|

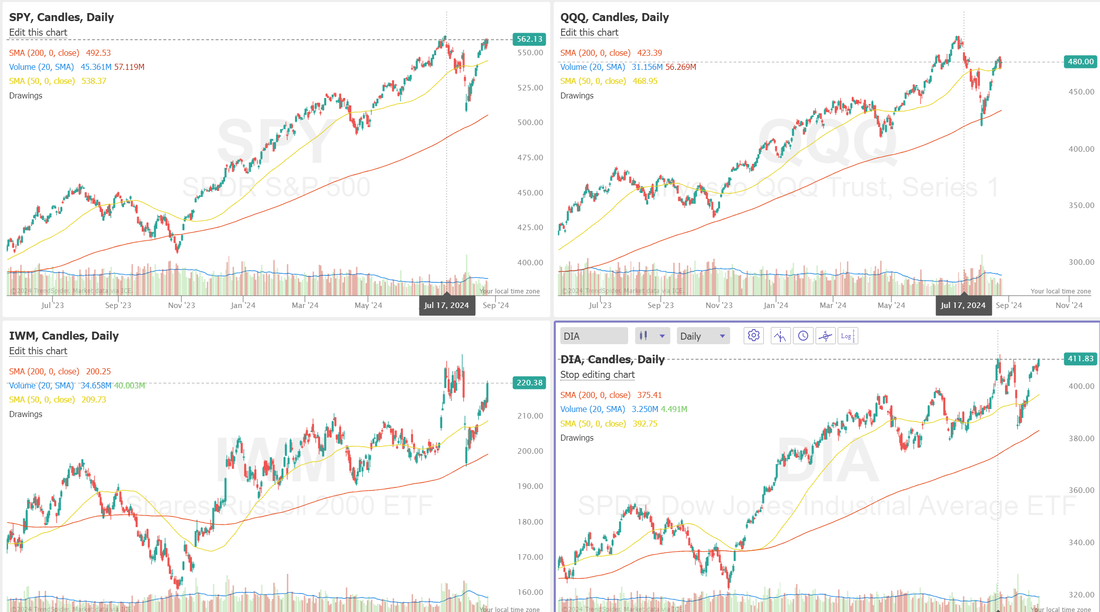

Welcome back to a new week of trading folks! We got a confirmation from Powell last week that curs are coming. Now the question is, how big? Our Friday was epic. Thursday was tough. I booked losses on two NDX put legs and we rolled a lot of other positions. My net liq was down 20K Thurs. Friday was the payday for a lot of the seeds we planted Thurs. My net liq bounced back 27K and we booked some amazing profits on most of our rolls. We are pushing $320,000 of 0DTE profits. I have now idea if there is another 0DTE program showing these type of results but regardless...I'm super proud of our results. Scalping was a huge help. We've locked in most of the work we did on Thurs but still have almost $1,000 of ext. sitting in our /MNQ scalp that expires today. We have the chance to book over $6,200 of profits from those trades we set up Thurs. Sometimes your days are just about setting up for future potential. Thurs of last week wasn't fun but it paid off for us in the end. If you'r not scalping you're leaving a very valuable tool out of your tool box. Let's take a look at the markets: Over the past few weeks, the SPY has mounted one of the most impressive V-shaped recoveries in recent memory. The index closed just 1/2 a percent below the all-time high at $562.13 (+1.41%), filling the gap from July 17th and consolidating just above the 8-period EMA. Much like the SPY, the QQQ filled a key gap from July 24th and closed the week at $480.03 (+1.05%). The price is currently finding support at the 8-period EMA, and bulls are likely eyeing the July 17th gap as the next target higher. Perhaps NVDA earnings on Wednesday will be the catalyst for that move. The IWM did a bit of catching up this week, getting the bullish 8/21 EMA and MACD crosses that its peers got last week and closing at $220.38 (+3.66%). While the lion’s share of the recent volume lies just above the current price, if QQQ and SPY performance is any indication, this index should continue its move higher next week. Technicals continue to be bullish: I would like to look at the RSP and VTI as well: While both look clearly bullish, they also both look overstretched technically to the upside. Most of the indices we trade are close to their ATH's. Let's look at the expected moves this week. 1.3% expected move and 16% IV for the SPY is not bad. It's enough for us to get some good risk/reward this week. 2.1% expected move and 26% I.V. in the NDX! Do you think NVDA earnings Weds are being anticipated? My bias today in more neutral. Technicals are all bullish but most are getting overstretched to the upside. September S&P 500 E-Mini futures (ESU24) are up +0.16%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.23% this morning as market participants awaited an earnings report from semiconductor stalwart Nvidia as well as the release of the Fed’s preferred inflation gauge later in the week. In Friday’s trading session, Wall Street’s major averages closed higher, with the blue-chip Dow notching a 3-week high. Workday (WDAY) climbed over +12% and was the top percentage gainer on the Nasdaq 100 after the back-office software provider reported better-than-expected Q2 results and said it would sharply increase profitability over the next three years. Also, chip stocks gained ground, with Nvidia (NVDA), Marvell Technology (MRVL), and Arm (ARM) advancing more than +4%. In addition, CAVA Group (CAVA) soared over +19% after the company posted upbeat Q2 results and boosted its full-year guidance for adjusted EBITDA and restaurant comparable sales growth. On the bearish side, Intuit (INTU) slid more than -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after providing below-consensus Q1 adjusted EPS guidance. Economic data on Friday showed that U.S. new home sales rose +10.6% m/m to a 14-month high of 739K in July, stronger than expectations of 624K. Fed Chair Jerome Powell said Friday that “the time has come” for the U.S. central bank to lower its key policy rate. The Fed chief acknowledged recent progress on inflation and stated that the cooling in labor market conditions is “unmistakable.” Powell also mentioned that he observes the economy expanding at a “solid pace.” “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks,” Powell said in the text of a speech at the Kansas City Fed’s annual conference in Jackson Hole, Wyoming. Also, Atlanta Fed President Raphael Bostic said it is possible that more than one interest rate cut may now be required by year-end following data indicating falling inflation and a slowing labor market. In addition, Chicago Fed President Austan Goolsbee said it’s time to focus more on the employment side of the Fed’s dual mandate now that inflation is moderating toward the 2% target. “We’re not just fighting inflation now, inflation’s on a path to 2%,” Goolsbee said. “The market should be happy with [Powell’s] speech because it wasn’t hawkish in any way, gave the green light for 25 basis-point rate cuts - and left the door open for even larger cuts if that becomes necessary,” said Chris Zaccarelli at Independent Advisor Alliance. Meanwhile, U.S. rate futures have priced in a 63.5% chance of a 25 basis point rate cut and a 36.5% chance of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. Market participants will focus on earnings reports from several leading technology and retail companies this week, with chipmaker Nvidia’s (NVDA) report on Wednesday drawing the most attention. Prominent tech firms like Salesforce (CRM), Dell Technologies (DELL), HP (HPQ), and CrowdStrike (CRWD), along with retailers including Dollar General (DG), Lululemon (LULU), Best Buy (BBY), and Ulta Beauty (ULTA), are also scheduled to release their quarterly results this week. On the economic data front, the July reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight in the coming week. Also, investors will be monitoring a spate of other economic data releases, including U.S. GDP (second estimate), CB Consumer Confidence Index, S&P/CS HPI Composite - 20 n.s.a., Richmond Manufacturing Index, Crude Oil Inventories, Goods Trade Balance (preliminary), Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Income, Personal Spending, Chicago PMI, and Michigan Consumer Sentiment Index. In addition, San Francisco Fed President Mary Daly, Fed Governor Christopher Waller, and Atlanta Fed President Raphael Bostic will be making appearances this week. Today, investors will focus on U.S. Durable Goods Orders data, set to be released in a couple of hours. Economists, on average, forecast that July Durable Goods Orders will stand at +4.0% m/m, compared to -6.6% m/m in June. U.S. Core Durable Goods Orders data will also be reported today. Economists foresee this figure to be unchanged m/m in July, compared to the previous number of +0.5% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.788%, down -0.32%. Our Trade docket is busy, as it is most Mondays. /MCL, /MNQ scalping, /ZC, DELL, DIA, DJT, FSLR, IWM, WYNN, UPST, ORCL, CCL, CRM?, SHOP, /ZN, GLD/NEM, SPY/QQQ 4DTE. 0DTE's. Let's take a look at some key intra-day levels for our 0DTE's today: /ES; There are some key levels that are very tight today. 5664 is the first resistance. Its super close as I type but still shows as a major overhang. Then comes 5684 and then big resistance at 5697. Support is close at 5650. Below that we could push down to 5637 which is PoC on the 2hr. chart. /NQ: The NDX hasn't moved much in the last six trading sessions! Today I have two clear levels I'm watching. 19807 on the upside is PoC on the 2 hr. chart and a key resistance level for the bulls. 19750 is strong support. If bears can break that down we could get some downside. Let's have a great day folks! We'be got 9K of extrinsic right now in our scalping and NDX positions. We don't need to be greedy! I'd take half of that to start the week off!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |