|

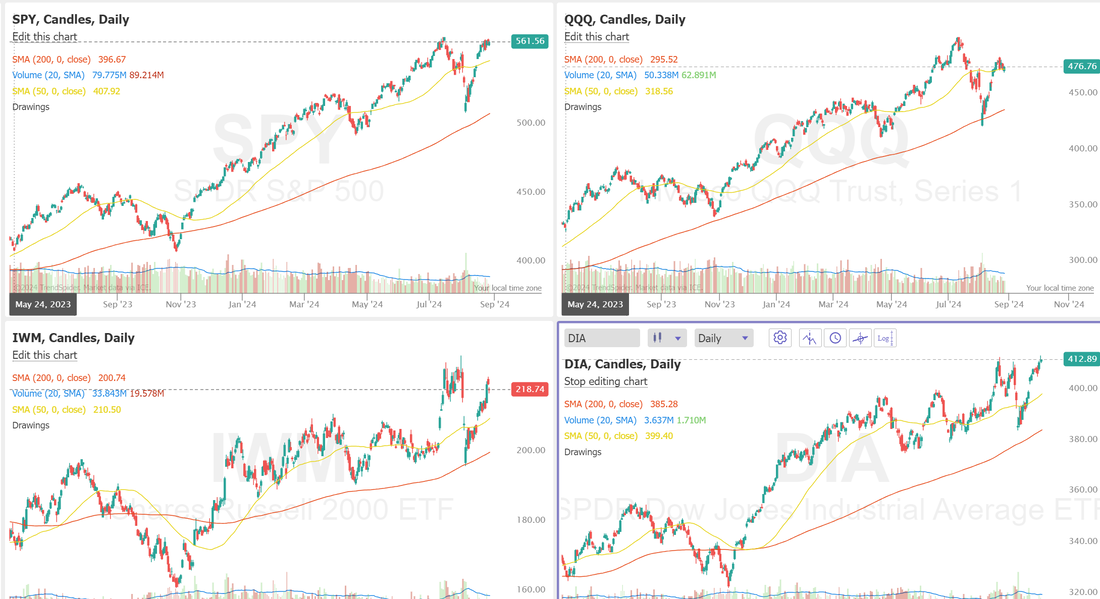

Good morning traders! Welcome to NVDA earnings day. More on that in a bit. We had a really productive day yesterday. Check out my results below: Let's take a quick look at the markets then talk about NVDA. The DOW hit another ATH while the other indices languished. Everyones waiting for that NVDA shoe to drop. It will be interesting to see what the price action will be today. I'm looking for a down day. Technicals are still holding in there. Stretched to the upside, to be sure but still bullish. Let's talk NVDA. It's the biggest earnings announcement of the week. It should announce another blowout quarter however, expectations are sky high. The stock is already up 160% YTD. The key numbers to watch are revenue and forward guidance. NVDA is projecting a $28 billion revenue number. They have beat expectations by $2 billion each of the last four quarters. To me this means they need to hit at least $30 billion in revenue or the market will be dissapointed. Expectations for Q3 will be important as well. Since Q2 of last year NVDA's earnings surprise has continually dropped from 31% to 9.8% is Q1 of this year. I believe the chance for a pullback is great here. Expectations are really setting a high bar. Additionally its strange to me that the "smart money" seems to be walking away from the trade all together. After Monday's close NVDA traded 2.22 million option contracts against 26.28 million open contracts. This figure represents a 50% decline from the trailing one month average. Call volume was 1.39 million contracts with put volume 829,000 contracts. NVDA’s earnings release on Wednesday has the potential to impact the major indices. 22% of the Semiconductor ETF (SMH) weight is in NVDA. It also makes up 7% of the S&P 500 (SPY) and 8% of the Nasdaq (QQQ). Last earnings, NVDA’s price moved 9% after its release, and the earnings before that was 16%. High volatility is expected. We are going to build two and maybe three "NVDA" trades today. One will be on NVDA with a bearish slant. Another will be on NVDA looking to take advantage of a big "nothing burger" potential outcome. A 16% move is a lot. What if it doesn't move, or moves way less? We'll have a trade for that. Additionally I've got a setup on the SMH that I think is the best way to play the NVDA earnings from a strict, risk/reward view. Another interesting ticker to keep an eye on is SMCI. We've traded this a bunch. Hindenburg research just put out a scathing report on them. https://hindenburgresearch.com/smci/ Our trade docket for today; /MNQ, QQQ scalping, SMCI? AFRM, CRWD, CRM, NVDA, DDD?, /MCL, CHWY, DJT, ETH, FSLR, IWM, QQQ, SMH, /ZC, 0DTE's. Again, my lean is bearish today. I don't see the buyers for NVDA like we've seen in the past four quarters. Let's take a look at the Intra-day levels for our 0DTEs today: /ES; We scored a nice little profit on a butterfly yesterday, placing it right on the PoC. There's no real reason to expect much today. Chop zone is 5669-5618. Anything in this zone is not meaningful to me. /NQ; Same goes for the Nasdaq. Chop zone is a little tighter at 19693-19573 Let's have a great day folks. We'll have trades on today that cover a bullish, neutral or bearish move in NVDA so no matter what the move is tomorrow morning...we'll have something to talk about!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |