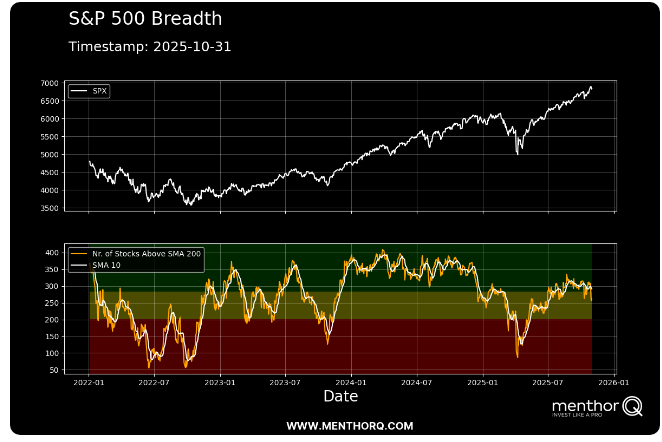

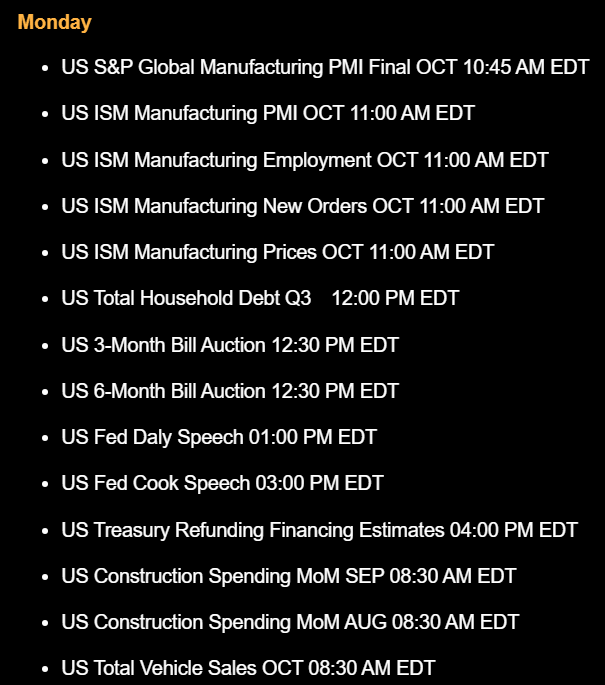

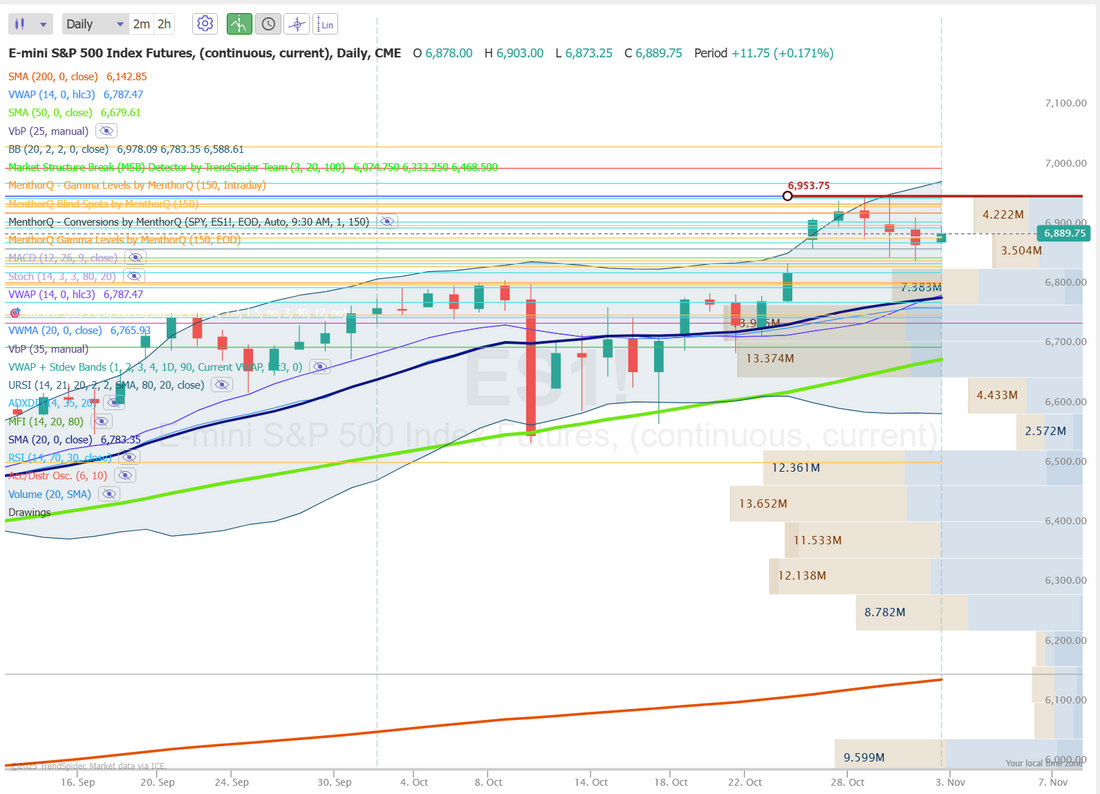

Today's training is a good one. We'll cover R and R-multiple calculations and talk about the different ways you can calculate ROI. Join us at 12:00 noon MDT in our live Zoom feed. The S&P 500 breadth chart shows that while the index continues to push toward new highs, market participation is narrowing, the number of stocks above their 200-day moving average has stalled around mid-range levels. This suggests that recent gains are being driven by a smaller group of large-cap names rather than broad-based strength. Short-term, breadth momentum (SMA 10) has flattened, hinting that the rally may be losing internal support unless participation improves. Traders may watch for whether breadth rebounds toward the upper green zone, a sign of renewed confirmation, or dips lower, which could signal near-term consolidation or rotation beneath the surface. Mondays key (planned) news catalysts. Let's look at some key intraday levels for us today on /ES for 0DTE trading. 6953 has been a brick wall for the last week. Bulls can't get a break above it. Intraday levels seem well formed. 6900, 6909, 6925, 6935, 6940 are resistance with 6888 the first step for bears. Then comes 6875, 6865, 6850, 6844 for support. I look forward to seeing you all in the live trading room today. Let's make it a great start to the week!

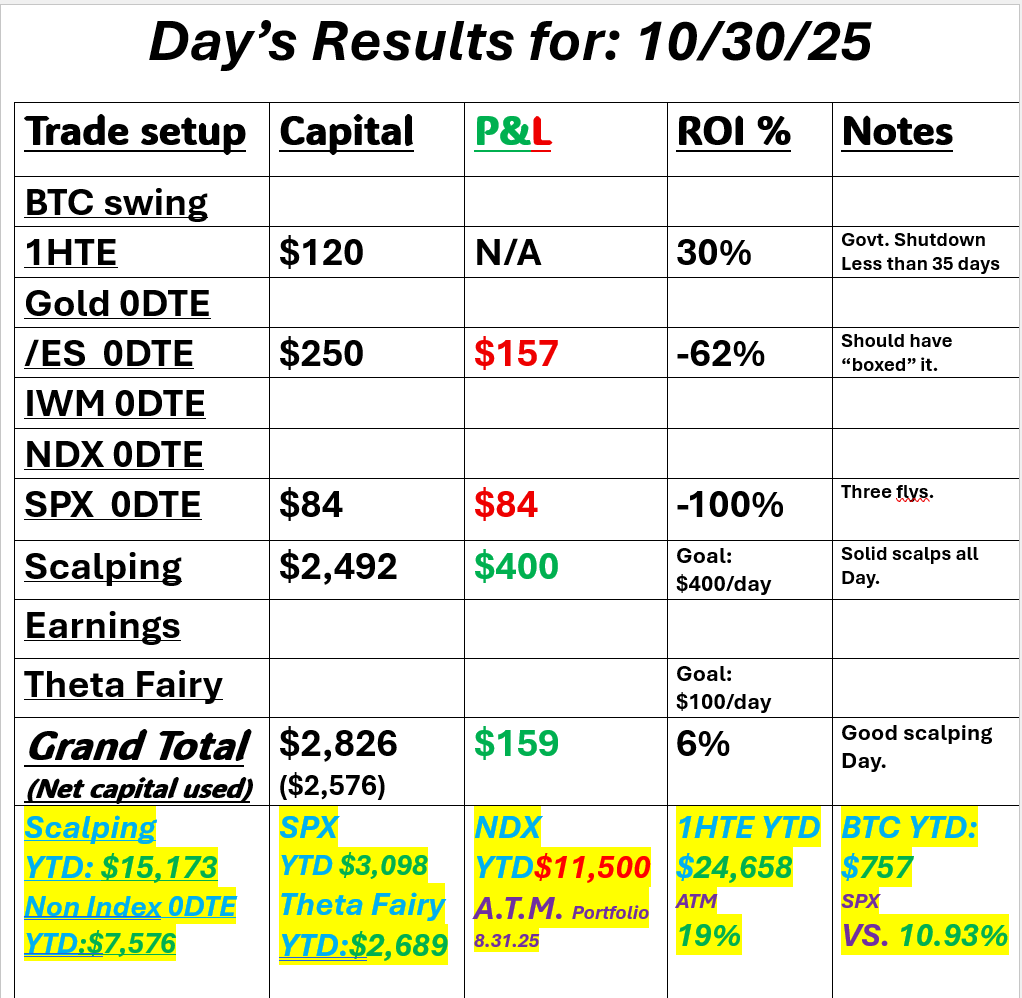

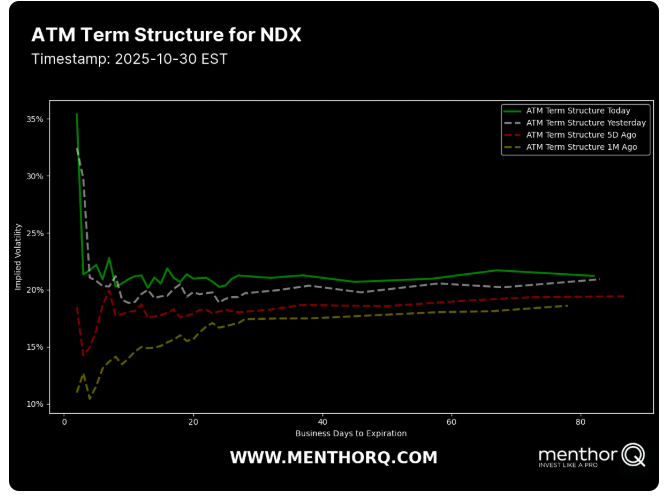

Happy HalloweenMy better half is out of town visiting her family in the pacific northwest for a few days but she'll be celebrating Halloween hard. I think she likes it more than Christmas. The market seems to like it as well. We are getting this morning what I thought we would get yesterday. I thought META, MSFT, GOOG earnings would pop us as well but they didn't pull through. Good trade news combined with solid AAPL/AMZN earnings are doing it today. We continue to see the duality of this market. Any hint of bad news tanks us. It's a tentative bull and yet, every dip gets bought. We had a small profit yesterday but excellent risk/reward. Here's a look at our day: Let's take a look at the market. With the strong futures this morning we are right back to bullish technicals. Just when the roll over looks like it's taking hold, we get another "buy the dip" morning. December Nasdaq 100 E-Mini futures (NQZ25) are trending up +1.15% this morning as strong quarterly results and guidance from Amazon and Apple boosted sentiment. Amazon.com (AMZN) jumped over +12% in pre-market trading after the tech and online retailing giant posted the strongest growth rate in nearly three years in its cloud unit in the third quarter and issued solid Q4 revenue guidance. Also, Apple (AAPL) rose more than +1% in pre-market trading after the iPhone maker reported better-than-expected FQ4 results and provided an upbeat sales forecast for the holiday quarter. In yesterday’s trading session, Wall Street’s major indices ended in the red. Meta Platforms (META) plunged over -11% and was the top percentage loser on the Nasdaq 100 after the maker of Facebook and Instagram reported weaker-than-expected Q3 EPS and raised its full-year total expense forecast. Also, Microsoft (MSFT) fell nearly -3% after the technology behemoth reported FQ1 revenue growth in its Azure cloud-computing unit that failed to meet the highest expectations. In addition, Chipotle Mexican Grill (CMG) tumbled over -18% and was the top percentage loser on the S&P 500 after the burrito chain cut its full-year comparable restaurant sales guidance. On the bullish side, C.H. Robinson Worldwide (CHRW) soared more than +19% and was the top percentage gainer on the S&P 500 after the freight and logistics company posted better-than-expected Q3 adjusted EPS and raised its 2026 operating income guidance. Third-quarter corporate earnings season continues, and investors await reports today from notable companies such as Exxon Mobil (XOM), AbbVie (ABBV), Chevron (CVX), and Colgate-Palmolive (CL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Market participants will also hear perspectives from Dallas Fed President Lorie Logan, Atlanta Fed President Raphael Bostic, and Cleveland Fed President Beth Hammack throughout the day. Meanwhile, the U.S. government shutdown has entered its 31st day, with no clear resolution in sight. In light of the government shutdown, the publication of the September core PCE price index, Personal Spending and Personal Income data, as well as the third-quarter Employment Cost Index, originally set for today, will be delayed. Still, the U.S. Chicago PMI will be released today. Economists forecast the October figure at 42.3, compared to the previous value of 40.6. The Congressional Budget Office stated earlier this week that the four-week government shutdown will trim real annualized GDP growth by 1 percentage point this quarter, with the impact intensifying the longer it continues. U.S. rate futures have priced in a 68.8% chance of a 25 basis point rate cut and a 31.2% chance of no rate change at the December FOMC meeting. Notably, a move in December was almost fully priced in before this week’s FOMC meeting. Fed Chair Jerome Powell on Wednesday threw some cold water on market expectations of another rate cut in December when he said, “A further reduction in the policy rate at our December meeting is not a foregone conclusion—far from it. Policy is not on a preset course.” “With uncertainty around Fed policy going forward and the ongoing government shutdown, there is the potential for volatility,” said Chris Fasciano at Commonwealth Financial Network. “But companies across a large swath of the economy continue to report solid earnings. On top of that, we’ve seen good news on trade policy, particularly with China. These should provide decent tailwinds for investors.” In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.111%, up +0.34%. The SPX option score remains elevated near recent highs, signaling that option market sentiment continues to lean constructive even as spot prices show a mild pullback from peak levels. This suggests traders are maintaining bullish or neutral positioning, potentially reflecting confidence in short-term support holding after a strong upward stretch. However, the slight dip in the score toward the end hints at waning momentum and some hedging activity as volatility expectations edge higher. In the near term, monitoring whether the score stabilizes above mid-range levels will be key, sustained strength could reinforce buying conviction, while further erosion may point to a shift toward consolidation or profit-taking behavior. The NDX ATM term structure shows a notable uptick in short-dated implied volatility, with front-end contracts rising sharply compared to both yesterday and last week. This suggests that near-term uncertainty has increased, likely reflecting upcoming catalysts such as earnings or macro data releases. Beyond the short end, the curve flattens around the 20–22% range, implying that longer-dated volatility remains anchored, with traders pricing the current spike as temporary rather than structural. The steep front-end slope signals that options markets are bracing for short-term swings, but the contained back end highlights confidence in medium-term stability if volatility events pass without major disruption. My lean or bias today is bullish. The "buy the dip" effect seems to be back in effect this morning. Let's take a look at the intra-day levels on /ES for our 0DTE setups. I feel like we have some pretty clear levels to work with today. 6919, 6925, 6944, 6950 are resistance with 6907, 6900, 6889, 6880 working as support. Let's see if we can finish off the week strong! See you all shortly in the live trading room. Enjoy the holiday and have a great weekend.

Powell gives a small surpriseFOMC has come and gone. Powell made it crystal clear that a Dec. rate cut was not a given. The algos grabbed that quickly and tanked the market. While we slowly worked our way back up towards the close, it was a cautious note that inflation is still real and stagflation (although he rarely uses that word) is a big problem. The big trio of META, GOOG, MSFT all reported earnings after the close. It was a mixed bag of results. We had (have) a 1DTE /ES trade on that expires today but we did scalp on and off. FOMC days are usually good scalping days. Here's a look at our results. Let's take a look at the markets. Technicals are still holding firmly bullish. Are we getting a topping pattern here? Who knows? It could just be a pause before we hit another ATH but we know, at some point we'll get a retrace. December S&P 500 E-Mini futures (ESZ25) are down -0.05%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.11% this morning as investors weigh the outcome of the highly anticipated Trump-Xi meeting, mixed Big Tech earnings, and a cautious Federal Reserve. U.S. President Donald Trump and Chinese President Xi Jinping met in person for the first time in six years on Thursday, emerging from what Trump described as “an amazing meeting.” Mr. Trump announced that fentanyl tariffs would be lowered from 20% to 10% effective immediately. The decision was part of a broader framework to ease trade tensions, which Trump said included China’s agreement to lift restrictions on the global trade of its rare earth elements. China’s commerce ministry said it would suspend rare earth export controls for one year, while the U.S. agreed to keep reciprocal tariffs suspended for the same period. China also agreed to resume purchases of U.S. soybeans. The meeting’s outcome was broadly in line with market expectations. Investors also digested earnings reports from a trio of U.S. tech giants. Alphabet (GOOGL) surged over +7% in pre-market trading after the Google-parent posted upbeat Q3 results. At the same time, Meta Platforms (META) slumped more than -7% in pre-market trading after the maker of Facebook and Instagram reported weaker-than-expected Q3 EPS. Also, Mark Zuckerberg’s pledge to ramp up spending on artificial intelligence has renewed investor concerns that the company may lack a clear path to returns on these investments. In addition, Microsoft (MSFT) fell about -3% in pre-market trading after the technology behemoth reported FQ1 revenue growth in its Azure cloud-computing unit that failed to meet lofty expectations. Investors now await earnings reports from Magnificent Seven companies Apple and Amazon. As widely expected, the Federal Reserve cut interest rates yesterday. The Federal Open Market Committee voted 10-2 to lower the target range for the Fed funds rate by a quarter percentage point to 3.75%-4.00%, the lowest in three years. Governor Stephen Miran once again dissented, advocating for a larger half-point rate cut. At the same time, Kansas City Fed President Jeff Schmid said he would have preferred to leave rates unchanged. In a post-meeting statement, officials reiterated that “job gains have slowed” and noted that “risks to employment rose in recent months.” Policymakers also described economic growth as “moderate” and stated that inflation “has moved up since earlier this year and remains somewhat elevated.” In addition, officials agreed to stop shrinking the Fed’s $6.6 trillion asset portfolio starting December 1st. At a press conference, Chair Jerome Powell threw some cold water on market expectations of another rate cut in December. “In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December. A further reduction in the policy rate at our December meeting is not a foregone conclusion—far from it. Policy is not on a preset course,” he said. The Fed chair also noted that the absence of economic data during the ongoing government shutdown could prompt policymakers to take a more cautious approach. “Given these dissents on both sides, it might be difficult to put a down payment on December,” said Neil Dutta at Renaissance Macro Research. U.S. rate futures have priced in a 70.4% chance of a 25 basis point rate cut and a 29.6% chance of no rate change at the next FOMC meeting in December. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed. Nvidia (NVDA) rose about +3% after U.S. President Donald Trump said he plans to discuss the chipmaker’s Blackwell AI processors with Chinese President Xi Jinping. Also, Teradyne (TER) jumped more than +20% and was the top percentage gainer on the S&P 500 after the automatic test equipment designer posted upbeat Q3 results and issued above-consensus Q4 guidance. In addition, Caterpillar (CAT) surged over +11% and was the top percentage gainer on the Dow after the maker of heavy construction equipment reported stronger-than-expected Q3 results. On the bearish side, Fiserv (FI) plummeted more than -44% and was the top percentage loser on the S&P 500 after the financial-technology company posted downbeat Q3 results and cut its full-year adjusted EPS guidance. Economic data released on Wednesday showed that U.S. pending home sales were unchanged m/m in September, weaker than expectations of +1.6% m/m. Third-quarter corporate earnings season rolls on. Today, market participants will pay close attention to earnings reports from Magnificent Seven companies Apple (AAPL) and Amazon.com (AMZN). High-profile companies such as Eli Lilly (LLY), Mastercard (MA), Merck & Co. (MRK), Gilead (GILD), and Altria (MO) are also set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Investors will also parse comments today from Fed Vice Chair for Supervision Michelle Bowman and Dallas Fed President Lorie Logan. Meanwhile, the U.S. government shutdown has entered its 30th day, with no clear resolution in sight. In light of the government shutdown, the publication of the advance estimate of third-quarter gross domestic product and weekly jobless claims, originally set for today, will be delayed. Allianz Research estimates that the shutdown has likely already shaved 0.45 percentage points off fourth-quarter annualized GDP growth. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.067%, up +0.20%. The SPX Volatility Risk Premium (VRP) has turned modestly positive at 1.2%, with implied volatility now sitting in the overvalued range and positioned near the 32nd percentile of its 3-month history. This suggests that option pricing has slightly outpaced realized volatility as the index continues its upward momentum. In the short term, this setup points to a market environment where traders may be paying up for downside protection, even as spot prices push toward new highs. Historically, such conditions can indicate short-term caution or hedging activity rather than outright fear. If realized volatility remains subdued and spot prices stabilize above recent resistance, implied vol could ease, potentially tightening the VRP again in the coming sessions. The SPY 1-month skew shows a notable call bias, sitting near the 8th percentile of its 3-month range, which suggests that upside options are relatively more favored than downside protection. This shift often reflects improving sentiment or short-term optimism as traders position for potential follow-through in the recent market rally. The 25-delta risk reversal remains well below the neutral zone, indicating that demand for calls has outpaced puts after a period of balanced skew. In the short term, this configuration implies a market leaning toward tactical bullish positioning, but also one that could be sensitive to shifts in volatility or macro catalysts that challenge this optimism. Let's take a look at our intraday levels on /ES for 0DTE today. 6931, 6940, 6950 are resistance levels. 6907, 6900, 6890 are support. My lean or bias today is a bit bearish. Earnings came is mixed and Powell threw a bucket of cold water of future rate cuts. Today could be a good day for the bulls to sit on the side lines. Zoom Note for today: I've got to run my wife to the airport this morning at 11:30 A.M. MDT so I'll be away for about an hour from our zoom feed. We'll work our trades around that.

See you all in the zoom shortly. FOMC and Powell dayToday's the day. The market is banking on another rate cut. We usually sit on our hands for most of the day until Powell speaks but we do have a 1DTE /ES trade already working so we'll see how that develops as the day progresses. I had some technical issues this morning so I'm getting started on todays post a bit late and as such, it will be a bit shorter. We'll go over our intraday levels in our zoom session. Yesterday was a bust for me. We focus on multiple strategies and trades so that if one doesn't work we can still have a solid day. Pretty much everything lost for me yesterday. I'm o.k. with the SPX result I went 1 for 4 there so risking only $260 feels like a win but overall it was just a bad day. Here's a look at my results. As I mentioned, we have an /ES 1DTE trade already working. It's profitable as I type. I may pull it. Build on it or just sit on it, depending on how the day develops. We could add a credit call spread to it that removes risk to the upside and minimizes risk to the downside. Something like this. Again, lets just see how we open up. We'll try to get two trainings in today. One on the R-multiple and one on Jessie Livermore discipline. We should have the time as we wait until Powell speaks. December S&P 500 E-Mini futures (ESZ25) are up +0.19%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.35% this morning, buoyed by ongoing tech and AI momentum, while investors await the Federal Reserve’s interest rate decision and U.S. megacap tech earnings. Stock index futures were boosted by a more than +3% rise in Nvidia (NVDA) in pre-market trading after U.S. President Donald Trump said he plans to discuss the chipmaker’s Blackwell AI processors with Chinese President Xi Jinping. Also aiding sentiment, President Trump said on Wednesday that he expects to sign a trade agreement with China when he meets with Xi on Thursday. Trump also said he plans to reduce tariffs the U.S. has imposed on Chinese goods due to the fentanyl crisis. However, higher bond yields today are limiting gains in U.S. equity futures. Traders warned that any hawkish comments from Fed Chair Jerome Powell at his post-policy meeting press conference could trigger fresh volatility in the world’s largest bond market. In yesterday’s trading session, Wall Street’s major indexes closed at record highs. Nvidia (NVDA) climbed nearly +5% after CEO Jensen Huang delivered the keynote speech at the company’s GTC event, stating that the AI industry has “turned a corner” and announcing new partnerships and technologies. Also, Microsoft (MSFT) rose about +2% after the software giant finalized a new agreement with OpenAI that will give it a 27% ownership stake in the ChatGPT-maker valued at around $135 billion. In addition, Regeneron Pharmaceuticals (REGN) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted better-than-expected Q3 results. On the bearish side, Alexandria Real Estate Equities (ARE) cratered more than -19% and was the top percentage loser on the S&P 500 after the life-science-focused REIT posted downbeat Q3 results and cut its full-year adjusted FFO guidance. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index fell to 94.6 in October, stronger than expectations of 93.4. Also, the U.S. August S&P/CS HPI Composite - 20 n.s.a. eased to +1.6% y/y from +1.8% y/y in July, stronger than expectations of +1.4% y/y. In addition, the U.S. Richmond Fed manufacturing index rose to -4 in October, stronger than expectations of -11. Today, all eyes are focused on the Federal Reserve’s monetary policy decision. The Federal Open Market Committee is widely expected to deliver a 25 basis point rate cut for a second consecutive meeting. That would take the Fed funds rate to a range of 3.75% to 4.00%, the lowest level since late 2022. Market watchers will follow Chair Jerome Powell’s post-policy meeting press conference for clues on how far and how fast interest rates may fall from here. Notably, U.S. money markets have almost fully priced in a follow-up rate cut in December. Market participants will also watch for signals on when policymakers may stop shrinking the bank’s $6.6 trillion securities portfolio. Third-quarter corporate earnings season continues in full force. Investors will be closely monitoring earnings reports today from a trio of the Magnificent Seven companies—Microsoft (MSFT), Alphabet (GOOGL), and Meta Platforms (META). They will be seeking assurances that the multibillion-dollar investments in computing infrastructure will continue and ultimately deliver returns. Prominent companies like Caterpillar (CAT), ServiceNow (NOW), Boeing (BA), Verizon (VZ), KLA Corp. (KLAC), and CVS Health Corp. (CVS) are also scheduled to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. “We expect another strong round of megacap tech earnings reports, given the relentless demand for AI technology and infrastructure,” said Clark Bellin at Bellwether Wealth. “While profitability in AI remains an unknown, investors for right now are willing to overlook this as the AI arms race heats up.” On the economic data front, investors will focus on the National Association of Realtors’ pending home sales data, set to be released in a couple of hours. Economists forecast the September figure at +1.6% m/m, compared to the previous figure of +4.0% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -0.9 million barrels, compared to last week’s value of -1 million barrels. Meanwhile, the U.S. government shutdown has entered its 29th day, with no clear resolution in sight. The shutdown means that official U.S. economic data continue to be delayed. Allianz Research estimates that the shutdown has likely already shaved 0.45 percentage points off fourth-quarter annualized GDP growth. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.992%, up +0.23%. Technicals are still bullish The attempt for new ATH's continues. Let's see how the morning goes. This afternoon is really when the sparks should fly. See you all shortly!

Rate cut guaranteed?FOMC is coming up tomorrow. Markets are all but guaranteeing another rate cut is coming along with the promise of one more in Dec. Bulls are pushing us to new ATH's with a big gap up yesterday. We are in new territory here. It get a bit tougher to divine resistance zones when you're constantly hitting new ATH's. Yesterday was disappointing for me. We bailed on our SPX before it turned red. Our scalping and gold are rolled into today. I tried a retrace setup near the end of the day on NDX that didn't work. Here's a look at my day: I'll continue to work our scalp and gold trade today. Let's take a look at the markets: Bullish bias is pretty entrenched. Gap up yesterday morning and strength all day into new ATH's. December S&P 500 E-Mini futures (ESZ25) are trending down -0.02% this morning, taking a breather after a record-breaking rally, while investors await the start of the Federal Reserve’s two-day policy meeting, a new round of corporate earnings reports, and U.S. private-sector economic data. In yesterday’s trading session, Wall Street’s main stock indexes closed at record highs. The Magnificent Seven stocks climbed, with Tesla (TSLA) rising over +4% and Nvidia (NVDA) advancing more than +2% to lead gainers in the Dow. Also, Qualcomm (QCOM) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after introducing new chips and computers for the lucrative AI data center market. In addition, Avidity Biosciences (RNA) soared more than +42% after Novartis agreed to acquire the company in a deal valued at about $12 billion. On the bearish side, rare earth stocks slumped after Treasury Secretary Scott Bessent said he anticipated China would postpone the implementation of its stricter export controls on rare earths, with USA Rare Earth (USAR) sliding over -8% and MP Materials (MP) falling more than -7%. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to deliver a 25 basis point rate cut on Wednesday, particularly after last Friday’s mostly favorable September inflation data. That would take the Fed funds rate to a range of 3.75% to 4.00%, the lowest level since late 2022. Investors will closely follow Chair Jerome Powell’s post-policy meeting press conference for clues on how far and how fast interest rates may fall from here. U.S. money markets have almost fully priced in a follow-up rate cut in December. Third-quarter corporate earnings season is in full swing, with investors looking ahead to new reports from prominent companies today, including Visa (V), UnitedHealth Group (UNH), Booking (BKNG), United Parcel Service (UPS), and PayPal (PYPL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. “With the Fed on track to cut rates, extending the run would appear to hinge on this week’s lineup of high-profile earnings releases. And it may, barring any surprises in U.S.-China trade negotiations,” said Chris Larkin at E*Trade from Morgan Stanley. On the economic data front, investors will focus on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the October CB Consumer Confidence index will stand at 93.4, compared to last month’s figure of 94.2. The U.S. S&P/CS HPI Composite - 20 n.s.a. will also be reported today. Economists expect the August figure to ease to +1.4% y/y from +1.8% y/y in July. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists foresee this figure coming in at -11 in October, compared to the previous value of -17. Meanwhile, the U.S. government shutdown has entered its 28th day, with no clear resolution in sight. The shutdown means that official U.S. economic data continue to be delayed. Allianz Research estimates that the shutdown has likely already shaved 0.45 percentage points off fourth-quarter annualized GDP growth. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.973%, down -0.58%. The SPX option score has climbed back to its upper range, coinciding with a strong rebound in spot prices to fresh short-term highs near 6,850. The sustained improvement in option sentiment suggests a renewed risk-on tone among market participants after weeks of consolidation. From a short-term perspective, the recent uptick in call activity and volatility compression could indicate that traders are positioning for continued upside momentum, though the index is nearing overextended territory. Monitoring whether the option score can stay elevated in the coming sessions will be key, a quick drop back toward neutral would hint at profit-taking or fading confidence in the current rally. Let's take a look at the new intraday levels for our 0DTE for today on /ES. There are only three major levels I'm looking at today. 6917 is the demarcation point for bullish/bearish price action. Above is bullish. Below is bearish. 6870 is major overhead resistance with 6874 major support. We've got a lot of our trades already rolled into this morning so we'll work those first today. See you all in the live trading room shortly!

New highs. Gap up openingMarket euphoria seems to be at an all time high. Today it's a potential deal with China but it doesn't really matter what the news it. Bad news gets tossed aside quickly and buy the dip seems to have been the trade all year long. We had an excellent day Friday. We waited a lot for trade entries and I feel today may be more of the same. /ES futures are already up 55+ points as I type. What do you do with that other than wait for a potential retrace? Our ATM portfolio hit a new ATH also. We are still beating the SP 500, once again this year but our goal of 30% APR is going to be a tough one. The potential's there. We just need to be perfect these last couple months of the year. Here's a look at our excellent day Friday. NOTE: To be more accurate on our daily ROI I've changed how I calculate the amount of capital used. Rather than adding up the total capital used in each individual trade I'll calculate the max capital used at any one time. For example, we may do four trades in a day but only two may be open simultaneously so we are "reusing" the same capital over and over. This will make the ROI on wins and losses look more accurate. Let's take a look at the markets to start the new week. With the big gap up in futures its very bullish. New highs pretty much across the board from Fridays close. Investors remain firmly in risk-on mode with the Greed and Fear Index sitting at 71.07—sentiment high and any dip here is more likely to be seen as an excuse to buy than a reason to sell Margin debt is soaring to levels that make some investors uneasy, flirting with the "danger zone." For now, momentum still points higher—but a reversal would be the real red flag Bank Reserves fall to their lowest level since early January Shocking stat of the day: The US government now spends ~23 cents of every Dollar of revenue on interest expense, near the highest level this century. This comes as interest expenditures exceeded $1.2 TRILLION over the last 12 months for the first time. Interest costs have DOUBLED over the last 4 years as both rates and federal debt have surged. As a result, interest expense as a % of tax revenue jumped +10 percentage points, or +70%, to 23% during this period. For perspective, the government spent ~10% of its revenue on interest on average before 2020. Interest will soon be the US government's largest expense. December S&P 500 E-Mini futures (ESZ25) are up +0.91%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +1.28% this morning, pointing to a sharply higher open on Wall Street as signs that the U.S. and China were nearing a trade deal boosted risk appetite at the start of a busy week. Top trade negotiators from the U.S. and China said on Sunday that they reached an initial consensus on multiple contentious issues, including tariffs, shipping fees, fentanyl, and export controls. China’s official Communist Party mouthpiece urged the world’s biggest economies to “jointly safeguard hard-won achievements” from recent trade negotiations, ahead of Thursday’s high-stakes meeting between U.S. President Donald Trump and Chinese leader Xi Jinping. “I think we have a very successful framework for the leaders to discuss on Thursday,” said U.S. Treasury Secretary Scott Bessent. This week, market participants will also focus on earnings reports from major tech names and the Federal Reserve’s interest rate decision. In Friday’s trading session, Wall Street’s major equity averages closed at record highs. Most members of the Magnificent Seven stocks advanced, with Alphabet (GOOGL) and Nvidia (NVDA) gaining over +2%. Also, chip stocks rallied, with Advanced Micro Devices (AMD) climbing more than +7% to lead gainers in the Nasdaq 100 and Micron Technology (MU) rising over +5%. In addition, Ford Motor (F) surged more than +12% and was the top percentage gainer on the S&P 500 after the automaker reported better-than-expected Q3 results. On the bearish side, Deckers Outdoor (DECK) plunged over -15% and was the top percentage loser on the S&P 500 after the maker of Hoka sneakers and Ugg boots issued disappointing full-year revenue guidance. The U.S. Bureau of Labor Statistics report released on Friday showed that consumer prices rose +0.3% m/m in September, weaker than expectations of +0.4% m/m. On an annual basis, headline inflation picked up to +3.0% in September from +2.9% in August, weaker than expectations of +3.1%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.2% m/m and +3.0% y/y in September, weaker than expectations of +0.3% m/m and +3.1% y/y. In addition, the U.S. S&P Global manufacturing PMI rose to 52.2 in October, stronger than expectations of 51.9, and the S&P Global services PMI rose to 55.2, stronger than expectations of 53.5. At the same time, the University of Michigan’s U.S. October consumer sentiment index was revised lower to 53.6, weaker than expectations of 54.6. “Much like a Sherlock Holmes’ story, inflation is the dog that didn’t bark. So many people have been expecting a sharp increase in inflation and have positioned bearishly as a result, but the market is likely to keep squeezing the shorts until they realize that the economy–and Corporate America–is more resilient than many expected,” said Chris Zaccarelli at Northlight Asset Management. Third-quarter corporate earnings season hits full throttle, and investors await fresh reports from high-profile companies this week, including Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), Apple (AAPL), Amazon.com (AMZN), Eli Lilly (LLY), AbbVie (ABBV), Mastercard (MA), Visa (V), ServiceNow (NOW), Caterpillar (CAT), UnitedHealth (UNH), Boeing (BA), Exxon Mobil (XOM), and Chevron (CVX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Market watchers will also keep a close eye on the Fed’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference. The central bank is widely expected to cut the Fed funds rate by 25 basis points to a range of 3.75% to 4.00%, particularly after last Friday’s mostly favorable September inflation data. Investors will pay close attention to the Fed’s accompanying comments for clues on how far and how fast interest rates may fall from here. U.S. money markets have almost fully priced in a follow-up rate cut in December. In other trade news, President Trump announced a series of agreements during his Asia diplomacy tour aimed at securing access to critical minerals and expanding a market for U.S. agricultural products. He offered exemptions from his reciprocal tariffs on key exports from Thailand, Cambodia, Vietnam, and Malaysia as part of the deals. In tariff news, Mr. Trump announced on Saturday an additional 10% tariff on Canada in response to an advertisement from Ontario that he said misrepresented remarks by former President Ronald Reagan. “Because of their serious misrepresentation of the facts, and hostile act, I am increasing the Tariff on Canada by 10% over and above what they are paying now,” Trump posted on his Truth Social platform. U.S. tariffs on Canada currently stand at 35%, with energy products at 10%, though goods that meet the terms of the U.S.-Mexico-Canada Agreement are exempt from the duties. Meanwhile, the U.S. government shutdown has entered its 27th day, with no clear resolution in sight. If the government shutdown continues, the publication of official U.S. economic data scheduled for this week, including the advance estimate of third-quarter gross domestic product, weekly jobless claims, and the September PCE inflation report, will be delayed. This leaves investors focusing on the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., and the National Association of Realtors’ pending home sales data. Allianz Research estimates that the shutdown has likely already shaved 0.45 percentage points off fourth-quarter annualized GDP growth. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.025%, up +0.70%. The SPX volatility setup shows a short-term cooling in implied volatility, with the Volatility Risk Premium (VRP) dipping to -1.0%, marking one of its lowest readings in months. This indicates that implied volatility is currently undervalued, suggesting traders are pricing in less near-term risk despite recent choppy price action. The spot price has rebounded from recent lows, while volatility metrics have compressed, often reflecting short-term complacency or positioning resets. In the immediate term, focus may turn to whether SPX sustains momentum above the 6700 area, any renewed volatility uptick could challenge that stability. The SPY first-expiration skew currently shows a notable put bias, sitting in the 83rd percentile over the past three months. This means traders are paying a premium for downside protection, reflecting elevated short-term hedging demand even as spot prices recover toward recent highs. The 25D risk reversal skew has remained firmly in the upper band, signaling that the options market is positioning more defensively. In the near term, this skew dynamic suggests that sentiment remains cautious, volatility buyers may still be active, particularly around downside strikes, while any stabilization in skew could indicate easing near-term market stress. VIX is back down. This will drain a lot of premium potential out of credit trades. 1.24% expected move for SPX this week. Heads up on our next couple training sessions: Today we'll finally get to our discussion on Martingale vs. Pyramiding and where DCA (dollar cost averaging) fits in. On Weds. we'll get into R and R-multiple as a way to judge the performance of your trade setups. Join us today in our live zoom feed. I'll see you there! Let's take a look at the /ES intraday 0DTE levels: Key GEX levels for today. The large GEX levels are at 6900 for resistance. 6539 for support with 6770 being the demarcation point. 6891, 6917, 6979 are all resistance zones with 6876, 6812, 6752 working as support. I'll see you all shortly in the live trading room. Let's make today a great trading day!

CPI incomingWe finally get a bit of economic data today in spite of the Govt. shutdown continuing. It's likely that it's release won't effect the current risk on environment. The FED is more interested and concerned with Jobs vs. Inflation. We had another winning day yesterday. Our SPX setup failed but we kept risk in check. Here's a look at our day Our ATM portfolio briefly touched a new ATH before giving a bit of that gain back. It continues to look like a solid year for our model portfolio. Let's take a look at the markets. Bulls are back in charge. We continue to be stuck around our ATH's. December S&P 500 E-Mini futures (ESZ25) are trending up +0.32% this morning as investors look ahead to the release of key U.S. inflation data for clues on the health of the economy and the Federal Reserve’s rate path. Some positive corporate news is supporting U.S. equity futures, with Intel (INTC) climbing over +8% in pre-market trading after the chipmaker posted upbeat Q3 results, citing strong demand for PC processors. Also, Ford Motor (F) rose more than +4% in pre-market trading after the automaker reported better-than-expected Q3 results. Also aiding sentiment, the White House confirmed on Thursday that U.S. President Donald Trump will meet with Chinese President Xi Jinping next week on the sidelines of the Asia-Pacific Economic Cooperation summit. In yesterday’s trading session, Wall Street’s major indices ended in the green. Dow Inc. (DOW) surged nearly +13% and was the top percentage gainer on the S&P 500 after the commodity chemicals producer posted a narrower-than-expected Q3 loss. Also, energy stocks climbed as the price of WTI crude oil rose more than +5%, with APA Corp (APA) rising over +7% and Valero Energy (VLO) gaining more than +6%. In addition, Honeywell International (HON) advanced over +6% and was the top percentage gainer on the Dow and Nasdaq 100 after the industrial conglomerate reported stronger-than-expected Q3 results. On the bearish side, Molina Healthcare (MOH) tumbled more than -17% and was the top percentage loser on the S&P 500 after the insurer again cut its full-year earnings guidance. Economic data released on Thursday showed that U.S. existing home sales rose +1.5% m/m to a 7-month high of 4.06 million in September, in line with expectations. “As anticipated, falling mortgage rates are lifting home sales. Home prices continue to rise in most parts of the country, further contributing to overall household wealth,” NAR Chief Economist Lawrence Yun said in a statement. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The Department of Labor has recalled a limited number of employees to release the CPI report on a delayed basis, making a rare exception to publish data during the government shutdown. The data, originally scheduled for release on October 15th, will provide Fed officials with key insight into inflation ahead of their policy meeting next week. Economists, on average, forecast that the U.S. September CPI will come in at +0.4% m/m and +3.1% y/y, compared to the previous numbers of +0.4% m/m and +2.9% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.1% y/y in September, unchanged from August’s figures of +0.3% m/m and +3.1% y/y. A survey conducted by 22V Research showed that 45% of investors expect a “risk-on” market reaction to the CPI report, while 26% anticipate “risk-off” and 29% foresee a “mixed/negligible” response. “But since the Federal Reserve is likely more focused on the labor market, we don’t expect Friday’s CPI to weigh heavily on next week’s Fed decision,” said Emily Bowersock Hill, founding partner of Bowersock Capital Partners. “We will likely see two more rate cuts this year, in October and December.” U.S. rate futures have priced in a 98.9% chance of a 25 basis point rate cut and a 1.1% chance of no rate change at the upcoming monetary policy meeting. Investors will also focus on preliminary U.S. purchasing managers’ surveys. Economists expect the October S&P Global Manufacturing PMI to be 51.9 and the S&P Global Services PMI to be 53.5, compared to the previous values of 52.0 and 54.2, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists anticipate that the final October figure will be revised lower to 54.6 from the preliminary reading of 55.0. On the earnings front, notable companies like Procter & Gamble (PG), HCA Healthcare (HCA), and General Dynamics (GD) are slated to release their quarterly results today. Meanwhile, the U.S. government shutdown has entered its 24th day, with no clear signs of compromise between Republicans and Democrats. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.010%, up +0.50%. My lean or bias today is bullish unless CPI comes in and wrecks the futures. We had a good training yesterday with Matt Tuttle on the failure of the Yield Max ETF's like MSTY and UTLY. Next Monday should be another good one! Make sure and tune in. Let's look at our intraday /ES levels for 0DTE trading today. While I don't think CPI will be the driver that it can be, it may still throw a spanner in the works. 6804 is really my only focus on the upside resistance. A break above that, and we could get a start to our next bull leg higher. 6796, 6788, 6782, 6777, 6770 are support levels on the way down. Today should be a good one for us. We've already got our Gold 0DTE started. I will be out of pocket for about 1hr. this morning between 9:15 -10:15 A.M. MDT to get some blood work done. That shouldn't affect our trades today. I'll see you all shortly in the live trading room!

Why do you trade?Yesterday was very reflective for me. I feel very lucky not to have had a "job" for a couple of decades now. I wanted to become a full time trader for many of the same reasons of many. I wanted the freedom. I wanted the control. I wanted the upside potential. I wanted to not be beholden to an employer, and I've gotten all of that. I'm tremendously grateful but...let's be real. Trading is still a job. You still trade time for money. It can get monotonous and a bit "ground hoggy day." Yesterday though was just pure joy. Our ATM portfolio has some very cool short positions in Nuclear/ A.I. / Quantum stocks. We took advantage of the idiots running up BYND to make a quick 80% ROI. It was a great day for scalping (even though I gave most of my gains back!) and our day trades were spot on. I really, really had fun and enjoyed myself yesterday. Making money is nice (even necessary) but enjoying what you do it critical to having a good life. I'm excited what other shorts we can potentially add to our ATM portfolio today as our Tesla position should put some profit and buying power back into our account. The key is to have a plan. BYND is no different than GME, AMC, or any other meme stock. All those shot to the moon, and we made money shorting ALL of them. Fundamentals ALWAYS win in the long run. We'll be selling more calls on BYND today. This is a bankrupt company... no one's just told them yet. The same goes for all the poor retail traders who were suckered into the siren song of the Yield Max ETF scams. We knew the MSTY and UTLY junk would go down. They will continue to go down. Math simply dictates it! We are now up over 70% ROI on our long BTC/ Short MSTY trade. It was such a layup. We will be attending a Zoom training today from Matthew Tuttle of Tuttle Capital. He'll share why the math told us these would be failures and a much better approach than 0DTE covered call ETFs. Join us at 12:00 noon MST today for that training. Why Covered Call ETFs Suck-And What To Do Instead Thursday October 23rd 2-3PM EST Covered call ETFs are everywhere — and everyone thinks they’ve found a “safe” way to collect yield in a sideways market. The truth? Most of them suck. They cap your upside, mislead investors with “yield” that’s really your own money coming back, and often trail just owning the stock by a mile. Join me for a brutally honest breakdown of how these funds actually work — and what you should be doing instead. What You’ll Learn: Why “high yield” covered call ETFs are often just returning your own capital How most call-writing strategies quietly destroy compounding Why owning covered calls in bull markets is like running a marathon in a weighted vest The simple structure that can fix these problems — and where the real daily income opportunities are hiding As I mentioned. Yesterday was crazy busy for us in all our portfolios. It was a fun day. Here's our day trade results. Let's take a look at the markets: Technicals are bearish this morning. Let's go! There's been a lot of volatility and movement, intraday this month. It's all amounted to nothing. At some point we'll get some true directional moves. It certainly seems like its a much bigger ask to see that trend going higher than lower. We'll know for sure eventually. That's why we show up every day. December S&P 500 E-Mini futures (ESZ25) are up +0.01%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.08% this morning as investors digest quarterly results from major companies, including Tesla and IBM, and await a new batch of corporate earnings reports. Tesla (TSLA) fell over -3% in pre-market trading after the EV maker posted weaker-than-expected Q3 adjusted EPS despite a sales surge. Also, International Business Machines (IBM) slumped more than -6% in pre-market trading after the technology services giant reported disappointing Q3 revenue in two key software categories. On the positive side, Medpace Holdings (MEDP) surged over +18% in pre-market trading after the company posted upbeat Q3 results and raised its full-year guidance. Higher bond yields today are weighing on stock index futures. Treasury yields climbed as higher oil prices reignited concerns about inflation. Oil prices jumped more than +5% after U.S. President Donald Trump imposed sanctions on Russia’s two biggest oil companies over the Ukraine war. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed lower. Netflix (NFLX) plunged over -10% and was the top percentage loser on the Nasdaq 100 after the streaming giant reported weaker-than-expected Q3 EPS. Also, Texas Instruments (TXN) slid more than -5% to lead chipmakers lower after issuing underwhelming Q4 guidance. In addition, Lennox International (LII) slumped over -10% and was the top percentage loser on the S&P 500 after the climate control solutions innovator posted mixed Q3 results and cut its full-year guidance. On the bullish side, Intuitive Surgical (ISRG) jumped more than +13% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company reported upbeat Q3 results and raised its full-year da Vinci procedure growth guidance. Thomas Lee at Fundstrat Global Advisors said that the post-earnings drop in companies like Netflix and Texas Instruments “is not thesis-changing.” “We are not necessarily concerned about stocks selling off, short-term,” Lee said. He outlined the main reasons for a strong final 10 weeks of 2025: solid corporate earnings, a dovish Fed, sustained strength in AI visibility, and positive fourth-quarter seasonality. Third-quarter corporate earnings season continues in full flow, and investors look forward to fresh reports from notable companies today, including Intel (INTC), T-Mobile US (TMUS), Ford Motor (F), Blackstone (BX), and Union Pacific (UNP). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Meanwhile, the U.S. government shutdown has entered its 23rd day, with no clear signs of compromise between Republicans and Democrats. In light of the government shutdown, the publication of weekly jobless claims, originally set for today, will be delayed. Still, investors will focus on the National Association of Realtors’ existing home sales data, which is set to be released in a couple of hours. Economists foresee this figure coming in at 4.06 million in September, compared to 4.00 million in August. Fed Governor Michael Barr is scheduled to deliver a speech later today at the Novogradac 2025 Fall New Markets Tax Credit Conference. With Fed officials in a blackout period before the October 28-29 policy meeting, Barr is likely to avoid commenting on interest rates. U.S. rate futures have priced in a 96.7% probability of a 25 basis point rate cut and a 3.3% chance of no rate change at the upcoming monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.990%, up +0.96%. Commercial Office Delinquency Rate is now worse than the past Financial Crisis Against my better judgement and if you absolutely must gamble on the next "massive short squeeze" here's a list of the equities with the highest percentage of short interest to pick from. My lean or bias today is bearish. Let's see if the bears can take some of this weakness and run with it! Let's take a look at the intraday levels for /ES today. Today is a critical day IMHO. If we break the 20-day moving average on the daily chart, the bears will continue to be emboldened. (blue line) 6740* Fib line as well as 200 P.M.A., 6748, 6753, 6759, 6715 are resistance. 6722, 6711, 6700, 6691, 6665 are support. Trump is scheduled to speak at 11:00 A.M. MDT. Sometimes these are big nothing burgers and sometimes they are market moving. Generally it's his tweets that come out of nowhere that shake things up. Regardless, I believe I'll start today, once again with a Gold trade and then see what we can find in SPX.

See you all in the live trading room shortly. Let's have another great day! Here come the Mag 7Earnings season rolls on. We've got the big Mag 7 companies coming up. Tesla is the first big one today after the close. We are eagerly awaiting it. It's a big position in our ATM portfolio with a credit strangle. It's been a big producer for us this year. It's also a buying power hog so hopefully the I.V. crush will free up some buying power for us tomorrow. BYND is the latest meme stock, literally. It's been added to the $MEME ETF! We started a small short position yesterday and are adding to it today as it continues to climb. Whether it's AMC, GME or whoever, they all end the same. BYND is a company that has negative gross margins. There's only one way this ends up. We started small and will continue to scale our short position via selling short calls. We had a very solid day yesterday, but didn't get much capital deployed, so the dollar profit is small. However, the ATM portfolio kicked butt. In trying times, it's so nice to have the bulk of our money in an asset allocation model like this. Going on six years running now. No down years. Trouncing the market returns. What's not to like? Here's a look at our day yesterday. Let's take a look at the markets: Markets stalled yesterday. We're still waiting for a break out. Either up or down. Technicals are clinging to bullish mode. December Nasdaq 100 E-Mini futures (NQZ25) are trending down -0.27% this morning as investors digest disappointing results from Netflix and Texas Instruments. Netflix (NFLX) slumped over -6% in pre-market trading after the streaming giant reported weaker-than-expected Q3 EPS. Separately, Texas Instruments (TXN) plunged more than -8% in pre-market trading after the analog chipmaker posted weaker-than-expected Q3 EPS and provided underwhelming Q4 guidance. Peers Microchip Technology (MCHP), NXP Semiconductors N.V. (NXPI), and ON Semiconductor (ON) fell over -2% in pre-market trading. Investors now await a new round of corporate earnings reports, with a particular focus on results from Magnificent Seven member Tesla. In yesterday’s trading session, Wall Street’s major indexes ended mixed. General Motors (GM) jumped over +14% and was the top percentage gainer on the S&P 500 after the automaker posted better-than-expected Q3 results and raised its full-year adjusted EPS guidance. Also, Warner Bros. Discovery (WBD) climbed more than +10% and was the top percentage gainer on the Nasdaq 100 after the entertainment company announced it had initiated a review of strategic alternatives. In addition, Halliburton (HAL) surged over +11% after the company reported stronger-than-expected Q3 results. On the bearish side, mining stocks slumped as gold and silver prices sank, with Coeur Mining (CDE) tumbling more than -16% and Newmont (NEM) sliding over -9% to lead losers in the S&P 500. “October has, so far, lived up to its spooky season moniker. Yet equities continue to be resilient in the face of an unending stream of bad news,” said Victoria Greene at G Squared Private Wealth. Third-quarter corporate earnings season is in full swing, with all eyes today on Tesla (TSLA), the first of the Magnificent Seven companies to report. Investors will also monitor earnings reports from other prominent companies such as International Business Machines (IBM), Thermo Fisher Scientific (TMO), AT&T (T), and Lam Research (LRCX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. On the economic data front, investors will focus on the EIA’s weekly crude oil inventories report, set to be released in a couple of hours. Economists expect this figure to be 2.2 million barrels, compared to last week’s value of 3.5 million barrels. In addition, market participants will parse comments today from Fed Governor Michael Barr. Notably, Barr’s speech will be delivered via pre-recorded video, as Fed officials are currently in a blackout period before the October 28-29 policy meeting. U.S. rate futures have priced in a 96.7% chance of a 25 basis point rate cut and a 3.3% chance of no rate change at next week’s FOMC meeting. Meanwhile, the U.S. government shutdown continues, with no clear signs of compromise between Republicans and Democrats. The government shutdown has entered its 22nd day, putting it on the verge of becoming the second-longest in history. The shutdown means that official U.S. economic data continue to be delayed. However, the Department of Labor has recalled a limited number of employees to release the September inflation report on a delayed basis this Friday, making a rare exception to publish data during the shutdown. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.957%, down -0.10%. I'm not an economist but this doesn't happen in "good times". I've got no real bias or lean this morning. Futures are bouncing between green and red. Pretty directionless. Our trade setup from yesterday is still a favorite of mine. Low risk with a potential big payoff. We'll see how we open up. Let's give is 30 mins. to develop. We haven't had much luck trading Gold lately but it continues to look like an attractive (if difficult) underlying to trade. Gold and silver posted their steepest one-day declines in more than a decade as traders locked in profits following a historic rally. Spot gold fell as much as 6.3%, while silver tumbled nearly 9%, triggering a sharp correction across the metals space. Analysts point to a blend of technical exhaustion, dollar strength, and liquidity gaps as key drivers behind the reversal. With India’s Diwali holiday curbing demand and a lack of CFTC positioning data due to the U.S. government shutdown, speculative positioning may have amplified the volatility. What did the Q-levels show at open? What stood out in yesterday’s session was the market’s open right around a major Reaction Zone. The Call Resistance level, the area with the highest concentration of call activity, acted as a strong reaction zone. For price action to meaningfully break above this level, a significant catalyst was needed to trigger renewed momentum. You could also see from the Net GEX how much Gamma Exposure needed to be absorbed around that major Reaction Zone near the Call Resistance. This clearly highlighted the level of dealer positioning that the market had to break through before any sustained move higher could occur. We will continue our discussion today on two very different ways to scale capital into trades. Martingale vs. Pyramiding. Join us at 12:00 Noon MDT on our live zoom feed. Let's take a look at our intraday /ES levels. As you can see, nothing constructive was accomplished yesterday. Neither bullish nor bearish. 6777 is the demarcation point for me today. Bullish above and bearish below. Resistance zones are 6782, 6789, 6796, 6800, 6811. Support comes in at 6770, 6765, 6762, 6759, 6752. I look forward to seeing you all in the live trading room shortly. Our training today should be a good one. Gold looks as promising as SPX this morning so I may start with that and work into an SPX (or NDX) later in the day.

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |